Bitkub Online's Potential $3 Billion Valuation Ahead of Planned IPO

Bitkub Online, Thailand's major crypto exchange, plans a $3 billion IPO next year, led by Bitkub Capital Group CEO Jirayut Srupsrisopa.

Bernice

Bernice

01 Stablecoin Legislation Race: Hong Kong and the United States from the Global Trend

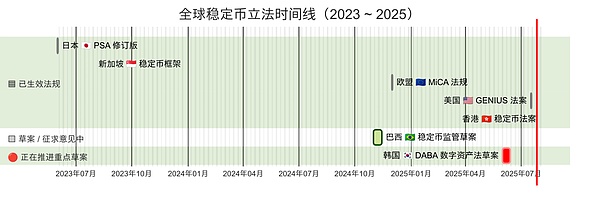

As a bridge connecting the crypto world and traditional finance, stablecoins have developed a market size of about US$250 billion in recent years (99% of which is pegged to the US dollar). Major economies have accelerated the legislation of stablecoin regulation: the United States promulgated the "Guiding and Establishing the United States Stablecoin National Innovation Act" (GENIUS Act) in July 2025, the EU "MiCA Act" came into effect at the end of 2024, Singapore issued a regulatory framework in August 2023, and Japan also improved relevant regulations in June 2023. Against this backdrop, Hong Kong has taken the lead - the Stablecoin Ordinance, which has been under legislative preparation for three and a half years, will officially take effect on August 1, 2025, making Hong Kong an "offshore test field" for China's exploration of digital finance. Why are stablecoins so popular? On the one hand, the value of stablecoins is anchored to legal currency or other assets, with stable prices, and can be used as a payment tool and a means of storing value. They only exist on the blockchain and can be used for transaction payments in the Web3 ecosystem, such as subscribing to tokenized financial products and real-world assets (RWA). Issuers can also use stablecoins instead of legal currency for dividends or redemption. In decentralized finance (DeFi), stablecoins can also be used for activities such as lending, and are therefore seen as a "value bridge" between the traditional financial system and the crypto market. On the other hand, regulators in various countries hope to prevent the risks that stablecoins may bring while supporting financial innovation, such as weakening the status of legal tender, impacting monetary sovereignty and financial stability, as well as money laundering, cybersecurity and other issues. For this reason, Hong Kong and the United States introduced stablecoin regulations almost simultaneously, attracting global attention. We will deeply analyze the main content, background and policy objectives of the Hong Kong Stablecoin Act, and make a structural comparison with the US GENIUS Act, sorting out the differences between the two in terms of regulatory scope, compliance path, stablecoin definition, cross-border payment, and the degree of participation of financial institutions. In addition, we focus on the real-world application case of stablecoin + RWA - the world's first photovoltaic green asset RWA financing project completed by GCL Energy and Ant Digits, and how stablecoins inject financial innovation momentum into traditional industries.

02 Hong Kong's Stablecoin Ordinance: Content, Objectives and Regulatory Path

Legislative Background: Hong Kong's stablecoin regulatory framework has been formed step by step. The "Stablecoin Ordinance" has been perfected for three and a half years: as early as January 2022, the Hong Kong Monetary Authority (HKMA) issued the "Crypto Assets and Stablecoins Discussion Paper" and began to conceive the regulatory model for stablecoins used for payment; in December 2023, a consultation document was issued to clarify the regulatory direction; in March 2024, the "Stablecoin Issuer Sandbox" pilot actual scenario was launched, and the consultation summary was announced in July of the same year to determine the legislative plan; finally, on May 21, 2025, the Hong Kong Legislative Council passed the draft bill in the third reading and it is scheduled to take effect in August 2025. This series of measures reflects Hong Kong's regulatory concept of trial first and steady progress. Before the ordinance came into effect, the HKMA had conveyed regulatory expectations to institutions planning to issue legal currency stablecoins in Hong Kong through the sandbox, and collected feedback to ensure that the system design was in line with regulatory goals. At present, three groups of institutions, including JD Technology, Yuanbi Innovation, Standard Chartered Bank and Hong Kong Telecom Joint Venture, have participated in the sandbox test and started trial operation in July 2024. It can be seen that Hong Kong actively laid out infrastructure and market testing before the legislation was implemented to prepare for smooth implementation. Policy objectives: Hong Kong positions itself as China's offshore financial hub, hoping to seize the digital financial initiative through the new stablecoin policy. On the one hand, the Stablecoin Ordinance has paved the way for the issuance of the offshore RMB stablecoin (CNH Stablecoin): Hong Kong has an offshore fund pool of about 1 trillion yuan to support the issuance of RMB stablecoins. By testing the cross-border settlement application of RMB stablecoins in Hong Kong, it can avoid violating mainland capital controls or impacting onshore financial stability. Hong Kong regulators see RMB stablecoins as a potential component of the future cross-border RMB settlement system (such as coordination with infrastructure such as RMB swaps and the CIPS cross-border payment system). On the other hand, Hong Kong aims to balance innovation and risk: by strictly requiring 100% reserves and setting capital thresholds for issuers to control risks, while using its status as an international financial center to guide stablecoins to serve the real economy and consolidate Hong Kong's role as a "financial connector between China and the United States." As Morgan Stanley pointed out, while strengthening Hong Kong's position as a global financial center, the new regulations put stablecoin innovation in a controllable environment, taking a key step for China to participate in global digital financial competition.

Core content:The Hong Kong Stablecoin Ordinance has established a comprehensivelicensing and regulatory system, currently focusing on stablecoins anchored to the value of legal tender (fiat stablecoins). The following are its main requirements:

License and issuance qualifications: Anyone who issues stablecoins pegged to legal tender in the course of operating in Hong Kong, or issues stablecoins claiming to be anchored to the value of the Hong Kong dollar overseas, must apply for a license from the Hong Kong Monetary Authority. The place of registration of the issuer is not limited to the local area, and overseas institutions are allowed to apply for a license. Hong Kong is relatively flexible in terms of the type of issuer. It does not limit the issue to licensed banks (joint ventures with technology companies or financial institutions are also acceptable), but the capital must not be less than HK$25 million or 1% of the par value of the issued stablecoin. The HKMA expects to issue only a small number of licenses in the initial stage, and prefers traditional banks and technology companies to cooperate with them to have sufficient strength and compliance capabilities. This means that the initial issuance of stablecoins is likely to be dominated by a few leading institutions.

Reserves and custody: 100% reserve support is required. The issuer must fully reserve the stablecoins in circulation with highly liquid and low-risk assets at a ratio of 1:1. Reserve assets must match the anchored fiat currency, and typical forms include high-quality assets such as cash and short-term government bonds. All reserves must be isolated from the issuer's own assets, deposited in an independent custody account, and disclosed in a timely manner and audited regularly. It is worth noting that the Hong Kong regulations do not explicitly prohibit the re-pledge or use of reserve assets (that is, the issuer can use reserve assets to obtain reasonable returns based on compliance needs), which is in contrast to US regulations.

Redemption and stability of funds: Issuers must ensure that holders can redeem stablecoins at face value at any time and complete redemption within a reasonable fee range. The value of stablecoins must remain stable and equal to the anchored assets. If there is a deviation, a stabilization mechanism must be used to adjust. In addition, Hong Kong requires timely disclosure of information - such as monthly announcement of the number of stablecoins in circulation and the composition of reserves, and audit reports must also be made public regularly to ensure transparency and holder confidence.

Compliance and risk control: Mandatory KYC/AML. All issuance and exchange links must implement strict customer identification and anti-money laundering/anti-terrorist financing procedures to prevent illegal funds from using stablecoin channels. Issuers must establish internal control and risk management systems and undergo regular external audits. If abnormal transactions or risk events occur, they must be reported to the regulator in a timely manner and countermeasures must be taken. Hong Kong has also established a "Stablecoin Review Arbitration Tribunal" to accept appeals and reviews related to licenses and penalties to strengthen regulatory enforcement.

Purpose orientation: Hong Kong clearly guides stablecoins to serve the actual scenarios of the real economy, rather than speculation. Regulatory policies encourage the use of stablecoins in cross-border payment settlement, supply chain finance, retail consumption and other fields to support trade and business development. For example, stablecoins can be used to reduce cross-border remittance costs, improve the efficiency of supply chain capital turnover, and facilitate e-commerce platform payments. On the contrary, Hong Kong does not encourage activities that are purely for the purpose of trading arbitrage. This orientation reflects that Hong Kong hopes that stablecoins will become an innovative tool for industrial finance, rather than a speculative product that is independent of the real economy.

Summary: The core of the Hong Kong Stablecoin Ordinance is to establish full-process supervision for the issuance, circulation and use of stablecoins under the principle of giving equal importance to security and innovation. Ensure soundness through capital and reserve requirements, ensure financial integrity through AML/KYC, incorporate stablecoins into the formal financial system through a licensing system, and at the same time attract global institutions to issue multi-currency stablecoins (including Hong Kong dollars, US dollars, and even RMB) in Hong Kong with an open attitude. Hong Kong's move is seen as "seizing the first opportunity" in the field of digital assets: it not only meets international regulatory standards, but also provides experimental space for non-US dollar stablecoins such as RMB, and is intended to enhance Hong Kong's status as a regional stablecoin compliance market and a global financial center.

03 GENIUS Act of the United States: The Birth of Federal Stablecoin Regulation

Legislative Background:On July 18, 2025, US President Trump officially signed the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act for short), making it the first federal-level stablecoin law in the United States. This marks that the United States has established a comprehensive legal regulatory framework for payment stablecoins. Previously, each state in the United States had its own way of regulating stablecoins, and there was a lack of unified standards at the federal level. The GENIUS Act was passed by both houses with a high vote and quickly signed into law, reflecting the urgent attitude of the US regulatory authorities towards the development of stablecoins: they hope to "set rules" for this emerging field to alleviate the long-standing regulatory vacuum and uncertainty and promote cryptocurrencies to truly move towards the mainstream payment system. Policy objectives: The GENIUS Act seeks a balance between encouraging financial innovation and preventing risks. On the one hand, US regulators recognize the improvement in payment efficiency and financial innovation value brought by stablecoins and digital assets, and on the other hand, they are highly vigilant about the negative impact they may have on traditional financial markets and even the real economy. Stablecoins are pegged to fiat currencies and their reserve assets are mainly traditional assets such as bank deposits and treasury bonds. This high correlation means that without regulation, the collapse of stablecoins may affect the banking system or the money market. In addition, the US government is concerned about whether the large-scale adoption of stablecoins will marginalize the legal dollar, thereby affecting the transmission of monetary policy, weakening the sovereign status of the dollar, and bringing a series of challenges such as consumer protection, cybersecurity, and anti-money laundering. Therefore, the GENIUS Act establishes a complete licensing system, reserve requirements, and compliance standards, with the goal of protecting consumer rights, strengthening monetary sovereignty, and maintaining financial stability while promoting digital financial innovation. It is worth noting that the bill hides a strategic intention: to consolidate the dominance of the US dollar in the digital age and create a sustained demand for US Treasury bonds. By requiring stablecoin reserves to be limited to US dollar cash or US Treasury bonds, legislators intend to ensure that the "on-chain dollar" becomes the foundation of the global digital economy and extends the influence of the US dollar to the crypto field.

Main content: The GENIUS Act establishes a clear definition and regulatory framework around "payment stablecoins":

Definition and exemption of stablecoins: The Act defines payment stablecoins as: value accounting units recorded on encrypted distributed ledgers, used for payment or settlement, and their issuers promise to redeem them at a fixed amount of legal currency (such as 1 US dollar) and ensure the stability of the currency value. This definition focuses on the three elements of "redeemable", "stable value" and "payment purpose", and basically covers the current mainstream US dollar stablecoins (such as USDT, USDC). The Act also clarifies that those that do not belong to payment stablecoins include: digital currencies issued by central banks, bank deposits (even if recorded on distributed ledgers), and security tokens regulated by securities laws. In addition, in order to avoid multiple supervision, it is stipulated that payment stablecoins issued with permission are not considered securities or commodities, thereby excluding overlapping intervention by the SEC and commodity futures supervision. This series of definitions and exemptions has given stablecoins a name and provided legal clarity, making compliant stablecoin operations more standardized.

Licensed issuer system: The GENIUS Act requires that only qualified entities can issue payment stablecoins in the United States, and it is illegal for anyone else to issue them. The so-called "permitted payment stablecoin issuers" (PPSI) include three categories: ① Subsidiaries of insured depository institutions, that is, approved commercial bank subsidiaries, can issue stablecoins; ② Federal qualified issuers, including non-bank institutions, are new types of issuers approved by the federal level; ③ State qualified issuers, issuers approved by state regulators on the premise of meeting federal standards. The regulatory level depends on the scale of issuance: large issuers with a combined issuance volume of more than US$10 billion will be regulated by federal agencies (Federal Reserve, OCC, etc.); small and medium-sized issuers with an issuance volume of no more than US$10 billion may choose to accept state supervision, but once the issuance volume exceeds US$10 billion, they must gradually transfer to federal supervision according to procedures. This "dual track" design takes into account the state power under the US federal system, allowing start-up projects to grow in state sandboxes while ensuring that large issuers are included in the stricter federal regulatory network. Compared with Hong Kong's single license system, the issuer access in the United States is more difficult: in fact, most compliant issuers will be new institutions affiliated with banks or strictly reviewed, and pure technology companies will find it difficult to obtain federal licenses directly without a banking background. This highlights the US's tendency to let regulated financial institutions dominate the stablecoin market.

Reserve requirements: The bill stipulates 100% reserve coverage to ensure redemption at any time. Licensed issuers must hold identifiable reserve assets equivalent to the issued stablecoin to support their stablecoin balances at a 1:1 ratio. Eligible reserve assets are strictly limited to include US dollar cash, funds deposited at the Federal Reserve, commercial bank demand deposits (in compliance with FDIC regulations), US Treasury bonds with a maturity of no more than 93 days, overnight repo funds collateralized by short-term Treasury bonds, and money market funds that invest only in the above assets. This list almost limits reserves to the US dollar and the credit of the US government, reflecting the consideration of the bill to serve the US dollar strategy. In addition, the bill prohibits the re-pledge or misappropriation of reserve assets, and issuers may not use reserves for any other purpose except for limited circumstances such as meeting redemption liquidity and standard custody requirements. In short, US stablecoin issuers cannot use reserves for random investment, nor can they pay any form of interest or income to holders. Holders do not enjoy interest on reserve assets, and issuers need to make profits from other businesses. This is in contrast to Hong Kong: Hong Kong does not explicitly prohibit the distribution of dividends and interest to holders, but it is expressly prohibited in the United States to prevent stablecoins from becoming "quasi-deposit" or securities products. In addition, the GENIUS Act requires issuers to prioritize the interests of holders: when the issuer goes bankrupt and liquidates, the stablecoin holders' claim to reserve assets takes precedence over other creditors.

Redemption and transparency: The Act requires issuers to establish a redemption mechanism at any time and disclose redemption policies and fee standards to ensure that users can easily exchange stablecoins back to legal tender. At the same time, information disclosure is mandatory: issuers must publish a report on the composition of reserve assets on their official website every month, including the number of stablecoins in circulation, the total amount of reserves and details (average term, custody location, etc.), and must be audited regularly by certified public accountants and reported to regulatory authorities. Issuers with an annual issuance scale of more than US$50 billion must also prepare and audit annual reports in accordance with US accounting standards (GAAP) and make them public on their official websites. These measures are intended to enhance the market's trust in stablecoins through high-frequency information transparency and prevent panic caused by the market's lack of transparency in stablecoin reserves in the past.

Capital and risk management: In addition to reserve requirements, regulators will set capital adequacy ratios, liquidity ratios and other requirements for issuers based on their business models and risk profiles to ensure that issuers have sufficient capital to cope with potential losses. At the same time, issuers must establish sound corporate governance, risk management and IT systems to ensure sound operations. In terms of business restrictions, the bill authorizes regulators to impose restrictions on the business scope and investment activities of issuers to prevent excessive risk-taking. The general principle is "same rules and same quality": stablecoin issuers need to maintain the bottom line of sound operations like banks, but specific requirements are adjusted differently according to the size of the institution and the degree of risk. This flexible regulatory approach not only ensures financial security, but also leaves some room for small and medium-sized innovators.

Anti-money laundering and compliance obligations: The bill clearly states that licensed stablecoin issuers will be treated as financial institutions subject to the Bank Secrecy Act (BSA). Therefore, issuers must comply with all federal laws applicable to U.S. financial institutions, including economic sanctions, anti-money laundering (AML), and customer due diligence (KYC) requirements. Specific requirements include: establishing effective internal anti-money laundering controls, keeping transaction records, monitoring and reporting suspicious activities, having the technical ability to block illegal transactions and freeze assets, and establishing strict customer identification and sanctions list screening mechanisms. In other words, the issuance of stablecoins needs to be fully embedded in the existing financial crime compliance system to ensure that stablecoins will not become loopholes for illegal activities such as money laundering and terrorist financing. Hong Kong and the United States are highly consistent on this point: stablecoins must be "clean" to develop.

Cross-border issuance and market access: Considering the global liquidity of stablecoins, the GENIUS Act also sets rules for foreign stablecoins to enter the U.S. market. Three years after the Act takes effect, no digital asset service provider shall provide stablecoin transactions of non-licensed issuers to U.S. users, otherwise it will be illegal. There are only two types of exemptions: one is the stablecoin issued by an approved issuer (which is already legal); the other is a qualified "foreign stablecoin issuer". The latter must be registered outside the United States, but subject to the equivalent regulatory framework recognized by the U.S. Treasury Department, registered with the U.S. Office of the Comptroller of the Currency (OCC), have sufficient reserve assets in U.S. financial institutions (unless the two sides have mutual regulatory recognition exemptions), and the country of registration is not on the U.S. sanctions or anti-money laundering high-risk list. Foreign issuers who meet these conditions can sell and circulate their stablecoins in the United States. This is equivalent to the United States reserving a "mutual recognition channel" for other countries' compliant stablecoins, which will encourage other jurisdictions to improve their regulatory standards in the long run and align with the United States. For foreign issuances that do not meet the standards and refuse to rectify, the bill authorizes the Treasury Department to prohibit secondary market trading services in the United States and cut off their access to U.S. investors. This advance and retreat reflects the United States' desire to lead the formulation of international rules for stablecoins: both protecting the local market and exporting regulatory influence.

Summary:The GENIUS Act builds the US version of the stablecoin regulatory moat. By clearly defining the attributes of stablecoins, limiting the issuance of licensed institutions, requiring full US dollar reserves and strict compliance, the United States intends to incorporate stablecoins into the mainstream financial system while maintaining its own monetary hegemony. The promulgation of the bill is regarded as a watershed in the US crypto industry: on the one hand, it eliminates the policy uncertainty that has plagued financial institutions in issuing and holding stablecoin services; some large US banks have taken advantage of the situation to launch their own stablecoin plans and explore the application of US dollars on the chain. On the other hand, strict access and obligations mean that small and medium-sized crypto companies find it difficult to fight alone, and the cost of compliance operations has increased significantly. In general, the US regulatory approach is more inclined towards "bank-led, comprehensive control", which puts a "tight rein" on the development of stablecoins while paving the way for them to enter the mainstream payment stage.

04 Bill Comparison: Differences and Similarities and Strategic Intentions

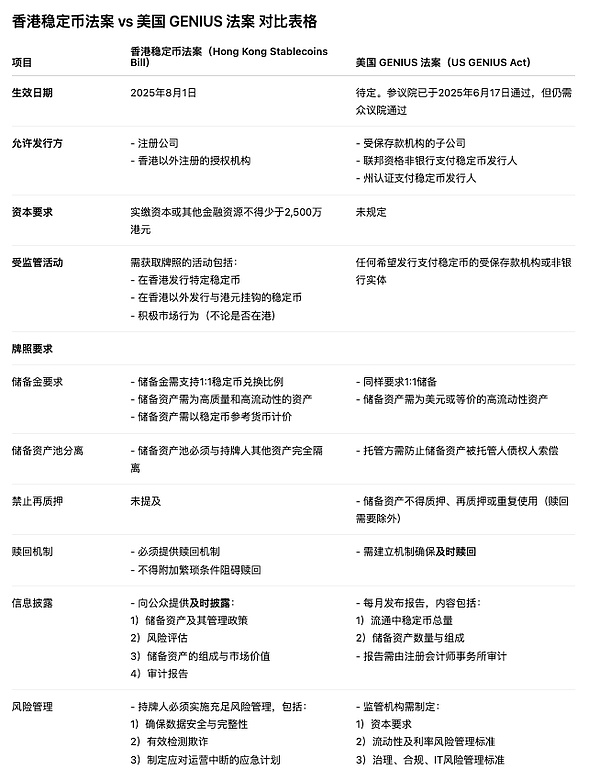

The stablecoin regulations in Hong Kong and the United States have many similarities in the framework: both implement comprehensive supervision on stablecoin issuers and related activities, and refer to international standards (such as the Financial Stability Board FSB, the Basel Committee BCBS, etc.) to set strict reserve and compliance requirements to protect users and prevent systemic risks. However, subject to different legal systems and policy objectives, there are also obvious differences in the details of the regulations in the two places. The following is a structural comparison from the dimensions of stablecoin scope, issuer, reserve assets, compliance methods, cross-border and participationand other dimensions:

Regulatory scope and stablecoin definition: Hong Kong regulations mainly target stablecoins anchored to the value of legal currencies, and do not consider algorithmic stablecoins and other types in the initial stage. The regulations do not explicitly prohibit algorithmic or commodity-linked stablecoins, but require compliance with reserve asset specifications, which actually excludes algorithmic stablecoins that do not have 1:1 asset support from the scope of legal issuance. Hong Kong aims to create a compliant legal currency stablecoin market, and the currency is not limited to the Hong Kong dollar. It also welcomes the issuance of legal currency-linked currencies such as the US dollar and the RMB in Hong Kong. In contrast, the US GENIUS Act focuses on payment-type stablecoins denominated in US dollars, and the definition emphasizes redemption at a fixed face value (such as US dollars). Although the bill allows "currency issued by foreign central banks" as an anchor value, from the legislative motivation, the United States is more concerned about consolidating the status of the US dollar stablecoin. The United States explicitly prohibits the payment of interest to currency holders to prevent stablecoins from becoming a disguised income-generating investment product; Hong Kong has no similar explicit provisions, but in practice stablecoins usually do not pay interest to users. In general, the United States positions stablecoins as a substitute for "on-chain dollars", and the regulatory map basically covers payment tokens supported by 1:1 US dollars, while Hong Kong has a looser definition, as long as there is sufficient reserve support for legal currency stablecoins, they are all within the scope of regulation.

Issuing entities and financial institutions participate: Hong Kong adopts an open licensing system, allowing all types of qualified institutions to participate in the issuance of stablecoins. Overseas legal persons, technology companies and even virtual asset trading platform subsidiaries can apply for Hong Kong licenses as long as they meet capital and operating requirements. At the same time, Hong Kong also welcomes the participation of traditional financial institutions: for example, existing banks, licensed securities firms, licensed exchanges, stored value payment institutions, etc. are included in the scope of "licensed issuers", allowing them to provide stablecoin-related services (such as distribution and custody). This model encourages banks and technology companies to cooperate and innovate and give full play to their respective advantages. In the Hong Kong sandbox, there is a case of Standard Chartered Bank and local telecommunications and technology companies jointly piloting stablecoins. In contrast, the United States strictly limits the qualifications for issuance: only limited institutions approved by the federal government or the state can issue coins, and it is more inclined to bank participation. Large commercial banks can directly issue stablecoins through subsidiaries, and small and medium-sized institutions need to go through a supervised approval process to obtain a regulatory identity similar to that of banks if they want to issue them. This has led to the US stablecoin market being dominated by regulated financial institutions, and technology companies are mostly indirectly involved in the form of cooperation or investment. For example, after the bill was passed, some banks and regulated trusts in the United States announced plans to issue or custody stablecoins. In other words, the United States has built a "moat" with financial license barriers, and traditional banks play a key role in the field of stablecoins, while Hong Kong is more flexible and diverse, providing space for banks, exchanges, and financial technology companies to co-create.

Reserve assets and RWA supervision: Both parties require that stablecoins be 100% backed by high-quality assets, but there are differences in asset categories and applications. The US bill strictly limits reserve assets to US dollar cash, US bank deposits, US Treasury bonds, etc., and even stipulates that the repurchase of Treasury bonds pledged must expire within 93 days. This means that US stablecoins can basically only be fully supported by US dollar assets and cannot invest in other types of assets. The purpose of the bill is not only security, but also to strengthen the demand for US dollar bonds. In addition, the United States explicitly prohibits the re-pledge of reserve assets. Except for meeting specific purposes such as redemption liquidity, reserves cannot be used or invested for the second time. Hong Kong's requirements for reserve assets are slightly wider: they also emphasize high liquidity and security, such as cash, short-term government bonds, etc. However, Hong Kong has not detailed the specific asset list in the law, nor does it have a clause directly prohibiting the reinvestment of reserves. This means that Hong Kong issuers may be able to use reserve assets in a prudent way to obtain some income (such as purchasing short-term bonds or depositing in interest accounts) without affecting redemption, thereby improving operational sustainability. However, the HKMA's guidelines also require that reserve assets must match the currency category to which they are anchored, focus on low-risk assets, and disclose audits regularly. It is worth noting that both regulators isolate stablecoin reserves from the issuer's own assets and grant holders priority claims to maximize the security of user funds. In general, the United States is more conservative and treats stablecoin reserves as bank reserves with strict restrictions; Hong Kong is slightly more flexible, but it will never allow a situation similar to the past where algorithmic stablecoins were not backed by assets.

Compliance methods and regulatory mechanisms: In terms of compliance requirements such as anti-money laundering and consumer protection, Hong Kong and the United States are generally consistent, requiring issuers to establish a sound KYC/AML mechanism and internal control. However, the regulatory framework is different: Hong Kong adopts a single regulatory agency model, with the HKMA leading the licensing and daily supervision, and coordinating management with the Securities and Futures Commission (if stablecoin transactions involve securities, the Securities and Futures Commission will be in charge). In the event of a dispute, there is also a dedicated arbitration tribunal to review the regulatory decision. This model has a shorter decision-making chain, which is conducive to rapid response to market changes. The United States has multiple regulators: depending on the nature of the issuer, it may be regulated by the Federal Reserve, OCC, FDIC or state financial departments. Federal regulators also need to coordinate and divide their work. Although this system is complex, it is in line with the tradition of US financial regulation. Importantly, the GENIUS Act explicitly requires stablecoin issuers to have the technical ability to execute the "lawful orders" of the US government or courts, including the ability to freeze and confiscate specific stablecoin assets when necessary. This is different from Hong Kong, which does not mention similar requirements at the legal level (but Hong Kong law enforcement agencies can freeze relevant accounts or assets through judicial procedures). It can be seen that the United States has also established rigid obligations for stablecoins at the law enforcement and national security levels, while Hong Kong emphasizes compliance in daily operations. The two models have different focuses: the United States emphasizes the full inclusion of stablecoins in the existing financial legal network, while Hong Kong takes its own regulatory agency as the center and adapts to local conditions.

Cross-border payment and currency strategy: Hong Kong regards stablecoins as a tool to improve the efficiency of cross-border payments and settlements, and actively explores the cross-border application of currencies such as the RMB. As Morgan Stanley pointed out, the Hong Kong Ordinance actually provides the first legal soil for "offshore RMB stablecoins", using Hong Kong's trillion-level offshore RMB pool to verify the use case of cross-border settlement. This is seen as a new attempt at RMB internationalization: using the form of stablecoins to bypass traditional cross-border transfer frictions without violating mainland controls. In the future, if RMB stablecoins can be connected to China's CIPS system, or combined with the expansion of offshore RMB bond issuance, the efficiency of RMB cross-border circulation will be significantly accelerated. At the same time, Hong Kong also hopes that stablecoins will be used in scenarios such as the Guangdong-Hong Kong-Macao Bay Area to promote trade and investment convenience. The United States' focus on cross-border is to stabilize the US dollar as a global digital transaction medium. The GENIUS Act aims to expand the strategic position of the US dollar on the chain, and after standardization, it is expected to attract more international investors and companies to use US dollar stablecoins for cross-border settlement. It can also be seen from the strict conditions for foreign issuers that the United States hopes that global stablecoins will operate under a "framework with US participation". It can be said that the United States is more concerned about consolidating the hegemony of the US dollar, while Hong Kong hopes to become a regional clearing center for multiple stablecoins and make breakthroughs in the fields of RMB and Hong Kong dollars.

Innovative applications and market ecology: The regulatory orientation of the two places has different impacts on the market ecology. Hong Kong's new policy is seen as beneficial to the local crypto ecology, financial technology, exchanges and other industries. For example, Hong Kong allows regulated crypto trading platforms to provide stablecoin trading services, digital banks such as ZA Bank participate in stablecoin reserve custody, and some companies such as ZhongAn Online have made early arrangements by investing in sandbox companies. The Hong Kong Stock Exchange may also benefit from the increase in cross-border capital flows brought by stablecoins, and even explore the use of stablecoins to achieve T+0 settlement and other efficiency improvements in the future. Overall, it is a gradual integration: stablecoins have limited impact on traditional bank deposits in the short term (because stablecoins do not pay interest and are difficult to replace savings functions), but in the long run, they can reduce cross-border settlement costs by about 80%, shortening cross-border remittances from 3 days to a few minutes. Cross-border e-commerce giants such as Alibaba and JD.com expect stablecoins to reduce international payment costs by up to 90%. All of this shows that Hong Kong hopes to inject efficiency dividends into trade, investment, and retail sectors with the power of stablecoins. In contrast, in the United States, due to the recent implementation of regulations, stablecoins are still mainly used in areas such as crypto transactions and international remittances in the short term. However, as compliance channels are opened, large financial institutions and technology companies are expected to test stablecoins in payment scenarios. Yahoo Finance analysis pointed out that retailers are also considering issuing their own stablecoins to reduce transaction costs and increase profits. Traditional credit card payments often charge a 2%-3% handling fee and are indirectly borne by consumers, while stablecoin payments have almost zero handling fees, funds arrive in seconds, and there are no high cross-border remittance fees and bank business hours restrictions. This is very attractive to both merchants and consumers. It can be foreseen that under the promotion of the bill, stablecoins are expected to gradually move out of exchanges and enter applications such as e-commerce payments, corporate settlements, and even personal salary payments. However, the steady pace of supervision in the United States means that this change is "slow-moving". Overall, Hong Kong's regulatory ecology is more inclined to encourage innovation to take place, trying to quickly form a demonstration effect; the United States takes the system first, and then allows the market to innovate step by step after the regulations are in place.

To summarize the differences between the two sides: Hong Konguses the method of "flexible opening + strict adherence to the bottom line" to create a regional stable currency test field, especially in the RMB stable currency and cross-border scenarios; The United Statestakes "strengthening supervision + consolidating the US dollar" as the core, and uses high standards to protect financial stability and the interests of the US dollar. The two bills complement each other, reflecting the different paths of global stable currency supervision, and also foreshadowing the futuregame of the international pattern of digital currency.

05 RWA landing: pioneering practice of photovoltaic green asset on-chain financing

The improvement of the stablecoin regulatory framework is not only meaningful at the financial level, but also introduces new financing tools and ideas to the real industry. The most eye-catching of these is the on-chain financing practice of

RWA (Real World Assets). RWA refers to the digitization/tokenization of real-world assets through blockchain, so that they can be traded and financed on the chain. Stablecoins often serve as pricing and settlement media in this process, because of their stable value and convenient on-chain circulation, they are very suitable as a tool for investors to contribute capital and distribute returns. At the end of 2024, China launched the world's first RWA financing project for photovoltaic green assets, opening a new door for financing traditional new energy industries.Case Background: In December 2024, green energy service provider GCL-Poly Energy (002015.SZ) and Ant Group's digital technology division (Ant Digital Technology) completed a pilot RWA financing project based on photovoltaic physical assets, with a financing amount of more than 200 million yuan. This is the first photovoltaic green asset RWA project in the world, and it is also a breakthrough in the financing of the domestic RWA model. Since there were no clear regulations on RWA in mainland China at that time, the project was mainly completed through issuance in overseas markets, which is a cross-border financing model. In fact, GCL Energy and Ant Digits started planning a few months ago: the two parties expressed their intention to cooperate at the Shanghai Bund Conference in September 2024, and the project was officially launched three months later. Prior to this, Ant Digits had cooperated with Longsun Group and Patrol Eagle Group to issue RWA financing projects for charging piles and battery swapping equipment in Hong Kong in October 2024 and March 2025, respectively, with a scale of approximately RMB 100 million and tens of millions of yuan. GCL Energy's photovoltaic project is the third order in the series and the largest in scale, marking the beginning of the expansion of RWA financing to larger scale and wider asset types.

Project details:The underlying assets anchored by this RWA project are82MW household distributed photovoltaic power stations located in Hunan and Hubei provinces. These photovoltaic power stations arenew energy physical assets, which have several ideal characteristics: authenticity and verifiability, stable income, and traceable data. The project party uses blockchain technology to digitally map the power station assets, that is, "on the chain", and packages the rights and interests such as future power generation income rights into tokens for subscription financing on the chain. Investors use stablecoins or other digital payment methods to invest, and the project issuer promises to regularly repurchase or distribute income to investors with the power station's electricity sales income. The whole process is executed by smart contracts. The innovation of this model is:

Improve financing efficiency: Traditional photovoltaic power station financing often relies on bank loans or asset securitization, which has a slow process and high threshold. Under the RWA model, financing is directly provided to global investors through the chain, eliminating intermediaries and greatly improving the speed. According to project participants, blockchain ensures that assets and income data can be tracked in real time, reducing trust costs, while smart contracts automatically execute income distribution, improving efficiency and transparency.

Break through geographical restrictions: Due to the cross-border issuance, foreign funds can be directly invested in domestic new energy projects through stablecoins and other channels, realizing cross-border flow of capital financing. This time, GCL Energy used the compliance environment of Hong Kong to attract overseas funds to enter the domestic photovoltaic field and obtained 200 million yuan of cross-border financing support. Stablecoins play an important role as a payment medium, making the inflow and outflow of funds more convenient and fast. This provides a new paradigm for the "globalization of industrial capital."

Careful asset selection: The person in charge of Ant Digital Technology said in a public event that it was no accident that they chose new energy assets as the first batch of RWA targets, because they meet the ideal requirements of the RWA project for underlying assets: "trustworthy, traceable, and stable income". The electricity generated by photovoltaic power stations is sold to the State Grid, with stable cash flow, data collection is easy to digitize, and the physical existence of the assets themselves is easy to confirm ownership. These characteristics make photovoltaics an excellent carrier for RWA pilot projects. Of course, RWA is not exclusive to new energy, and "everything can be RWA" also needs to be viewed rationally. The team rejected many asset applications that did not meet the standards, and preferred assets such as high-end manufacturing industries with data sedimentation and clear income for further exploration. It can be foreseen that in the future, as technology matures, various physical assets with continuous cash flow (such as infrastructure projects, leased assets, accounts receivable, etc.) may achieve on-chain financing through RWA.

Significance and Impact:The successful implementation of the GCL-Polymer RWA project has triggered heated discussions in the industry about the "stablecoin + RWA" model. Some people regard it as a vivid footnote to the "resonance" between the digital economy and the new energy industry. Traditionally, photovoltaic projects have a long financing cycle and limited funding sources, but RWA turns it into a digital financial product for global investors, breaking through the boundaries of regions and financial systems. More importantly, this practice demonstrates the huge potential of stablecoins to serve the real economy: through the stablecoin funds on the chain, a steady stream of global capital can be more efficiently injected into real industry projects, achieving mutual benefit and win-win results - investors obtain stable returns, enterprises obtain low-cost funds, and society reaps the benefits of green energy development. Because of this, the RWA track has recently received great attention from the capital market. Domestic securities research pointed out that RWA anchor assets should have the three characteristics of "sustained market growth, clear and transparent returns, and clear financing needs." GCL Energy's project meets these standards and sets a model for the industry.

Regulators have also noticed the development opportunities of RWA. The deputy director of the Hong Kong Monetary Authority once mentioned that the combination of RWA and stablecoinsis a new opportunity for high-quality development of the financial industry. After Hong Kong improves the stablecoin bill, this type of cross-border RWA financing is expected toenter the fast lane. Taking the GCL-Ant project as an example, if Hong Kong permits the issuance of RMB stablecoins in the future, the above financing can be completely denominated and settled through compliant RMB stablecoins, which is closer to the project assets themselves, and is expected to further simplify the process and reduce exchange rate risks. It can be expected that under a clear legal framework, RWA will become an important focus for stablecoins to connect with the real economy: whether it is green energy, supply chain finance, or real estate and infrastructure, they may be revitalized by the introduction of stablecoins. This trend is not a temporary trend. According to the Boston Consulting Group (BCG), the global RWA market size will exceed 16 trillion US dollars by 2030. Behind the huge numbers, it indicates that a large amount of physical assets will be moved to the blockchain for trading and circulation. Stablecoins play the role of value carrier and lubricant in this scenario: their value stability makes investors willing to trade RWA with them, and their programmable characteristics can be seamlessly combined with smart contracts to automatically execute dividends and redemptions. This will greatly improve the liquidity and financing efficiency of traditional assets and inject unprecedented financial innovation momentum into the real economy.

06 Stablecoins inject innovative momentum into traditional industries

Both the maturity of the legal framework and the success of the RWA case point to one fact:

Stablecoins are bringing new financial vitality to traditional industries and the real economy. This empowerment is mainly reflected in the following aspects:

1. Reduce transaction costs and improve payment efficiency.The emergence of stablecoins is expected to completely revolutionize traditional payment and cross-border remittance models. Currently, cross-border transfers between enterprises and individuals through banks are not only expensive (often several percentage points of the total amount), but also may take several days for the funds to arrive, involving the SWIFT network and multiple intermediary banks. With stablecoins, the fees can be reduced to almost zero, and the speed is measured in minutes. According to estimates, the cost of cross-border settlement of stablecoins can be reduced by about 80% compared with SWIFT, and the time is shortened from 3 days to a few minutes. This is of great significance to manufacturing and foreign trade companies that rely on international trade, and can greatly improve capital turnover efficiency and cash flow management. The same is true for retail payment scenarios. Taking credit cards as an example, merchants need to pay a 2-3% handling fee to the issuing bank/network for each transaction, while the stablecoin transaction fee is only a few cents, regardless of the amount. Consumers also do not need to wait for funds to be settled and are no longer subject to bank working hours. Because of these advantages, many global retail giants have begun to secretly plan their own stablecoins for membership points, supply chain settlement, etc., in order to save costs and improve operational efficiency. It can be foreseen that when legal barriers are removed, stablecoin payments will be implemented in industries such as e-commerce, logistics, and tourism, bringing consumers a cheaper and faster payment experience, and forcing traditional payment companies to optimize services and reduce fees. 2. Broaden financing channels and activate deposited assets. The demonstration significance of RWA lies in the fact that stablecoins and blockchain technology have joined forces to open up the on-chain financing channel for physical assets. In the past, assets in many industries (such as accounts receivable, equipment, infrastructure, etc.) lacked liquidity, and financing required mortgage loans or asset securitization, which was a cumbersome process and only available to a small number of institutional investors. Now, with the help of stablecoins, companies can "chain" these deposited assets into tradable tokens, allowing global investors to participate in financing. Traditional industries have thus gained a new financing channel: neither bonds and stocks nor bank loans, but direct integration of social funds through the stablecoin market under a compliance framework. This is somewhat similar to the industrial funds or trusts of the past, but with a wider scope, higher efficiency and better transparency. For example, the aforementioned photovoltaic power station attracted foreign funds through RWA. Similarly, a manufacturing company can also package its warehouse inventory and order receivables into tokens, allowing investors to subscribe with stablecoins and obtain short-term financing support. This method bypasses the banking system and reduces intermediary costs. For investors, it enriches the types of investable "real world assets", and the risks are relatively controllable because they are protected by the transparent mechanism of stablecoins. Authoritative dataalso confirms this trend: As of July 2025, the global stablecoin daily on-chain transaction volume has reached about 30 billion US dollars, doubling from 18 months ago. The huge flow of funds means that stablecoins are becoming a new channel for corporate financing and value exchange, introducing previously untouchable "crypto liquidity"to the real economy.

3. Enhance financial inclusion and promote inclusiveness and innovation. Another potential contribution of stablecoins is in inclusive finance and emerging markets. Traditional banking services in developing countries and regions are often insufficient, and the cost of cross-border remittances is extremely high. Stablecoins can provide cheap and efficient financial services to the population in these regions. For example, some African fintech companies have launched stablecoin wallets, allowing users to send and receive stablecoins equivalent to US dollars with their mobile phones, bypassing the risk of local currency depreciation and complicated banking procedures. This is particularly useful in scenarios such as cross-border labor remittances and international aid payments. In some countries, there are already millions of stablecoin wallets with millions of users, hundreds of millions of transactions, and a growth rate of more than 200%. The easy accessibility of stablecoins has greatly improved the coverage of financial services. In addition, because stablecoins are programmable, they have also spawned many innovative applications: for example, automated supply chain payments, when the delivery of goods triggers smart contracts to pay immediately; in the NFT market, stablecoin settlement makes art transactions more convenient, etc. Traditional industries can often unlock new business models by accessing stablecoin payments. For example, if cross-border e-commerce platforms support stablecoin settlement, they can attract overseas users without bank cards and expand the market; large enterprises can issue internal stablecoins to integrate the capital dispatch of branches around the world, settle internal accounts in real time, and improve the efficiency of capital use. It can be said that stablecoins are bringing the dividends of financial innovation to more corners, thereby promoting the digital transformation and model upgrading of traditional industries. Of course, we also need to remain calm. The development of stablecoins is still in its early stages and still faces three potential risks in the future: one is regulatory arbitrage. If the rules of different jurisdictions are inconsistent, funds may flow to areas with loose supervision, triggering unbalanced competition. The policy coordination between Hong Kong and the Mainland on stablecoins deserves continued attention. The second is liquidity shock. When the market is extremely volatile, stablecoin holders may redeem in a concentrated manner, forcing the issuer to sell off reserve assets (for example, selling US bonds may push up the yield by several basis points). Such a chain reaction deserves vigilance. The third is commercial feasibility. The strict 100% reserve requirement compresses the issuer's profit margin, and the enthusiasm of small and medium-sized institutions to participate may be limited. These challenges remind us that stablecoins are not a panacea, and supervision and risk control still need to be continuously improved.

07 Conclusion

In general, the regulatory "Tale of Two Cities" between Hong Kong and the United States over stablecoins is both competitive and resonant: both sides recognize the huge impact of stablecoins on the future financial landscape and strive to release their potential under the premise of controllable risks. However, each has its own emphasis on the path they choose: Hong Kong is determined to forge ahead, using stablecoins to consolidate its position as an international financial center and explore new channels for the internationalization of the RMB; the United States is steady and solid, using laws to consolidate the foundation of the dollar's digital hegemony and accelerate the integration of crypto finance and traditional systems. The common point between the two is that stablecoins have gone from wild growth to compliant operation, which will profoundly change the financial ecology of traditional industries. When the spring breeze of stablecoins blows into the real economy, what kind of chemical reaction will it trigger? From the success of photovoltaic green asset RWA, we have seen the resonance of digital finance and industrial development; from the enthusiasm of merchants to embrace stablecoin payments, we have experienced the new vitality of traditional business models. It can be foreseen that under the guidance of clear regulations, stablecoins will continue to evolve iteratively, inject innovative power into many fields such as manufacturing, energy, cross-border trade, and Internet economy, and promote finance to better serve entities. In the face of this financial change, regulators, enterprises and investors should actively participate and make rational decisions. The new policy of stablecoins is just a starting point. How to use this tool to benefit the economy is a common issue for the world. As Morgan Stanley said, the rise of stablecoins does not mean the creation of a new "super-sovereign" monetary system. It is essentially an extension and supplement to the current legal currency system, with the purpose of promoting cross-border transactions and industrial innovation. We have reason to believe that under the escort of sound supervision, stablecoins will become a powerful engine for the digital transformation of traditional industries, allowing financial innovation to truly empower the high-quality development of the real economy.

Disclaimer: This article is for academic exchange and dissemination only.

Bitkub Online, Thailand's major crypto exchange, plans a $3 billion IPO next year, led by Bitkub Capital Group CEO Jirayut Srupsrisopa.

Bernice

BerniceAyshei.com, an upcoming web3-enabled online marketplace, is gearing up to redefine online commerce in the UAE. Backed by Medad Holding and leading investors, the platform is set to officially launch at the beginning of 2024. The move comes amid projections of the UAE e-commerce market reaching $17.2 billion by 2027, marking a significant shift in the digital marketplace landscape.

Joy

Joy Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive SuperWeb3 hosted an Online Demo Day on October 23, 2022 on ZOOM.

Others

Others Nulltx

NulltxGensokishi Online has announced the opening of its closed alpha. The project which incorporates the elements of NFT and GameFi ...

Bitcoinist

Bitcoinist