Author: Martin Young, CoinTelegraph; Compiler: Wuzhu, Golden Finance

Donald Trump’s inauguration is just days away, and the U.S. president-elect has promised to overhaul cryptocurrency regulation, but New York Digital Investment Group says it may be too early.

Greg Cipolaro, global head of research at NYDIG, said in a research note on January 10 that even though Trump is set to take office on January 20, it is “cautious to expect immediate changes in cryptocurrency policy.”

Cipolaro said that while the inauguration has rekindled hopes that the new administration will deliver on many of its campaign promises, “many of those promises may come to pass soon, but some may take some time.”

“Key officials still need to be appointed, those who have been appointed need to go through a confirmation process, and once confirmed they need to call in their staffs.”

Other important cryptocurrency legislation, such as rules governing stablecoins and a bill clarifying the role of the Securities and Commodities Regulatory Authority in regulating cryptocurrencies, “may take some time to pass” because a reenergized conservative and free-market legislature “may not be as willing to compromise on certain issues as when liberals controlled the Senate.”

“The execution of those initiatives may be a priority, while issues such as geopolitical conflicts, budgets and debt ceilings, global trade and tariffs, and immigration may be more pressing issues,”he said.

Trump's picks for the Treasury Department, the Securities and Exchange Commission and the White House digital assets adviser appear to be positive about cryptocurrencies, but his picks for key positions at the Commodity Futures Trading Commission, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation remain unannounced.

"Trump's picks haven't all been announced yet, but from what we know so far about the agencies involved in cryptocurrencies and Bitcoin, we like what we see," Cipolaro said.

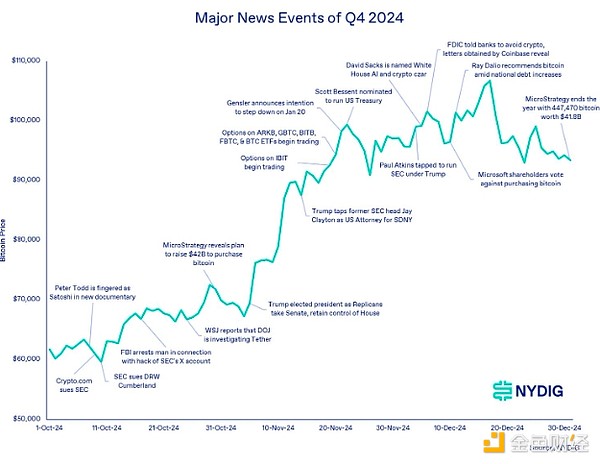

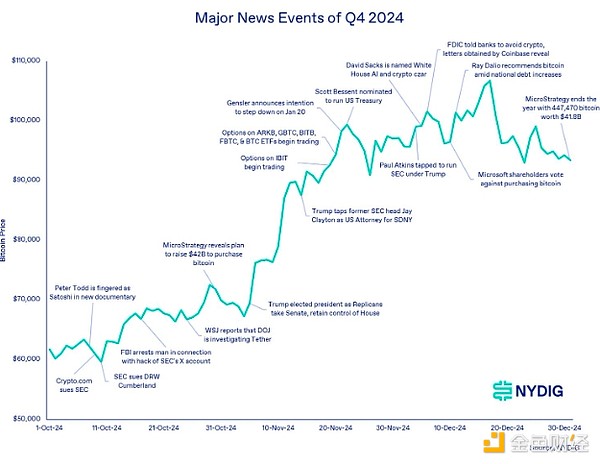

Events affecting the fourth quarter of 2024. Source: NYDIG

One potential change could be the implementation of a strategic bitcoin reserve, which Cipolaro said “could be done quickly through an executive order.”

He added that a draft of such an executive order has been prepared by bitcoin advocacy groups and circulated on social media. However, Cipolaro said an executive order “would not be permanent and could be rescinded by the next president.”

A possible U.S. strategic bitcoin reserve could come from the $18.3 billion worth of cryptocurrency seized by the government, he said.

“This alleviates concerns that the U.S. will be a seller of bitcoin,” Cipolaro added. “But it won’t create incremental demand.”

Weatherly

Weatherly