Author: Multicoin Capital; Translation: Golden Finance xiaozou

At the end of each year, we get together to discuss what major changes we expect to happen in the coming year. However, this is the first time these ideas have been made public.

Shayon Sengupta (Partner of Multicoin Capital): Value Focus Theory

Exchanges are used to trade things that are easy to price - stocks, commodities, interest rates, etc. There are some canonical ways to measure these assets (e.g., discounted cash flow model DCF for stocks; current price of a barrel of oil at the border; willingness to pay for a redeemable $1.05 in the future). This is what price discovery means for liquid markets.

However, there is a category of goods for which price discovery is entirely based on attention. Sneakers, art, sports collectibles, antique furniture - these commodities are inherently less liquid than stocks or commodities, and their value comes purely from social consensus, not from any DCF model.

In recent years, due largely to the influence of the Internet, value focus theory has penetrated into traditional markets. Under this model, TSLA, GME, AMC, DOGE, and CryptoKitties have all experienced significant price discovery. In the past, the main pricing mechanism for these assets was cash flow and settlement price, but now the main pricing mechanism comes from the attention they receive.

Cryptocurrencies play two important roles in the value focus theory: the first is the ability to create new assets quickly, and the second is the ability to trade these new assets. If attention is the core pricing factor, then what cryptocurrencies achieve is an infinitely extending canvas for issuing and trading assets that track attention. The broader model of “financialization attention” requires the two most important properties of cryptocurrencies to naturally reach their final state: permissionless and composability.

●Permissionless: Anyone can issue any type of asset.

●Composability: Anyone can trade these assets anywhere.

The experimental design space is as follows:

● Increase the surface area for new asset issuance (e.g., creator tokens, prediction market LP positions, meme coins).

●Embed issuance and trading into new venues (e.g., messenger bots like bonkbot or bananagun, leaderboards like friend.tech, in-game markets).

● Promote coordination among asset holders (e.g., pool funds to purchase copies of the Constitution, build a radio footprint for offloading and decompressing operators).

The near-term impact of this situation will be that the next big exchange will look less like an exchange and more like a live streaming platform where creators and viewers can place bets together, or something like A group chat platform where friends and the community can immediately launch a crowdfunding campaign to raise millions of dollars to build a network presence, or a Stack Exchange type forum where top contributors not only receive platform-specific status points, and will also receive material economic benefits.

In 2024, we will see entrepreneurs experimenting along these three models. We will see the emergence of the first “non-exchange” type exchanges for liquid and illiquid assets. Trading volumes on these exchanges will climb up the leaderboard and take over from Waa Street Bets.

Vishal Kankani (Head of Multicoin Capital): Social Network for NFT Collectors

In 2024, I am very optimistic about NFT collection. More people will collect NFT and social network around collectors. Experience will also receive more and more attention.

Collecting has a long origin, from the peerless treasures collected by the kings of Egypt and China to the curiosities of Renaissance Europe. In essence, museums evolved from these private collections.

Psychologically speaking, in addition to speculative opportunities, collecting is also a way of self-expression. In some circles, collecting has become a status symbol, and the act of collecting is intertwined with personal identity, symbolizing commitment, expertise, and knowledge. The Internet has amplified this behavior, connecting previously separate enthusiasts and fostering a new sense of belonging within their respective circles.

Despite these advances, collectors still face a number of obstacles:

●Fraud related to authenticity and provenance

●Trading and exchangeability< /p>

●Security, damage and loss

●Space and storage issues

By design, blockchain can greatly break down the above barriers and attract more people Enter the collection realm. Blockchain will be particularly attractive to younger generations who have entered the field of digital collections, such as Pokémon Go, virtual sneakers and game skins. These collections are precursors to digitally native collections that reside on public blockchains.

Even if digital collections move from private databases to public blockchains, some behaviors of collectors will remain the same: showing off their collections, easily exchanging collections, discovering and connecting with peers, and interacting with others. desire. These behaviors will lay the foundation for the rise of social experiences based on ownership graphs.

Spencer Applebaum (Partner at Multicoin Capital): Stablecoin remittances in emerging markets

After interning at Bitspark, I fell down the cryptocurrency rabbit hole. Bitspark is one of the first companies to use Bitcoin as a remittance channel, with its business scope mainly in Southeast Asia and Africa. Cryptocurrency-powered cross-border payments are the use case that has excited me the most since I discovered cryptocurrencies.

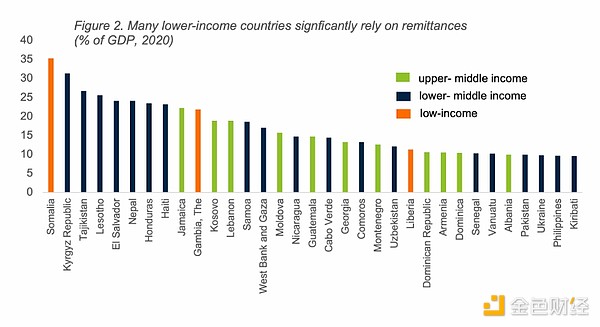

In some low-income countries, the remittance industry is one of the largest drivers of gross domestic product (GDP) and the way many economies survive:

The challenge for remittances has always been the high cost, and only a handful of fiat currencies can Exchange and trade outside of their home country (e.g. USD, EUR, JPY, GBP), which makes many remittance channels slow and difficult to access. According to the World Bank, the average cost of remittances is about 6.2%, but for certain long-tail channels, this cost will increase significantly. For example, the cost of sending money from South Africa to China is over 25%.

In this context, I expect that 2024 will see the emergence of: consumer-facing remittance apps and B2B SaaS companies for tangible money transfer operators (MTOs) (especially in traditionally inaccessible and / or MTO using stablecoins in expensive channels).

These products either convert local currency to USDC/USDT via local payment channels P2P (such as oRamp or El Dorado), send USDC to another country, or hold USDC or use familiar Domestic payment channels exchange to local currency with other brokers or liquidity providers.

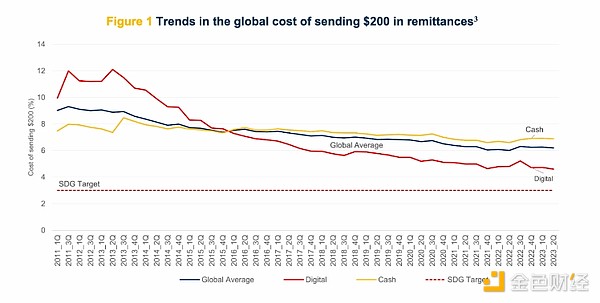

Digital payments have had a profound impact on global remittances over the past 12 years:

Stablecoins will accelerate this trend and further reduce the cost of remittances, especially those long-tail channels that have historically been slow and expensive. With the rapid adoption of stablecoins in 2023, 2024 will be the year stablecoin remittances boom.

Matt Shapiro (Partner at Multicoin Capital): Cryptocurrencies shift from products to supporting products

In 2024, we will see a meaningful shift in cryptocurrency Switch from product to product support. Early signs of this are now emerging and widespread.

Last year, cryptocurrencies lit up new markets that were once impossible or extremely inefficient. Hivemapper creates an entirely new map with locations viewed 24 to 100 times more often than Google Street View and has mapped 10% of the world in less than a year, using encryption to incentivize permissions in a scalable way without the need for permission contribution. Amid the global GPU shortage, the Render Network has created a new market for GPU supply. We believe that in the next few years, the GPU supply field will continue to face the problem of supply and demand imbalance. Helium Mobile is looking to fundamentally change the cost structure of the telecommunications industry by onboarding encryption-enabled user-owned infrastructure and devices.

Nubank, one of the largest neobanks with over 80 million customers, is leaning into cryptocurrency adoption, having released the Nucoin token for its loyalty program. Starbucks is leaning into cryptocurrencies with their Odyssey program, an offshoot of their existing top-tier rewards program. Blackbird is using cryptocurrency rewards as a wedge into the restaurant industry (which could be the precursor to a strong payments business, adding another layer to restaurants’ bottom lines).

BAXUS is using cryptocurrency to drive the development of trading and investment markets for whiskey and other premium spirits, opening these markets to more new participants. oRamp is using cryptocurrencies to open up a new market for local and regional foreign exchange, narrowing spreads and reducing costs for customers.

All of these examples are different, but at their core they are consistent: they are all using cryptocurrencies to power products that drive meaningful economic outcomes. In some cases, like Starbucks, Nucoin, and Blackbird, cryptocurrencies are mostly obscure and operate behind the scenes. In other cases, like Hivemapper and Render, the cryptocurrency is closely related, highly visible, and a key part of the product itself. The design space here is vast, and the infrastructure built over the past five years has paved the way for cryptocurrencies to support everyday use cases. In 2024, experiments in this field will explode.

Eli Qian (Investment Analyst at Multicoin Capital): On-chain data

In 2024, I predict that the scale of on-chain data will grow by orders of magnitude. As new users join, the use cases and functionality of dApps and protocols will grow. The amount of data coming from decentralized social protocols will be especially rich - people will be more active on social products and generate more data than financial products.

How do we deal with this data explosion? In the past, people viewed on-chain data through the lens of advertising and personalization. However, I'm eager to see teams take a more fundamental approach and realize that contextualizing on-chain data is not just a luxury but a necessity when building social products.

Currently, our on-chain social data and identities are built in a common graph (such as Farcaster), which makes it difficult to build social products for different social environments. People are multi-faceted. We live in a variety of social environments. Different environments will shape our different behaviors and give us different needs. We all use Facebook, Twitter, LinkedIn and Snapchat for different reasons – the social graph creates specific context and experiences on each platform.

The release of Threads provides a case study in this regard. Threads didn't kill Twitter for many reasons, but one of them was blurred social context. Threads' social graph is imported from Instagram, a social network whose context is primarily about real-life relationships. But Threads' user interaction model mirrors that of Twitter, an online-first, often anonymous social environment. Because the product doesn't fit the context, it's unclear to users how they should act.

In 2024, the boundaries and nodes of the social graph will be fragmented and divided into more specific and relevant contexts. Currently, on-protocol solutions are already available (like channels on Farcaster), but I hope to see off-protocol solutions as developers start to need data more relevant to the products and social experiences they plan to build. I'm excited about the next wave of data primitives and developer infrastructure that will power a new generation of social applications.

Tushar Jain (Co-founder and Partner of Multicoin Capital): New form of token distribution

Every bull market in cryptocurrency is driven by a new method of token distribution started. Examples include:

●Propagation of the PoW chain— 2013/2014

●ICO—2017

●IEO—2019

●Liquidity Mining – 2020

●NFT Minting – 2021

In the recent bear market, there are two new token distribution mechanisms that can serve as ignition Fuel for the new bull market:

●DePIN — Reward those who help build productive capital assets (e.g. Helium, Hivemapper, Render) with tokens.

●Points — Incentivize people to use the product before all token mechanisms come into play. There is a lot of work involved in issuing a token, and once the token is online, it is difficult to change the token economics. Points have no units, no maximum supply limit, and because they are non-transferable, there is less regulatory risk. Points are an incentive before product-market fit is achieved.

New forms of token distribution are a powerful way to attract new users into the crypto ecosystem. I think the next surge in users will come from users earning their own crypto assets, not buying them. DePIN and Points are new ways to offer crypto assets to new users who have never used a crypto wallet before.

Kyle Samani (Partner of Multicoin Capital): UI layer composability and client ZK (zero-knowledge proof)

(1) UI layer composability

< p>In my speech at the Multicoin Summit in 2021, I discussed the concept of composability. At the time, I was more focused on on-chain atomic composability. However, over the past few years, I've started to take on-chain atomic composability less seriously (so I changed my name on X from "Composability Kyle" to "Integration Kyle"). Lately, I've been more interested in the composability of permissionless UI layers. In 2023, we saw the first major breakthrough in UI layer composability: Unibot. Unibot is an on-chain terminal and DEX bot on Telegram. Previously, people would get information somewhere on the internet (X, Reddit, news, Bloomberg, Telegram chat, etc.) and then navigate to a separate UI to trade (e.g. Drift, Binance, Coinbase, etc.), whereas Unibot brings the trade to Come to Telegram, where people already gather, socialize and exchange information.

In 2024, there will be a huge opportunity to bring trading activity into many different online environments, in addition to group chats on Telegram.

Based on this idea, I would like to see more UI layer composability, not only for asset ledgers but also for social products, most notably Farcaster. Farcaster's dream is audacious: a single event feed where every event is signed by a single person, and countless UIs can read and write data from that event feed.

We usually discuss X as if it provides a unique product experience for different use cases: cryptoTwitter, fintwit, sportTwitter, politicalTwitter, etc. There is a real opportunity to build a Farcaster client that implements this vision from first principles. The design space will open in 2024.

(2) Client ZK

In the past few years, most discussions about zero-knowledge proofs (ZK) have revolved around using zero-knowledge rollup and ZK co-processors to Extended asset ledger. However, I think the most interesting design area of ZK is client-side privacy protection. I recently looked at the ZK configuration of two clients that I found very compelling:

●Zk.me — As the name suggests, this is a place to generate ZK proofs about yourself systems, especially in the context of KYC and AML compliance. Without stricter on-chain KYC, it’s hard for me to imagine DeFi seeing another 10x growth. Under this assumption, I would prefer users not to leak their data, and ZK proofs will be the basis for realizing this vision.

●Brave Boomerang — Traditionally, ad exchanges have run on centralized servers. This is true for Google, Facebook and every other online ad exchange. Brave is disrupting the ad exchange model. Users run the ad exchange locally on their devices and submit proof to the blockchain that they are running the ad exchange correctly. This model ensures that no personal information is leaked and still gives advertisers the targeting granularity they seek (ZK is proven to ensure that Honda's ads are shown to an audience of 16-year-olds rather than 6-year-olds).

As these two examples show, the greatest opportunity to rebuild trust on the Internet and use ZK to build new business models lies on the client side.

Bitcoinist

Bitcoinist

Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist