As an old miner, I may have to stop my BTC mining.

Surface reason 1:

Because my machine is not profitable, it has been halved, the output has decreased, the electricity cost has remained unchanged, the price of the currency has not increased, and there is no profit. Then why not buy a new upgraded machine?

Reason 2, a phenomenon scares me:

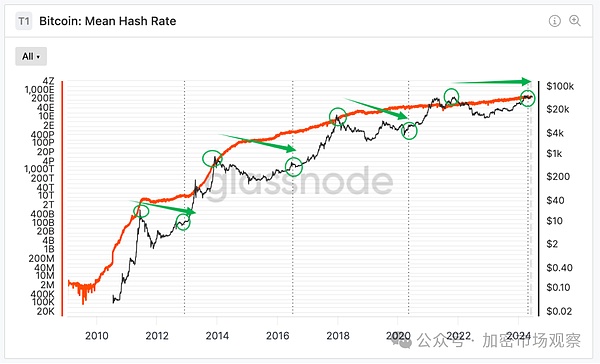

The computing power of the entire network has not decreased after the halving, what does it mean? A large number of machines should have been eliminated and shut down, but they were not,

Or: only my machine was shut down because it was not profitable, but others were not shut down, they continued to operate.

Who left the phone on?

Lower electricity bill than mine?

The electricity cost in the United States is 7.5 cents (after tax)

The electricity cost in Southeast Asia is 6.5 cents (after tax)

The electricity cost in Central Asia is 6 cents (after tax)

The electricity cost in Russia is 5.8 cents (after tax)

The electricity cost in Africa is 5.5 cents (after protection fee)

The only places that can kill other regions are: Russia and Africa

I cannot trust these two places. I have also looked for mines in Africa, but the regime is unstable and it is impossible to sign a contract.

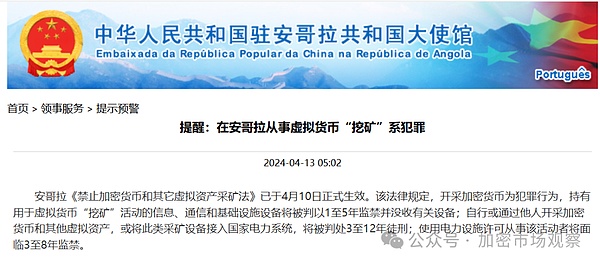

Even if the mine owner is willing to sign for me and help me to manage, he may be arrested by the government in the next second.

For example, before the halving in February, I wanted to send the machine to Angola in Africa. Just after I had negotiated with the mine owner, there was a policy change in their local area, and he immediately changed from a foreign entrepreneur to a lawbreaker.

Who has a higher output than me?

Better machines than mine, I am now using the last generation 19 series machine, which is indeed outdated. People with newer machines do have higher output than me. Machines with higher outputs of more than 200t can only be water-cooled machines.

Water-cooled machines, this thing is extremely expensive! Because we not only have to buy machines but also cabinets.

A cabinet costs 70,000 US dollars and can hold 210 machines. But each machine also costs more than 6,000 US dollars, so 210 machines means more than 1 million US dollars.

How can I have such a huge amount of money at such a young age?

So, who has the ability to not shut down?

Listed companies!!!

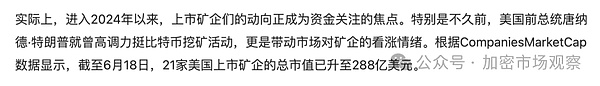

You may not know that in 2021 and 2022, when our industry was extremely bearish, several North American Bitcoin mining companies had secretly gone public.

They raised a lot of funds in the secondary market, and used large sums of money to build mining farms and buy machines.

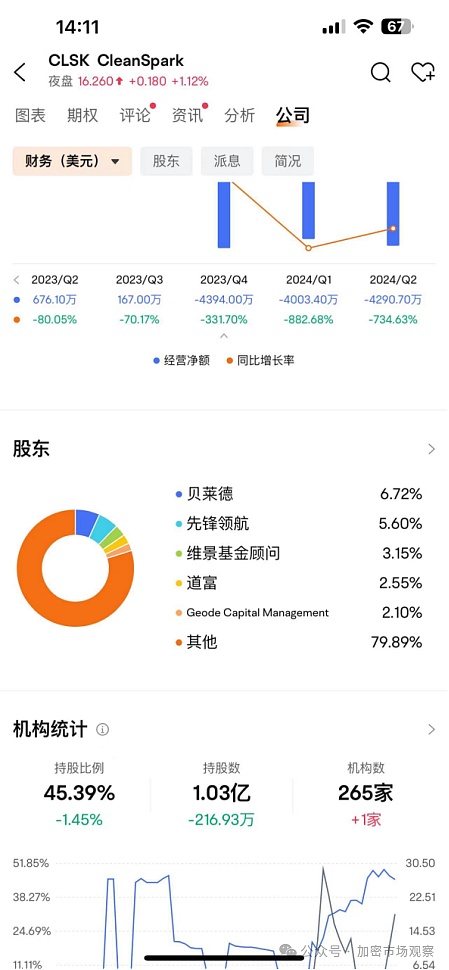

For example, Marathon, the listed mining company with the largest market value, has a market value of nearly 6 billion US dollars. BlackRock and Pioneer are its top two shareholders.

In addition to the first place, there are 20 listed companies such as the second place Riot and BitDeer.

These listed companies are bigger and stronger. It is precisely because of their existence that the computing power of the entire network, which should have declined due to halving, has remained standing until now.

I don’t have so much money, so I’m out of this track.

Small and medium-sized miners are going out

I represent small and medium-sized miners, that is, small and medium-sized miners are almost wiped out in this round, leaving only a few comrades who are risking their lives in Africa or Russia.

The gradual elimination of small and medium-sized players means that BTC mining is the first industry in our blockchain industry to achieve monopoly, the least profitable industry in the future, and the biggest time bomb of our entire blockchain foundation!

Why is it not profitable? Next, let's calculate the economic account:

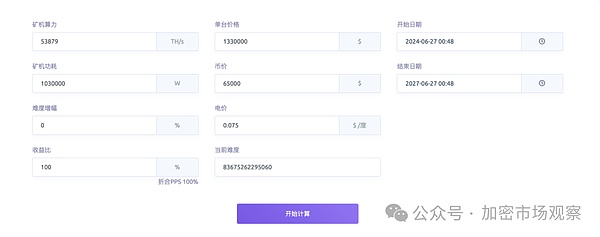

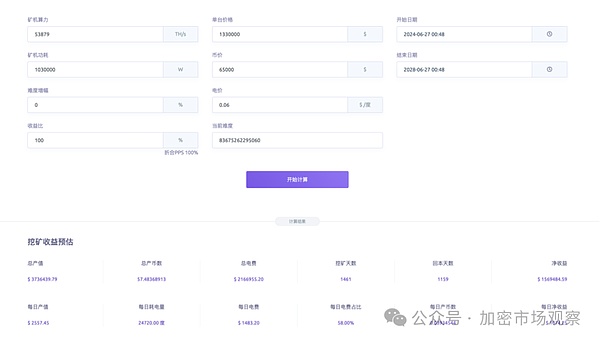

According to the configuration at the beginning of the article, we use water cooling to mine BTC. The cost of a mining box machine is: 70,000+210*6000=1.33 million US dollars.

A machine with 257T computing power can buy a total of 53879T computing power.

The power of a mining box is 1030kw. We calculate it based on the US electricity cost of 7.5 cents and the ideal state that the mining difficulty does not continue to increase.

We can see that I can't make back my investment in mining for 4 years. 4 years is a halving cycle. After 4 years, the output of this machine will be halved again, and it is very likely to be eliminated.

Some people say that the electricity cost I calculated is too high. Some listed companies have lower electricity costs, so I will calculate it at 6 cents.

It still takes 1159 days to get back the investment.

So even if these listed companies squeeze our small and medium-sized miners out, the meat they eat is not fat.

1159 days to get back the investment may be a good thing for listed companies, but for us practitioners in the crypto industry, I have 1.33 million US dollars, so I might as well buy 22 bitcoins directly.

If BTC doubles in three years, I will have double the return. If BTC drops by 50%, I will lose 50% of my principal, but mining may be even worse. If the machine is turned off, the income will be 0!

Bitcoin may become a time bomb

Why is it a time bomb? Is it a time bomb if it does not make money?

Some novice players may think so, because miners are actually helping the BTC network to calculate and help everyone who uses BTC to transfer money to keep accounts. If miners do not make money, no one will keep accounts, and BTC will collapse.

No, it is not!

Due to the genius design of Satoshi, this situation will not exist, because whenever miners do not make money, they will shut down their machines, but because each company has different electricity costs and different shutdown prices, if they shut down, they will start from the ones with the highest shutdown prices. If some people shut down, the computing power of the entire network will decrease, and the income of the remaining part will increase, and they can still start up and operate to maintain network security.

So BTC will not die just because miners do not make money.

What really killed BTC was the 51 attack.

What is a 51 attack:

Blockchain is a distributed ledger that records every transaction on a cryptocurrency network.

A 51% attack is an attack on a blockchain launched by an entity or group that controls more than 50% of the network.

An attacker with majority control of the network can interrupt the record of new blocks by preventing other miners from completing blocks.

Due to the chain of information stored in the Bitcoin blockchain, it is impossible to change historical blocks.

Although successful attacks on Bitcoin or Ethereum are unlikely at present, smaller networks are often the target of 51% attacks.

But now that the BTC mining industry has changed, 51 attacks are possible.

Two reasons:

1. Accounting

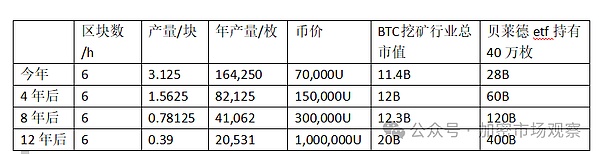

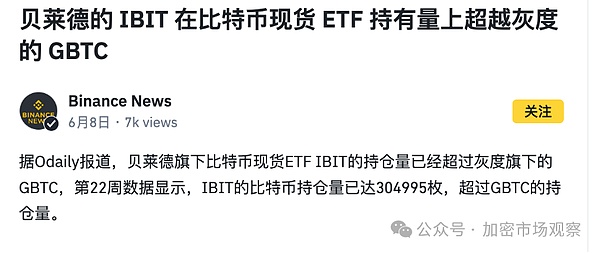

Look at this table. If IBIT slowly stops increasing its holdings of BTC now, it will be calculated based on its holdings of 400,000 coins.

After 8 years, it will only use 10% of its financial resources to eat up the output of the entire BTC mining market for a whole year. It will be easy for it to control 51%.

It can tamper with and interrupt every transfer in the future, and the BTC network security will no longer exist.

Reason 2: Conspiracy

I discovered last year that BlackRock has been quietly making some acquisitions in our industry. It is now one of the top three shareholders of the world's largest mining companies:

After all, human nature is good.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan

Bankless

Bankless Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph