Author: ASXN; Translation: Jinse Finance xiaozou

1. Introduction

Throughout history, money has evolved to fulfill three core functions: medium of exchange, store of value, and unit of account. The relentless pursuit of faster settlement, lower costs, and borderless availability has propelled its evolution from local barter systems to today's global digital networks. Stablecoins represent a new stage in the evolution of money and payments, building the cornerstone of a financial system characterized by faster settlement, lower fees, seamless cross-border functionality, native programmability, and strong auditability.

USD stablecoins are in high demand across a range of use cases, including store of value, cross-border remittances, payments, income generation, and transactions, and are increasingly viewed as strategic tools by governments and finance ministries. Beyond their digital financial utility, they are becoming shadow monetary policy tools, used to manage sovereign debt and extend the global influence of national monetary and financial systems. Against the backdrop of an improving regulatory environment, evolving US debt landscape, and technological advancements, we forecast the stablecoin market capitalization to reach approximately $4.9 trillion over the next decade: a nearly 20-fold expansion from current levels. Plasma is a customized Layer 1 public chain optimized for stablecoins. As stablecoins continue to penetrate the world, we believe Plasma is well-positioned to capitalize on this macro trend by providing highly customized infrastructure for payments, remittances, fiat-to-currency gateways, foreign exchange, and DeFi. 2. Stablecoins Stablecoins are on-chain representations of fiat currencies (primarily the US dollar). Essentially, they encapsulate the US dollar in software, enabling it to flow at the speed of light anywhere the internet is connected. Simply put, stablecoins are the fastest-growing form of the US dollar in existence. Its market size has expanded from a mere $30 million in 2018 to over $250 billion today, with a compound annual growth rate of 263%. Stablecoins, initially serving as crypto-native collateral and settlement mechanisms (particularly used by market makers and arbitrageurs), have evolved into widely adopted financial primitives. The current stablecoin ecosystem comprises several major types, distinguished by their collateral type, degree of decentralization, and peg-maintenance mechanisms. Fiat-collateralized stablecoins dominate the market, accounting for over 92% of the total market capitalization. We categorize them as follows: Fiat-collateralized – Each token is fully collateralized by holding an equivalent amount of off-chain fiat currency, maintaining a 1:1 peg. For example, each USDC token is backed by $1 in a combination of cash and short-term US government debt. According to the latest reserve report, each USDC is backed by approximately $0.885 in US Treasury bonds and $0.115 in cash. Fiat-collateralized stablecoins can be minted and redeemed by specific entities, maintaining their peg to $1 through arbitrage mechanisms. Fiat-collateralized issuers primarily derive revenue from allocating reserves to interest-bearing U.S. Treasury instruments. For example, Tether earned approximately $7 billion in 2024 from its holdings of U.S. Treasury bonds and repurchase agreements. Crypto-collateralized stablecoins operate on similar principles, but due to their decentralized and KYC-free nature, they often utilize an over-collateralized lending system. The typical process involves users depositing collateral (e.g., $1,000 worth of BTC) into the protocol, which then mints up to $800 worth of stablecoins, corresponding to an 80% loan-to-value (LTV) ratio. To prevent collateral depreciation and insolvency, the protocol sets a liquidation threshold. If the collateral value falls below a certain LTV ratio, the system automatically liquidates the user's BTC to cover the debt, preventing the accumulation of bad debt. This mechanism closely mimics the process by which banks create new money through loans, but uses liquid on-chain collateral.

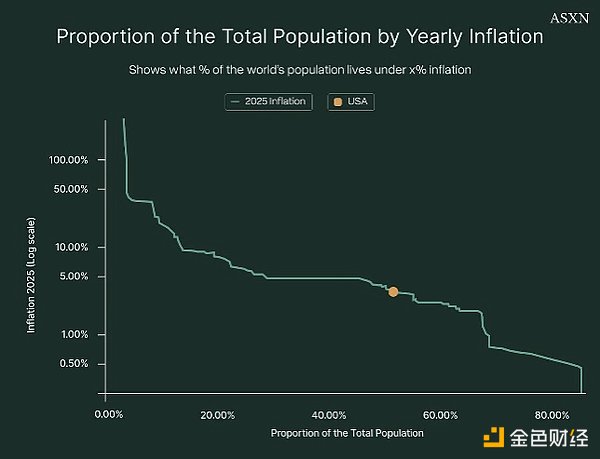

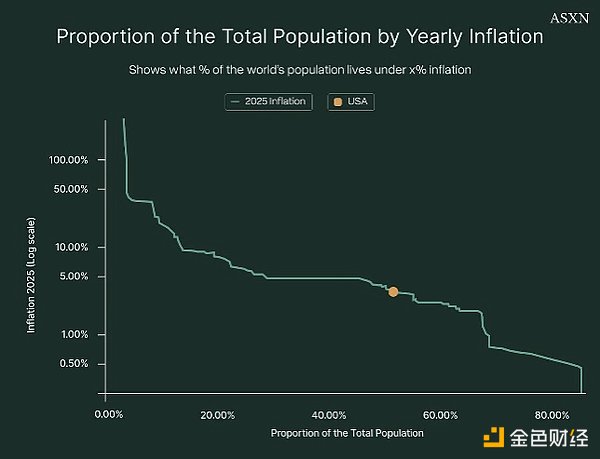

Algorithmic Stablecoins - Unlike fiat/crypto-asset-collateralized stablecoins, algorithmic stablecoins are not always backed by hard assets, but instead rely on algorithms and smart contracts to maintain their peg. Seigniorage-based algorithmic stablecoins (dual-token systems) maintain their value through a dual-token system. Two other types of algorithmic stablecoins are reconstructed stablecoins (which directly adjust wallet balances to maintain a $1 peg, such as Ampleforth/AMPL) and partially algorithmic stablecoins (which combine partial collateral with algorithmic supply control, such as the early FRAX). Under current US regulations and the GENIUS Compliance Act, algorithmic stablecoins are effectively prohibited. Strategy-backed stablecoins – A new category of "stablecoins" has recently emerged. These tokens maintain a $1 face value while embedding exposure to a yield strategy. Their functionality is more similar to dollar-denominated shares in an open-end hedge fund than to traditional stablecoins. The concept gained attention in March 2023 with Arthur Hayes, founder of BitMEX and a pioneer of perpetual swaps,'s "Introducing the NakaDollar," and was later implemented by Ethena in the form of the USDe stablecoin. We collectively refer to these strategy-backed stablecoins as dollar products (or synthetic dollar products), but it's important to note that their risk profiles differ fundamentally from traditional stablecoins. In addition to the emergence of various stablecoin issuers, the supporting ecosystem is also rapidly expanding, covering areas such as P2P/B2B/B2C payments, process orchestration, foreign exchange, payroll, consumer banking, and card issuance. 3. Application Scenarios for Stablecoins (1) Store of Value Although most investors (especially Bitcoin holders) recognize that the US dollar is slowly losing purchasing power due to persistent inflation and currency depreciation, as Ray Dalio aptly put it, "the dollar remains the least dirty shirt in the laundry hamper." In fact, over 20% of the world's population lives in regimes with inflation rates ≥ 6.5%, and over 51% face inflation worse than that of the United States (2025 data). In countries experiencing hyperinflation, currency depreciation, or strict capital controls, grassroots financial reforms are underway: individuals and businesses are increasingly turning to dollar-pegged stablecoins as a store of value. In economies like Argentina, Turkey, Lebanon, Venezuela, and Nigeria, citizens are depositing their savings in digital dollars like USDT, USDC, or DAI rather than holding their rapidly depreciating local currencies. In this scenario, stablecoins function more like digital savings accounts than payment channels, providing a more stable option for maintaining purchasing power.

(2)Cross-border remittances

Remittance is an important application scenario of stablecoins. Every year, tens of millions of workers remit part of their wages back home, supporting over 200 million beneficiaries worldwide. In 2024, cross-border remittances reached approximately $905 billion, equivalent to the GDP of a medium-sized developed economy. This figure is expected to continue to grow in 2025. Approximately 76% of this total, or approximately $685 billion, flows to low- and middle-income countries (LMICs), where remittances often serve as an economic lifeline. In the fourth quarter of 2023, the average cost of sending $200 across borders was approximately 6.4%. Some remittance corridors even charge fees exceeding 10%. For those already struggling financially, such a high percentage of remittances being eaten away by fees is undoubtedly a heavy burden. These costs act like a regressive tax on the world's poorest workers. Despite the 2030 Sustainable Development Goals calling for a global remittance cost of 3%, fees continue to climb, increasing by 3.2% year-over-year. Just as the internet revolutionized information transmission through lightning-fast global transmission, stablecoins are similarly transforming the transfer of value. Stablecoins and the cryptographic channels they underpin offer an internet-native solution for money movement, offering the advantages of speed, transparency, and low costs. Plasma will enable zero-fee USDT transfers, creating the fastest and cheapest way to circulate US dollars globally. Stablecoins are suitable for remittances not only because they provide a more stable store of value (in the form of digital dollars), but also because they benefit from the inherent advantages of efficient settlement via blockchain channels. (3) Payments: While remittances constitute a distinct market segment, the broader global payments ecosystem (covering consumer transactions, enterprise-level funding flows, public sector issuance, and emerging and embedded channels) continues to struggle with legacy infrastructure. Core pain points such as high costs, slow settlement times, low transparency, and weak composability permeate all sectors. Despite structural inefficiencies, the global payments industry remains one of the largest—processing 340 billion transactions worth $180 trillion and generating $2.4 trillion in revenue in 2023. A16Z has conducted a comprehensive review of these traditional payment methods, detailing their associated fees, settlement times, and operational characteristics. Compared to cryptocurrencies, these traditional systems appear outdated: characterized by high transaction costs, slow settlement speeds, chargeback risks, closed networks, and limited accessibility. We believe that stablecoin-based payments will have the most direct impact on US businesses, particularly those selling to the world's largest consumer market. This is primarily due to the high penetration of credit cards in the US and the associated processing fees. (4) Crypto Trading As mentioned in our stablecoin overview, these tokens initially gained attention as crypto-native collateral and settlement rails, improving capital efficiency for market makers and arbitrageurs. Today, trading firms and liquidity providers hold significant stablecoin positions, and DeFi protocols embed them in collateral vaults, lending pools, and AMM trading pairs. Centralized exchanges have similarly shifted perpetual swaps from BTC/cryptoasset collateral to stablecoin contracts (primarily USDT trading pairs, with USDC experiencing rapid growth), which now dominate trading volume and liquidity depth. In over-the-counter (OTC) trading, stablecoins are routinely used to settle large transactions, and USD-denominated tokens have become the preferred unit of account for market-neutral strategy funds and crypto credit/income funds. (5) Income Generation In addition to serving as a reliable store of value and a frictionless payment medium, stablecoins also open up access to permissionless income strategies—particularly valuable for investors excluded from traditional markets, including US capital markets. (6) Monetary Policy Stablecoins are becoming a powerful shadow monetary policy tool, increasingly viewed by governments and treasuries as a strategic tool for managing sovereign debt and expanding the global influence of the monetary and financial system. In Washington, their application is moving to the forefront of policy as the US government seeks innovative solutions to control its debt burden. The mechanism by which stablecoins help governments lower borrowing costs is as follows: As discussed in the stablecoin section, fiat-collateralized stablecoins typically allocate the majority of their reserves in short-term U.S. government debt instruments: primarily Treasury bills and reverse repurchase agreements. This strategy allows centralized issuers to earn returns on customer deposits, both as a source of revenue and as a way to pass them on to stablecoin holders through certain models. Consequently, as the market capitalization of fiat-collateralized stablecoins grows, demand for short-term U.S. Treasury bonds should increase in a near-linear manner. Reserve reports from leading issuers confirm this trend: Tether and Circle currently hold the majority of their assets in government-backed instruments. Circle discloses 88.5% of its reserves in U.S. Treasury bonds, while Tether allocates approximately 82.2% in a portfolio of U.S. Treasury bonds, repurchase agreements, and money market funds. This increased demand for government debt drives up bond prices (given the inverse relationship between prices and yields), leading to lower yields. This ultimately enables the U.S. government to finance itself at lower interest rates, reducing its fiscal operating costs. The U.S. national debt is reaching unprecedented levels both in absolute terms and relative to GDP, with peacetime budget deficits unprecedented in history. This dynamic is driving compounding growth in the overall debt burden. At the same time, demand from traditional buyers of U.S. debt (such as foreign central banks and reserve managers) has significantly declined, leaving relative value hedge funds as marginal price setters. However, this mechanism is increasingly fragile—a notable example being the post-Trump tariff war period, when several relative value funds reportedly suffered significant losses, contributing to a rise in 10-year yields and even a stock market sell-off. The functions of stablecoins vary depending on user type: for individuals in authoritarian or hyperinflationary economies, they provide a self-custodial store of value and wealth preservation. For others, they serve as a high-speed, low-cost channel for cross-border remittances to friends and family. For businesses, they act as a financial "superconductor," enabling 24/7 instant cross-border settlement at a fraction of the cost of traditional payment systems (directly improving efficiency and profitability). For governments (particularly the US government), stablecoins are becoming a powerful shadow monetary policy tool, expanding financial influence and US dollar hegemony while creating new demand for US Treasury bonds. Therefore, stablecoins touch multiple market sectors, and estimating their TAM or market capitalization growth requires numerous assumptions. By summarizing the main immediate use cases for stablecoins and setting reasonable assumptions for penetration rates in each sector (here, 10%), we can provide a preliminary estimate of the potential scale of stablecoins after increased adoption. Focusing on four key use cases: offshore USD demand, cross-border remittances, payments, and money market fund replacement, our analysis suggests that stablecoin supply could grow to approximately $4.9 trillion (assuming moderate penetration). This market capitalization is expected to grow linearly with increasing penetration in each sector and does not yet account for more speculative use cases such as AI-native payments. M2 (the most widely cited measure of US money supply) comprises M1 (cash in circulation and demand deposits) and "quasi-money" instruments (such as savings deposits, small time deposits under $100,000, and retail money market funds). The current M2 size is approximately $21.86 trillion, with stablecoins accounting for just over 1.1%. With clearer regulatory guidance, strengthened infrastructure, and the transition to fully digital payments, we believe the share of stablecoins in M2 is expected to increase tenfold over the next decade. Plasma combines the Byzantine Fault Tolerant (BFT) consensus protocol, PlasmaBFT, with an execution layer built on Reth. The chain is EVM-equivalent, meaning its contracts, opcodes, and tools behave identically to Ethereum. Building on this EVM equivalence, the chain adds native stablecoin functionality: zero-fee USDT transfers and support for custom gas tokens. (1) PlasmaBFT HotStuff Technical Background HotStuff was created by VMresearch and optimized with LibraBFT from the former Meta blockchain team. It achieves both linear view switching and responsiveness, enabling efficient leader rotation and advancing consensus at actual network speeds (rather than pre-set timeouts). HotStuff also uses threshold signatures for improved efficiency and pipelining to allow new blocks to be proposed before previous ones are confirmed. However, these advantages come with certain trade-offs: the additional rounds compared to classic two-round BFT protocols result in higher latency and introduce the risk of forks during pipeline execution. Despite these trade-offs, HotStuff's design supports improved scalability, making it particularly suitable for large-scale blockchain applications—although finalization is slower than with two-round BFT protocols. Below is a simplified diagram of the HotStuff protocol: When transactions are generated, they are sent to a validator (the leader) in the network. The leader bundles these transactions into blocks and broadcasts them to other validators in the network. Validators vote to validate the blocks and send their votes to the leader of the next block. To prevent malicious behavior or communication failures, blocks must go through multiple rounds of voting before their state is finalized. Depending on the implementation, blocks must pass two or three consecutive voting rounds before they can be committed, ensuring the robustness and security of the consensus mechanism. PlasmaBFT Design PlasmaBFT offers several improvements over regular HotStuff. PlasmaBFT is a fast HotStuff pipeline implementation written in Rust. The protocol ensures that as long as fewer than one-third of validators are faulty, two conflicting blocks cannot be finalized simultaneously. Finalization requires approval from at least two-thirds of validators. Because a two-thirds majority necessarily overlaps, there are always common honest validators who will not sign conflicting blocks. In the fast path, PlasmaBFT uses a two-chain commitment rule, so blocks can be finalized after two consecutive quorum certificates, rather than three. Pipelining allows leaders to propose new blocks even before previous blocks have been finalized. PlasmaBFT uses quorum certificates (QCs) to vote on validators. A QC is proof that a supermajority of validators has approved a block. If validators agree, they sign the block, and when at least two-thirds of the votes are collected, these signatures are merged into a single certificate. The QC creation process is as follows: The leader proposes a block; validators vote by signing; after two-thirds of the votes are gathered, aggregation occurs; and a QC is generated to prove that the block is safe to extend. During a view switch, validators send their latest QCs to the new leader. The new leader aggregates these QCs into an Aggregate QC (AggQC). An AggQC represents the highest-security block agreed upon by a supermajority in a single object. This prevents forks during leadership changes and reduces overhead by condensing multiple signatures into a single proof. PlasmaBFT also employs a different approach to incentives. It uses a reward slashing mechanism rather than stake slashing. In a stake slashing system, if a validator misbehaves (double-signing, censorship, or going offline), a portion of their staked funds is destroyed. While this provides strong security, it carries a higher risk, as even unintentional mistakes can result in the validator losing real funds.

In PlasmaBFT, misconduct or non-participation does not destroy the validator's stake, but it will prevent the validator from receiving rewards during that period. Rewards are only distributed to validators that actively participate and follow the rules. If a validator fails to sign a block, signs a conflicting block, or fails to perform his duties, he will not receive rewards.

Instead of having every validator vote on every block, PlasmaBFT forms a smaller committee in each round. The committee is selected through a stake-weighted random process, which reduces latency and communication costs by reducing the number of nodes that need to exchange votes. Plasma also deploys non-validating nodes - these nodes do not participate in consensus, but follow the validator's final confirmation chain and provide RPC access to applications and users.

(2) Execution Layer (Reth)

Plasma uses Reth (Rust ETH), developed by Paradigm, as its execution client. Reth is an EVM reimplementation written in Rust, responsible for processing transactions, executing contracts, and updating state. Plasma is EVM-equivalent, so every opcode and precompiled contract behavior is consistent with the Ethereum mainnet.

Reth connects to PlasmaBFT through the Engine API. This interface implements the following functionality:

The consensus client submits new block proposals to the execution client for processing;

The execution client executes transactions within the EVM, updates the state, and returns the results;

When proposing a new block, the consensus client requests a block data packet from the execution client;

Both components synchronize and maintain consensus on valid and finalized blocks.

PlasmaBFT is responsible for proposing and finalizing blocks, which are then passed to Reth. Reth applies transactions in sequence and updates the state root. This architecture follows the consensus-execution separation model adopted by Ethereum after the merger.

Reth is built modularly. It separates the transaction pool, block construction, execution, and storage into independent components: the transaction pool temporarily stores pending transactions, the block builder selects and packages transactions, the execution engine applies EVM rules to update state, and the storage module tracks account balances, contract code, and contract storage.

Reth also uses a phased synchronization mechanism to download on-chain data. This means it processes block headers, block bodies, and state data in stages rather than all at once. This approach reduces memory and disk requirements and speeds up the initial synchronization process.

(3)PlasmaNative Features

Plasma integrates stablecoin-centric features at the protocol level, including zero-fee USDT transfers, support for custom gas tokens, and confidential transfers (under development). Before discussing zero-fee USDT transfers and custom gas tokens, a brief introduction to Paymasters and the EIP-4337 standard is in order. Paymasters is a smart contract that supports flexible gas policies, allowing applications to pay user operation fees (theoretically enabling free transactions) or accept ERC-20 tokens (such as USDC) as gas payments instead of the public blockchain's native currency. The Paymasters smart contract, originally introduced by EIP-4337, offers a core value proposition: an improved user onboarding experience, convenient gas policies, and greater programmability for transactions. EIP-4337 introduces a separate processing model for user operations (UserOp) from regular transactions: Bundlers aggregate these operations into blocks, and Paymasters validate and pay gas according to the rules. Paymasters implement the validatePaymasterUserOp function to verify eligibility, ensure cost control, and assume responsibility for gas payments. In Plasma, the Paymaster model is implemented in two ways: first, enabling zero-fee USDT transfers, and second, supporting custom ERC-20 tokens for gas payments. Plasma implements a protocol-managed paymaster based on EIP-4337. This paymaster only supports the transfer and transferFrom methods in the official USDT contract and cannot sponsor arbitrary data calls or general transactions. Gas fees for these operations are prepaid by the Plasma Foundation. To prevent abuse, the paymaster implements identity verification and rate limiting. Only verified users can receive this subsidy, and usage is capped per wallet. This ensures that the free transfer mechanism cannot be abused without limit. This was one of the main concerns surrounding Plasma's announcement of free transactions—in theory, any transaction on any blockchain could be free (assuming validators/miners have no incentive issues), but gas fees would still be required to prevent spam attacks. Plans are currently underway to reserve block space for these transfers. One proposed design would mark eligible USDT transfers in the mempool and modify the block builder to prioritize a portion of block gas capacity for such transactions; unused reserved space would be returned to regular transactions. Any EVM-compatible wallet would support these gas-free USDT transfers without modification, and would be compatible with both EIP-4337 Smart Accounts and standard wallet processes. Plasma also supports the use of approved ERC-20 tokens to pay for transaction fees, a feature handled by a paymaster operated by a separate protocol. The operational process is as follows:

The user selects a supported token;

The Paymaster determines the gas fee using oracle data;

The user authorizes the Paymaster to use the token;

The Paymaster pays the consensus gas fee in the native token and simultaneously deducts the equivalent amount in ERC-20 tokens from the user's account.

The custom gas paymaster and the zero-fee USDT paymaster are independent of each other: the USDT paymaster subsidizes the gas fee, while the custom paymaster accepts ERC-20 tokens as gas payment. This mechanism eliminates the need for users to hold XPL. Initial supported tokens include USDT and pBTC, with more to come. Only protocol-approved tokens are accepted.

Confidential Transfers

USDT confidential transfer functionality is still under research and has not yet been implemented. Its goal is to provide optional privacy while maintaining EVM compatibility and composability. The design aims to support the following features: Anonymity of transfer amounts and recipient addresses; A cryptographic memo accompanying transactions; Private-to-public and public-to-private transfer channels; Selective disclosure (for auditing or regulatory compliance). Because this module is under active research, specific details have not yet been finalized. The ultimate goal is to make confidential transfers similar to regular ERC-20 transfers for users, applications, and wallets, meaning that existing contracts and wallets can interact seamlessly. Furthermore, the Plasma team aims to ensure an efficient implementation (low computational overhead and gas costs) and support optional use. The team has confirmed that they are exploring potential avenues such as stealth addresses (sending funds to a one-time derived address), memo encryption, indexing methods, and proof systems. (4) Plasma One As mentioned above, individuals and businesses in countries with weak currencies and strict capital controls are turning to dollar-pegged stablecoins as a store of value. In economies like Argentina, Turkey, Lebanon, Venezuela, and Nigeria, people are storing their savings in digital dollars, primarily USDT, rather than holding rapidly depreciating local currencies. In these environments, stablecoins function more like digital savings accounts than payment rails, providing a more stable option for preserving purchasing power. These users typically prefer to use centralized exchanges to send, receive, and increase the value of digital dollars. However, there is also a growing market for sophisticated users seeking to manage stablecoins in a self-custodial manner. Over the past year, we have witnessed the rise of a wave of crypto card and digital banking providers. Traditional digital banks, such as Revolut, often heavily mark up crypto deposits and withdrawals or charge high fees and spreads. Furthermore, most crypto banks and cards are isolated from the DeFi ecosystem, making it difficult for funds to enter and exit practical ecosystems and products, leading to missed opportunities for yield, rewards, and treasury. Plasma One enables Plasma to provide banking and payment services whose backends effectively leverage DeFi protocols. While most users in emerging markets may continue to use centralized exchanges for payments, we believe Plasma One offers a potential alternative for these users, while also providing established users with a digital bank integrated with DeFi. Stablecoin-native digital bank Plasma One is a non-custodial, stablecoin-native digital bank and card product that integrates savings, spending, earnings, and transfer functionality into a single platform. Its goal is to package core stablecoin-related financial services into a single application, enabling users to use digital dollars like regular currency. A core feature of Plasma One is the ability to spend directly from a stablecoin balance that continuously generates income. Users can make payments using funds that continue to earn interest until they are spent, with reported yields of 10% or more. In addition, purchases made with the Plasma One card can earn up to 4% cashback (distributed in XPL). The card will be available in over 150 countries worldwide through the Visa network. Transfers within the Plasma system are advertised as free, allowing users to send USDT instantly and at no cost, but the company notes that third-party fees may still apply depending on the path taken. (5) pBTC Overview: pBTC is a natural fit for Plasma's goal of becoming a crypto-native digital bank (Plasma One), strengthening the platform in two key ways: First, it introduces Bitcoin as a stablecoin counterpart in payments and savings scenarios. Second, it enables BTC to circulate on Plasma, serving as collateral, facilitating transfers, and integrating into various DeFi applications. The core value of BTC on pBTC lies in its collateral role. Historically, users have sought to maintain Bitcoin exposure while also gaining liquidity. Through pBTC, users can pledge their BTC holdings and borrow against stablecoins or other assets, creating funds for consumption or reinvestment without having to sell their underlying Bitcoin positions. Users also seek ways to accumulate more Bitcoin, often through custodial products like cbBTC or directly on the Bitcoin native blockchain. However, cbBTC requires users to fully trust Coinbase's reserve security and redemption guarantees, creating a single point of failure. Such custodial controls could also lead to potential freezes or restrictions based on compliance or operational decisions. The Bitcoin native blockchain itself has limitations and lacks DeFi functionality that supports programmable financial activities like lending. Beyond Bitcoin's productive uses, pBTC provides users with access to harder monetary assets. Cryptocurrencies have proven their irreplaceable value through digital dollars for citizens in countries experiencing high inflation, capital controls, and poor central bank governance. Bitcoin extends this concept, offering protection against currency devaluation even in developed economies. While the US dollar remains the dominant unit of account and medium of exchange, its purchasing power continues to be subject to inflationary pressures. Concerns about high government debt raise questions about the long-term stability of the US dollar. Large debts often force governments to raise taxes, cut spending, or accept higher inflation, eroding the real value of their debt. This persistent inflationary risk drives some savers toward assets that cannot be arbitrarily inflated. Bitcoin, like gold, appeals to those concerned about currency devaluation due to its fixed or finite supply, establishing its status as a "hard" asset amidst monetary uncertainty. pBTC Mechanism: pBTC aims to bring native Bitcoin to the Plasma network without relying on centralized custody or fragmented wrapped assets. Unlike existing Bitcoin representation schemes like wBTC, which rely on custodians to issue chain-specific wrapped tokens, pBTC utilizes LayerZero's fully fungible token (OFT) standard. This ensures that pBTC, as a single asset with a uniform supply, can flow seamlessly across multiple LayerZero interconnected chains, rather than requiring independent token contracts on each network. It is worth noting that pBTC operates as a fungible ERC-20 token, but the OFT framework ensures that it can be directly transferred to other LayerZero interconnected chains without the need to repackage or replicate liquidity pools.

The pBTC architecture consists of three core layers: In the custody layer, users deposit BTC into addresses collectively controlled by the system, and withdrawals are managed through a threshold signature (MPC/TSS) mechanism to prevent any single validator from accessing the signing key; the validator network constitutes the second layer, each validator runs an independent Bitcoin full node and indexer, monitors deposit and withdrawal operations and issues proofs after the transaction is finally confirmed. These proofs are stored on the chain and require a quorum to execute the operation; the final issuance layer handles pBTC minting. When a sufficient number of proofs confirm the deposit, the corresponding amount of pBTC is minted directly on Plasma and associated with the user's mapping address. The following simplified transaction lifecycle illustrates the actual operation of pBTC: Deposit Process: When a user deposits, they send BTC to the Plasma vault address; Each validator independently monitors Bitcoin network transactions and broadcasts proof after confirming finality; After reaching a supermajority consensus, Plasma mints the corresponding pBTC to the user's wallet. Withdrawal Process: When a user withdraws, they destroy pBTC on Plasma and specify the target Bitcoin address; After validators confirm the destruction operation, they collectively sign the Bitcoin transaction through MPC/TSS; Only when a quorum consensus is reached is the BTC released to the user on the underlying chain. Although OFT still uses a burn-and-mint mechanism to maintain a global supply, there are key differences between it and traditional cross-chain bridges: First, traditional bridges typically issue independent packaged assets on each chain, resulting in fragmented supply and liquidity, and relying heavily on custodians or small multi-signatures to control locked collateral; OFT, on the other hand, treats tokens as a unified global supply and uses LayerZero messaging to achieve cross-chain state transfer. Token issuers retain direct control over contracts and parameters, and the standard is designed for multiple chains rather than bridge modifications. Because pBTC exists across chains with a unified supply, liquidity is not fragmented by multiple versions of packages. Withdrawals are secured by quorum-based threshold signatures, replacing the single-custodian model to weaken unilateral control. In addition, all verification events are stored on-chain and are available for audit by any participant. 5. Token Economics (1) Token Utility XPL is the core asset securing L1 through a Proof-of-Stake (PoS) mechanism, used to facilitate transactions and reward users who support the network by validating transactions. XPL ensures the integrity of this new system and aligns long-term incentives as stablecoin adoption scales.

(2)Token Supply

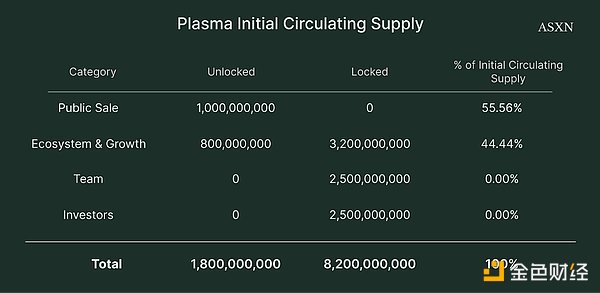

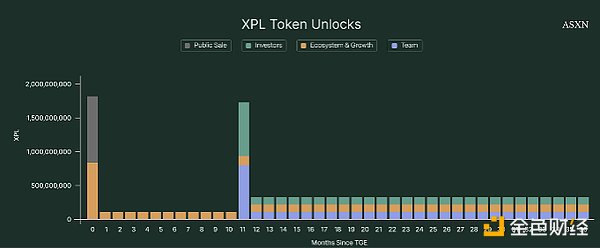

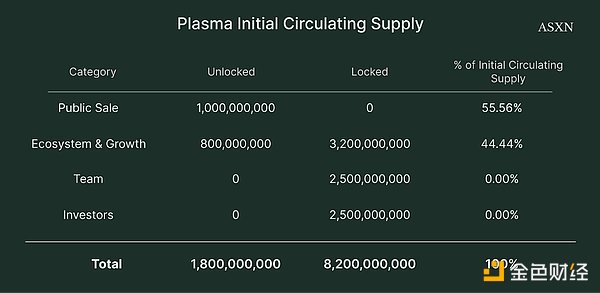

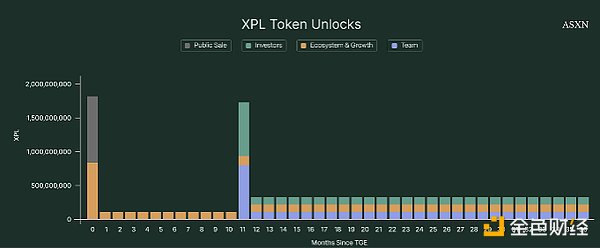

The initial supply of the mainnet beta version when it goes online will be 10 billion XPL, and programmatic issuance (inflation) for staking will be introduced later. The initial XPL distribution ratio is as follows: XPL Public Sale (10%) - On May 27, 2025, the Plasma team announced the XPL public sale, allocating 10% of the total supply (1 billion XPL) to participants in the deposit program. Users who deposited stablecoins into the Plasma depository at a valuation of $500 million will be sold a proportional amount of $50 million worth of XPL. The XPL public offering will unlock as follows: XPL purchased by non-US purchasers will be fully unlocked upon the launch of the Plasma mainnet beta. XPL purchased by US purchasers will be subject to a 12-month lockup period, fully unlocking on July 28, 2026. Ecosystem and Growth (40%) - The Plasma team plans to leverage XPL to enhance network effects, extending beyond the crypto-native ecosystem to encompass traditional finance and capital markets. Therefore, 40% of the supply will be allocated for strategic growth initiatives aimed at expanding the utility, liquidity, and institutional adoption of the Plasma network. The token unlock schedule is as follows: 8% of the XPL supply (800 million) will be unlocked immediately upon the launch of the mainnet beta to fund DeFi incentives for strategic partners, liquidity needs, exchange integration support, and early ecosystem growth activities. The remaining 32% (3.2 billion XPL) will be vested in equal monthly increments over the next three years, bringing the Ecosystem and Growth allocation to 100% by the third anniversary of the public launch of the mainnet beta. Team (25%) - 25% of the XPL supply (2.5 billion) will be used to incentivize existing and future service providers. In addition to a vesting schedule tied to the date of hire, the team's XPL allocation will be vested as follows: One-third of the team tokens will be vested with a one-year cliff period starting from the public launch of the Plasma mainnet beta. The remaining two-thirds will be vested in equal monthly increments over the next two years, bringing the total team allocation to 100% by the third anniversary of the public launch of the mainnet beta. Investors (25%) — 25% of the XPL supply is allocated to Plasma institutional and community investors, including Founder's Fund, Framework, Bitminex, and the first Echo sale to private investors. (3) Release and Inflation Plan At the TGE, the initial circulating supply of XPL will only account for approximately 18% of the total supply, with the remaining supply locked according to the vesting plan. The initial token supply comes from the public sale and an 8% share of the total supply from the Ecosystem and Growth Allocation. Therefore, the supply composition at the TGE is as follows:

Note: This calculation assumes that 100% of the public sale shares are purchased by non-US citizens and unlocked immediately at the TGE. In reality, due to the one-year lockup period for US citizens participating, the initial circulating supply will be lower. For example, if 10% of sales come from KYC-verified US accounts, the supply at the TGE will be: 1 billion * 90% + 800 million = 1.7 billion XPL. In terms of vesting period, the team and investors follow the same liquidity release path, while the ecosystem and growth allocations are gradually unlocked according to a linear schedule within three years. The results are as follows:

Because Plasma uses a PoS consensus mechanism, validator rewards are typically minted by the protocol to achieve two goals: (i) ensure that the validator economic model is attractive to top participants to safeguard the network; and (ii) minimize the long-term dilution effect on XPL holders. Therefore, the XPL reward inflation rate initially is 5%, decreasing by 0.5% annually to a baseline of 3%, and is only activated after the launch of external validators and staking delegation.

The emission is distributed to stakers through validators, and the locked-up XPL of teams and investors does not participate in reward distribution. To offset the dilution effect, Plasma uses the EIP-1559 model to permanently destroy base transaction fees, creating a balance between new token emission and network usage. Further details on validator rewards will be released closer to the launch of the inflation mechanism and reward system. Plasma appears to be pursuing a three-pronged growth strategy to achieve its ultimate goal: to surpass any other blockchain or payments company in settled USD transaction volume globally. This report delves into these three dimensions: (1) Engaging with Existing USDT Users: USD stablecoins are already a $292 billion market, representing a 69.7% year-over-year increase and a 70-fold increase since the beginning of this decade. This incredibly rapid growth means all signs point to a supply reaching trillions of dollars within the next few years. By offering zero-fee USDT transfers, Plasma can quickly tap into the existing $170 billion Tether supply and capture market share from public blockchains that fail to provide a smooth experience for users simply holding funds, making payments, and transferring USD. According to Chainalysis data from August 2025, 40% of blockchain base fees are spent on simple USDT transfers. (2) Expanding market capacity and connecting those with limited payment infrastructure: Approximately 30% of the world's population (2.4 billion people) lack access to basic and affordable financial services, including transactions, payments, savings, and credit. While there's a significant learning curve for using stablecoins, it's likely the easiest and fastest way for people to access three of these four services in USD (credit still needs improvement). Distribution channels, user experience, and a broad ecosystem of financial primitives are three factors hindering the expansion of Plasma, a less exploitative and less restrictive platform, to hundreds of millions of users. Connecting to Plasma means self-custody, access to a vast array of real-world assets, and 24/7 fee-free transactions. (3) On-chain Economies Built for Crypto-Native Users and Investors: Veda, Binance Earn, and Maple attracted nearly $3 billion in USDT locked on their launch day. Whether this capital can be deployed at attractive yields and attract the subsequent influx of hundreds of billions of dollars into the ecosystem will depend entirely on Plasma's ability to build a complete DeFi ecosystem. In the next section, we will delve deeper into Plasma's first-day launch partners and explore the current deployment patterns of productive capital in the crypto space. L1, with its numerous initial launch applications, is clearly not enough to differentiate itself from competitors like Solana, Ethereum, Tron, and Hyperliquid. Plasma's opportunity lies in providing a complete end-to-end money experience—from receiving payments and paying bills to saving and managing savings. This end-to-end experience means Plasma can not only serve those lacking basic financial services, but also meet the needs of crypto-native users and a broader range of investors. Over the past five years, other public chains have made significant progress in throughput and user experience, which is partly responsible for the hundreds of billions of dollars in stablecoin market capitalization that have continued to grow annually. However, we firmly believe that improvements in wallet security, smart contract robustness, and the issuance of high-quality assets will be key to driving stablecoins into a $3 trillion market over the next few years, and Plasma is ideally positioned to capture this growth. As we mentioned in our previous Plasma report, PayPal's CEO focused on the platform's inability to retain funds within its internal systems. In 2024, its 430 million active users completed 26 billion transactions totaling over $1.7 trillion, but recipients (whether between individuals or businesses) often withdraw funds immediately to their bank accounts. This makes sense, as users need to actually access these funds to spend, earn interest, invest, and pay bills. The following sections will explain Plasma's plan: to allow everyone to use a top-tier payment system (a PayPal-like experience) while meeting most of their financial needs on a single network.

(4) Day 1 DeFi Ecosystem

In the coming weeks, Plasma will host billions of dollars in USDT. The network, from top-level design to underlying architecture, is designed to attract and retain stablecoin inflows. In the past few weeks, we have witnessed Plasma establishing partnerships with several successful cross-ecological protocols (Aave, Maple, Veda, Uniswap, Pendle, etc.). Focusing on the synergy between core primitives and initial partners, it is expected to achieve precise DeFi incentive activities - as "8% of the XPL supply (800 million) will be unlocked immediately when the mainnet beta is launched, and will be used for DeFi incentives, liquidity needs, exchange integration support and early ecosystem growth activities of strategic partners." So what elements are needed to build a self-circulating DeFi ecosystem? Asset Issuance, Credit, and Inflow Driving In addition to USDT, Plasma will support a wide range of long-tail stablecoins and tokenized treasury products, including key launch partners such as Ethena, Centrifuge, USD.ai, Neutrl, Resolv, and Clearpool. Given the day-one integration of Pendle, the market has high expectations for the performance of these assets on the Plasma mainnet. The following highlights some of these partners: Ethena (TVL $14 billion) will launch simultaneously with Plasma's launch. Given the rapid growth of USDE, Ethena will need to continuously generate large deposits of USDT and liquid stablecoins to earn yield, while ensuring seamless withdrawals for users and avoiding undesirable liquidations. This will create a "black hole" for hundreds of millions of USDT and BTC on Plasma. Binance Earn and Plasma are collaborating on a program that gives Binance's 280 million users the opportunity to increase the value of their over $30 billion in USDT within the Plasma ecosystem, earning on-chain yields and XPL incentives. Maple (TVL over $4 billion) has launched the Syrup USDT Vault, which will bring $200 million in deposits to Plasma upon launch. The vault was fully funded at launch, demonstrating the high market demand for XPL incentives and the enthusiasm for migrating stablecoins to Plasma. Maple provides overcollateralized loans to crypto-native companies in need of short-term financing. Centrifuge (TVL over $1.2 billion) provides on-chain access to tokenized assets, particularly Treasury bonds and credit funds. Given the depth of the US Treasury and broader AAA bond markets, these tokenized vaults offer virtually unlimited exposure to yields of 4-5%. This will become an excellent market for non-US investors to access the safest lending opportunities on-chain. USD.ai (TVL $750 million, $500 million dedicated to Plasma) is a relatively new protocol that provides hardware (GPU) financing for AI companies. Borrowers tokenize these GPUs through a bankruptcy-remote SPV and borrow from USD.ai vault depositors, paying a premium of a few percentage points above the risk-free rate. Given the recent growth of the AI sector, it is expected that demand for GPUs and physical hardware financing will continue to grow exponentially. While this clearly presents different off-chain risks, it provides another pool of Plasma liquidity for stablecoins seeking yield. Several key pre-release protocols are coming to Plasma and should receive significant XPL incentives: Axis is an on-chain treasury that allows depositors to profit from price arbitrage across different trading venues. Daylight is a renewable energy company aiming to leverage on-chain economics to lower the cost of solar installation and ultimately create a trading market for green electricity generated by decentralized grids. Uranium Digital is an institutional-grade uranium trading platform operating 24/7. The Plasma team plans to continue driving credit opportunity discovery, creating new opportunities for on-chain stablecoin holders in the months following launch.

Liquidity and Trading

If the Plasma vision is realized, there will be thousands of stablecoins targeting different fiat currencies, with different yield characteristics and trust assumptions. The ability to exchange assets or currencies with minimal or no price impact is critical to attracting high-net-worth users to the ecosystem.

At launch, Uniswap, Curve, Fluid, and Balancer will cooperate with professional pool management deployment to support stablecoin exchange, ensuring that on-chain users can enter and exit stablecoins at any time at the anchor price. Plasma has committed to directing tens of millions of US dollars worth of XPL incentives to different USDT pools within 6 months to ensure permanent liquidity for XPL, ETH, weETH, XAUT, and the many long-tail stablecoins mentioned above. On-chain leverage: Plasma's DeFi ecosystem faces a crucial balance: providing stablecoin holders with sufficiently high returns to attract them to the network, while ensuring borrowers receive competitive interest rates to participate in Plasma DeFi. The key lies in identifying sources of yield beyond the demand for on-chain leverage and incentivizing Aave deposits with sufficient XPL to encourage users to migrate their positions from Ethereum. We believe the launch of Ethena and Plasma One will bring significant supply-side liquidity to lending protocols—Ethena needs to mobilize stablecoin balances to avoid dragging down returns, while Plasma One card users are eager to earn 4-5% returns on their stablecoin balances. As Plasma's head of DeFi said, "This is where borrowers and lenders meet." Aave, the most trusted on-chain lending platform (TVL $69 billion), will support the DeFi ecosystem on its first day. Euler, Fluid, and Wildcat are also launch partners, bringing permissionless marketplaces, undercollateralized lending, and other borrower-oriented lending capabilities to the network. Treasury and Yield Management Yield management and active DeFi treasuries have grown significantly over the past few years and will play a crucial role given the abundant supply of stablecoins within the Plasma ecosystem. Pendle and Veda are launch partners, bringing highly customized solutions for yield generation within the Plasma ecosystem. Veda: A non-custodial DeFi treasury curation protocol designed to automate and optimize on-chain capital allocation. It allows capital providers to passively earn top-tier yields without having to continuously manage positions across dozens of protocols. By deploying passive capital to the pools with the highest risk-adjusted returns at any given time, it helps maintain the efficiency and balance of the DeFi ecosystem. Pendle: A tokenized yield trading platform that allows traders to speculate on the future returns of interest-bearing assets. If speculators believe that asset returns will exceed Pendle market pricing, they can lock in fixed returns on interest-bearing assets by purchasing future income rights.

The combination of these two partners builds a Plasma ecosystem that caters to both sophisticated/active traders and more passive DeFi users (who may only use Plasma for payments and savings). Combining top-tier returns with a feature-rich DeFi ecosystem enables Plasma to truly compete with leading Layer 1 public chains.

7Core Thesis

(1) Stablecoin Super Cycle

Stablecoins are becoming the cornerstone of the new financial system. They offer faster settlement, lower transaction costs, seamless cross-border functionality, programmability, and auditability. Its adoption rate is astonishing: As mentioned above, the market size has grown from $30 million in 2018 to over $250 billion today, with a compound annual growth rate of 263%. Initial applications were primarily crypto-native: used as collateral and settlement assets by market makers and arbitrageurs, as underlying assets in DeFi collateralization structures, and on exchanges for stablecoin margin trading. However, its use cases extend beyond the crypto-native realm. Citizens in countries with high inflation or economic instability are increasingly turning to stablecoins as a store of value, while the remittance market is adopting them for low-cost, near-real-time cross-border payments. This trend is supported by infrastructure improvements, including efficient fiat currency on-ramps, low-cost public blockchains, and improved wallet solutions. The market is expected to continue to grow to a trillion-dollar market. This is primarily due to its intertwined development with the global macroeconomy: stablecoin reserves increasingly include U.S. Treasuries, making issuers a source of structural demand for government debt. Currently, stablecoins as a whole are the 15th largest holder of U.S. Treasuries, with an exposure of approximately $193 billion. Policymakers have recognized their strategic value. Stablecoins are seen as a tool for strengthening the US dollar's hegemony, managing sovereign debt, and strengthening the financial system. Bipartisan legislation is being advanced in the US to regulate issuance and reserves. The House-led "STABLE Act" and the Senate's "GENIUS Act" both establish frameworks for compliant US dollar stablecoins. These developments indicate that regulatory clarity is imminent, which will further fuel the growth of stablecoins. Plasma, positioned as a customized public chain optimized for stablecoins, is poised to benefit from this growth trend. (2) Ethereum and Tron are not purpose-built for stablecoins. Currently, the majority of stablecoins exist on Ethereum and Tron, but neither public chain is tailor-made for them. Ethereum is limited by excessively high transaction fees (during peak hours), while Tron suffers from both high fees and centralization issues. Both hinder the potential of stablecoins as efficient transfer systems. This creates space for specialized infrastructure. Plasma addresses these pain points by offering zero-fee USDT transfers. With a current Tether supply of $170 billion, there's a massive opportunity to absorb user traffic that currently incurs unnecessary costs. As of August 2025, 40% of blockchain base fees were spent on simple USDT transfers. Plasma's model directly addresses this inefficiency, providing a smoother and more cost-effective experience for payments and transfers. (3) Crypto-Native Digital Bank Plasma One is designed as a digital bank native to stablecoins. It integrates savings, spending, earnings, and transfer functionality into a single, non-custodial application, allowing users to use stablecoins like regular money. This positions Plasma as a full-service platform, not just a payment rail. The market is also seeing a surge in sophisticated users seeking to manage stablecoins in a self-custodial manner. Over the past year, numerous crypto card and digital bank providers have emerged to meet this demand. Traditional digital banks, such as Revolut, often flag or restrict crypto-related transfers and charge high fees and spreads. Meanwhile, most crypto-native digital bank and card products remain disconnected from the DeFi ecosystem, limiting users' access to productive ecosystems that offer yield, rewards, and treasury strategies. Plasma One fills this gap by providing banking and payment services that directly connect back-end to DeFi protocols, enabling users to access a wider range of financial opportunities while maintaining self-custody. Stablecoins themselves open up permissionless access to a diverse range of income-generating strategies. Income can come from holding government bonds, providing liquidity in stablecoin pools, lending markets, structured strategies like perpetual contract arbitrage, and private credit markets. Currently, DeFi is concentrated on Ethereum, where high costs and complexity limit accessibility. In contrast, integrating DeFi onto Layer 1 public chains tied to digital banks can simplify access, consolidate financial services, and expand participation. Early-stage incentives are likely to drive user growth. Plasma's strategy allows it to serve both sophisticated crypto-native investors and the broader market, combining traditional financial primitives with integrated DeFi yields on a single platform. (4) Payments and Cross-Border Remittances Stablecoins offer an internet-native alternative to money movement. They settle in seconds, are available 24/7, and cost significantly less than traditional systems. By comparison, the global average cost of a $200 cross-border remittance was 6.4% at the end of 2023, with some corridors exceeding 10%. These fees impose a regressive burden on workers who rely on remittances. On public chains, transaction costs are measured in cents or even smaller: for example, the recent average fee on Base Chain is only $0.00024, compared to $0.155 on Ethereum. Plasma plans to further reduce costs, enabling zero-fee USDT transfers. Remittances are particularly important in emerging markets, where centralized exchanges often serve as the primary channel for sending and receiving funds. The integration of Plasma and Binance directly taps into this behavior. Through a joint initiative, Binance's 280 million users can invest over $30 billion in USDT into the Plasma ecosystem, earning on-chain returns and incentives while enjoying lower transfer costs. This creates a direct onramp for users in emerging markets who already rely on CEX platforms and may expand services through the Plasma One application. The role of stablecoins in these markets goes beyond payments. With over 20% of the global population living in an economy with inflation exceeding 6.5%, and over half facing inflation higher than that of the United States, digital dollars have become a grassroots savings tool. In countries like Argentina, Turkey, Lebanon, Venezuela, and Nigeria, individuals and businesses are increasingly using stablecoins to hedge against local currency fluctuations and maintain purchasing power. In these scenarios, stablecoins function more like digital savings accounts than as a medium of exchange.

Jasper

Jasper