Introduction

There's a principle in behavioral economics called mental accounting. People's attitudes towards money differ depending on where they store it. $100 in a current account feels like it's at their disposal, while $100 in a retirement account feels like it's untouchable. Although money itself is interchangeable, where it's stored affects how you perceive it.

Frax founder Sam Kazemian calls this the "net worth theory." People tend to put spare change where most of their wealth is already held. If your net worth is mainly concentrated in Charles Schwab's stock and bond accounts, you'd keep dollars in linked bank accounts because transferring funds between them is very convenient. If your net worth is mainly in Ethereum wallets and DeFi positions, you'd want dollars to interact with the DeFi world just as easily.

For the first time ever, a significant number of people are storing the vast majority of their wealth on-chain.

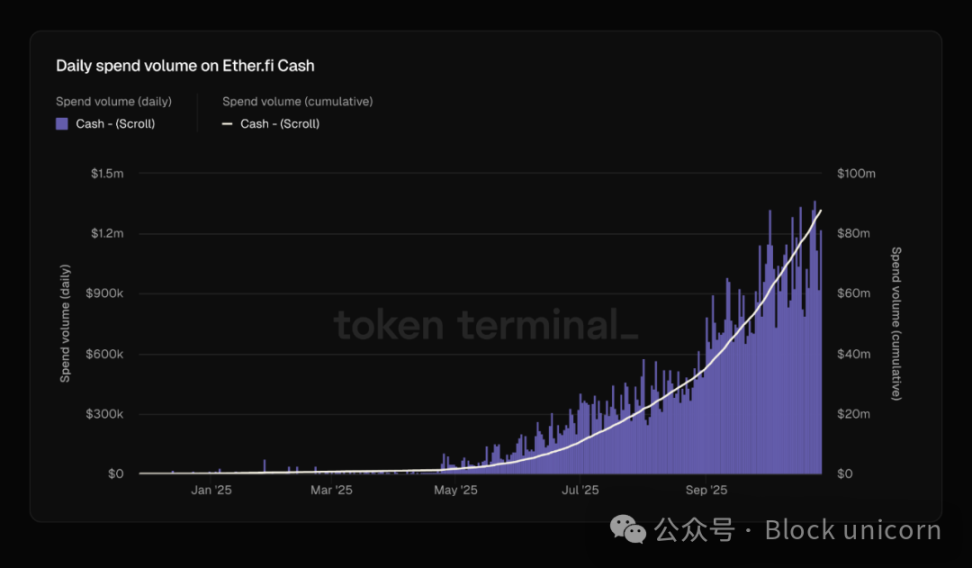

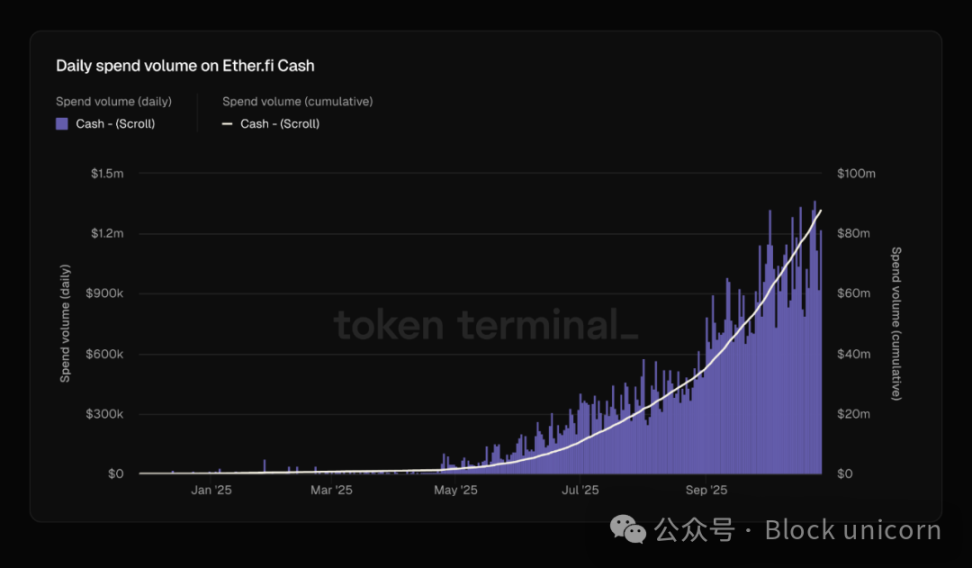

They're tired of constantly transferring money through traditional banks just to buy a cup of coffee. Crypto banks are addressing this by building platforms that integrate all these functions in one place. With these platforms, you can deposit money in interest-bearing stablecoins and spend with a Visa card without ever touching a traditional bank account. The rapid growth of these platforms is a market response to the fact that cryptocurrencies finally have enough real users and enough real on-chain funds, making the construction of such platforms worthwhile. Stablecoins seamlessly integrate into everyday consumption. For over a decade, cryptocurrencies have promised to eliminate intermediaries, reduce fees, and give users more control. But one problem has always remained: merchants don't accept cryptocurrencies, and it's impossible to convince all merchants to accept them simultaneously. You can't pay your rent with USDC. Your employer won't pay your salary in ETH. Supermarkets don't accept stablecoins. Even if you invest all your wealth in cryptocurrency, you still need a traditional bank account to live a normal life. Every exchange between cryptocurrency and fiat currency incurs fees, settlement delays, and friction. This is why most crypto payment projects fail. BitPay tried to get merchants to accept Bitcoin directly. The Lightning Network built the peer-to-peer infrastructure but struggled with liquidity management and routing reliability. Neither achieved significant adoption due to the high conversion costs. Merchants needed to be certain their customers would use this payment method. Customers needed to be certain merchants would accept it. Nobody was willing to take the lead. Cryptocurrency banks hide the coordination problems. You spend stablecoins from your own custodial wallet. The new bank converts the stablecoins into dollars and settles with the merchant via Visa or Mastercard. The coffee shop receives dollars as usual. They have no idea that a cryptocurrency transaction is involved. You don't need to convince all merchants to accept cryptocurrency. You simply need to streamline the conversion process so users can use cryptocurrency to pay at any merchant that accepts regular debit cards (basically everywhere). Three pieces of infrastructure matured simultaneously in 2025, making it possible after years of failed attempts. First, stablecoins were legalized. The GENIUS Act, passed in July 2025, provides a clear legal framework for stablecoin issuance. Treasury Secretary Scott Bessant predicts that by 2030, transactions using stablecoins will reach $3 trillion. This is tantamount to the U.S. Treasury officially declaring stablecoins as part of the financial system. Second, bank card infrastructure was commoditized. Companies like Bridge offer out-of-the-box APIs, allowing teams to launch complete virtual banking products within weeks. Stripe acquired Bridge for $1.1 billion. Teams no longer need to negotiate directly with bank card networks or build banking partnerships from scratch. Third, people now genuinely own wealth on-chain. Early attempts at cryptocurrency payments failed because users didn't hold significant net cryptocurrency assets. Most savings were held in traditional securities accounts and 401k retirement plans. Cryptocurrency was seen as a speculative tool, not a place to store life savings. Now, things are different. Younger users and cryptocurrency natives now hold substantial wealth in Ethereum wallets, staking positions, and DeFi protocols. People's mental accounting has shifted. Keeping funds on-chain and spending directly from the chain is far easier than converting them back to bank deposits. The differences between new cryptocurrency banks primarily lie in yields, cashback rates, and geographic coverage. But they all address the same core issue: enabling people to use their cryptocurrency assets without relinquishing autonomy or frequently converting them back to bank deposits. EtherFi processes over $1 million in credit card spending daily, a figure that has doubled in the past two months. Similarly, Monerium's EURe stablecoin has seen significant increases in both issuance and burn rates. This distinction is crucial because it demonstrates that these platforms are facilitating genuine economic activity, not just speculation among cryptocurrencies. Funds are flowing out of the crypto sphere and into the broader economic system.

That long-missing bridge has finally been built.

The competitive landscape has undergone a dramatic transformation in the past year. Plasma One launched as the first native stablecoin bank, focusing on emerging markets with limited access to USD. Tria, built on Arbitrum, offers self-custodied wallets and gas-free trading. EtherFi has evolved from a liquidity restaking protocol into a mature new bank with $11 billion in total value locked (TVL). Mantle's UR, prioritizing Swiss regulation and compliance, is targeting the Asian market.

Different approaches, but the same problem: how to make on-chain wealth directly spendable without spending time dealing with traditional banks?

There's another reason why new crypto banks, even if smaller, can compete: their users are inherently more valuable. The average American has a current account balance of around $8,000. Crypto native users frequently conduct six- or even seven-figure transactions across different protocols, blockchains, and platforms. Their transaction volume is equivalent to the combined volume of hundreds of traditional bank customers. This fundamentally changes traditional unit economics. New crypto banks don't need millions of users to be profitable; a few thousand suitable customers are enough. Traditional banks pursue economies of scale because each customer generates limited revenue. New crypto banks, even with a smaller user base, can build sustainable businesses because each customer is 10 to 100 times more valuable than a traditional bank in terms of transaction fees, exchange fees, and managed assets. Everything changes when the average user no longer deposits $2,000 of their salary twice a month like a traditional bank does.

Each new cryptocurrency bank has independently built the same architecture: separate spending and savings accounts. Payment stablecoins like Frax's FRAUSD, backed by low-risk government bonds, aim for widespread adoption, thus simplifying merchant integration. Yield-generating stablecoins like Ethena's sUSDe optimize yields through sophisticated arbitrage trading and DeFi strategies that can generate 4-12% annualized returns, but their complexity exceeds merchants' assessment capabilities. Several years ago, DeFi attempted to merge these categories, assuming all assets were yield-generating, but found the friction from merging these features far outweighed the problems it solved. Traditional banks separate checking and savings accounts due to regulatory requirements. Cryptocurrencies are fundamentally rethinking this separation because you need a payment layer that maximizes acceptance and a savings layer that maximizes returns. Trying to optimize both simultaneously only harms both. Cryptocurrency banks can offer returns that traditional banks cannot match. They utilize the yields of government bonds backing stablecoins, adding a payment process simply for compliance. Traditional banks cannot compete on interest rates because their cost structure is fundamentally higher, including physical branches, legacy systems, and compliance overhead. New banks eliminate all these costs and pass the savings back to users. The cryptocurrency space has attempted to build payment systems many times. What's different this time? This time is different because all three necessary conditions are finally met simultaneously. The regulatory framework is clear enough that banks are willing to participate; the infrastructure is mature enough that teams can deliver products quickly; and most importantly, the number of on-chain users is large enough and their wealth is substantial enough to guarantee market viability. People's mental accounts have shifted. In the past, people kept their wealth in traditional accounts and speculated with cryptocurrencies. Now, people keep their wealth in cryptocurrencies and only exchange them for fiat currency when they need to spend it. New banks are building infrastructure to accommodate this shift in user behavior. Money has always been the story we tell about value. For centuries, this story required intermediaries to validate it—banks kept the books, governments backed the currency, and card organizations processed transactions. Cryptocurrencies promised to rewrite this story without intermediaries, but it turns out we still need someone to bridge the gap between the old and new narratives. New banks may be able to play that role. What's fascinating is that in building bridges between the two monetary systems, they haven't created anything entirely new. They've simply rediscovered patterns that existed a century ago, patterns that reflect the fundamental nature of the human relationship with money. Technology is constantly evolving, but the stories we tell about what money is and where it should exist have remained remarkably consistent. Perhaps this is the real lesson: we think we're disrupting finance, but in reality, we're simply shifting wealth to places that conform to existing narratives.

Miyuki

Miyuki