Author: Stacy Muur Translation: Shan Ouba, Golden Finance

At the beginning of 2025, the blockchain industry ushered in a number of highly-watched new public chains, each claiming to have unique value propositions. Six months later, the data revealed a more sober reality: there was a gap between the actual popularity after the launch and the expectations.

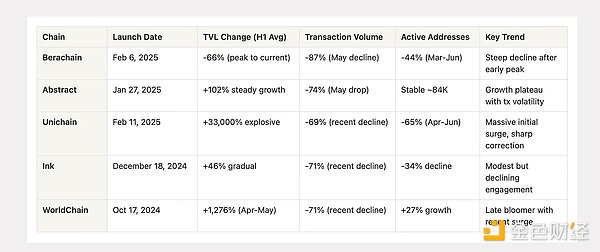

Performance Overview: Changes in Key Metrics by Month

On-Chain Performance Analysis

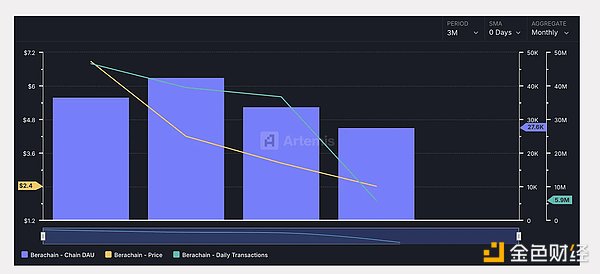

Berachain: A Reality Test of the Hype Cycle

Highlights: Using the "Proof of Liquidity" (PoL) consensus mechanism to combine network security with liquidity provision

Tokens: BERA, initial price $6.90, current price $2.45 (down 58%)

Berachain attracted $3.1 billion in liquidity before its launch, and the total locked value (TVL) reached $3.27 billion within 20 days of the mainnet launch, becoming the sixth largest chain in TVL. However, data shows that the typical "issuance and peak" trend subsequently appeared: TVL plummeted from $3.14 billion in March to $988 million in June, a drop of 68%; in May alone, on-chain transaction volume plummeted 87%.

Reality: Despite the innovation of the PoL mechanism, Berachain is facing the problem of "difficult to sustain incentives after airdrops". Its indicators are declining rapidly, indicating that its growth relies more on token rewards rather than real usage needs.

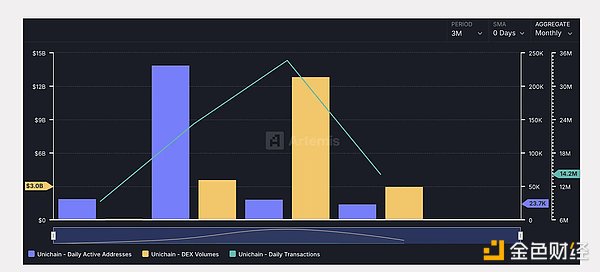

Unichain: The new upstart of DeFi native infrastructure

Highlights: DeFi optimized second-layer chain developed by the Uniswap team, 1 second block time, 95% reduction in transaction fees

Tokens: No native tokens have been issued yet

During the testnet, Unichain processed 95 million transactions and deployed 14.7 million smart contracts, showing strong developer interest. TVL surged from $2.28 million to $755 million, and DEX monthly trading volume reached $12.86 billion in April, reflecting the real DeFi user migration trend.

Reality: Thanks to the ecological integration of Uniswap, Unichain has seen steady growth in the early stages. The recent 69% drop in trading volume is more likely due to the overall market environment, not structural problems with the chain itself. Its DEX activity shows strong liquidity stickiness.

Abstract: Robust construction, but insufficient user stickiness

Main highlights: Consumer-oriented blockchain, focusing on user experience and account abstraction design

Tokens: Not yet issued

Abstract shows certain growth signals: TVL increased from US$14 million to US$28 million (+102%), but user activity is still significantly insufficient. Although active addresses remained at 72,000, trading volume plummeted by 74% in May and fees also fell by 70%. There is very little DEX activity, indicating that DeFi penetration is low.

Reality: Although it avoids the short-term hype route of "pull the market by issuing coins", Abstract still lacks sufficient internal mechanisms to retain users. TVL growth is out of touch with actual activities on the chain, and there may be brushing or incentive deposits rather than real use.

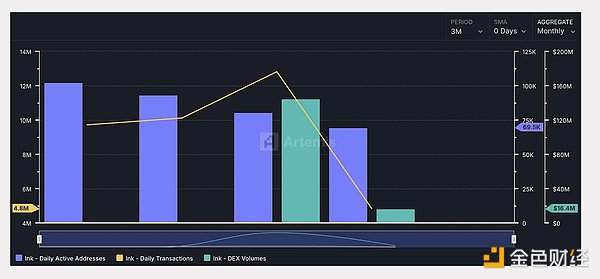

Ink: Silent Challenger

Highlights: Layer 2 backed by Kraken, focusing on institutional-grade DeFi and trading infrastructure

Tokens: Native tokens have not yet been issued

Ink's overall indicators have limited growth but there are concerns: TVL increased by 46% to $7.55 million in the first half of 2025, but the starting point is low. Despite maintaining about 75,000 active addresses, trading volume has fallen 71% in recent months. DEX monthly trading volume briefly soared to $145 million in April, and then plummeted 92% to $11.74 million.

Reality: Even with Kraken’s endorsement, Ink still has difficulty breaking out in the crowded L2 market. Low and volatile TVL suggests that user growth and activity are still unsustainable. Its institutional positioning has not yet translated into significant market traction.

Worldchain: An unexpected dark horse

Main highlights: A blockchain that is bound to the Worldcoin ecosystem and has an identity authentication mechanism

Token: WLD, current price $1.13

WorldChain performed outstandingly in the later period, with its TVL soaring from US$2.92 million in March to US$40.21 million in May, an increase of 1276%. This growth is closely tied to other developments in the Worldcoin ecosystem and token price appreciation.

Reality: WorldChain is developing a unique network effect thanks to Worldcoin’s identity verification system. Recent growth suggests that the “identity + blockchain” narrative may have real value beyond initial skepticism.

Market Signals and Trends

Incentive “Cliff” Effect

Most new chains experienced a severe drop in transaction volume between May and June, indicating that the launch incentive period has ended. Berachain’s transaction volume plummeted 87% during this period, becoming a typical representative of this trend.

TVL is out of touch with usage activity

High total locked value (TVL) does not mean continued activity. Berachain’s trading volume has collapsed, despite still maintaining nearly $1 billion in TVL, indicating that assets may be locked or illiquid.

The Importance of DeFi Integration

Unichain’s current $2.05 billion in DEX trading volume proves that when infrastructure is tailored for DeFi and deeply integrated with existing protocols, it can indeed bring real demand for use.

Authentication Creates “Stickiness”

WorldChain’s explosive growth in the later period shows that networks with authentication mechanisms may have different growth drivers than purely financial blockchains.

Summary of the first half of 2025

The new chain wave in 2025 shows an increasingly mature market: the initial hype cycle is rapidly compressing. To succeed, at least one of the following conditions must be met:

Deep integration of the ecosystem (such as Unichain)

Continuous incentive mechanism beyond airdrops (Berachain is still challenging this)

Unique value proposition that can create network effects (such as WorldChain's identity system)

But most public chains have faced reality tests after the mainnet is launched: Converting speculative use into real demand is the most difficult step in the process of blockchain expansion. From May to June 2025, the transaction volume of many new chains fell by more than 70%, indicating that the market is becoming more rational and users are more cautious in allocating funds and attention. The chains that can truly survive and develop in the long run are those that solve practical problems rather than just promise "better performance".

Snake

Snake

Snake

Snake YouQuan

YouQuan Alex

Alex Hui Xin

Hui Xin YouQuan

YouQuan Aaron

Aaron Alex

Alex Alex

Alex Aaron

Aaron Hui Xin

Hui Xin