2024 is about to pass. At the end of 2024, the airdrop of Magic Eden's token $ME and the collective recovery of ETH's "old blue chips", especially the sunny airdrop of the "fat penguin" Pudgy Penguins' token $PENGU, the real wealth effect has made NFT gain market attention for a long time.

What kind of year is this for NFT? Rhythm BlockBeats reviews the NFT market in the past 12 months for you. After reviewing the NFT market in 2024 with us, how would you rate the performance of the NFT market in 2024?

January: The trend of the world being divided into three parts is beginning to take shape, and the end of the "hexagonal avatar"

In December 2023, the total monthly transaction volume of Solana NFT was about 365 million US dollars, which slightly surpassed Ethereum's about 363 million US dollars. Looking back, this is the beginning of the three-way division of the NFT world among Ethereum, Solana and Bitcoin (Ordinals). Although at the end of the year, Ethereum has re-proved itself as the current king of the chain in the NFT field through its absolute monopoly on the top market value NFT projects and the volume of players, if we go back to January this year, in 2024, the NFT market will spend the whole year in the trend of the world being divided into three parts.

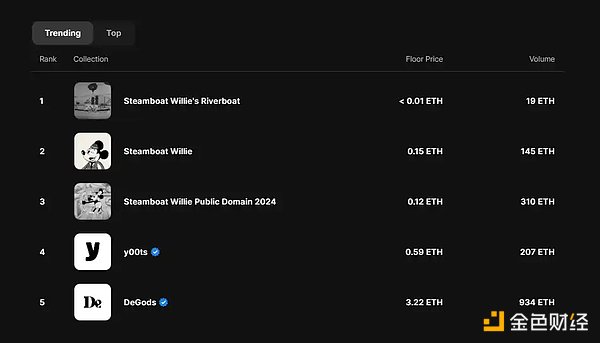

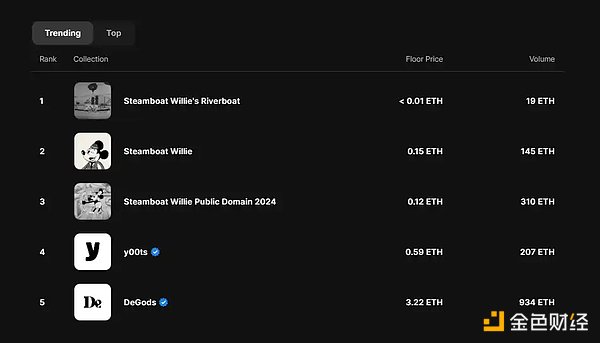

Ethereum NFT started the year with "Retro Mickey Mouse". Because US law only allows copyrights to be owned for 95 years, in January of this year, the copyright of the old version of Mickey Mouse no longer belongs to Disney and is open to the public. So we saw "Mickey Mouse" dominating the list on OpenSea.

But then, there was bad news - Twitter cancelled the function of using NFT as Twitter avatar. This seems to tell us that, except for Crypto players, no one in the world cares whether an avatar is worth 10 or 100,000 yuan. Anyway, do you still remember this "hexagonal avatar"?

This month's star new projects include:

Pizza Ninjas (Bitcoin Ordinals), another Tier 1 project in the Bitcoin ecosystem was born.

RSIC (Bitcoin Ordinals), the most popular pre-mined rune NFT series before the launch of the Rune Protocol quietly airdropped, and rune pre-mining became popular.

Tinfun (Ethereum, later migrated to Blast), Chinese power recasts the glory of the Ethereum mainnet.

ittybits (Ether Inscription), a 10x opportunity in a niche track, led to the rise of the entire Ethereum Inscription small picture, but unfortunately there was no follow-up.

CryptoUndeads (Solana), got the Cabal disk that made a lot of money in pre-sale, and passed by like a meteor.

February: ERC-404 "Pandora's Box", Yuga Labs acquired "Moonbird"

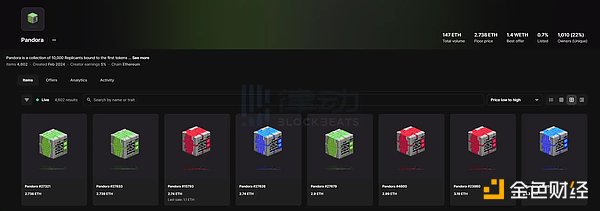

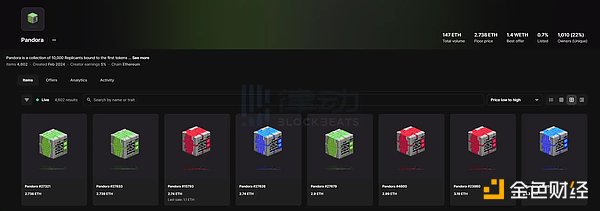

The concept of "picture and currency integration" shined in early February. The first project of ERC-404, "Pandora's Box", was undoubtedly the absolute star in early February, and it soared nearly 30 times.

At that time, we had this idea -

ERC-404 directly created a "symbiotic relationship between images and tokens", which can be traded on CEX and is also a subversion of existing NFTfi products. As long as the oracle is introduced, it is easy to leverage native NFTs based on ERC-404 (directly open long and short positions on ERC-20 Tokens), and direct lending is also easy. It is no longer a form of storing small images in a specified address, but can be operated directly based on ERC-20 Tokens.

But now, this concept has not been realized. Instead, the Hybrid "picture-coin hybrid" model that became popular on Solana later, that is, the rise of meme coins led to the rise of the NFT series with community cult attributes, showing the effect of a double helix of liquidity.

In February, Yuga Labs announced the acquisition of Moonbirds' development team PROOF, and became an NFT "giant" with top NFT IPs/projects such as CryptoPunks, BAYC, MAYC, BAKC, "Monkey Land" Otherdeed, Meebits, and Moonbirds. At that time, the view we put forward was -

Yuga Labs is no longer cool, and there may not be much time left for Yuga Labs to think. This will be a race with the bull market.

Now it seems that the attention and excellent market performance of Pudgy Penguins and Doodles at the end of the year provide evidence for this view.

This month's star new projects include:

Quantum Cats (Bitcoin Ordinals), although the price of 0.1 Bitcoin at the time caused some disagreement in the market, the current price of 0.3 Bitcoin has made the project's blue-chip Bitcoin NFT status undisputed.

March: Blast mainnet launched, Runestone airdrop triggered a rune craze

The Blast mainnet was launched on March 1, firing the "first shot" of the NFT market in March. But in general, the most popular place this month is Bitcoin Ordinals.

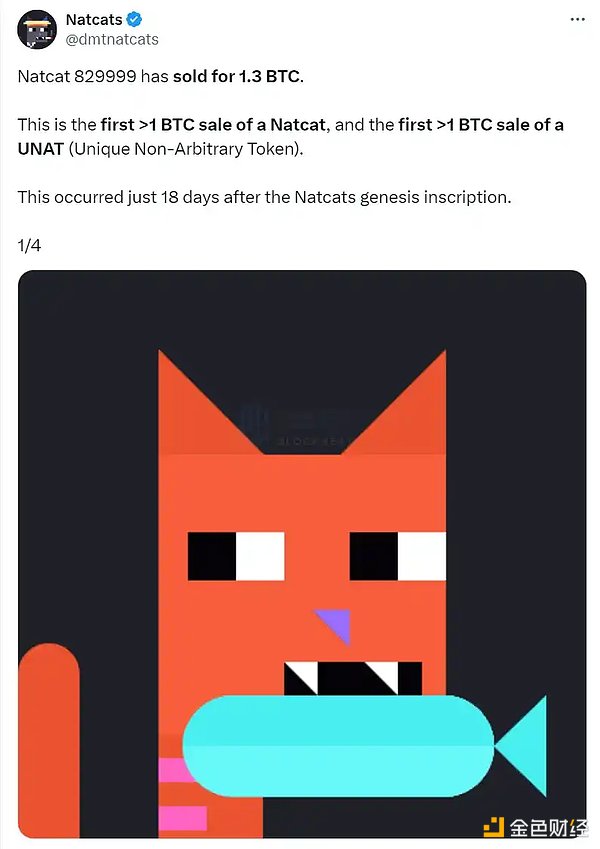

First, the concept of "DMT (a concept that derives a generative art based on Bitcoin block data)" started to rise at the end of February. As the leader of the DMT concept, Natcats set a single sales record of 1.3 Bitcoins before it was listed on any Bitcoin NFT trading market.

Then there was the Runestone airdrop in mid-March. This huge airdrop included more than 112,000 Bitcoin addresses and became the third largest NFT series in terms of total market value of all chains in just two days. It is also the predecessor of the rune $DOG, which ranks first today.

Runestone airdrop has a profound impact on the Bitcoin ecosystem. "Free, fair, big truck", these three keywords have become the criteria for judging whether the Bitcoin Ordinals ecosystem project is excellent for a long time this year.

At the same time, on Solana, Mad Lads reached its peak this month, and holders are very happy to wait for their Wormhole airdrop to arrive.

Overall, it was a lively month, but there was still frustrating news. Starbucks' NFT loyalty reward program "Starbucks Odyssey" on Polygon announced that it would be shut down after the end of this month, and Kevin Rose also caused controversy for selling a bunch of small pictures.

This month’s star new projects include:

Runestone (Bitcoin Ordinals), the rune legend begins with this stone.

CENTS (Bitcoin Ordinals), 10,000 smelted and chained penny coins, have become the art series with the highest market value on Bitcoin.

Plutocats (Blast), which is quite similar to the “Nouns” on Blast, has soared due to the allocation of Blast Gold far higher than other NFT projects.

Crypto Valley (Blast), this farming game issued 1,500 free “farmer” characters at the time, which was once FOMO, but no one has been interested in it for a long time.

April: Bitcoin halved, Base NFT grew

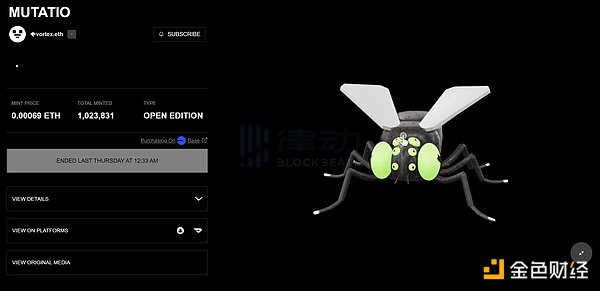

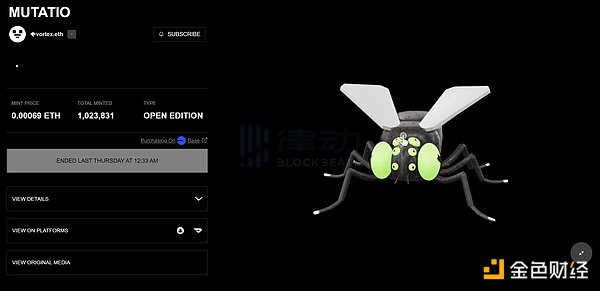

The star new projects in March should also include XCOPY's Open Edition series "MUTATIO" on Base, which sold 1,023,831 copies during the 2-day minting period, with total sales exceeding 700 ETH.

But the hottest is the Meme token $FLIES launched by the project community in April, which was forwarded and recommended by XCOPY himself.

On the Blast network, fantasy.top, a "friend trading" game, continues to be popular.

Of course, the Bitcoin network is still the hottest. The halved Epic Satoshi was traded at 33.3 Bitcoins, and an Epic Satoshi rune was born. It seems that everything in the Bitcoin ecosystem is stable and improving, but in the end, this Epic Satoshi did not give players much return, and it was even a failure...

This month's star new projects include:

Blob (Bitcoin Ordinals), a self-funded airdrop, an all-star lineup, and took the lead in winning Epic Satoshi. Just when everyone was looking forward to a new Bitcoin blue chip appearing as a generative art, it collapsed due to a series of operations. This may be one of the most disappointing Bitcoin NFT investments in the past year.

Prometheans (Bitcoin Ordinals), the CyberKongz team’s first attempt to enter the Bitcoin ecosystem, was a successful airdrop, but then they failed in the sales of the PFP series, and then left the Bitcoin ecosystem with the rune DECENTRALIZED No. 2.

May: The beginning of the cold transition

Starting from this month, NFTs in 2024 began to enter a relatively cold phase.

From the perspective of degen fighting on the chain this month, there is really nothing to say. The news is basically such as Pudgy Penguins toys entering the stores of the US retail giant Target, DeGods returning to Solana, etc.

This month, Milady performed well, rising against the trend.

June: Cold and Desolate

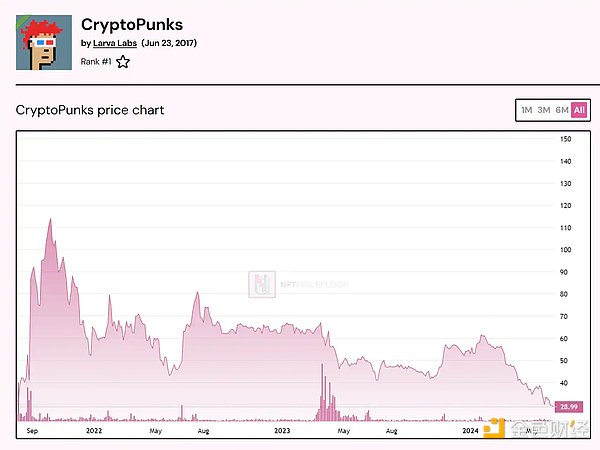

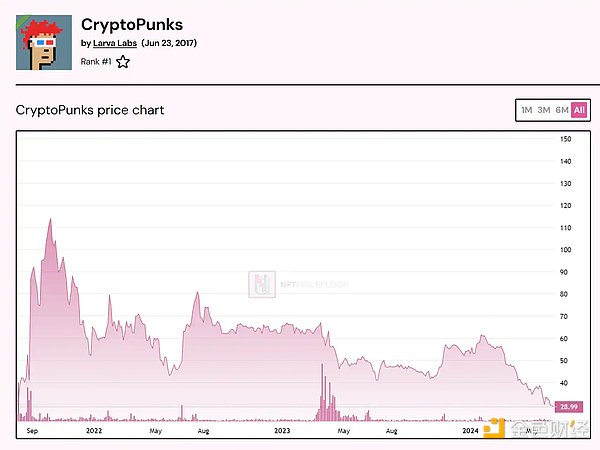

This month, we saw CryptoPunks below 30 ETH. This is the first time that the floor price of CryptoPunks has fallen below 30 ETH since August 2021.

In addition, the full set of gold skins BAYC + 2 MAYC + BAKC, a total of four Yuga Labs NFTs purchased by Three Arrows Capital in August 2021 and March 2022 for a total of approximately 140 ETH, were auctioned at Sotheby's on June 18. At the peak of NFT, the price of this asset should have exceeded 1,000 ETH. In June, BAYC's floor price once fell below 9 ETH.

It can be said to be the darkest moment for NFT. It was not until the last week of June that the old Ethereum blue-chip NFT projects rebounded. CryptoPunks rebounded by 24%, BAYC rebounded by 30%, Pudgy Penguins rebounded by 50%, and Azuki rebounded by 35%. Solana's top player Mad Lads also rose by 40%, and Bitcoin's top projects NodeMonkes and Bitcoin Puppets also rose by more than 20%.

In June, another NFT project became popular because of LayerZero's airdrop, that is Kanpai Pandas. The market's dissatisfaction with LayerZero's airdrop spread to this project, and there was once a voice that suspected that the project was "rat warehouse", but in fact it was not.

At the end of June, Abstract, the now popular "Penguin Chain", also debuted in its current new look for the first time. As an NFT Layer2 chain, Frame, the predecessor of Abstract, has been silent since the official tweet announced the extension of the airdrop pre-claim period on January 30 this year. Until the end of June, Frame finally held back its big move-the chain was acquired by Igloo, the newly established parent company of Pudgy Penguins. So far, the three brands of the Igloo ecosystem have all unveiled their veils-Pudgy Penguins, the on-chain IP licensing platform Overpass, and Frame.

Frame has been rebranded. In addition to changing its name to Abstract, the overall vision has also been upgraded from empowering creators and providing a more convenient and secure NFT user experience to oriented to mass consumers and promoting the large-scale adoption of Crypto.

Looking back, the flames after the cold winter began to ignite from this time. In addition to Abstract, there are some new star projects in June:

Writ of Passage by The Beacon (Arbitrum), with a total of 10,000, a minting price of 0.115 ETH, sold out in 7 minutes after entering the FCFS round. In the market environment at the time, it was really rare to sell 10,000 NFTs at such a price. Of course, this was sold out mainly because it essentially took out the tokens for pre-sale.

Gigabud (Solana), the public sale price at the time was 1.25 SOL. As the official PFP of Grass "WiFi Grass", this series not only brought a considerable amount of airdrops later, but also could be sold at a price of more than 1.25 SOL after the airdrop, which is very comfortable.

End of the year: directly recover to hot

The months without writing in the middle are not because I am lazy, but there is really nothing worth writing. Some things happened during these windows:

Magic Eden confirmed that it would issue coins, and finally at the end of the year, the airdrop of $ME gave NFT players rich returns.

Azuki confirmed that it would issue coins.

NFT has gradually become popular as a means of cold start for many projects since the middle of the year. At that time, the Free Mint projects with a total supply of 1,000 or even less were popular, and they directly stated that there would be token airdrops in the future. By the end of this year, we saw the popular Kaito.

On the Solana network, the rise of the NFT series driven by the popularity of meme coins blurred the boundary between meme and NFT. The most typical representative is Retardio Cousins.

Ape Chain was a little popular for a while, and the low Mint price produced some high-multiple projects, but from the amount of income, there was no case that shocked the market.

Everyone has a deep impression of the things at the end of the year. OpenSea is already on the way to issue coins. Abstract, Monad, Berachain, Story and other chains that have not yet issued coins have brought related NFT projects to the forefront because of potential token airdrops (Related reading: What NFTs are worth paying attention to on public chains that have not issued coins?). The wealth-creating effect of the $PENGU airdrop has made Doodles, Azuki and even Cool Cats soar. New star projects have begun to appear, such as Abstract's On-chain Heroes and Fukuhedrons on the Bitcoin network.

The long-awaited spring has returned to the earth, but only one old blue chip has left the market sadly, that is Clone X. This old blue chip with a Nike background announced the cessation of operations on December 3, just like announcing that it would no longer eat at the New Year's Eve dinner, which shocked all NFT players.

Looking forward to the new year, Abstract's mainnet will be launched in January, and Monad, Berachain, and Story may also have new opportunities. I just hope that you will not launch too closely, as diversion is not friendly to degen.

On the basis of the steady improvement of Ethereum's old blue chips, although it is difficult for Ethereum to have projects that can match the old blue chips (the investment and resources of the old blue chips, it is really hard to imagine that there will be investors who will spend a lot of effort to catch up with what the old blue chips have done), but new narratives may bring new opportunities, such as AI-related NFTs.

More and more coin issuance projects may choose NFT, which is a small amount and easy to control, as a warm-up method.

Bitcoin's NFT still has room to grow upward.

NFT is no longer the NFT we are familiar with. Content and IP narratives no longer meet the current version standards for screening new projects. "Coin issuance" and "conspiracy" have become mainstream, but it does not prevent us from still finding high-quality content that we like and love. NFT is still growing.

Perhaps the concept of NFT is outdated, but the thing we like to play has not changed, it has always been pictures.

I am finally going to finish what I said. Now, how would you rate the NFT market in 2024?

Kikyo

Kikyo