Author: SANYUAN Labs Source: X, @SanyuanCapital

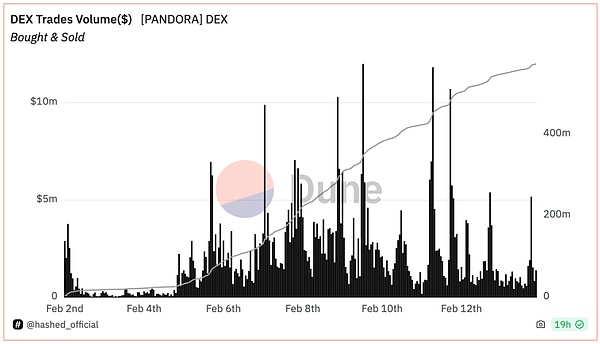

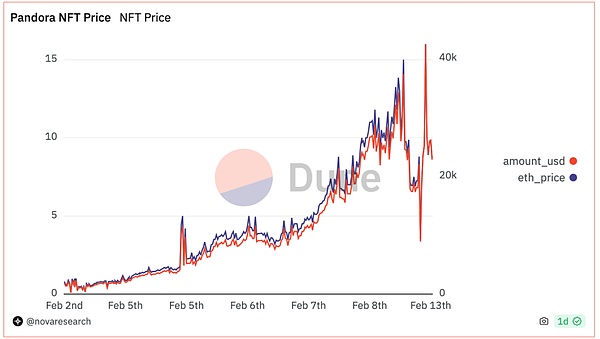

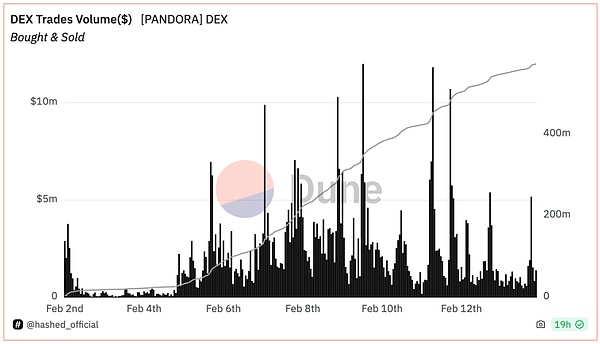

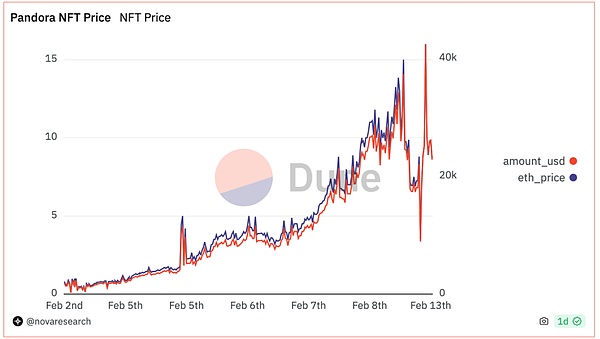

ERC404 attracted a lot of attention a few years ago, which once caused Ethereum gas to surge. Currently, $PANDORA has retreated to more than 10,000. Just when the initial popularity has subsided, let’s have a rational chat.

The development history of NFT split track

Pandora_ERC404 The proposed ERC404 is a FT/NFT hybrid protocol for NFT fragmentation, so let’s start with the development history of the NFT fragmentation track.

With the arrival of NFT summer in 2021, the prices ofblue-chip NFTs such as CryptoPunk and Boring Ape have risen to the point where ordinary users are disappointed, and the liquidity The problem has always been a major pain point for NFT. Therefore, the demand for NFT split reached its peak at that time. This demand was actually perceived by many project parties very early on.

One of the early solutions is NFT crowdfunding, which generally involves purchasing NFT through centralized crowdfunding. However, there are many problems with the crowdfunding method: such as NFT custody issues, inconvenience in withdrawing or transferring, etc. As a result, projects that use a decentralized approach to fragment NFTs emerged.

These NFT fragmentation protocols all use smart contracts to host NFTs. For example, NIFTEX proposed an NFT fragmentation plan as early as 2020. Users can By casting fragmented NFTs (shards), shard holders enjoy the governance rights of the original NFT; and a buyout clause is introduced. For example, when the minimum condition for triggering a buyout is at least 10% of the shards, the buyer can hold 10% of the shards. The above fragments can be purchased by adding the remaining value of ETH to obtain the NFT. However, NIFTEX announced in 2022 that it had been acquired, the domain name was deactivated, and no coins would be issued. It has gradually faded out of sight.

Considering that the price of a series of NFTs may be different, some projects consider packaging multiple NFTs of the same series and issuing index tokens uToken in fragments. , such as Unicly uniclyNFT. Unicly has also considered the Defi scenario of FT tokens by issuing the governance token $UNIC and using liquidity mining to increase the liquidity of uToken. In terms of NFT redemption, Unicly's uToken creator can set a ratio. When uToken holders exceeding the ratio agree to unlock it, the successful bidder obtains the NFT and pays the corresponding amount to uToken holders. However, there is currently very little transaction volume. The project raised US$10 million in 2021, with investments from Blockchain and Animoca. The solid financial support has supported it through the cold winter. Last month, Unicly announced that the V3 version will be launched this year and will be deployed on frame.xyz, but it is still deserted. The current homepage Data such as TVL and transaction volume are no longer displayed.

There is also the star project Fractional, which has raised approximately US$28 million. It designs a vault for a single fragmented NFT and a vault for multiple fragmented NFTs. treasury. The person who fragments the NFT is called a curator, and they can obtain fee income from the fragment auction. In addition, NFT shard holders can vote on the vault's reserve price. The weighted average of the votes determines the price required to initiate an acquisition. Anyone holding a holder greater than or equal to the reserve price can conduct a vault acquisition. After the auction is successful, the corresponding vault's NFT shard holders can exchange their ERC20 tokens for ETH. Fractional later changed its name to Tessera. Unfortunately, after several changes, Tessera announced last year that it would be gradually closed.

In addition to fragmenting specific NFTs, there is also an exponential splitting method, such as NFTX, Fragmenting similar NFTs NFTs with similar prices are put into a vault, and the vault issues corresponding vTokens. The advantage of this method is that you only need to hold enough vTokens to randomly redeem NFTs from the vault. There is no need to vote, and deposit and redemption are relatively simple. Convenient, but it may not be possible to redeem the designated NFT. A similar project, NFT20, has improved NFTX, first by allowing the redemption of designated NFTs, and secondly by adding empowerment to the governance token $MUSE, with part of the FT token minting fee returned to $MUSE holders. NFT20 also completed $750,000 in financing in 2021.

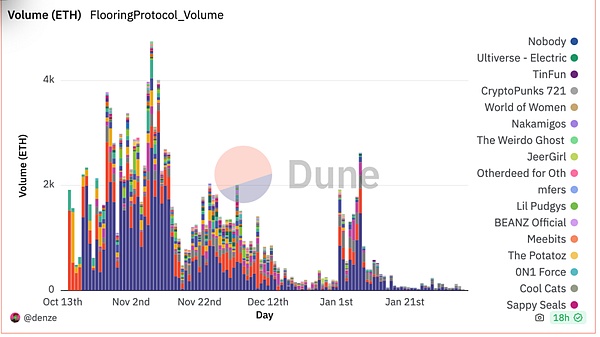

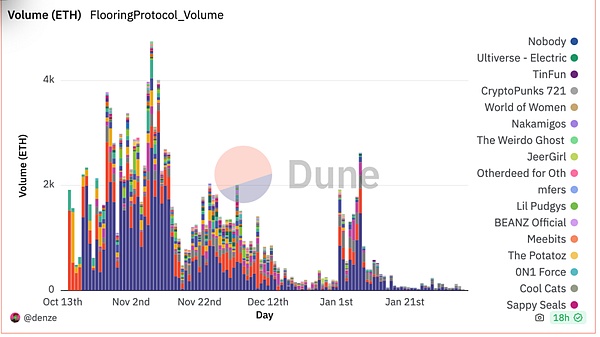

Just when many projects were in trouble in the NFT bear market, a new fragmented NFT project, Flooring Protocol floorprotocol, was announced to be online last year. Flooring Protocol transferred a high-end The net worth NFT is fragmented into 1 million ERC-20 μTokens. The μTokens between different NFT collections are not connected. The fragmented μTokens of NFTs in the same NFT collection are consistent. Flooring Protocol has two fragmentation modes: Valut and Safebox. Users can choose to store NFT in Vault, obtain 1 million μTokens, and give up ownership of the NFT; they can also choose to store NFT in Safebox, and select a storage time and a certain amount of pledge. The amount of platform currency FLC (the longer the storage time, the more FLC is pledged), thereby obtaining 1 million μTokens and the Safebox Key used to verify the ownership of the NFT. The Safebox Key can be auctioned and traded. When redeeming, the Vault mode needs to destroy 1 million μTokens corresponding to the NFT set, but the redemption is random; while the Safebox mode redeems the previously deposited NFT by holding the Safebox Key, and also needs to destroy 1 million μTokens. When the Safebox storage time expires, some users will face the problem of being unable to redeem the NFTs in the Safebox (the pledged FLC can be retrieved). Within 24 hours after expiration, any user can use FLC to initiate an auction for the expired Safebox Key, but will need to pay a 20% fee to the protocol. If no one auctions it, any user can use 1 million μTokens to unlock the Safebox and redeem it. NFT.

Currently the most popular series in Flooring is also CryptoPunks. After the FLC incentive craze when it was first launched has subsided, TVL is currently at a low level.

It can be seen that the current NFT splitting projects basically use the method of pledging NFT to issue FT tokens for splitting. The rules for splitting and redemption are different for each project. Projects that issue governance tokens will be relatively popular. Some, but the popularity is unsustainable, and they basically only support the split of blue-chip NFTs.

Detailed explanation of ERC-404 standard

PANDORA proposed a A new way to fragment NFT - ERC-404 standard. ERC-404 is an experimental token standard. ERC404 tokens are homogeneous tokens. One ERC404 token corresponds to one Replicant NFT.

Different from ERC721 standard NFT, Replicant NFT has a burning and recasting mechanism, which is triggered when the user transfers or trades ERC404, that is, When the ERC404 token changes, the Replicant NFT will also change. For example, when the user sells the ERC404 token, the Replicant NFT in the wallet will be burned; when the user transfers money, the Replicant NFT in the Sender wallet will be burned and stored in the Receiver. The wallet re-mints new Replicant NFTs. It is worth mentioning that with each reminting, the characteristics of Replicant NFT will be refreshed, and the rarity may also change accordingly. Therefore, users can continue to transfer money to refresh the NFT characteristics. If the user does not want to change the characteristics of his Replicant NFT and wants to sell or transfer it, he can sell or send it on OpenSea (that is, only operate on the Replicant NFT).

ERC404 and previous NFT splitting plan They are different. It solves the problem of splitting from the bottom of the protocol. The astonishing increase also reflects the currency circle's pursuit of new concepts. But it is still in the early stages, and there is still a lot of room for improvement. It is still unknown whether the EIP proposal will be passed in the future.

Pandora announced last week that it has become a complete entity, and news of financing and cooperation cannot be ruled out in the future; the V2.1 version was recently launched, mainly to solve the complaints. The problem of high gas charges.

Personally, I think there have been no new concepts in the NFT track for a long time, and they still focus on liquidity issues from the perspective of underlying standards, so we must keep paying attention; in the future As the protocol improves, it is possible that more projects will be supported and more application scenarios will emerge.

JinseFinance

JinseFinance