Multi-chain Self-Hosted Wallet: It provides browser extensions and mobile wallets that support Ethereum and EVM-compatible chains, and extends support to non-EVM chains through Snaps plug-ins. It has approximately 30 million monthly active users. Built-in Trading: An integrated token swap aggregator consolidates quotes from multiple DEXs, generating approximately $325 million in cumulative fee income. Bridging and Fiat Currency Channels: Provides cross-chain bridging services and channels for purchasing cryptocurrencies with fiat, and supports login via social media accounts to simplify the onboarding process for new users. Staking and Earning: A built-in Ethereum staking portal and Portfolio asset management interface make it easy for users to manage their multi-chain asset portfolios. Institutional Wallet: MetaMask Institutional (MMI) is designed specifically for institutional users, offering advanced permission management and multi-signature capabilities. MetaMask USD Stablecoin (mUSD): Announced in August 2025, this USD stablecoin is issued and managed by Stripe's Bridge, with plans to launch on Ethereum and Linea. This is the industry's first native stablecoin issued by a self-custodial wallet, designed to make it easier for users to hold and use USD assets within their wallets. MetaMask Card: A debit card launched in partnership with Mastercard that supports direct cryptocurrency payments and instant conversions. However, the throne is not secure, as challengers from all sides are becoming increasingly powerful. Trust Wallet (TWT): As the core wallet of the Binance ecosystem, Trust Wallet has been downloaded over 200 million times on mobile devices and has tens of millions of active users, putting it on par with MetaMask. Furthermore, it issued the TWT token as early as 2020, successfully using token incentives to retain a large number of users. Phantom: The leading wallet in the Solana ecosystem, renowned for its exceptionally smooth user experience, has rapidly amassed millions of users within the Solana ecosystem. Now, it has begun expanding into multiple chains, entering Ethereum and directly threatening MetaMask's core turf. Faced with fierce competition, simple product iteration is no longer sufficient. MetaMask has resorted to the classic strategy of issuing tokens to attract users, shifting the focus of competition from "which wallet is better" to "which ecosystem can I co-own and share in its growth?" By delivering a large-scale airdrop to tens of millions of loyal users, $MASK will become a powerful tool for activating dormant users, expanding market influence, and solidifying user loyalty. Issuing the token at this time is expected to help MetaMask regain market share and strengthen its position as the premier gateway to Web3. Furthermore, the timing of the token launch is closely tied to the regulatory environment. In February 2025, ConsenSys reached an agreement with the SEC, which agreed to drop the unregistered securities or broker charges against MetaMask, temporarily alleviating significant regulatory pressure on MetaMask. Issuing the token at this time is a matter of chance. Meanwhile, other products within the ConsenSys ecosystem (such as Linea and mUSD) have already capitalized on this wave of "regulatory dividends." If MetaMask acts slowly, it could miss the opportunity to collaborate with these products, thereby hindering the growth of the ConsenSys ecosystem. More than just a "virtual coin": $MASK's potential use cases and value capture. Although the official token whitepaper has yet to be released (even the token symbol, $MASK, is speculation within the community), based on industry experience, we can reasonably infer that the $MASK token will possess the following core features to avoid becoming a "virtual coin" with no real value.

Governance: This is the fundamental utility of all major protocol tokens. $MASK holders will have the right to vote on the future development of the protocol. Decisions may include adjusting the MetaMask Swap fee rate, determining the development priority of new features, and managing the use of funds in the community treasury.

Fee Discounts:This is the utility that most directly attracts high-frequency traders. By holding or staking a certain amount of $MASK tokens, users can enjoy discounted or even waived transaction fees when using MetaMask Swap (currently 0.875%) and cross-chain bridges. This model has been successfully proven with Trust Wallet's TWT token, effectively increasing user engagement and transaction volume. Staking & Revenue Sharing: To allow token holders to directly share in the protocol's growth, MetaMask can design a staking mechanism. By staking $MASK tokens, users can receive a proportional share of the protocol's revenue. This revenue can come from a variety of sources, such as fees generated by MetaMask Swap or interest earned on its native stablecoin, mUSD, through its reserve assets (such as US Treasuries). Exclusive Access/Value-Added Services: $MASK tokens can also serve as a form of identity or equity, providing holders with a range of exclusive benefits, such as early access to new beta features, eligibility for limited-edition MetaMask Cards or annual fee waivers, and the opportunity to participate in early token sales for projects incubated or strategically partnered with MetaMask. Value: A Multi-Dimensional Valuation Analysis of $MASK Tokens Valuation is a key concern in the market. Although $MASK tokens have yet to be issued, we can infer their potential value from multiple perspectives, including project fundamentals, comparable project valuations, and ecosystem logic.

Valuation based on predicted revenue

First consider the source of revenue:

MetaMask's main revenue comes from its built-in Swap function, which charges a service fee of 0.875% for each transaction. According to DeFiLlama data, its annualized revenue is stable at approximately US$49 million to US$57 million.

With the launch of the mUSD stablecoin, MetaMask has the opportunity to obtain interest rate spreads from users' deposited funds. For example, if the on-chain circulation of mUSD reaches $1 billion (a modest goal), based on the current 5% US Treasury bond rate, this could generate approximately $50 million in annual interest income. Of course, this revenue would need to be shared with its partner, the Bridge/M0 protocol, but it would still be a significant new source of revenue. Considering MetaMask's other revenue streams, such as deposit and withdrawal fees and potential sharing of other transaction fees, MetaMask's overall revenue is expected to exceed $100 million in annual revenue within the next 1-2 years. Using a price-to-sales ratio (P/S) of 10-15x for tech companies as a reference, its valuation would be between $1 billion and $1.5 billion. Comparing MetaMask's user base with Trust Wallet's (approximately 30 million) is roughly double that of Trust Wallet's (approximately 17 million), while TWT's FDV is approximately $1.2 billion. Therefore, it can be inferred that $MASK's FDV could also be twice that, or approximately $2.4 billion. Comparing Revenue with Trust Wallet: TWT's annualized revenue is approximately $3.5 million, yet its fully diluted valuation (FDV) stands at $1.2 billion. Its FDV/annualized revenue multiple is a staggering 342x, reflecting the market's exceptionally high premium placed on its supporting Binance ecosystem. However, this valuation may be excessive. By comparison, MetaMask's annual revenue from swap fees alone is approximately $50 million, roughly 15 times that of TWT. Considering MetaMask's superior user base, brand reputation, and revenue channels compared to Trust Wallet, the market should reasonably expect a valuation for $MASK that's no less than that of TWT. Even without considering the future revenue of new businesses such as mUSD and MetaMask card, based only on the current annual revenue of approximately US$50 million and combined with different market sentiments, the following valuation range can be obtained: Pessimistic scenario: Given a P/S of 30 times (about 10% of TWT), the FDV is US$1.5 billion.

Base Scenario: Given a P/S ratio of 100 (approximately 30% of TWT), the FDV is

US$5 billion.

Optimistic Scenario: Given a P/S ratio of 200 (approximately 60% of TWT), the FDV isUS$10 billion.

Referring to ConsenSys's Financing History

We can also refer to the private equity valuation of its parent company, ConsenSys. After its Series D funding in 2022, ConsenSys's overall valuation reached $7 billion. Although this valuation includes other assets such as Infura, MetaMask is undoubtedly its most important value bearer. Therefore, this figure provides us with a reference for the valuation ceiling.

Based on Consensys's financing history, the author believes that MetaMask's valuation is at least $3 billion.

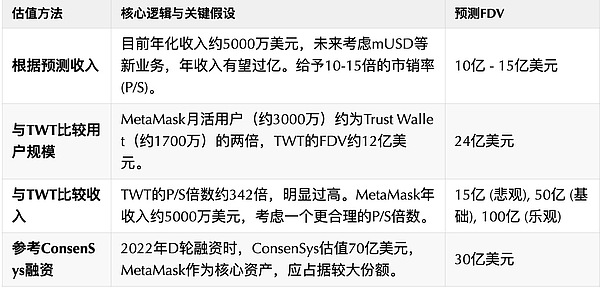

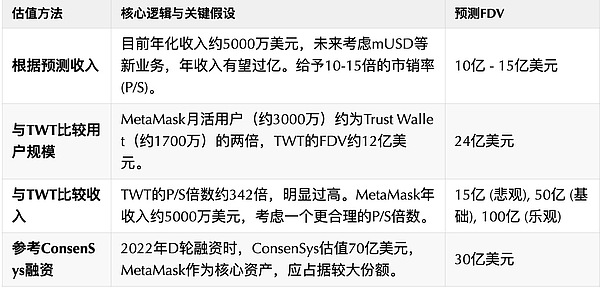

Valuation results list

In order to present the above valuation logic more clearly, we summarize it as follows:

Combining the above valuation methods, we believe that MetaMask's fully diluted valuation (FDV) is very likely to fall in the range of

US$1.5 billion to US$5 billion. Ecological Flywheel: How $MASK Became ConsenSys' Growth Engine To accurately assess the value of $MASK, it must be placed within the broader ecosystem built by its parent company, ConsenSys. As a blockchain software giant building tools and infrastructure around Ethereum, ConsenSys's product portfolio spans the entire stack, from user-side tools (MetaMask) and developer platforms (Infura, Truffle) to the underlying protocol (Linea). The $MASK token will become the core value carrier that connects this vast empire, driving a powerful ecological flywheel. The Symbiotic Relationship Between $MASK and Linea Linea is a zkEVM Layer 2 network developed by ConsenSys, designed to provide Ethereum with a lower-cost, more efficient, and fully EVM-compatible scaling solution. $MASK and Linea will form a deeply symbiotic relationship. As the premier Web3 gateway with tens of millions of users, MetaMask can seamlessly guide massive user and capital flows to the Linea network at the lowest cost and with the smoothest experience—a significant advantage unmatched by any other Layer 2 network. Furthermore, $MASK tokens can be used as the "startup fuel" for the Linea ecosystem. By airdropping or rewarding users and developers who provide liquidity, conduct transactions, or build applications on Linea, we can quickly attract early participants and ignite the liquidity and activity of the ecosystem. Although the airdrop criteria for MASK have not yet been announced, many users believe that holding Linea tokens or interacting on the Linea network may directly affect the airdrop eligibility of $MASK. ConsenSys CEO Joe Lubin also hinted at this in an X post on September 11, 2025, where he mentioned: “Well, just holding Linea will open up further rewards opportunities, mostly in other tokens; some from Consensys and some from protocols that we are aligned with. MetaMask and Linea are cooking someETHing together to make this happen. ......So if we notice, at some date in the future that you've held n LINEA tokens for m days, that just might lead to another token landing in your account. ......” This provides strong evidence for the community's speculation. The financial closed loop of $MASK, mUSD and MetaMask Card

ConsenSys is building a seamless payment closed loop from on-chain to off-chain through a combination of financial products, and $MASK is the core incentive layer of this closed loop.

Deposit (On-ramp):Users can conveniently exchange fiat currencies such as US dollars for mUSD through MetaMask's built-in fiat currency channel. On-chain Activity: Users use mUSD on the Linea network for low-cost transactions and DeFi activities. Holding or staking $MASK tokens can earn them transaction fee discounts or additional rewards. Off-ramp: Users can spend their mUSD balances on the Linea network directly in the real world using MetaMask Card, without withdrawing their assets to a bank, achieving seamless payments from Web3 to the real world. Cashback or rewards earned from consumption can be designed as $MASK tokens, further incentivizing users to hold and use $MASK, thereby locking more value within the ecosystem. The Road Ahead is Not Smooth: $MASK's Hidden Concerns and Market Scepticism Despite Joe Lubin's recent positive statements, pessimism persists in the market. On the prediction market Polymarket, the probability of a bullish prediction for the question, "Will MetaMask issue a token in 2025?" actually plummeted from 60% to 32% following the announcement, reflecting a lack of market confidence in a token launch this year. This pessimism may stem from two factors: "The Boy Who Cried Wolf" narrative fatigue: Rumors of a MetaMask token launch have persisted for years, despite repeated official denials. For example, as recently as March 2025, the official MetaMask account was still clarifying that there were no $MASK tokens. Despite positive signals from Lubin's latest interview, the market may have become fatigued and skeptical of these repeated "imminent" statements. Concerns about the fairness of the airdrop: Many users have pointed out that parent company ConsenSys encountered serious issues with the previous Linea airdrop, with a large number of real users being mistakenly labeled as Sybil accounts, while numerous addresses involved in bulk operations received large amounts of the airdrop, leading to unfair distribution and market sell-offs. This has led the community to worry that MetaMask's airdrop might repeat past mistakes, leaving real users' efforts unrewarded and thus undermining market confidence. Therefore, the design of this MetaMask airdrop is crucial; it must avoid a repeat of Linea's disappointing user experience. Otherwise, not only will this airdrop fail to build a positive reputation and attract users, but it could also hinder the synergy between MetaMask, Linea, mUSD, and the entire ConsenSys ecosystem, resulting in a negative "1+1<1" outcome. Conclusion: Opening a New Chapter in Wallet Competition MetaMask's token issuance is an inevitable choice amidst fierce competition and a carefully planned strategic upgrade. From a valuation perspective, with its strong fundamentals and grand ecosystem narrative, $MASK's fully diluted valuation (FDV) is highly likely to reach billions of dollars, and could even reach higher. From a product perspective, the MetaMask token pushes wallets to a new level of "self-built financial ecosystem": users, assets, and services will form a closed loop connected by the token, and the wallet will be upgraded from a tool to a platform. From a competitive perspective, this move is bound to shift the balance of power in the industry, forcing other players to adjust their strategies and ultimately accelerating the evolution of the entire sector.

Weatherly

Weatherly