Original: Liu Jiaolian

BTC continued its correction overnight, falling all the way back to below 66k.

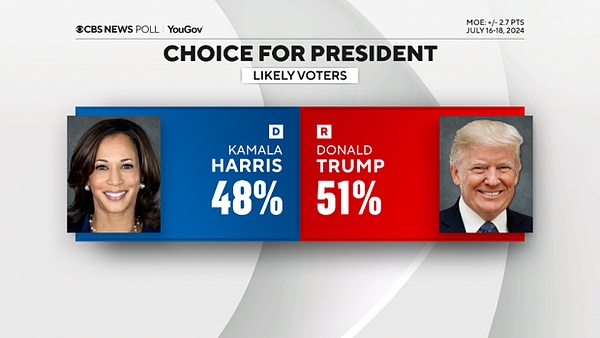

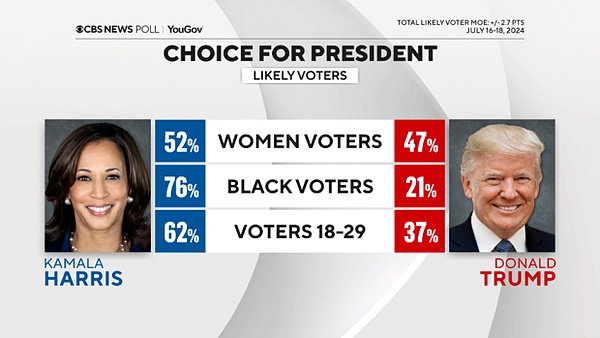

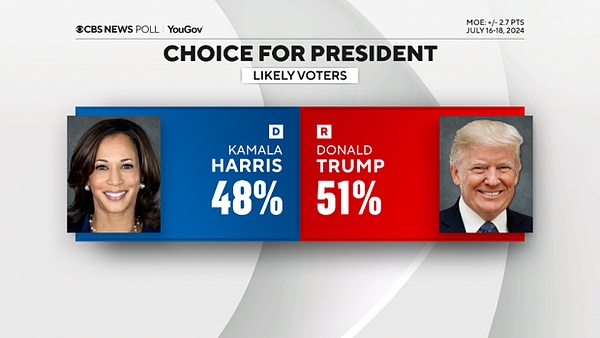

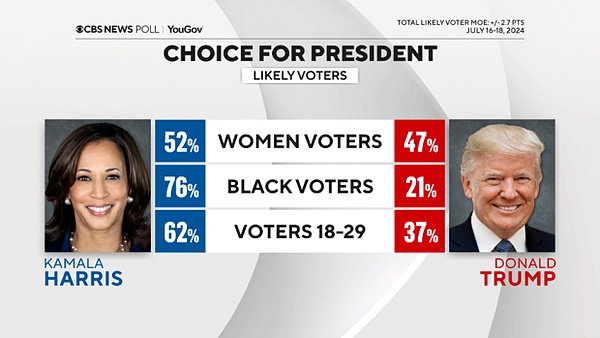

In the United States, the Democratic Party changed its leader at the last minute, and Harris came on stage with a big laugh. The latest polls show that she is evenly matched with the popular Trump, and there is even a possibility of a comeback.

It's not that Harris is really good, but that the Democratic Party's ability to operate is really amazing. In this way, Trump, who survived the disaster, will have to add a few more variables to the quota for admission. After all, didn't Reagan, who was assassinated that year, also lose the qualification for admission? So the positive news interpreted by the crypto market for Trump was suppressed.

If Harris really reverses the election situation again, defeats Trump, and advances to the US presidency, then the plot of the cartoon "The Simpsons" will really become a divine prophecy.

However, the good news is that Harris' campaign team is said to be attending the "Bitcoin 2024 Conference" this weekend. Some netizens joked that if Harris preemptively announces that if she is elected, it will promote BTC to be included in the US national strategic reserve. Wouldn't it be interesting? Take the opponent's path and leave the opponent with no way to go. Haha.

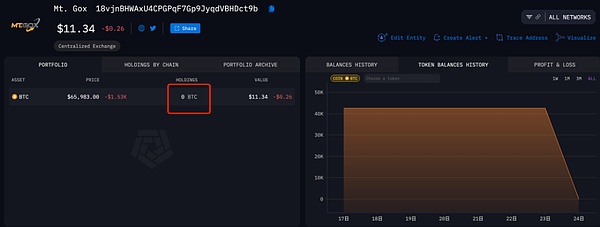

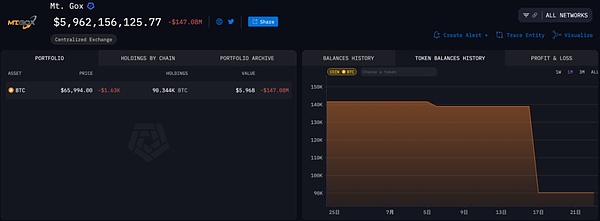

In Japan, KrakenFX CEO posted that the distribution of BTC and BCH to compensate the victims of Mt.Gox has been completed.

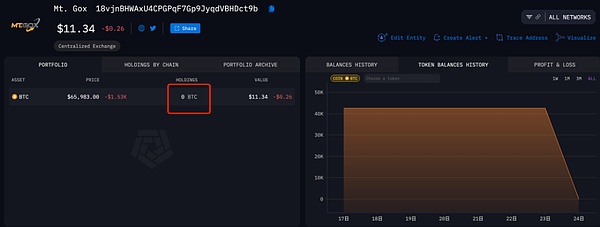

From the on-chain data, the BTC address distributed this time is exactly the address mentioned before, and its balance has decreased from 43,000 on July 23 to 0 on July 24.

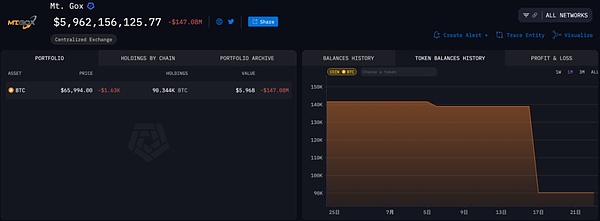

And these 43,000 BTC should come from a batch split from the Mt.Gox total asset pool on July 17. There are still more than 90,000 BTC left in the pool.

How much impact will Mt.Gox's compensation distribution have on the market?

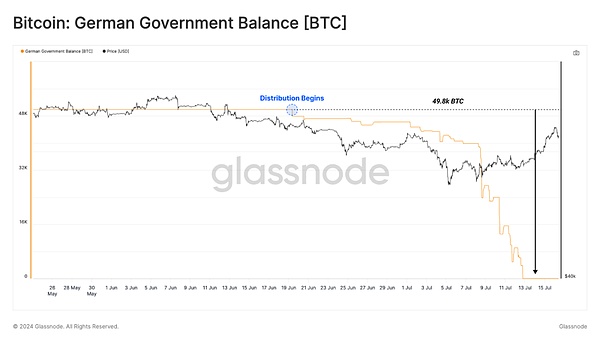

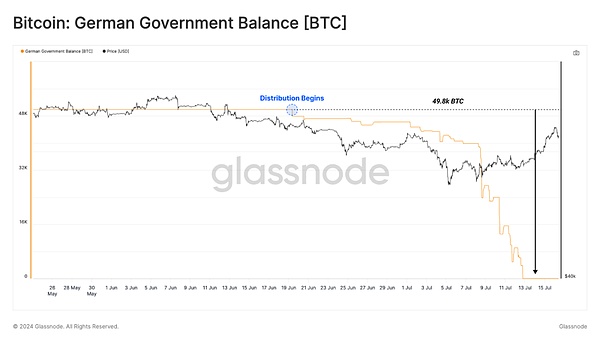

Let's review the process and market reaction of the German government selling off nearly 50,000 BTC in late June and early July. At that time, the market was in a state where there were almost no interference factors, which was an excellent observation sample.

As can be seen from the above figure, BTC began to peak and turn down more than 10 days before the German government sold off, reacting in advance. The local high point on June 6-7 before the decline was about 72k. This reflects the fact that the financial market will react in advance to future news.

When BTC hit the bottom of 53k locally on July 5, the German government was actually just cautiously shipping and had not had time to sell off in large quantities. It can be seen that the market will try to let the seller sell at a lower price.

When the German government finally started to liquidate on July 8, BTC only pulled back to 54k for the second time, and then began to rebound and rise sharply as the German government completed its liquidation.

In fact, when it hit the bottom of 53k on July 5, the market had already fully priced in the German government's liquidation.

From 72k to 53k, it retreated about 20,000 dollars, cutting more than 1/4.

From this point of view, the market had already responded to the Mt.Gox distribution in advance after reaching the local high of 68k on July 22.

Only by an extremely rough method of estimation: the German government sold from 72k to 53k, an average of 62.5k, multiplied by 50,000 BTC, it can be seen that the market's pressure purchasing power to digest this part of the additional selling pressure is about 3.125 billion dollars. This time, the 43,000 BTC distributed by Kraken has been digested. Currently, it has retreated from 68k to 65k, with an average of 66.5k, and the multiplication results in a selling pressure of 2.86 billion dollars.

If there are no other unexpected factors, the depth of this callback will not be lower than the 53k sold by the German government. There are three reasons: first, the total amount of 43,000 is nearly 15% less than 50,000; second, the starting point of the callback is 68k, which is lower than 72k, and the overdraft of market funds is less; third, the positions are more dispersed after this distribution, and the selling pressure is more even.

However, according to the previous announcement, the remaining more than 90,000 BTC of Mt.Gox will be distributed in the future, and the selling pressure will continue until the end of October. It is estimated that a total of 4.6 billion dollars of selling pressure will be released to the market. These have been reported and calculated in many aspects in a series of internal reference articles in the past four months of Jiaolian, so this article will not repeat them.

Cheng Yuan

Cheng Yuan