Author: DeMan

The stock prices of Bitcoin mining companies generally rose by about 10% on Wednesday, and the performance of the top ten mining companies by market capitalization was particularly significant. The rally was largely driven by U.S. presidential candidate Donald Trump’s pledge to bolster U.S. crypto mining operations, further solidifying the U.S.’s leadership in the field.

According to data from Google Finance, the stock prices of TeraWulf (WULF) and Hut 8 Mining (HUT) rose by 10.5% and 10.07% respectively on June 12. Core Scientific (CORZ), Iris Energy (IREN) and Cipher Mining (CIFR) gained 9.87%, 9.72% and 8.94% respectively. CleanSpark (CLSK) and Riot Platforms (RIOT) rose 8.15% and 6.5% respectively, and Marathon Digital (MARA), the largest Bitcoin mining company by market value, also rose 2.4%.

Before Trump announced his support, the stock prices of these mining companies were relatively stable, and the market was more worried about the uncertainty of the future. However, Trump issued a statement on Truth Social that Bitcoin mining may be the last line of defense against central bank digital currencies (CBDC) and called for all remaining Bitcoin to be manufactured in the United States. He also promised to strongly support the Bitcoin mining industry if elected president.

Trump’s statement significantly boosted market confidence and triggered a collective rise in the share prices of mining companies. In the future, whether these mining companies can continue to maintain their strong momentum with policy support will be the focus of the market.

Trump met with leading Bitcoin miners: Promising to keep mining in the United States, stock prices rose in response

Behind the rise in the stock prices of Bitcoin mining companies was former U.S. President Donald Trump Trump’s public support for Bitcoin mining. On June 12, Matthew Schultz, executive chairman of Bitcoin mining company CleanSpark, revealed that executives from several Bitcoin mining companies met with Trump at Mar-a-Lago on Tuesday night. Attendees included industry representatives such as Riot Platforms CEO Jason Les.

Schultz said Trump clearly expressed his love and understanding of cryptocurrencies at the meeting and pointed out that Bitcoin mining companies help stabilize the energy supply of the power grid. Trump also promised to speak out for mining companies if he returns to the White House. This statement undoubtedly injected a shot in the arm for mining companies and further boosted market confidence.

In addition to CleanSpark and Riot Platforms, participants in this so-called "Bitcoin Mining Presidential Roundtable" also included well-known companies in the industry such as Marathon Digital. After the meeting, several participants shared photos with Trump on social media and expressed their high praise for the outcomes of the meeting. CleanSpark's S Matthew Schultz wrote on the He also said: "I had an excellent discussion with former President Trump about Bitcoin and the energy advantages of the United States."

This meeting comes at a time when Bitcoin miners are facing difficulties due to climate change and the impact on local power grids. The impact was met with strong opposition. Previously, the Democratic Party has been promoting and criticizing the review of energy consumption and carbon emissions of Bitcoin miners. However, the cryptocurrency industry continues to strive to influence U.S. political decision-making by providing donations to candidates who support digital assets. Trump publicly demonstrated his change in attitude towards the cryptocurrency industry and regulation at the NFT dinner in May, and stated that his campaign team would accept cryptocurrency donations.

Trump’s public support not only boosted the stock prices of mining companies, but also provided policy guarantees for the future development of the Bitcoin mining industry. Next, we will conduct an in-depth analysis of the recent performance and future trends of these mining companies.

Inventory of the top eight mining companies by market value behind Trump’s support: Selecting the best from the best

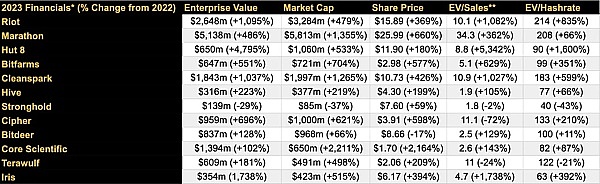

The significant rise in the stock prices of Bitcoin mining companies stems from former US President Donald Trump’s support for the Bitcoin mining industry. public support. On June 12, Trump stated on Truth Social that Bitcoin mining may be the last line of defense against central bank digital currency (CBDC) and hoped that all remaining Bitcoins could be manufactured in the United States. He also promised to strongly support the Bitcoin mining industry if elected president. The following are eight Bitcoin mining companies worthy of attention in market capitalization and their recent performance:

TeraWulf Inc.

TeraWulf (WULF) is the Bitcoin mining company with the largest share price increase this time , up 10.5% on June 12. The digital asset technology company is focused on developing and operating environmentally friendly Bitcoin mining facilities within the United States. TeraWulf’s mining facilities are powered by clean, affordable and reliable energy sources. The company has partnered with Cumulus Coin to launch the United States’ first 100% nuclear-powered Bitcoin mining platform, with its 200MW Nautilus facility connected to Pennsylvania’s Susquehanna Nuclear Power Plant.

Hut 8 Mining

Following this is Hut 8 Mining (HUT), whose shares rose 10.07%. Hut 8 is one of the largest innovation-focused digital asset miners in North America. The company and its subsidiaries are primarily engaged in the mining of digital assets, using specialized equipment to solve computational problems to verify transactions on different blockchains and receive Bitcoins. Hut 8 operates cloud and colocation data center facilities in Canada for enterprise customers seeking computing services. In August 2023, BlackRock invested $384 million in Hut 8 to explore the potential impact of digital currencies on the global economy.

Core Scientific

Core Scientific (CORZ) shares rose 9.87%. As one of the largest blockchain data center providers and digital asset miners in North America, Core Scientific has been operating blockchain data centers in North America since 2017 for digital asset managed mining and self-mining. The company has completed multiple large-scale financings and has accumulated extensive experience in deploying, powering up and maintaining mining machines to maximize Bitcoin production and return on investment.

Iris Energy

Iris Energy (IREN) shares rose 9.72%. The company focuses on sustainable Bitcoin mining, operating next-generation data centers powered by 100% renewable energy. Iris Energy harnesses excess renewable energy to support energy networks while building profitable businesses in emerging sectors. The company’s founders, Dan and Will, have extensive experience in the renewable energy and traditional mining sectors, and they are applying this expertise to their Bitcoin mining operations.

Cipher Mining

Cipher Mining (CIFR) shares rose 8.94%. This is an industrial-scale Bitcoin mining company dedicated to expanding and strengthening the critical infrastructure of the U.S. Bitcoin network. Cipher Mining has an experienced management team from the technology, fintech, energy and finance sectors. The company is committed to providing a solid foundation for the Bitcoin network to support its future development and applications.

CleanSpark

CleanSpark (CLSK) shares rose 8.15%. Founded in 1987 as a Bitcoin mining company, the company owns and operates five independent data centers with a total development capacity of 230 megawatts. CleanSpark works to develop infrastructure in low-carbon energy communities using wind, solar, nuclear and hydroelectric power. The company has also further expanded its operations by acquiring three Bitcoin mining facilities in Mississippi.

Riot Platforms

Riot Platforms (RIOT) shares rose 6.5%. Riot is a leading Bitcoin mining company focused on maximizing its Bitcoin production and return on investment. The company operates multiple large-scale mining facilities in North America and works with major hardware suppliers to ensure the efficiency and stability of its operations.

Marathon Digital

Marathon Digital (MARA) shares rose 2.4%. As the largest Bitcoin mining company by market value, Marathon Digital is mainly engaged in digital asset mining business and is committed to building efficient and sustainable mining facilities. Although this increase is small, Marathon Digital’s influence in the industry cannot be underestimated.

Through a detailed inventory of these leading mining companies, it can be seen that Trump’s support has a significant boost to market confidence.

With Trump’s support and halving test, will mining companies usher in new opportunities or face a reshuffle?

Bitcoin mining companies face the dual challenges of financing and halving in the second quarter of 2024. While former President Donald Trump's support has given the market a shot in the arm, with shares of mining companies generally rising, uncertainty about the future remains.

Equity financing activity by mining companies is expected to decline significantly in the second quarter, according to analysis by BlocksBridge Consulting. As of mid-May, investment volume was less than $500 million, well below previous quarters. While Marathon Digital, CleanSpark, and Riot Platforms collectively raised significant amounts of capital last quarter, a slowdown in funding activity could impact their ability to cope with the upcoming halving event.

The Bitcoin halving will reduce mining rewards by half, increase mining difficulty, and directly affect the income of mining companies. Despite this, the top five Bitcoin miners did not sell large amounts of Bitcoin in the first quarter and continued to hold on to it. Global Bitcoin miners hold more than 700,000 Bitcoins, accounting for 3.4% of the total supply.

Riot Platforms’ net revenue reached a record $211.8 million in the first quarter of 2024, despite rising mining costs and declining production. Marathon Digital's revenue grew 223% year over year, but still fell short of expectations. These financial performances show the active preparations of mining companies before the halving and the uncertainty of the market.

The Bitcoin halving is a stress test for mining companies. Unless Bitcoin prices remain above $40,000, most miners will face profitability challenges. Mining companies need to control costs and seek more revenue models to cope with future uncertainties.

Although Trump’s support has boosted market confidence, the challenges posed by the halving will still test the financial resilience and adaptability of mining companies. Whether mining companies can gain a foothold in the new round of market reshuffle will depend on their strategies and execution capabilities to deal with these challenges.

Bernice

Bernice

Bernice

Bernice Joy

Joy Alex

Alex Edmund

Edmund Davin

Davin Catherine

Catherine Coinlive

Coinlive  Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx