Author: danny; Source: X, @agintender

Nvidia released its Q3 financial report on November 19th. While not outstanding, it certainly exceeded expectations. The problem is, despite such results, the market didn't react positively, experiencing a sharp drop after a 5% increase. Many cryptocurrency enthusiasts are completely bewildered. This article attempts to summarize, interpret, and analyze the hidden aspects of this seemingly "unbelievably good" financial report from the perspective of those who are bearish on the company.

Furthermore, there are already numerous articles advocating for a bullish market, so I won't go into detail here.

If you're too lazy to read the long article, here are the core bearish points: Nvidia has created a closed loop of cash flow by investing in clients like xAI, converting investment funds into on-paper revenue, but lacking substantial cash delivery. Accounts Receivable Surge Abnormally High: Accounts receivable balance reached $33.4 billion, growing far faster than revenue, and the turnover days calculation is suspected of being misleading, suggesting serious "channel congestion" and back-end loading issues. Inventory and Narrative Discrepancy: Under the narrative of "supply shortage," finished goods inventory unexpectedly doubled, indicating potential customer delays or product stagnation risks.

Cash Flow Inversion: Operating cash flow is significantly lower than net profit, proving that the company's profits mainly remain on paper and have not been converted into real cash.

This article does not constitute any investment advice. This article is just a collection of viewpoints.

1. Recurring Revenue and Supplier Financing Model

1.1 Closed-Loop Mechanism of Fund Flow

Background: In November 2025, Elon Musk's xAI completed a $20 billion funding round, in which Nvidia directly participated in approximately $2 billion of equity investment, but this is not a simple "investment behavior".

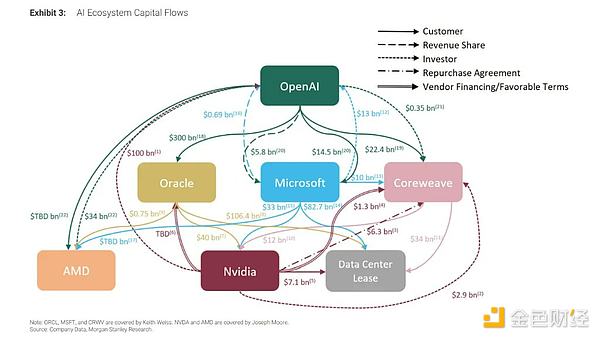

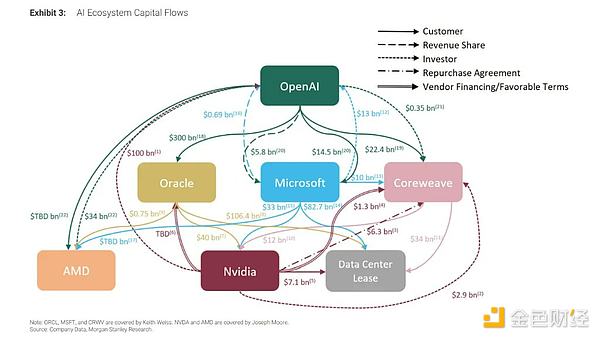

Let's follow the logic step by step: Capital Outflow (Investment Side): Nvidia allocates approximately $2 billion in cash from its balance sheet, recorded as "Purchases of non-marketable equity securities," as an equity investment in xAI or a related SPV. This outflow is reflected under "Investing Activities" in the cash flow statement. Capital Conversion (Client Side): xAI receives this capital and uses it as an initial payment or capital expenditure budget for purchasing a GPU cluster (i.e., the Colossus 2 project, involving 100,000 H100/H200 and Blackwell chips). Capital Inflow (Revenue Side): xAI then places a purchase order with Nvidia. Nvidia ships the goods and recognizes "Data Center Revenue." Financial Results: Nvidia effectively transformed its "cash" assets on its balance sheet into "revenue" and "net profit" on its income statement through the intermediary xAI. While this practice is generally permissible under General Accounting Principles (GAAP) (provided it is assessed), it is essentially "low-quality revenue" (IFRS is clearly challenging this). This is also what short sellers like Michael Burry criticize, as this model of "almost all customers being funded by their suppliers" is a typical characteristic of the late stages of a bubble. When a company's revenue growth depends on its own balance sheet expansion, its revenue growth will dry up once it stops investing externally. (Does this feel a bit like a nested doll arrangement in the crypto world?) 1.2 SPV Leverage and Risk Isolation If you found the recurring revenue model impressive, the special purpose vehicle (SPV) structure involved in the transaction might open your eyes even further. According to news reports, xAI's financing included equity and debt, with the debt portion constructed through an SPV. This SPV was primarily used to purchase Nvidia processors and lease them to xAI. The operating logic of the SPV: The SPV, as a legally independent entity, holds the GPU assets. Nvidia is not only the seller of the GPUs but also an equity investor (first-loss capital provider) in the SPV. This means that Nvidia plays a dual role in the transaction: supplier and underwriter. Revenue Recognition Circular Arbitrage Model: By selling hardware to the SPV, Nvidia can immediately recognize full hardware sales revenue. However, for the end-user xAI, this is essentially an operating lease, with cash outflows occurring in installments (e.g., over 5 years). Hidden Risk: This structure transforms long-term credit risk (xAI's future ability to pay rent) into immediate revenue recognition. If AI computing power prices collapse in the future, or xAI fails to generate sufficient cash flow to pay rent, the SPV will face default, and Nvidia, as the SPV's equity holder, will face asset write-down risk. But in the current earnings season, all of this is presented as a dazzling "genesis revenue." 1.3 The Shadow of Supplier Financing During the Internet Bubble The current business model is somewhat similar to the internet bubble of 2000. At that time, Lucent lent billions of dollars to customers to purchase its own equipment. When internet traffic growth fell short of expectations, these startups defaulted, Lucent was forced to write off huge amounts of bad debt, and its stock price plummeted by 99%. Nvidia's current risk exposure (direct investments + SPV debt support) is estimated to exceed $110 billion, representing a significant proportion of its annual revenue. Although Nvidia does not currently list "customer loans" directly on its balance sheet, its actual risk exposure is consistent through holding customer equity and SPV interests. 2. Accounts Receivable Mystery 2.1 Rapid Growth in Accounts Receivable Ratio According to the Q3 FY2026 financial report, Nvidia's accounts receivable balance reached $33.4 billion. The year-on-year growth rate of accounts receivable (224%) is 3.6 times that of the revenue growth rate (62%). In normal business logic, accounts receivable should grow in tandem with revenue, especially given Nvidia's strong performance. When accounts receivable growth far exceeds revenue growth, it usually indicates two possibilities: a. Declining revenue quality: The company has relaxed credit terms, allowing customers to defer payments to stimulate sales. b. Channel congestion: The company rushes to ship to distributors at the end of the quarter to recognize revenue, but these products haven't actually been absorbed by the end market. (This will be discussed later.) 2.2 Calculation of DSO (Days of Accounts Receivable Turnover) This quarter's DSO is 53 days, slightly lower than last quarter's 54 days. So what is the actual situation? First, the standard DSO calculation formula: DSO = (Accounts Receivable / Total Credit Sales) x Number of Days in the Period. Beginning AR (End of Q2): $23.065 billion. Ending AR (End of Q3): $33.391 billion. Average AR: $28.228 billion ((Q2+Q3)/2) Quarterly Revenue: $57.006 billion. Number of Days: 90 days. The standard DSO is approximately 28.228 / 57.006 * 90 = 44.566 (days). However, the reported DSO is 53 days. Logically, from the perspective of "window dressing" financial statements, a more "aggressive" figure would be reported, but here it's conservative? This suggests that Nvidia may be using ending accounts receivable as the numerator, or its calculation logic may be more inclined to reflect the cash tied up at the end of the period. If calculated using the ending balance: 333.91 / 570.06 * 90 = 52.717 (days) This figure matches the report. But what does this mean? It means that the accounts receivable balance at the end of the quarter is extremely high relative to the sales for the entire quarter. This suggests a back-end loading phenomenon, where a large amount of sales occur in the last month or even the last week of the quarter. If sales were evenly distributed, ending accounts receivable should only include sales from the last month (approximately $19 billion). But the current balance is $33.4 billion, meaning that nearly 58% of quarterly revenue has not been received in cash. Under the narrative of a so-called "seller's market" and "supply shortage," Nvidia should have extremely strong bargaining power, even demanding advance payments. However, the reality is that Nvidia not only hasn't received advance payments, but has also offered customers payment terms of nearly two months?! This seems inconsistent with the "buying frenzy" narrative?! 3. The Inventory Puzzle: The Paradox of Supply Shortage and Inventory Overstock While Jensen proclaims "Blackwell demand is insane (Off the charts)," Nvidia's inventory data seems to tell a different story. 3.1 Reasons for the Doubling of Inventory Total inventory in Q3 FY2026 reached $19.8 billion, nearly double the $10 billion at the beginning of the year and a 32% increase from $15 billion in the previous quarter. More importantly, the composition of the inventory is as follows: Raw Materials: $4.2 billion Work in Process (WIP): $8.7 billion Finished Goods: $6.8 billion In short, finished goods inventory has surged. At the beginning of 2025, finished goods inventory was only $3.2 billion. Now it has surged to $6.8 billion. Especially when Huang (Nvidia's CEO) was proclaiming that demand was exploding, and assuming chip shortages and customers queuing for orders, finished products should have been "shipped immediately after production," with inventory levels kept extremely low. Why is this? Are they waiting to collect payments after the Chinese New Year? 3.2 $50 Billion in Purchase Commitments In addition to the inventory on its balance sheet, Nvidia also disclosed a staggering $50.3 billion in supply-related commitments. This represents the amount of future purchases Nvidia has pledged to suppliers such as TSMC and Micron. This is a huge "hidden danger." If AI demand slows or weakens in any way in the coming quarters, Nvidia will face a double blow: Inventory Impairment: The existing $19.8 billion in inventory may depreciate.

Default or Forced Procurement: A $50 billion procurement contract leads to more inventory backlog or huge default penalties.

This "asset-heavy" characteristic signifies that Nvidia is no longer the asset-light chip designer, but increasingly resembles a hardware manufacturer burdened with a heavy supply chain.

Production capacity is running ahead, and inventory is chasing behind—is it out of its mind?

4. Increased profits, but decreased cash flow?

Postscript

Why write this article? First, it's been a long time since I've written a long article on this type of financial statement analysis, and I wanted to relive the feeling of looking at financial statements.

Second, there's a prevailing sentiment or logic in the market that the crypto market is driven by the US stock market, the US stock market by the AI revolution, and AI by Nvidia's performance. Although Nvidia's earnings exceeded expectations, there are still many bearish views.

Compared to other speculative bearish views, a more substantive discussion requires a thorough examination of financial statements to uncover any clues. It's been a while since I've written a report analyzing financial statements like this; consider this an opportunity to offer another perspective on the current market environment.

Joy

Joy