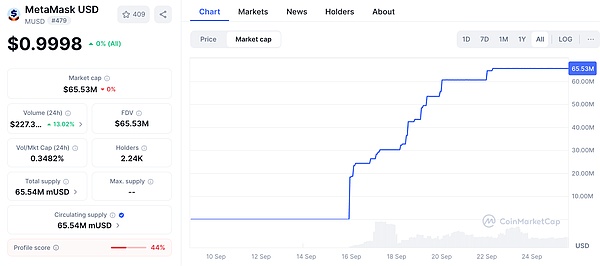

By Prathik Desai, Source: Token Dispatch It feels like déjà vu every week lately—another stablecoin launch, another attempt to shift the direction of value. First, we saw the bidding war for Hyperliquid's USDH; then we discussed the trend toward verticalization to capture US Treasury yields. Now, there's MetaMask's native mUSD. What ties all these strategies together? Distribution. Distribution has become a cheat code, not just in cryptocurrency but across all sectors, for building a thriving business model. If your community has millions of users, why not leverage it and simply put tokens in their hands? However, this doesn't always work. Telegram tried to do this with TON, boasting 500 million messaging users, but those users never migrated on-chain. Facebook tried to do the same with Libra, betting that its billions of social media accounts could form the basis of a new currency. In theory, both projects seemed destined for success, but in practice, they failed. This is probably why MetaMask's mUSD (with fox ears and a "$" symbol on top) caught my eye. At first glance, it looks like any other stablecoin—backed by regulated, short-term U.S. Treasuries and issued through a framework developed by Bridge.xyz using the M0 protocol. But in the $300 billion stablecoin market, currently dominated by a duopoly, what makes Metamask's mUSD different? MetaMask may be entering a highly competitive space, but it boasts a unique selling point that rivals can't match: decentralization. With 100 million annual active users worldwide, MetaMask boasts a user base that's virtually unmatched. mUSD will also be the first stablecoin natively issued in a self-custodial wallet, allowing users to purchase and exchange it with fiat currency, even using the MetaMask card for in-store purchases. Users no longer need to navigate exchanges, cross-chain bridges, or deal with the hassle of adding custom tokens. Telegram lacks this kind of product-to-user fit, while MetaMask does. Telegram seeks to migrate its messaging users to the blockchain for decentralized finance applications. MetaMask, on the other hand, enhances the user experience by integrating its native stablecoin into the app. Data shows that this initiative has been adopted very quickly. MetaMask's mUSD market capitalization surged from $25 million to $65 million in less than a week. Nearly 90% of this capital came from Linea, ConsenSys's internal Layer 2 platform, demonstrating that MetaMask's interface can effectively channel liquidity. This leverage is similar to past exchanges: in 2022, Binance automatically converted deposits into BUSD, causing the circulating supply to surge overnight. Whoever controls the users controls the tokens. MetaMask has over 30 million monthly active users, the largest user base in the Web3 space.

This distribution capability will differentiate MetaMask from earlier entrants who have tried and failed to build sustainable stablecoins.

Telegram's grand plan was partially thwarted by regulatory concerns. MetaMask circumvented this issue by partnering with Bridge, an issuer owned by Stripe, and backing each token with short-term government bonds. This satisfies regulatory requirements, and the newly enacted US GENIUS Act provides a legal framework from day one. Liquidity will also be key. MetaMask is injecting mUSD trading pairs into Linea's DeFi, betting that its internal network can solidify its adoption. However, distribution doesn't guarantee success. MetaMask's biggest challenge will come from incumbent giants, especially in a market already dominated by a few giants. Tether's USDT and Circle's USDC already hold nearly 85% of all stablecoins. In third place is Ethena's USDe, with $14 billion in circulation and attracting users due to its yield. Hyperliquid's USDH has just launched, aiming to reinvest exchange deposits into its ecosystem. This brings me back to the question: What exactly does MetaMask want mUSD to be? USDT and USDC seem unlikely to see direct challengers. Liquidity, exchange listings, and user habits all favor the incumbents. mUSD may not need direct competition. Just as I expect Hyperliquid's USDH to benefit its ecosystem by delivering more value to the community, mUSD is likely designed to extract more value from existing users.

Every time a new user deposits through Transak, every time someone swaps ETH for a new stablecoin within MetaMask, and every time they swipe their MetaMask card at a store, mUSD will be the first choice. This integrates stablecoins as the default option within the network.

This reminds me of the days when I needed to bridge USDC between Ethereum, Solana, Arbitrum, and Polygon, depending on what I needed to do with my stablecoin.

MUSD puts an end to all the tedious bridging and swapping. And then there's another important benefit: yield. With mUSD, MetaMask can earn income from the US Treasury bonds that back the token. Every $1 billion in circulation means tens of millions of dollars in interest flowing back to ConsenSys each year. This transforms the wallet from a cost center into a profit engine. If just $1 billion of mUSD were backed by an equivalent amount of US Treasury bonds, it could earn $40 million in interest annually. By comparison, MetaMask earned $67 million from fees last year. This could open up another passive, significant revenue stream for MetaMask. However, one factor makes me uneasy. For years, I've viewed wallets as neutral tools for signing and sending. mUSD blurs that line, turning a neutral infrastructure tool I once trusted into a business unit profiting from my deposits. Distribution, therefore, presents both advantages and risks. It could make mUSD the default, sticky choice, but it could also raise questions about bias and lock-in. If MetaMask adjusts its redemption process to make its own token path cheaper or prioritized, it could make the world of open finance less open. Then there's the issue of fragmentation. If every decentralized wallet started issuing its own mUSD, it could create multiple closed-end currencies, rather than the fungible USDT/USDC duopoly we have today. I don't know where this will lead. MetaMask has done a great job closing the financial loop of buying, investing, and spending mUSD by integrating it with cards. Its first week's growth shows it can overcome the initial hurdles of a launch. However, the dominance of the incumbent giants shows how challenging the climb from millions to billions will be. I don't know where this will lead. MetaMask has done a great job closing the financial loop of buying, investing, and spending mUSD by integrating it with cards. Its first week's growth shows it can overcome the initial hurdles of a launch. However, the dominance of the incumbent giants shows how challenging the climb from millions to billions will be. Between these realities will likely determine the fate of MetaMask's mUSD.

Alex

Alex

Alex

Alex Kikyo

Kikyo YouQuan

YouQuan Hui Xin

Hui Xin Alex

Alex YouQuan

YouQuan Davin

Davin Catherine

Catherine Hui Xin

Hui Xin Clement

Clement