Author: Murphy

Source: Arkham

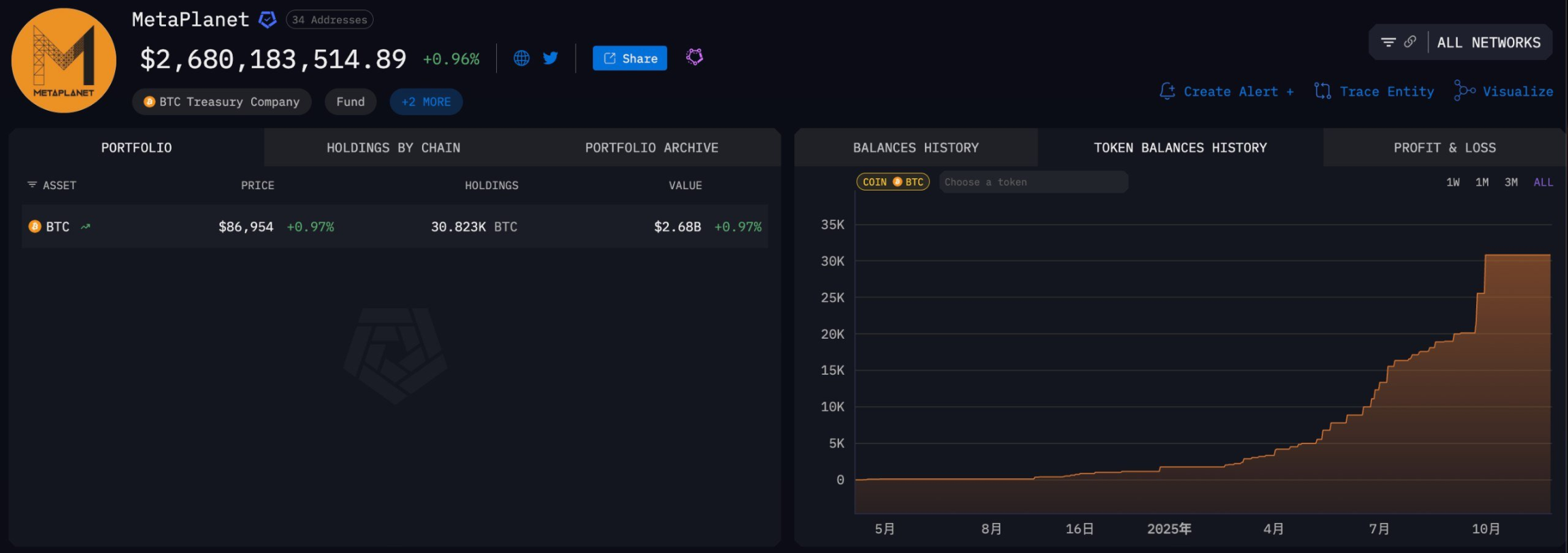

On November 25th, Metaplanet, a Japanese listed company, announced that it had executed a new loan of $130 million under a credit line agreement, using its Bitcoin holdings as collateral. The entire credit line has a maximum limit of $500 million. Including this loan, a total of $230 million has been lent out, which will be used to subsequently purchase Bitcoin on the market. Simply put, it's a cycle of pledging Bitcoin, obtaining cash, and then buying more Bitcoin. Currently, the company still holds 30,823 Bitcoins on its books, which is sufficient to cover the collateral requirements.

Source: Metaplanet

The next wheel of micro-strategies has begun to turn

Before understanding the advanced version of "micro-strategies," let's first review the logic and valuation methods of MicroStrategy, the "first Bitcoin stock." With this foundation, understanding Metaplanet will be easier.

MicroStrategy's cryptocurrency purchases primarily come from three sources: Convertible bonds, accounting for approximately 60% to 70%. For example, it's like using a credit card to buy Bitcoin, which you might later use to pay off the debt. This type of debt is low-cost and highly flexible, making it MicroStrategy's main source of funding. Corporate bonds, accounting for approximately 20% to 25%. This is like taking out a mortgage from a bank, using your house or Bitcoin as collateral to buy more Bitcoin. The collateral ensures the security of the debt, but it also means that if a risk is triggered, additional collateral may be required or liquidation may be necessary. Stock issuance, accounting for approximately 10% to 15%. This is like cutting a slice of your cake and selling it to someone else for money, then using that money to buy Bitcoin. However, the existing shareholders' share has shrunk, and their equity has been diluted. Having understood these three logics, let's look at MicroStrategy's stock value. When the value of MSTR fell from $450 to $179, this drop far exceeded the drop in Bitcoin's own value. Therefore, assuming the price of MSTR rises, Bitcoin will follow suit. Let's calculate the net asset value using the simplest method. The formula is actually very simple: Stock Price ≈ Bitcoin Holdings ÷ Number of Circulating Shares. According to their latest data, they hold 649,870 Bitcoins, currently priced at $89,000, with 284,380,000 shares outstanding. Therefore: 649,870 × 89,000 ÷ 284,380,000 ≈ $203.5 per share. In other words, MSTR stock was trading at $179 last night, below its net asset value (NAV) of $203.5. This means that, theoretically, the stock price is undervalued, seemingly presenting an opportunity to buy at the bottom. Of course, NAV only considers the value of the Bitcoin portion. Several factors are not taken into account: first, the company's core business value, i.e., the premium it can generate; second, the cost of debt. Convertible bond interest rates are typically less than 1%, and corporate bond interest rates are around 6% to 8%, representing a small percentage of total assets. In other words, debt won't significantly drag down the holdings. Next, let's look at Metaplanet, a typical example of an advanced micro-strategy. It didn't sell its own Bitcoin or dilute its equity; instead, it used its Bitcoin holdings as collateral to obtain cash and then continued to buy Bitcoin, using Bitcoin as a financial instrument to amplify its position. This approach is somewhat similar to mortgaging your house to borrow money and then using that money to buy a second house. Metaplanet's latest loan of $130 million, combined with its previous total of $230 million in loans, leaves it with approximately 30,823 Bitcoins, equivalent to $3.5 billion at the time of its valuation. This means they have turned their Bitcoin holdings into a leveraged pool and then used cash to further invest in Bitcoin. This operation appears stable on the surface and could be a catalyst for Bitcoin's rise, but the negative impact far outweighs the positive. If risks are triggered, it could amplify market volatility instantly. The Risks of "Revolving Loans" Revolving loans are most vulnerable to drastic market fluctuations. Looking back at Web3 history, the collapse of Iron Finance's TITAN/IRON is a typical example. Collateralized lending + leverage + market panic led to a chain of liquidations, resulting in massive losses for users. Similarly, Three Arrows Capital's 3AC lending leveraged Bitcoin, Ethereum, and LUNA prices plummeted, ultimately triggering liquidation and collapse. Users leverage their assets to borrow money, and if the price triggers the liquidation threshold, a chain reaction of liquidations occurs, instantly drying up market liquidity and causing token prices to plummet. While Metaplanet is a publicly traded company, its leverage and liquidation mechanisms are more robust than those of retail investors or DeFi projects, but the logic remains the same: if the price of Bitcoin falls and triggers liquidation, they may face additional collateral or forced liquidation. Assume Metaplanet holds 30,823 Bitcoins and has borrowed a total of $230 million. If the price of Bitcoin falls and triggers a safe collateral ratio of approximately 50% to 60%, where the collateral value equals the principal loan, this is the price level at which "risk is triggered." In other words, if Bitcoin falls by more than 40% of its current price, it may trigger the liquidation boundary. For the market, this is why retail investors constantly monitor the leverage operations of large institutions, rather than just focusing on the token price. Furthermore, revolving loans have a psychological effect. If institutions continue to expand lending and increase their positions, the market may follow suit, thinking, "If someone keeps buying, it must be safe." Once panic sets in, leveraged positions can cause a sell-off to occur faster than expected, and the risks of the bull market's end lie hidden in these seemingly stable operations. While Metaplanet's strategy appears robust, its potential impact should not be underestimated; this is the underlying dynamic of second-generation micro-strategies. Metaplanet's operations tell us that second-generation micro-strategies have indeed increased the demand for Bitcoin hoarding and made price increases more scarce, but they have also indirectly inflated the bubble. What the market fears most is not that people are buying, but that leverage is quietly added at the end of a bull market. Metaplanet's revolving loan is a typical example of a "bull market cycle." Unlike short-term buying and selling by retail investors that directly affects prices, it continuously rolls leverage, turning Bitcoin into a reusable pool of funds. Each round of collateralization and each additional investment slowly changes the market's supply and demand structure, subtly pushing up prices. Bitcoin doesn't leave the account; funds come in and buy more coins, increasing the position size. As long as the price doesn't trigger liquidation, everything remains stable.

Catherine

Catherine

Catherine

Catherine Weatherly

Weatherly Alex

Alex Joy

Joy Kikyo

Kikyo Alex

Alex Miyuki

Miyuki Miyuki

Miyuki Weiliang

Weiliang Anais

Anais