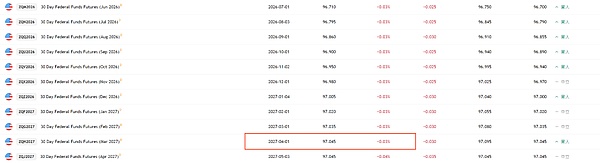

After the Federal Reserve's first interest rate cut in September, the market experienced a brief correction, which was widely interpreted as "the end of the good news." However, this interpretation ignores the gradual nature of monetary policy transmission. Just as the market may not immediately turn negative in the early stages of a rate hike week, the boosting effect of a rate cut on the market will also take time to gradually manifest. According to the federal funds rate futures market, the federal funds rate will fall by a cumulative 130 to 155 basis points from September this year to April next year. Therefore, the current first interest rate cut of 25 basis points is just the beginning of a downward interest rate cycle.

Despite the ultimate extent of the interest rate cut and the effect of credit expansion,

is still constrained by the dual risks of inflation rebound and economic recession

However, CME Fed Watch shows that the market still expects a 72% probability of the Fed cutting interest rates by 75 basis points this year, and generally views the first two rate cuts as precautionary (a two-month data sample is insufficient to characterize a recession). Therefore, the window between the second and third rate cuts could become an excellent window for long positions. In the current market environment of declining interest rates and ample liquidity, institutional financing capabilities continue to strengthen, further reinforcing their path-dependent behavior—concentrating newly acquired funds on increasing existing holdings. As a result, the valuation expansion of core assets such as BTC, ETH, SOL, and BNB will continue. Meanwhile, as market risk appetite continues to improve, some low-performing altcoins will also experience a strong round of catch-up gains. However, it's important to note that the synchronized rise of large and small-cap cryptocurrencies will significantly deplete on-market liquidity and push existing positions to even higher levels. This process could accelerate the formation of a mid- to long-term market top. As of now, the market remains significantly divided on whether ETH's rally can continue. A key signal is that a large number of whales have already reduced or even liquidated their holdings during the recent rebound. A typical example is Yi Lihua, who publicly declared that "ETH will break through $10,000 next year," but then liquidated all of his 145,000 ETH holdings. Investor sentiment has turned cautious, primarily due to two concerns: first, the mNAV of many DATs is approaching 1, limiting their ability to raise further financing; second, some DATs are overleveraged and may face backlash from a violent deleveraging. Bitmine and its CEO, Tom Lee, currently at the center of public opinion, have become targets of this sentiment. Andrew Kang, co-founder of Mechanism Capital, publicly criticized Tom Lee, saying he "lacks basic financial literacy and most of his bullish logic is riddled with loopholes." Meanwhile, Ethereum founder Vitalik Buterin has expressed concerns about the financial soundness of DATs in multiple interviews. However, Bitmine actually maintains one of the healthiest balance sheets among DATs on the market. Its financing structure primarily relies on PIPEs, ATMs, and RDOs, with a very low proportion of debt financing, and it has not issued excessively high-yielding preferred stock. Thanks to this robust capital structure, Bitmine avoids the risk of margin calls faced by MSTR, nor the heavy pressure of paying dividends. Furthermore, Bitmine's financing capacity is not constrained by the decline in mNAV. Public data shows that on September 19, Bitmine completed a registered direct offering (RDO) of approximately US$365 million at a 14% premium to the market, accompanied by warrants with an exercise price of US$87.50 and expiring on March 22, 2029. The premium issuance indicates that institutions remain optimistic about Bitmine's future growth potential. On October 5, 2025, the price of Bitcoin soared to $125,689, setting another all-time record. However, unlike the frenzy and hype that accompanied previous bull markets, this peak was accompanied by a surprising calmness in the market, with Bitcoin's performance seemingly distancing itself from ordinary investors. In stark contrast to the market's calm, institutional funds are pouring in on an unprecedented scale. Last week, Bitcoin spot ETFs saw a net inflow of $3.24 billion, the second-largest weekly inflow on record. At the same time, on-chain data further reveals the tight supply side: the BTC inventory on exchanges has dropped to 1.8 million, the lowest since 2018; while "whale" addresses (holding 100-1,000 BTC) have frantically accumulated 72,000 Bitcoins in seven days. These medium-sized whales now control a record 3.78 million BTC.

This coexistence of retail calm and institutional enthusiasm reflects that the market is undergoing a fundamental structural transformation - it is shifting from a speculative market driven by retail sentiment to an asset allocation market reshaped by institutional capital.

Recent research by JPMorgan Chase's strategy team shows that Bitcoin is currently more attractive than gold: although Bitcoin's volatility is 1.85 times that of gold, its market capitalization of approximately $2.3 trillion is far lower than the approximately $6 trillion in private investment in gold. To match this scale, Bitcoin's market capitalization would need to increase by approximately 42% to $165,000, meaning that the potential return from bearing its additional volatility risk is far higher than that of gold, making it significantly undervalued on a risk-adjusted basis.

Kikyo

Kikyo

Kikyo

Kikyo Hui Xin

Hui Xin Joy

Joy Aaron

Aaron Jasper

Jasper Clement

Clement Clement

Clement Clement

Clement Clement

Clement Clement

Clement