Author: Climber, Golden Finance

Since the current round of Bitcoin halving, the revenue pressure of mining companies has been increasing. Not only has the closure of small mining companies gradually started, but even large mining companies have also received a large amount of capital transfusions. Data shows that after the halving, listed mining companies raised a total of US$2.2 billion to cope with cash flow tightening.

In addition to increasing stock market issuance, these leading mining companies also use equity financing, convertible notes and loans to alleviate debt problems caused by tight liquidity.

However, financing transfusions can only solve temporary emergencies. Listed mining companies still need to find new economic growth paths, including increasing mining machines to increase computing power, acquiring and merging to expand mining sites, and turning to the AI field. It is worth noting that some mining companies have begun to choose to invest in Bitcoin, such as Marathon Digital, which recently purchased more than 4,000 BTC. This shows that investing in BTC has become one of the business options for large mining companies, trying to follow in the footsteps of MicroStrategy.

Listed mining companies that have raised funds continuously

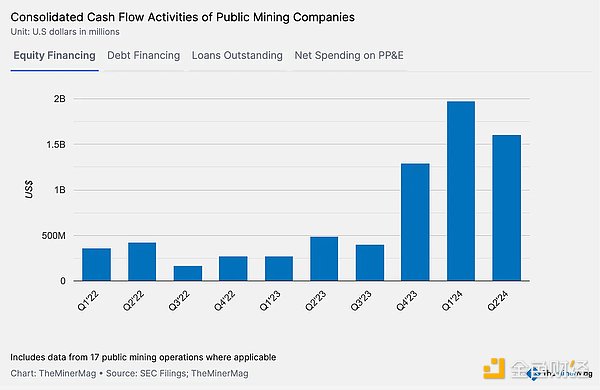

On August 1, Galaxy released its 2024 Bitcoin mining mid-year report. Data showed that listed mining companies raised $1.8 billion in Q1, setting a record for the highest quarterly financing amount in the past three years. Of the $1.8 billion raised, 75% came from the top three miners in terms of market value: Marathon, CleanSpark and Riot.

In addition, since the beginning of the year, a large number of mergers and acquisitions have occurred among Bitcoin mining companies, with a total transaction value of more than $460 million. The transaction types are divided into site sales, reverse mergers and corporate acquisitions.

According to TheMinerMag data, 9 of the 13 mining companies listed in the United States in Q2 2024 - Bitdeer, Bitfarms, Cipher, CleanSpark, Core, HIVE, Marathon, Riot and Terawulf - raised a total of $1.25 billion through various stock issuance plans. In addition, Iris Energy raised $458 million in the second quarter, bringing the total amount of funds raised by miners to more than $1.7 billion.

Another $530 million has been raised so far in the third quarter, bringing the total amount of financing to more than $2.2 billion.

As can be seen from the above figure, mining companies raised more than $1.5 billion in Q1 and Q2 of 2024. Although the second quarter data is slightly lower than the first quarter, it is worth noting that convertible notes and asset-backed loans have increased since the second quarter.

As can be seen from the above figure, mining companies raised more than $1.5 billion in Q1 and Q2 of 2024. Although the second quarter data is slightly lower than the first quarter, it is worth noting that convertible notes and asset-backed loans have increased since the second quarter.

The amount of financing raised by listed mining companies has increased significantly this year, which greatly illustrates the urgent need for cash flow of these companies. Especially with the arrival of the Bitcoin halving cycle, mining revenue has been greatly reduced, and the living environment of mining companies has become increasingly harsh. And such negative news has also frequently appeared in reports.

For example, in August this year, Bitcoin mining company Core Scientific announced its financial results for the second quarter of fiscal year 2024, with a net loss of US$804.9 million, compared with a net loss of US$9.3 million in the same period of 2023.

The Q2 financial report of mining company Cipher Mining showed a net loss of US$15 million in the quarter, slightly higher than the net loss of US$13.2 million in the same period last year. And just last month, the company had plans to sell after receiving an acquisition intention.

Even the leading mining company Marathon's second-quarter revenue was lower than expected, at US$145.1 million, and its second-quarter adjusted EBITDA turned from US$35.8 million last year to a loss of US$85.1 million.

In July, the CEO of Swan, a California-based Bitcoin-specific investment platform, announced that the company was withdrawing its mining operations, downsizing and canceling its listing plans. Swan's managed mining division was established in July 2023 and was originally scheduled to go public at the end of this year.

Revenue reduction, new paths

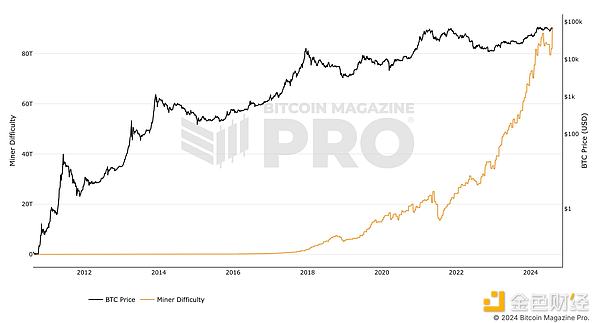

The biggest reason for the reduction in revenue of listed mining companies is the halving of Bitcoin, which does not need to be elaborated on. There are other factors behind the mining companies' willingness to issue additional shares to raise funds, such as the difficulty of mining reaching a record high and the increase in electricity costs.

According to the statistical chart of Bitcoin Magazine, the difficulty of Bitcoin mining has reached a record high. As of the time of writing, the difficulty of Bitcoin mining is 86.87 T, and the average computing power of the entire network in the past seven days is 633.73 EH/s. Correspondingly, as the difficulty of mining reaches its peak, the income of Bitcoin miners has also hit a new annual low, with only $2.54 million on August 11.

In this regard, JPMorgan analysts also pointed out that the profitability of Bitcoin mining fell to a historical low in August.

On the other hand, the electricity costs of mining companies are also increasing. The halving of Bitcoin and the increase in mining difficulty have forced mining companies to improve the performance of mining machines, expand the number of mining machines, and expand the scope of mining sites to maintain income, which will inevitably lead to an increase in electricity consumption.

Due to the shortage of electricity resources and the influence of environmental factors, government departments are also trying to raise electricity prices to put pressure on mining companies. For example, senior executives of the International Monetary Fund recently proposed to increase the electricity price of cryptocurrency mining by 85%, and the Paraguayan National Electricity Administration increased the electricity charges of cryptocurrency mining operators by 14%.

The sharp decline in revenue and the pressure on operating costs have also forced mining companies to constantly try new paths for corporate development. For example, the efforts of the above-mentioned mining companies to increase production, recent cases include BitDeer's plan to issue $150 million convertible bonds for data center expansion, and Cleanspark's acquisition of 26,000 Bitmain immersion mining machines for $167.7 million.

In addition, mergers and acquisitions between mining companies are also happening. For example, Riot Platforms acquired Block Mining for $92.5 million, CoreWeave intends to acquire Core Scientific in full, and Bitfarms is negotiating to acquire Stronghold Digital Mining for approximately $164 million.

In addition to improving the level of mining business, mining companies are also trying to turn to the field of AI. Cases that have already occurred include Core Scientific signing a long-term contract with CoreWeave, Hut8 announcing the start of AI business commercialization, and BitDeer's plan to acquire ASIC chip design company Desiweminer for $140 million in an all-stock transaction.

The layout and transformation of AI has been effective for mining companies, and their stock prices have rebounded to varying degrees. But in the long run, it still needs to be tested by the market. Obviously, the above paths require a lot of capital for mining companies to achieve, which can well explain why mining companies have been raising a lot of funds continuously.

What is different from the past is that some mining companies have begun to use the funds raised to invest in Bitcoin.

On August 12, Marathon Digital Holdings announced plans to privately issue $250 million in convertible senior notes, and the company intends to use the net proceeds from the sale of the notes to purchase additional Bitcoin. Then the market heard that it had purchased 4,144 Bitcoins in two days.

Previously in July, Marathon Digital increased its holdings by 2,282 BTC, and it did not sell any Bitcoin in June.

Marathon Digital's choice to buy a large amount of Bitcoin is inseparable from its performance. Its revenue in the second quarter was lower than expected. And it has made many efforts this year, such as Marathon Digital's acquisition of Applied Digital's Bitcoin mining data center for $87.3 million, cooperating with NiceHash to launch customized firmware for Bitcoin ASIC miners optimized for the NiceHash mining platform, and launching mining products MARAFW firmware and MARA UCB 2100 control board, but the above measures are all driving the company's stock price to rise.

Another mining company, CleanSpark, mined 494 BTC in July, but only sold 2.54, and its reserves reached 7082 BTC.

The CryptoQuant research report also pointed out that the Bitcoin hash index also indicates that the period of miners' selling has ended.

The above phenomenon shows that listed mining companies raise funds by issuing convertible bonds and stocks to expand market share and increase hash rate, but in the final analysis, they still find ways to maximize their profits. And retaining Bitcoin and investing in Bitcoin are becoming the business choices of mining companies.

Conclusion

The reduction in income has forced mining companies to seek diversified sources of income to maintain competitiveness, and conventional methods include improving existing business capabilities and levels, acquiring and forming a group, and adjusting the direction of the industry. However, Marathon Digital boldly made a choice different from other mining companies, that is, to purchase Bitcoin on a large scale.

In fact, MicroStrategy's successful model is right in front of us, and the benefits brought by mining companies' increased investment in Bitcoin may not be lower than other businesses, and continuing to sell Bitcoin will obviously not help mining companies get rid of their current predicament.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Others

Others Others

Others Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph