Since taking office, Trump has been pressuring Powell to cut interest rates quickly. Initially, Powell held back, but when the tariff war erupted, Powell resorted to a strategy of attacking the enemy with his own weapons, citing the possibility of tariffs spurring inflation as the reason for not cutting rates. On the surface, Trump appears to be being unreasonable and engaging in workplace bullying. His reckless behavior is eroding the Federal Reserve's independence, as he attempts to reduce the central bank to a federal agency. However, in a recent interview, Trump offered this interesting assessment of Powell: "Federal Reserve Chairman Powell is quite political." So, is Powell's refusal to cut interest rates a political move? The answer depends on our understanding of the interest rate system. If we firmly believe in the so-called common sense that rate cuts will stimulate a second wave of inflation, then Powell's approach is correct. However, if we use a cross-border capital flow model, we reach the opposite conclusion: rate cuts will cause overseas hot money to withdraw, which in turn helps reduce inflation. Therefore, Powell must be defending the interests of a certain group. In this article, we'll primarily take a counterintuitive approach, examining how Powell defends the interests of Wall Street. Interest Rates, Rent, and Inflation If we believe Wall Street's lies, we'll inevitably conclude: The lower the interest rate, the higher the rent. Therefore, maintaining high interest rates is the only way to curb excessive rent growth.

However, if we combine the cross-border capital flow model with Say's Law, we will get a very interesting conclusion:

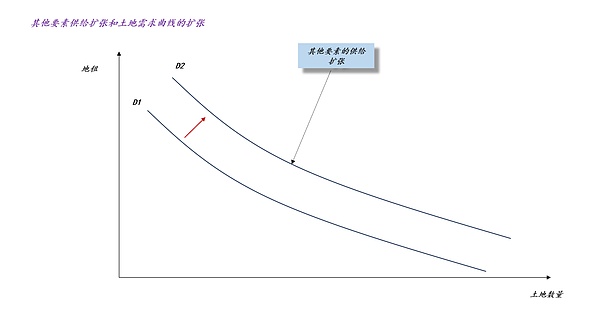

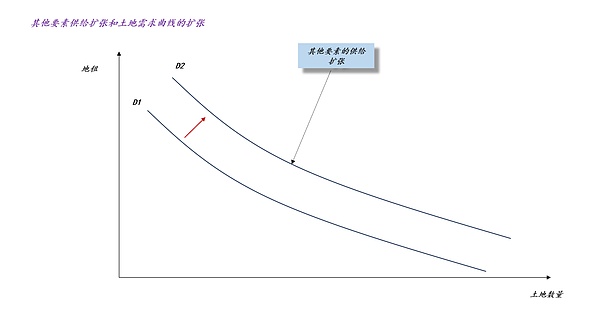

The higher the interest rate, the higher the rent. 1. Cross-border Capital Flow Model The above figure depicts a very simple story. When the Federal Reserve maintains high interest rates and the average interest rate of the non-US banking system remains unchanged, a global deposit migration will occur. As a result, the balance sheet of the US banking system will expand, while the balance sheet of the non-US banking system will shrink. It's not hard to see that this is a story about stock resources: deposits will spontaneously flow to places with higher interest rates. This story is simple because, at the micro level, depositors will also deposit their deposits in banks with higher interest rates. 2. Say's Law: Say's Law tells us that supply automatically creates demand. In other words, the demand for a specific factor, x, comes from the supply of a basket of other factors.

Thus, we get the figure above.

When the supply of other factors expands,

the demand curve for land expands from D1 to D2. Obviously, deposits are an extremely important resource.the inflow of overseas deposits will expand the demand curve for land.

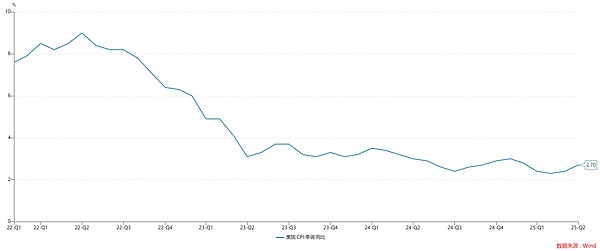

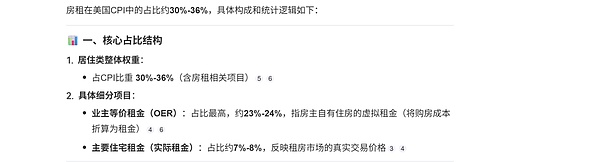

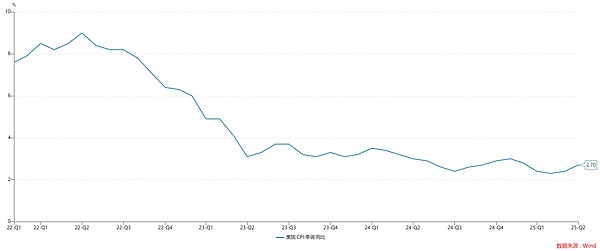

Going further, if we assume that the supply of land in the United States is inelastic and its supply curve is S1, when the demand curve for land expands from D1 to D2, we will find that the rent price rises from P1 to P2. In summary, when we combine the cross-border capital flow model and Say's Law, we can easily draw a conclusion that the higher the federal funds rate, the higher the land rent and the higher the house rent. What's even more interesting is that rent accounts for about 30-36% of the US CPI.

So, we come to a very strange conclusion:

The reason why the US CPI reading remains at 2.7% is because the Federal Reserve maintains a high policy interest rate.

The conflict between the U.S. government and Wall Street

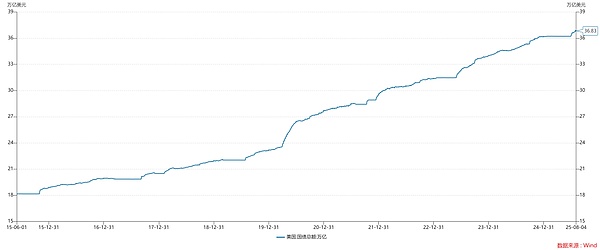

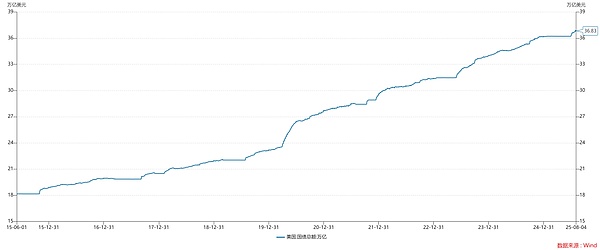

On the one hand, the 10-year U.S. Treasury bond interest rate remained above 4.2%.

On the other hand, the total U.S. national debt rose to 36.83 trillion. Therefore, a higher federal funds rate will incur significant interest costs for the US government. After all, a 1% interest rate difference can result in $368.3 billion in additional interest costs. The US government's calculations are clear. Trump has repeatedly demanded that Powell immediately cut interest rates by 1%. So, where do Wall Street's interests lie? First, a higher federal funds rate locks in a large amount of overseas deposits, supporting the US stock market. Once this money flees, will the US stock market still be able to hold up? No one knows. Secondly, the US economy is highly financialized, and its GDP is rife with various economic rents. The essence of income from industries like healthcare, insurance, law, and real estate is interest. In other words, if the Federal Reserve can no longer maintain high interest rates and overseas hot money flows out of the country, US land rents will fall, leading to a recession in the real estate industry. The United States' high degree of financialization means that many industries are essentially "rent-seeking industries" (P.S.: Michael Hudson calls these sectors "FIRE sectors"). The real estate industry's story won't be an isolated one; all industries will experience a sharp decline in EPS. In other words, interest rate cuts could lead to a collective decline in America's "rent-seeking industries," which is exactly what Wall Street can't stand. If the above reasoning is true, then we will see a different Federal Reserve, one that only serves the interests of "rent-seeking industries." The Federal Reserve attracted global hot money through high interest rates and used this hot money to ensure the thriving growth of "rent-seeking industries." The prosperity of these industries, in turn, drove up inflation, which the Fed used as an excuse to refuse to cut interest rates. Therefore, the cycle of "interest rate hikes—inflation—interest rate hikes" is a self-fulfilling cycle. To put it bluntly, it's a different kind of Ponzi scheme. With this level of reasoning, looking back at Trump's outlandish demands (ps: constantly demanding a 1-2% Fed rate cut), we no longer see him as a complete financial novice. Trump also famously said, "If there's no testing, there's no virus." If the Fed cuts interest rates by 1-2%, overseas hot money will massively withdraw, exposing the various problems of the US economy. At that point, people will be concerned about recession. Will anyone still care about inflation? Everyone will complain, "The Fed cut too late." This situation is so bizarre: the Fed is dragging its feet and not cutting rates, while Powell is a wise and powerful figure, a tragic hero fighting inflation and Trump's bullying. But if the Fed cuts rates significantly, everyone will realize it was too late. There's no such thing as a free lunch. The high profits of America's "rent-seeking industries" come both from the high costs borne by ordinary Americans and from the high interest rates borne by the US government. Consequently, the conflict between the US government and Wall Street is acute. The US government can no longer bear the high interest payments, but greedy capitalists are still hoping to "keep everyone going for another month."

Once we abandon such toxic dogmas as "lowering interest rates will stimulate the economy" and "lowering interest rates will stimulate inflation", we will find that:

1. Powell is not a white lotus at all. He has been covering up until he can no longer cover up;

2. The Federal Reserve is not so independent. They serve capital and the interests of Wall Street;

Recently,

the non-farm payroll data in the United States has exploded. The non-farm payroll data for the three months of May, June and July were very poor. Coupled with the resignation of Director Kugler, the US government has finally gained the upper hand. There's a high probability that the Federal Reserve will cut interest rates in September. If the US does indeed experience a recession as a result of the rate cut, don't be surprised. It simply proves that claims of "rate cuts stimulating the economy" and "rate cuts stimulating inflation" are Wall Street lies. Finally, this article isn't intended to convince anyone; its primary purpose is to explore new avenues of reasoning.

Weatherly

Weatherly