Author: Dewhales Capital Source: substack Translation: Shan Ouba, Golden Finance

1. Introduction

This time we launched a new project related to the Curve ecosystem. We have conducted a comprehensive study on the development of the ecosystem around Curve, and then it is clear that Curve's unique mechanism enables us to create a large and sustainable ecosystem with a large number of projects within this large mechanism, and a large number of projects using Curve for its intended purpose - as a liquidity pool.

With the development of LSDFi and LRTFi, the Curve ecosystem continues to expand, capturing and introducing new protocols and liquidity. This giant remains steadfast in adversity and confidently surpasses its competitors. Napier is just one example of a new wave of projects working with and adding new features and mechanisms to the Curve-based ecosystem.

2. Napier

Napier is a yield trading liquidity hub created as an extension of Curve Finance. Napier chose to build on top of Curve pools to maximize capital efficiency for yield trading. The Napier AMM optimizes fixed-term assets and syncs seamlessly with Curve v2 to increase momentum. Overall, the protocol is similar to Pendle and the multi-compound Curve pool.

Although the project started talking about links to DeFi protocols in 2020, it is a modern project because it uses LST and LRT mechanisms (and these are tightly integrated with Curve and Convex because these protocols are modifiable due to their time-transcending designs).

No matter what the market conditions are, Napier will allow users to always choose best practices, such as:

- Fixed Rate:Lock in the gains from your position, removing any uncertainty about future returns.

- Initial Income:Napier will allow users to receive expected income in advance, giving you immediate access to funds that would normally take months or years to accrue.

- Yield Trading (Points):Yield Tokens (YT) represent the right to future returns, allowing users to trade and speculate on interest rate fluctuations (APR), which is similar to buying a token and gaining access to its price changes. (More on this below)

- Liquidity Provision:Napier's liquidity provision allows users to earn swap fees while retaining your rights to accrue yield and various incentives.

Supported assets include wstETH (without rewards), rETH, and sfrxETH, which are the core and most liquid LST protocols. They are used in multi-asset liquidity pools (meta-pools, where one asset is traded with a pool of another asset) to maintain the stability of LST and LRT. The more different tokens of the same type there are in a meta-pool on one side, the lower the decoupling risk is due to the weighted average price being maintained. An example of a meta-pool is a three-pool pair (DAI, USDC and USDT), in the case of Napier we get TriPT-LSD. The asset allocation ratio in the TriPT-LSD pool is the same as Curve 3crv. PT is a token similar to Pendle, a fixed-term token.

YT allows investors to trade expected deposit returns without owning the asset itself. Upon maturity, YT loses its value.

PT allows holders to participate in the future value of the underlying asset after the YT expires. The owner of the PT can recover the underlying asset after the YT term expires.

YT LP tokens can be used to receive part of the commissions collected on the liquidity pool, or to participate in other incentive programs that Pendle (Napier) may offer

YT has a limited lifespan and loses value beyond its term, while PT continues to exist and represents the residual value of the asset.

Therefore, YT and YT LP are more suitable for active investors interested in speculative gains or generating liquidity income. PT is more suitable for investors interested in owning the underlying asset for the long term. Therefore, it is PT that is used for the metapool.

3. Architecture

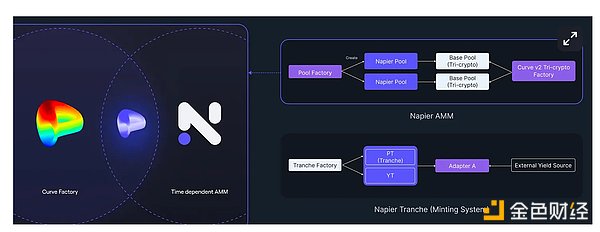

Napier Minting System

Napier Minting System is the first major part of Napier. It can convert any income-generating token on Ethereum into its fixed-income equivalent. The end result is that it allows users to split a “target asset” (variable yield asset) into two separate assets:

Primary Tokens (PT), which are the fixed yield equivalent of that asset.

Yield Tokens (YT), which are the rights to the variable yield generated by the target asset.

Any target asset has an underlying asset — the asset from which it generates income. For example, aDAI (Aave) generates DAI income from the DAI underlying asset, and rETH (Rocketpool) generates rETH income from the rETH underlying asset. In these cases, the basis is DAI and rETH, respectively. One underlying target value can be used to mint 1 PT and 1 YT — and these 1 PT and 1 YT can always be combined to return 1 underlying value of the variable yield target asset.

Napier AMM

Napier AMM is the second part, which is used to facilitate the yield trading between the base token (PT), the yield token (YT) and the corresponding underlying assets - the base pool, and the trading between the LP tokens of the base pool and the underlying assets - the time-related meta pool. It is responsible for the operation of the three pools and the meta pool. In addition, the Curve Factory pool can be used to facilitate PT and YT transactions. In the Napier Pool, different PTs can be traded directly with the underlying assets, while different YTs can be traded through lightning swaps.

Therefore, in order to understand the Napier pool, we can distinguish three main types of liquidity pools:

-Base Pool is the simplest pool created on Curve Finance for two or more periodic assets (such as PT and YT). An example of a Napier base pool is ETH LSD 3Pool, which contains tokens PT-stETH, PT-rETH, and PT-frxETH.

- Napier MetaPool (Time-Dependent Metapool):The Napier pool is a time-dependent AMM that is directly connected to the Curve pool and uses a nested AMM structure to facilitate yield trading between various PTs, YTs, and their underlying assets. The price changes of periodic assets with expiration dates depend on time. Therefore, the Napier pool is set up to offset the losses caused by changes in the time value of the LP tokens of the base pool. Napier pools are created from the underlying asset (ETH) and the LP token pair of the underlying pool, such as ETH LSD 3Pool (PT-stETH, PT-rETH, PT-frxETH).

So, in short, this type of pool is ideal for trading tokens that increase in value as the expiration date approaches (usually referred to here as PT/YT) and allows you to calculate the price and marginal interest rate using the pool reserve ratio and the remaining expiration time as variables. This is also necessary because when trading such tokens, once they expire, you need to identify a wide range of prices (fixed interest rates). This requires a wide liquidity pool similar to Uniswap v2.

- Curve MetaPool:MetaPool is a nested pool structure concept proposed by Curve Finance, where one token seems to be tradable with another base pool. Thanks to Napier Pool, pairing with the LP token of the base pool can list any regular asset on Curve Finance, just like stablecoins (such as FRAX) or volatile assets (such as ETH).

For example, we can create a pair of PT-swETH and the LP token of the base pool, such as ETH LSD 3Pool (PT-stETH, PT-rETH, PT-frxETH). In this example, users can seamlessly trade PT-swETH (also known as YT-swETH) between the three tokens in ETH LSD 3Pool and the underlying asset (ETH).

However, as the expiration date approaches and the trading rate is very close to 1:1, it becomes critical to concentrate liquidity in a narrower range to maximize liquidity utilization.

In addition, if you trade on other AMMs that do not include time parameters (such as Uniswap or Curve), impermanent losses will accumulate over time. This will make it difficult to protect liquidity providers' funds from arbitrage trading.

What this structure ultimately brings to users:

Capital Efficiency: Each market supports only 2 assets: Napier 3Pool bridge token and unique token. This design concentrates liquidity in separate pools and provides a high degree of efficiency.

Isolation Risk: In Napier, the impact of hacking, exploiting or manipulating revenue projects is mainly limited to the relevant market rather than the protocol.

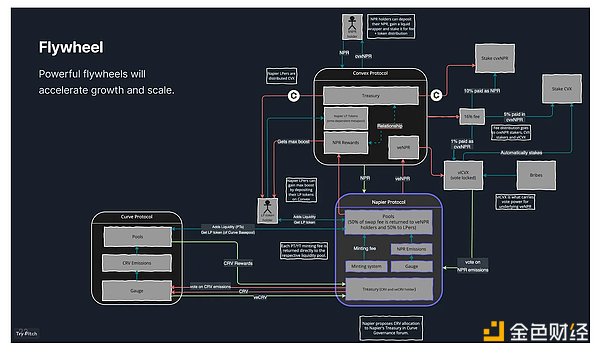

All of these mechanisms combined make Fhlyweel's operations possible. This is mainly achieved through the bootstrap program Llama Race (see the "Partnerships" section for more information). Mainly within Point Casinos, the project will rely on Point Casinos to create a pre-token flywheel. Point is the starting point for the project. The more points users contribute in Point Casinos, the more trading opportunities projects bring, which in turn brings in additional Napier points. This means that projects that have already tokenized can use Point Casino to create a points flywheel.

4. Partnerships

To achieve this goal, Napier has launched the Llama Race program, a gamified points competition designed to highlight users' contributions to the Napier and Curve ecosystems. The Llama Quest consists of five chapters that reflect Napier's journey to make Curve the home of LST/LRT again. In addition, Llama Race also connects a large number of protocols:

In addition, Napier seems to have close ties with the following projects:

Prisma Finance- Prisma allows users to issue stablecoins (acUSD) fully backed by LST. Compared with other stablecoins provided by the LSDfi protocol, the notable feature of this stablecoin is that it will be incentivized by Curve and Convex Finance. This creates an economic cycle where users can earn trading fees and rewards in CRV, CVX and PRISMA in addition to Ethereum staking rewards through other complex mechanisms.

Curve - Curve is an AMM DEX whose main competitor is Uniswap. The most important difference is that Curve is positioned as a DEX for low-volatility assets (stablecoins and wrapped/synthetic assets (sBTC, renBTC or wBTC)), which is also the reason why Curve has the lowest slippage - because stablecoin prices are considered predictable. This is why Curve's TVL has always been higher or close to Uniswap's TVL, even though Uniswap supports a wide range of assets, while Curve mainly supports a limited number of assets - because the stability of the Curve platform attracts liquidity providers who are looking for a safe place to store their stablecoins and wrapped assets, where they will be protected from the risk of slippage and impermanent loss. You can read more about how Curve works in our separate article.

Convex - Think of it as its younger brother, which enables Curve users to access liquidity without restrictions. Convex will also integrate veNPR, providing instant liquidity to NPR holders and optimizing Napier yields for LPs.

Yearn - Yearn remains an important part of the Curve ecosystem. Yearn is an automated DeFi yield aggregator platform that automatically calculates rewards for users. Without Yearn Finance, investors would need to manually transfer their liquidity to the highest-yielding protocol.

Dinero (formerly Redacted Cartel) - Redacted is a company that provides network liquidity, management, and cash flow to DeFi protocols. They have created several products that participate in the Curve ecosystem - Redacted Protocol, Pirex, and Hidden Hand, among others. You can read more about these protocols in Curve Finance Research Part 2.

Euler Finance - Euler Finance is a decentralized finance (DeFi) lending platform whose main advantage is permissionless listing of assets. It allows users to decide which tokens to list and create lending markets, as long as those tokens have a WETH trading pair on Uniswap v3.

Frax Finance - Fundamentally, Frax Finance is a decentralized cross-chain protocol that aims to create a scalable digital currency with flexible supply, algorithmic backing (AMO), and collateral. It issues tokens pegged to assets such as FRAX, sFRAX, and frxETH

Aave - is a decentralized non-custodial liquidity market protocol where users can participate as suppliers or borrowers. Suppliers provide liquidity to the market to earn passive income, while borrowers can borrow on an over-collateralized (perpetual) or under-collateralized (single-block liquidity) basis.

5. Conclusion

Napier proposed the next stage of the evolution of the Curve ecosystem, aiming to make Curve the home of LST/LRT. The mechanism introduced by Napier has the potential to trigger a new round of Curve wars, which may evolve into a full-blown LSDFi war. Last year, we thoroughly analyzed the Curve ecosystem to understand the possible scenarios of the LSDFi war, when various LSDFi projects promoted the progress of the war. Unfortunately, this narrative quickly faded due to the characteristics of the CDP protocol that LST supports and the relatively low returns compared to those promised by the re-staking protocol.

Napier takes a different approach: instead of reinventing the wheel and trying to entice projects to participate in simple two-asset pools on Uniswap or Curve by offering simple bribes, Napier introduces more complex mechanisms on top of existing technology. During the camel race, these innovations continue to pull new rabbits out of the hat, designed to strengthen Napier's flywheel. Which rabbit will the wizard pull next?

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance