Deng Tong, Golden Finance

On September 16, 2025, the decentralized prediction market platform Polymarket announced the launch of a new prediction category, allowing users to bet on the earnings of publicly listed companies. On the same day, Polymarket also announced a potential cryptocurrency offering.

On September 13, Massachusetts sued the prediction market platform Kalshi for alleged sports betting violations. Two days later, news broke that Kalshi would complete a new round of financing, more than doubling its valuation to $5 billion.

What are Polymarket's new initiatives? What other prediction market platforms are worth watching? Why is the prediction platform sector so rapidly emerging?

I. What are Polymarket's new initiatives?

1. New Product Launch

On July 22, Polymarket acquired QCEX, a licensed US derivatives exchange and clearinghouse, for $112 million, paving the way for the company's return to the US after a hiatus of more than two years. Two months later, Polymarket announced on September 3rd that, following the termination of the U.S. Commodity Futures Trading Commission (CFTC) investigation, it had received a joint "no action" letter from the CFTC's Division of Market Regulation and Division of Clearing and Risk, allowing it to re-enter the U.S. market under certain conditions.

Since returning to the U.S. market, Polymarket has partnered with Chainlink, Stocktwits, and others to continuously launch new products.

On September 12th, Polymarket announced that it had integrated Chainlink's oracle infrastructure to provide verifiable data and automate market resolution. This integration has been launched on the Polygon mainnet for peer-to-peer price-based markets in cryptocurrencies, designed to make results faster and more difficult to tamper with.

On September 16th, Polymarket announced that it had partnered with Stocktwits, a social platform for traders, to launch an earnings prediction market for widely followed public companies. The partnership combines Polymarket’s prediction markets with Stocktwits’ trading community, providing users with real-time, crowd-priced probabilities and discussions about earnings, sentiment, and market trends. Users have already begun placing bets on earnings forecasts for several companies, including FedEx and the cryptocurrency exchange Bullish. Matthew Modabber, Chief Marketing Officer of Polymarket, said: "Prediction markets transform big questions like profitability into simple, tradable outcomes, and through transparent pricing, they transform uncertainty into clarity."

2. Token Issuance

On September 16, Polymarket's filing with the U.S. Securities and Exchange Commission (SEC) showed that "Other Warrants" were provided in its latest round of financing. This has sparked market speculation as to whether Polymarket will issue tokens. Some industry insiders believe that Polymarket's token is about to be launched, and SEC filings are rarely so clear. It is expected that the token will surge after listing and then return to normal.

As early as July 23, people familiar with the matter revealed that Polymarket was deciding whether to launch its own customized stablecoin or accept a revenue sharing agreement with Circle based on the amount of USDC held on the platform. Polymarket's motivation for creating its own stablecoin is simply to have a reserve of revenue to support a large amount of Circle's USDC. A dollar-pegged token used for betting on popular gambling platforms.

If Polymarket does issue a token, it will provide a native asset for prediction market users, thereby aligning incentives. Tokens can enhance liquidity participation and governance capabilities, thereby propelling Polymarket from a niche market to the growing mainstream of on-chain gambling. By launching a platform-native stablecoin, Polymarket can also join the ranks of a growing number of fintech and financial players seeking to vertically integrate token issuance, reserve management, and platform economics.

2. What other prediction market platforms are worth paying attention to?

1. Kalshi

Founded in 2019 and headquartered in New York, Kalshi was co-founded by Tarek Mansour and Luana Lopes Lara. It is a legal prediction market platform operating under the supervision of the U.S. Commodity Futures Trading Commission (CFTC). August 19 On the same day, Robinhood announced that it would partner with Kalshi to launch a professional and college football prediction market, allowing users to trade (bet) on game outcomes. The Kalshi platform supports multiple cryptocurrencies for payment, including Solana, USDC, Bitcoin, and WLD.

Kalshi currently allows users to make predictions on topics such as emerging cryptocurrencies, macroeconomics, weather, and international politics. The platform claims that compared to traditional polls, prediction markets can more accurately reflect future trends through the collective expectations of participants, after all, real money is being used to vote.

However, Kalshi has also faced legal challenges from some state governments. Approximately 10 states, including Arizona, New Jersey, Maryland, Illinois, and Nevada, have issued bans on its sports and other event prediction contracts, fearing that they are similar to illegal online gambling.

2. PredictIt

PredictIt was originally an academic project testing the theory of "crowd wisdom" and was run by Victoria University of Wellington in New Zealand.

During the 2016 US presidential election, PredictIt Received media attention. In August 2022, the CFTC rescinded its no-action letter, alleging that PredictIt violated the restrictions in the agreement. In 2023, an appeals court issued an injunction allowing PredictIt to continue operating during its legal battle with the CFTC. In July 2025, PredictIt reached a settlement with the CFTC, allowing it to operate under the Prediction Market Research Consortium.

On September 10, PredictIt prepared to launch its new exchange after receiving CFTC approval. Aristotle, the Washington, D.C., company that operates PredictIt Last week, the company announced that the CFTC had approved its application to operate as a Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO).

3. Crypto.com

In December 2024, Crypto.com announced the launch of a sports prediction market in the United States, allowing US customers to bet on sporting events, starting with the Super Bowl, using various cryptocurrencies. If their predictions are correct, they will receive payment within one business day of settlement. Company spokesman Matt David stated that the product will leverage Crypto.com's popularity among US sports fans to serve the growing number of cryptocurrency traders who want to bet on the outcomes of real-world events.

4. Trepa

Trepa announced at the end of August 2025 that it had raised $420,000 in a pre-seed funding round led by Colosseum, a growth organization launched by the former head of growth at the Solana Foundation, with participation from angel investors including Ignight Capital and former Coinbase CTO Balaji Srinivasan.

Trepa Focusing on "accuracy equals profit, an easy-to-use Web2 experience," the official website showcases interactive "slider prediction + betting" features, such as predicting the 10-year U.S. Treasury yield. It emphasizes that participation requires no crypto wallet or cryptocurrency knowledge, making it suitable for traditional financial audiences.

5. Limitless

Limitless is a prediction market platform built on the Base blockchain, developed by Limitless Labs. Its mainnet launch is scheduled for May 2025. In September 2024, Limitless Network secured $3 million in seed funding led by 1confirmation. CJ Hetherington, co-founder and CEO of Limitless Labs, stated that Paper Ventures, Collider, and Public Works also participated. In July of this year, Limitless secured another $4 million in strategic funding, bringing the total raised to $7 million. The new funds are intended to be used in preparation for the upcoming TGE.

6. Gondor

Gondor is a prediction market DeFi platform. It is a platform for applications at the blockchain level. It relies on Polymarket and provides users with an innovative way to utilize funds. It has a unique position in the prediction market field.

On August 27, Gondor announced the completion of its angel round of financing. The specific amount of financing was not disclosed. This round of financing was participated by Maven 11. Gondor's first product, the "Polymarket Position Lending Protocol", is about to be launched.

7. Opinions.fun

Opinions.fun is an Initial Attention Offering (IAO) protocol on Solana, jointly developed by Meteora and Kaito Providing support. Using the Agree and Disagree tokens, social attention and discussion are converted into tradable assets.

III. Why the Prediction Platform Track is Rapidly Emerging

1. More Accurate Results

Ethereum founder Vitalik Buterin once pointed out: In a coin voting, if you vote incorrectly, there's no penalty. The only risk is the tiny probability that you might personally push the outcome to the edge. In a prediction market, however, if you misjudge, you lose money, and if you bet big, the losses can be substantial.

Personally, I find that the probabilities given by prediction markets are generally more accurate than my judgments influenced by the media (professional or social). They actually help me stay rational and not overestimate the importance of things (but they also help me recognize the significance of truly important things when they occur).

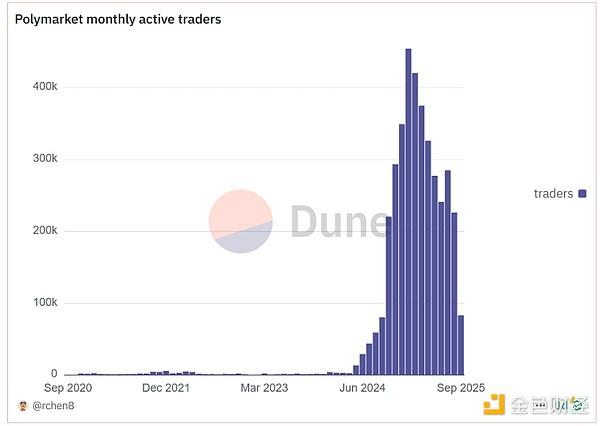

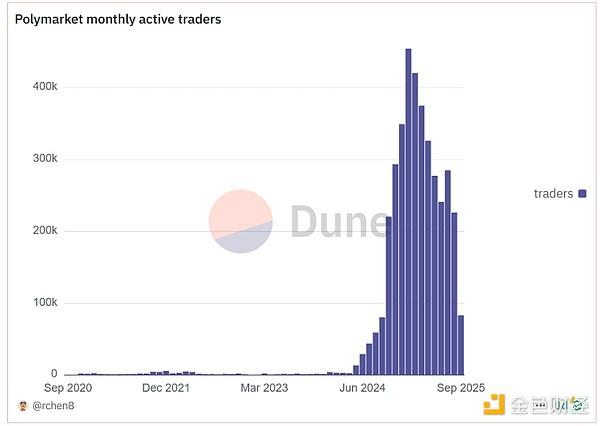

Polymarket rose to fame overnight for accurately predicting Trump's victory in the presidential election. Since then, trading activity has remained substantial.

Real money bets can improve the accuracy of predictions, and economic incentives force participants to invest more effort in making informed predictions. Prediction markets surpass traditional opinion polls in terms of accuracy, providing a clearer and more reliable picture of future events.

2. Investment Opportunities

In prediction markets, before a specific real-world event (such as an election, a sports competition, or an economic indicator) occurs, users purchase "shares" or contracts representing the occurrence or non-occurrence of that event based on their predictions of the outcome. If the prediction is accurate, users will profit by buying low and selling high; if the prediction is incorrect, they may lose their principal.

For example, during the US election, the largest address betting on Trump's victory on Polymarket was 0x d23...f29 once had a floating profit of $11.19 million, while the largest address betting on Harris's victory, 0x9ad...883, was basically zero, with a floating loss of $4.91 million.

The prediction market also allows for more refined and specific bets, such as predicting the number of viewers for a certain movie. The flexibility of the prediction market makes it possible to have more accurate and targeted risk exposure, allowing investors to isolate risks and express their views in a variety of ways.

3. Real-time reflection of public sentiment

Traditional poll results often take hours or weeks to be presented to the public, but the data on the prediction market platform is updated in real time, reflecting public sentiment at any time.

As of November 6, 2024, Trump's betting amount on Polymarket was approximately $1,449,655,243, and his winning rate once exceeded 98%. Harris's winning margin was approximately $970,887,050, with a 1.4% chance of winning. On November 7th, Polymarket posted on the X platform, stating that Polymarket has proven that prediction markets are more informed than polls, media, and experts. Polymarket consistently and accurately predicted the results, far ahead of all three, demonstrating the power of high-volume, high-liquidity prediction markets like those pioneered by Polymarket. This real-time data update provides immediate insight into public opinion and sentiment regarding events like the election.

Brian

Brian