Source: Zhou Ziheng

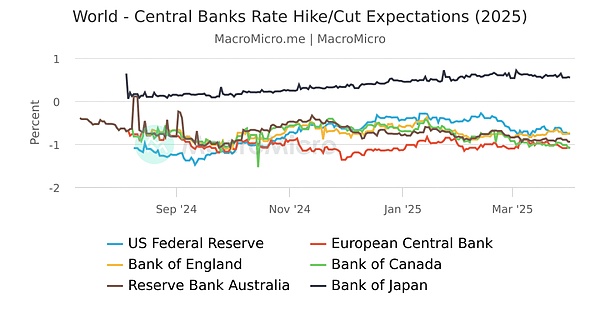

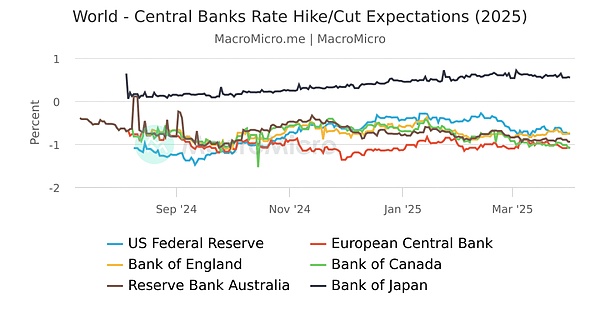

We are still in a temporary "hole" and hope that this will become a Q2 event. We have been expecting this. This stems from the huge US tax payment in April and the surge in reverse repurchase agreements (RRP) at the end of the quarter. In addition, Asian central banks (China and Japan) have taken tightening measures due to currency weakness. Could the situation in Q3 be very different?

In today's closely connected global economy, financial markets are closely linked. Recently, there have been many abnormal phenomena in the global financial field, and all signs indicate that a serious global US dollar liquidity crisis is quietly approaching. As the world's main reserve currency, the liquidity crisis of the US dollar has not only disrupted the stability of the financial market, but also posed a serious threat to the global economic system. An in-depth analysis of the causes, manifestations and impacts of this crisis is very important for governments, financial institutions and investors in the market.

1. Where does the global dollar liquidity crisis come from?

Central banks of various countries sell off dollar assets

The global dollar is becoming increasingly insufficient, which leaves central banks and institutions that manage foreign exchange reserves with no choice but to sell off their dollar assets. According to the data of the Institute of International Finance (IIF), since the second half of 2024, central banks in emerging market countries have sold a total of more than $150 billion in U.S. Treasury bonds due to tight dollar conditions. China is a big holder of U.S. Treasuries, having sold more than 400 billion yuan (almost $57 billion) of U.S. Treasuries in the past year. Since 2021, the size of its holdings of U.S. Treasuries has been decreasing rapidly. On February 18, 2025, data released by the U.S. Treasury Department showed that by the end of 2024, China held $759 billion in U.S. Treasuries. Japan is also a big buyer of U.S. Treasuries. Although Japanese Finance Minister Katsunobu Kato said that there was no large-scale sale of U.S. Treasuries to counter Trump's tariffs on Japanese goods, foreign investors sold a total of nearly $100 billion in U.S. Treasuries in the three months from November last year to January this year, and Japan is likely to be one of the sellers. Central banks of various countries sell their non-circulating treasuries in order to get the urgently needed U.S. dollars. So many treasuries suddenly flooded into the market, breaking the original supply and demand balance in the treasury market, and treasury yields suddenly rose, which made the dollar liquidity crisis even more serious.

Hedge fund leverage operation problems

Many hedge funds have long relied on the repo market to make money by buying and selling government bonds with high leverage. According to Bloomberg data, the scale of leveraged funds used to speculate on government bonds in the repo market in the past two years was about 3.5 trillion US dollars. However, as the global dollar liquidity crisis becomes more and more serious, the market environment deteriorates and the liquidity of collateral is gone. Investors who use high leverage cannot come up with margin or find enough collateral, so they are forced to sell their treasury bonds. For example, a well-known hedge fund recently had to sell $30 billion worth of U.S. treasury bonds because of liquidity problems with collateral. Many hedge funds do this, which increases the pressure to sell treasury bonds and increases the yield of treasury bonds, causing the dollar liquidity crisis to spread rapidly in the financial market.

Media misleading makes the market more chaotic

When reporting on the sale of treasury bonds, the mainstream media only saw the surface and did not mention the fundamental reason of the dollar shortage. They also followed the Federal Reserve in saying that "liquidity is sufficient", which misled investors and people in the market and made it difficult for everyone to see the real situation, making the market more chaotic and unstable. This information asymmetry and misleading make it difficult for people in the market to make correct judgments and decisions in a complex market environment. The normal operation of the market has been disrupted, and fluctuations have become larger and more frequent, which has also made the US dollar liquidity crisis worse to a certain extent.

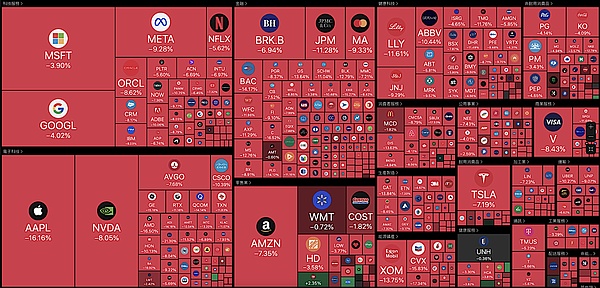

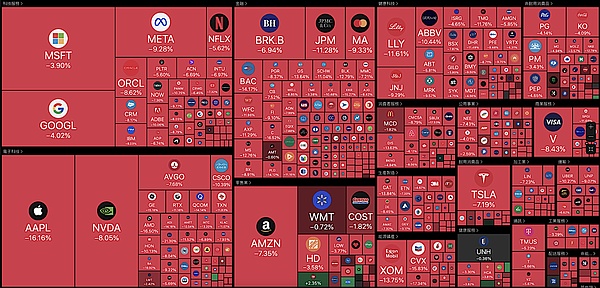

Second, how is the market performing?

Treasury bond market: abnormal increase in yields

Under the influence of the global US dollar liquidity crisis, the global financial market is in chaos, and all kinds of assets are being sold off. But strangely, the yield of US Treasury bonds has risen instead of falling, which is an abnormal trend. Take the 10-year US Treasury bond yield as an example. In just one week, it has risen sharply from 3.9% to 4.5%. This increase is particularly prominent in the data of the past 10 years, which is completely different from the previous market turmoil. Generally speaking, when the market panics, people will invest their money in the U.S. Treasury market for risk aversion, so that the price of Treasury bonds will rise and the yield will fall. For example, in the first month of the global financial crisis in 2008, the yield on 10-year U.S. Treasury bonds dropped from 4.1% to 2.5%; in 2020, when the COVID-19 pandemic just started, in a short period of time, the yield on 10-year Treasury bonds fell from 1.9% to a historical low of 0.5%. But this time the market performance is completely the opposite, which shows that the global dollar liquidity crisis has disrupted the normal operation of the financial market.

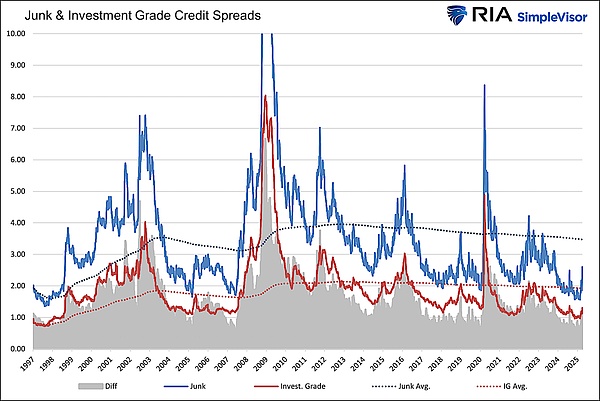

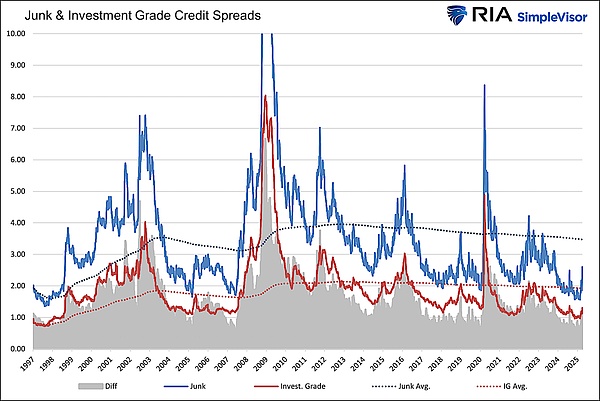

Credit Market: Risk of Collapse Increases

Credit market is an important part of the global financial system. Under the impact of the global dollar liquidity crisis, the danger signals have been particularly obvious recently. From March 1 to April 1, 2025, the spread of high-yield bonds rose by 156 basis points to 461 basis points, and the rate of deterioration was the fastest in 25 years. Data from Bloomberg Barclays shows that since the beginning of 2025, high-yield bond spreads have widened much faster than before. The increase in this month alone can be compared with the particularly severe financial turmoil caused by the global epidemic in March 2020 and the global financial crisis in 2008. In the first three months of the 2008 financial crisis, high-yield bond spreads rose rapidly from 250 basis points to 600 basis points; at the beginning of the epidemic in 2020, the spread also rose from 300 basis points to 550 basis points in about the same time. The rapid increase in high-yield bond spreads shows that the market is particularly worried about credit risk. Investors are afraid of bond defaults, so they require higher returns to compensate for the risk. This also reflects that the market has little confidence in the quality of credit assets.

As the credit market deteriorates, the value of junk bonds has shrunk significantly, and the quality of the collateral used has also become very poor. According to data from S&P Global Ratings, in the past year (2024), the default rate of junk bonds has risen from 1.8% to 3.5%, and the market value has also dropped significantly. In the financial system, many financial transactions rely on the stability of the value of collateral. The depreciation of junk bond collateral, like a virus, quickly spread throughout the financial system, severely impacted the trust between financial institutions, and made the market liquidity worse. In order to reduce risks, financial institutions have tightened credit policies, making it more difficult for companies and investors to get money, which has greatly restricted the activities of the real economy. According to statistics, in places where the depreciation of junk bond collateral is more serious, it is 40% more difficult for companies to get loans from banks than in the same period last year, and the financing cost has increased by 30%. Many companies can only reduce their production scale or even go bankrupt because they cannot get enough funds, which seriously hinders the normal development of the economy.

Commodity market: price plunge

Commodity market has not escaped the global dollar liquidity crisis and has been severely impacted. Crude oil (WTI) prices fell 20% in a week to $57 per barrel, and copper prices have fallen 22% from their March highs. According to data from the U.S. Energy Information Administration (EIA), this weekly drop in crude oil prices ranks third in the past 10 years, reflecting both a significant drop in market demand and investors' panic selling. According to data from the London Metal Exchange (LME), the drop in copper prices from their March highs is approaching the largest drop in the past 15 years. During the 2008 financial crisis, crude oil prices plunged more than 70% in a short period of time, and copper prices also fell more than 60%; although this time is not as extreme, the decline is still large.

Crude oil and copper are important industrial raw materials. Their prices have fallen sharply. On the one hand, it shows that the expectation of global economic growth has been reduced and the demand has become smaller; on the other hand, it also shows that many people in the market are selling commodities to recover funds, which makes the price fall more sharply. This price plunge has not only had a great impact on commodity production companies, but also affected related upstream and downstream companies through the industrial chain, and had a great impact on the stable operation of the real economy. The copper-gold ratio is an important indicator for measuring economic cycles and market risk preferences. Recently, it has also undergone very abnormal changes and has fallen to the lowest level in 40 years, only slightly higher than the crisis in 2020. Bloomberg data shows that the copper-gold ratio has been declining in the past year and a half, from the original value to the current historical low. This shows that the market is particularly worried about the prospects for economic growth. Everyone wants to avoid risks, and it also warns that the global economic situation is very serious.

Foreign exchange market: RMB exchange rate passively falls

The offshore RMB (CNH) exchange rate has recently fallen to a record low of 7.426, and the onshore exchange rate has also reached a 17-year low. Data from the China Foreign Exchange Trading Center shows that the offshore RMB exchange rate fell below the important mark of 7.4 for the first time on April 5, 2025, and the onshore exchange rate continued to hit new lows in the following week. This is not the RMB's own depreciation, but a passive situation in the context of a global shortage of US dollar liquidity. As the global dollar becomes increasingly tight, the market demand for the US dollar has increased significantly, and investors have sold other currencies in exchange for US dollars, and the RMB has also been affected. The decline in the RMB exchange rate not only directly affects China's import and export trade, foreign exchange reserves, etc., but also reflects the instability of the global financial market from the side. Data shows that after the RMB exchange rate fell, the exchange losses of Chinese export enterprises increased by almost 20% within one month, and the profit margins of some enterprises were severely compressed, which made Chinese export enterprises face greater competitive pressure in the international market, brought challenges to the stable growth of China's economy, and also had an indirect negative impact on the recovery of the global economy.

Third, the impact on the European dollar system

The circulation of collateral is problematic

The modern monetary system relies heavily on the smooth circulation of collateral, and government bonds are one of the main collaterals, which is very critical in the financial market. When central banks and hedge funds of various countries sell government bonds at the same time due to their own problems, the market value of government bonds shrinks significantly. According to a research report by the Bank for International Settlements (BIS), in the month from March 1 to April 1, 2025, the market value of government bonds fell by 12% due to large-scale selling. This has brought about a series of serious consequences.

The repo market function is affected

The repo market is an important place for financial institutions to borrow money in the short term. Its operation depends on the circulation of high-quality collateral. The shrinking value of treasury bonds has made traders very worried about the quality of collateral, and their risk awareness has become stronger. As a result, the trading activity in the repo market has dropped significantly. Data from the New York Federal Reserve shows that during the treasury bond sell-off, the average daily trading volume in the repo market dropped from US$180 billion to US$80 billion. The financing function has been seriously hindered. It has become difficult for financial institutions to allocate funds in the short term. The liquidity tension in the market has become more serious. The ability of financial institutions to allocate funds and the supply of funds in the market have been restricted.

Traders are more cautious

Faced with the unstable value of collateral, dealers have raised transaction thresholds and reduced transaction sizes in order to reduce their own risks. A survey of major financial dealers showed that after the volatility of the treasury bond market increased, more than 70% of dealers raised the credit review standards for counterparties, and nearly 60% of dealers reduced the size of their trading positions. This has made the liquidity of funds in the market worse, and it has become more difficult for financial institutions to allocate funds. Many small financial institutions find it difficult to obtain sufficient funds because they cannot meet the thresholds raised by dealers. The pressure to survive is great, and the vitality of the financial market and the efficiency of resource allocation have also been severely suppressed.

The velocity of money circulation has slowed down

Because the function of the repo market has been affected and dealers are very cautious, the velocity of money circulation has also been greatly affected. According to relevant economic models, when the treasury market was turbulent, the velocity of money circulation dropped by almost 35% compared to normal times, and economic vitality was further suppressed. The slower velocity of money circulation means that funds circulate more slowly in the market, making it more difficult for companies and investors to get money, and the driving force for economic growth has also decreased. This will have a long-term negative impact on the development of the real economy, and may cause the economy to fall into recession and hinder the normal recovery and development of the economy.

Fourth, warning and response

Although there has not yet been a full-scale crisis, many indicators clearly show that the global dollar liquidity crisis is still worsening. The shortage of US dollars has made the crisis more and more serious through three channels: foreign exchange reserves, repo markets, and commodities, forming a vicious cycle. The deterioration of collateral credit is likely to lead to a more serious liquidity freeze. Once liquidity is completely frozen, financial transactions will be suspended, the risk of corporate capital chain rupture will increase greatly, and the real economy will be hit hard. The "ample liquidity" mentioned by the Federal Reserve is completely different from the actual situation of dollar shortage in the market. When the yield of government bonds shows deflation rather than inflation, whether the global central bank can maintain the current monetary structure has become a key issue that all market participants and policymakers have to face.

Governments and financial institutions of various countries must attach importance to this global dollar liquidity crisis, strengthen policy coordination and cooperation, take effective measures to alleviate the dollar shortage problem, stabilize the order of financial markets, prevent the crisis from getting worse, and create good conditions for the stability and recovery of the global economy. For example, central banks of various countries can increase the liquidity of the dollar through currency swaps and other methods; financial institutions should strengthen risk management, optimize asset allocation, and not rely too much on dollar assets. At the same time, investors in the market should also pay close attention to the development of the crisis, adjust investment strategies in a timely manner, and deal with possible risks and challenges. In the context of global economic integration, only by working together can we effectively deal with the global dollar liquidity crisis and maintain the stability of the global financial system.

Catherine

Catherine