Author: Matt Crosby, Principal Analyst, Bitcoin Magazine Pro; Translated by: Shaw Jinse Finance

While many are still focused on how high Bitcoin can go in the current bull market (though given the current price action, the rally may be unsustainable), it's equally important to prepare for what's to come. Here, we'll explore some data and mathematical models to help us estimate where the bottom of Bitcoin's next bear market might be. This isn't a prediction, but rather a framework built on past cycles, on-chain valuation metrics, and even Bitcoin's fundamental valuation.

Cycle Master Chart

One of the most stable and accurate models for identifying Bitcoin's cyclical bottoms is what we call the **Bitcoin Cycle Master Chart**, which aggregates numerous on-chain metrics to create a range around the price with specific valuation levels.

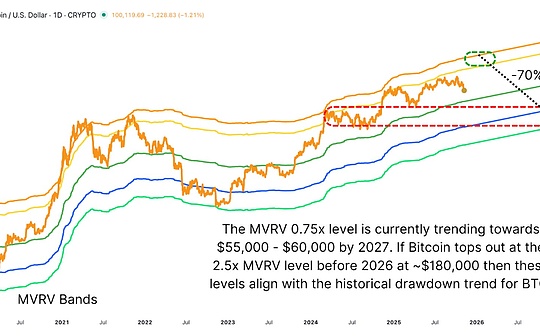

Figure 1: The cycle low line on the Bitcoin cycle main chart is precisely aligned with the bear market cycle low. Historically, this green "cycle low" line almost perfectly marks the macro bottom of Bitcoin. From $160 in 2015 to $3,200 in 2018, and then to $15,500 at the end of 2022. Currently, this range is around $43,000 and is rising daily, providing a useful benchmark for estimating the potential decline of Bitcoin in the next full cycle. The pullback is decreasing. Furthermore, we can look at the original MVRV ratio, which measures the ratio between Bitcoin's market price and its realized price (the average cost basis of all Bitcoins). Historically, during deep bear markets, Bitcoin's price has tended to fall to 0.75 times its realized price, meaning the market price is approximately 25% lower than the network's total cost basis. Figure 2: Historically, bear market lows have occurred when the MVRV ratio drops to 0.75. This repeatability provides a strong benchmark, combined with a trend of gradually narrowing declines, to estimate potential downside risks. While Bitcoin's early cyclical declines reached as deep as 88%, this figure has been steadily compressing, reaching 80% in 2018 and 75% in 2022. **If this trend continues, the next bear market correction is expected to be approximately 70% lower than the cycle high.** Figure 3 shows that the decreasing retracement magnitude of bear market cycles indicates that the next correction from the cycle high will not exceed 70%. Before predicting the next low, we need to make reasonable assumptions about the potential peak of this bull market. Based on historical MVRV multiples and realized price growth trends, Bitcoin tends to peak around 2.5 times its realized price in the near term. If this relationship remains unchanged and the realized price continues its upward trend, this suggests that the price of Bitcoin could reach a peak of approximately $180,000 per coin by the end of 2025. Figure 4: Applying MVRV multiples and realized price predictions, we can see that the cycle top is around $180,000, followed by a bear market cycle bottom around $55,000 to $60,000 in 2027. If this is indeed the case, and Bitcoin follows its historical pattern, entering a year-long bear market in 2027, then a 70% pullback from the current price would place the next major cycle low between $55,000 and $60,000. This aligns well with the consolidation range of Bitcoin's fluctuations last year, creating a certain resonance on a technical level. Production Costs: One of the most reliable long-term valuation metrics for Bitcoin is its production cost, the estimated electricity cost required to mine one Bitcoin. Historically, this metric has closely correlated with the lowest points of Bitcoin bear markets. After each halving, production costs double, creating a rising structural support level below the price over time. Figure 5: The estimated electricity cost to produce 1 Bitcoin is approximately $70,000, which constitutes a strong lower bound for price fluctuations. When Bitcoin trades below its production cost, it indicates pressure on miners and often signifies a good opportunity to accumulate wealth. Since the April 2024 halving, the new cost base has risen significantly, and each time Bitcoin's price has approached or slightly fallen below this level, it has marked a local bottom followed by a significant rebound. Currently, this figure is around $70,000, but it fluctuates daily. Conclusion Each Bitcoin cycle is accompanied by a wave of frenzy, with people proclaiming, "This time it's different." But the data proves otherwise. While institutional adoption and broader financial integration have indeed changed Bitcoin's structure, they haven't eliminated its cyclicality. The data suggests that the next bear market may be more moderate, reflecting a more mature market and a more pronounced liquidity-driven environment. A price pullback to the $55,000 to $70,000 range doesn't signify a collapse, but rather marks the continuation of Bitcoin's historic expansion and reset cycle.

Kikyo

Kikyo