Author: Liquid Strategies Portfolio Manager Cosmo Jiang, Content Director Erik Lowe, Pantera Capital; Compiler: Deng Tong, Golden Finance

< p>We are often asked by investors, "How correlated are various cryptocurrencies during a bull market cycle?"

To provide some perspective on this, we will analyze the two most recent cycles, when Investable tokens other than Bitcoin have meaningful market share.

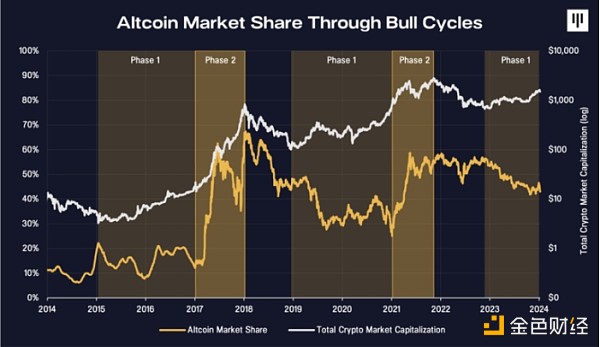

We observe that the bull market cycle has two distinct phases. The first phase is the early stages of a rally, when Bitcoin tends to outperform the rest of the market. The second phase is the later stage when altcoins tend to outperform the market.

We believe that Bitcoin’s excellence in the first phase Manifestations can be a by-product of a variety of causes. First, it is the most widely supplied and liquid digital asset on the market. In 2023, the average daily trading volume of Bitcoin will be US$18 billion. By comparison, Ethereum has $8 billion in daily trading volume. Secondly, first-time investors often purchase Bitcoin before looking to invest in other coins. It has a 15-year track record and a brand that many consider synonymous with the industry itself.

While some investors’ investing journeys ultimately end in Bitcoin, many will fall down the cryptocurrency rabbit hole. The range of investable tokens beyond Bitcoin is vast, and the bull market appears to be accelerating the expansion of the space as more entrepreneurs and developers enter the space. The second phase is when investors start looking for higher growth tokens that support different use cases, often driven by new innovations, < /span>That is, ICO in 2017-18, DeFi and NFT in 2020-21. This phase may coincide with what Sir John Templeton described as the "optimistic" phase of the bull market.

This is a visual of the two stages highlighted in gold shading. You’ll notice that altcoin market share declined during the first phase of the cycle, while total market cap increased slightly, indicating Bitcoin’s outperformance. During bull market cycles, altcoins’ market share quickly rises by around 60-70%.

The following is the actual return of Bitcoin and altcoins in terms of market capitalization growth, and the extent to which each cryptocurrency contributes to the overall growth of the cryptocurrency market.

In these cycles, Bitcoin has always outperformed altcoins during the first phase of the rise. During the second phase, altcoins significantly outperformed Bitcoin. Interestingly, altcoins have outperformed so much that altcoins have outperformed Bitcoin throughout the cycle.

Our thesis is that altcoin underlying protocols that have product market fit and generate real revenue through strong unit economics will perform best in the next cycle, as has been the case for other asset classes such as equities Same as expected. Just like not all stocks are created equal, not all tokens are created equal. Token selection will be critical in the long term, as outperformance will be context-specific and not necessarily within a certain industry or based on fickle, short-lived speculative narratives.

So far, In the current cycle, Bitcoin is up 2.8x and altcoins are up 1.7x .

Finbold

Finbold

Finbold

Finbold Others

Others Beincrypto

Beincrypto Nulltx

Nulltx Bitcoinist

Bitcoinist Nulltx

Nulltx Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Catherine

Catherine 链向资讯

链向资讯