PEPE Supply Drop Hints at Potential for Price Increase

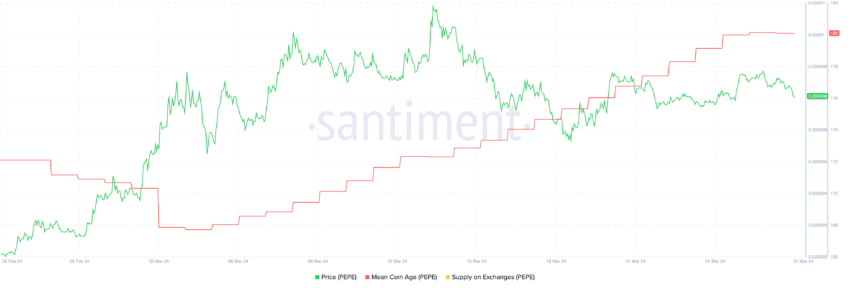

Between March 25 and March 26, PEPE supply on exchanges notably decreased from 180.7 trillion to 178.7 trillion. This reduction hints at a potential price surge as it aligns with principles of supply and demand, suggesting upward pressure on the price due to decreased availability.

PEPE Price Trajectory: Moving Averages Suggest Consolidation After 442.77% Gain Faces Support Challenge

EMA lines, though not indicating a strong bullish trend, suggest potential consolidation, setting the stage for a possible price surge. Despite a 442.77% increase this year, PEPE struggles to maintain above the $0.0000080 threshold.

PEPE Coin Holding Trend Turns Positive, Market Expectations of Bullish Sentiment Rise, Potentially Driving Up Prices

Since March, PEPE's Mean Coin Age has steadily risen, indicating accumulation as holders opt to hold onto their coins. This trend signals bullish sentiment and a potential decrease in selling pressure, typically preceding price increases.

PEPE Coin Price Fluctuation: Converging MAs Indicate Short-term Stability, Bullish Signals Emerge

On March 14, PEPE peaked at $0.0000106, facing challenges in maintaining value above $0.0000080. Currently, three out of four EMA lines for PEPE are converging, suggesting potential stabilization and consolidation, with short-term EMA lines positioned above longer-term counterparts, signaling bullish sentiment.

PEPE Coin Market Update: Holders Anticipate Gains as Supply Rises and Average Age Increases

Rising supply on exchanges and a growing Mean Coin Age for PEPE indicate holders' intentions to retain their assets, anticipating gains and setting the stage for potential price increases. If PEPE surpasses $0.0000085, it may reach $0.000011 for the first time. Conversely, falling below $0.0000070 support could see prices dip to $0.0000049.

Xu Lin

Xu Lin