Author: Wayne_Zhang, Senior Researcher at Web3Caff Source: substack

Foreword

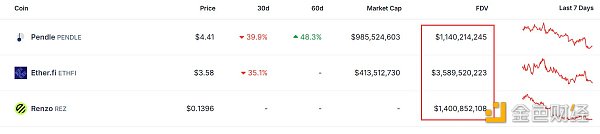

EigenLayer’s open airdrop has further ignited the coin issuance craze in the LRT track. Projects that have issued coins include Renzo, Ether.fi, etc., with a fully diluted market value of more than 1 billion US dollars, and all of them are listed on first-tier exchanges such as Binance and OKX. The market has a certain initial anchoring of the airdrop expectations and project valuation logic of other LRT track projects.

FDV data of launched LRT projects, source: Coingecko

Valuation calculation

Today we will mainly explore the potential arbitrage opportunities of an LRT project - Eigenpie.

Twitter screenshot

The two projects that have already issued coins, ether.fi and Renzo, rank first and second based on the LRT supply. According to the ratio of TVL and FDV, the reasonable valuation of Eigenpie should be: FDV (Eigenpie) = 801.21m / 3.93b * 3.58b = $ 729.855 m FDV (Eigenpie) = 801.21m / 3b * 1.40b = $ 373.898 m The ATH FDV of the two projects are 8.53b and 2.78b respectively. Then, the high point of Eigenpie's project token should be: FDV ATH (Eigenpie) = 729.855m * 8.53b / 3.58b = $ 1739.012 m FDV ATH (Eigenpie) = 373.898m * 2.78b / 1.40b = $ 742.4546m

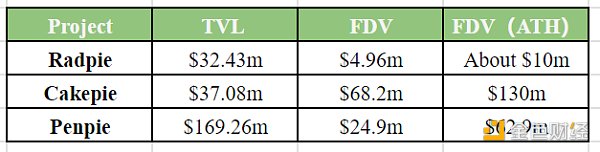

In addition to the track valuation, we can also look at the valuations of several similar products released by Magpie behind the Eigenpie team:

Magpie's incubated project TVL data

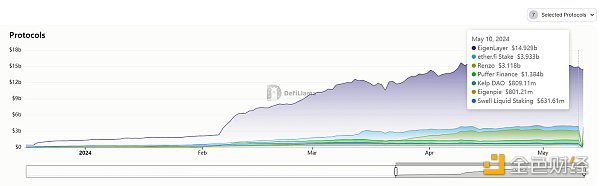

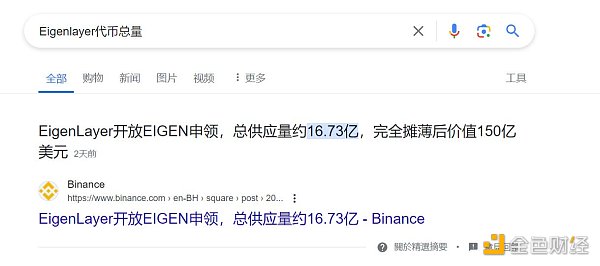

According to the TVL/FDV ratio, $801m The minimum and maximum Eigenpie valuations of TVL are: 801/169.26*24.9=$ 117.836m (Penpie FDV present value estimate) 801/37.08*68.2=$ 1473.252 m (Cakepie FDV present value estimate) The maximum value is: 801/37.08*130=$ 2808.252m (Cakepie FDV ATH estimate) I also saw a statement on Twitter that the track should be valued according to the EigenLayer valuation, and then the value of the participants should be estimated according to the market share. According to AEVO data on May 12, the price of EIGEN is $7.54. The current EigenLayer FDV should theoretically reach 12.61442 billion US dollars. The total TVL of EigenLayer is 14.929b. The valuation of Eigenpie based on market share is: 801/1000/14.929*126.1442=670 million US dollars. ($670m)

Source: AEVO

Summary

We can get the following data:

1. According to the market data of the projects that have been sold, the FDV range obtained by comparing with TVL is:

$373.898 m - $ 1739.012 m

Arbitrage opportunities

High-quality fundamental projects - Magpie with high "price-to-book ratio"

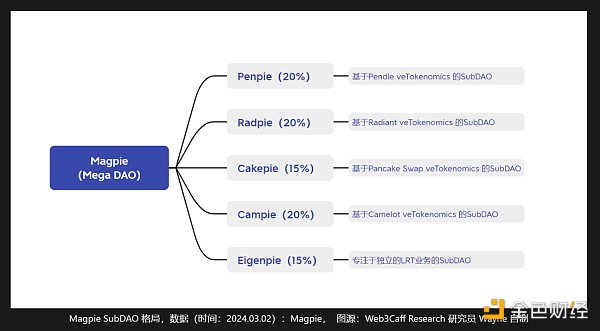

The business model adopted by Magpie, the incubator behind Eigenpie, is SubDAO. Friends who don’t know about SubDAO can click to read my SubDAO research report.

Under this model, Magpie can own a certain number of SubDAO tokens. According to the distribution principle, the Magpie community will take 15% of the EGP Tokens, with an estimated value of 75 million. It also owns Penpie Tokens with a current value of $4.98 million, Radpie Tokens with a current value of approximately $2 million, and Cakepie Tokens with a current value of $10.23 million. Campie and Listapie have not issued tokens yet, so from an asset perspective, Magpie will own approximately 92.21 million token assets after Eigenpie is issued.

And Magpie's FDV is only $70m

Due to time reasons, there is also a SubDAO for Lista DAO that is not included

Eigenpie IDO quota acquisition

Referring to the listing cases of various SubDAOs incubated by Magpie before, it can be found that Radpie has the opportunity to destroy Magpie Token to obtain quota. The core strategy of this article is based on this mechanism - the higher the proportion of MGP/vlMGP destroyed, the higher the IDO quota will be.

According to Eigenpie's EGP token economics, Eigenpie said it will introduce EGP tokens through a fair launch, without the participation of VC or pre-sale activities. The team officially gave up the token allocation and allocated 15% of the EGP tokens to the Magpie Treasury.

IDO accounts for 40% of the total tokens. The method of obtaining these quotas in Radpie is to obtain 10% through destruction. Assuming that this ratio is still the same this time, the destruction quota this time will be 4% of the total tokens. According to the previously assumed valuation of 4% * $500m = 20m. But according to Eigenpie Twitter, Eigenpie's IDO valuation is 3m. Correspondingly, users of this 4% token share will have to pay $120,000 in addition to the MGP cost.

Eigenpie Twitter

The $120,000 IDO purchase cost has been determined, so what is the destruction cost?

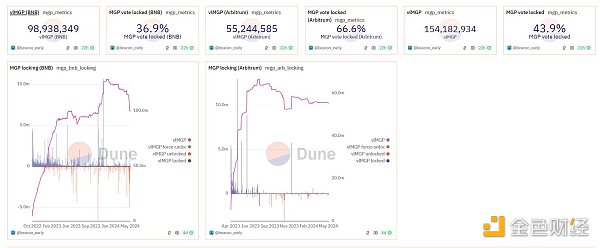

Dune Wizard @/beacon_early made a Dune panel. The existing MGP circulation is 378.573m (total amount is 1b), of which the total amount of vlMGP (MGP's veTokenomics token, which requires staking MGP to obtain, and extraction requires a 60-day unlocker) is 55.244 (BNB chain) +98.938 (Arbitrum) = 154.182m. Since these vlMGPs are obtained by staking MGP at a 1:1 ratio, the number of vlMGPs is actually included in the circulation:

Source: Dune Dashboard

So the actual maximum available MGP and vlMGP in the market is less than 400m, so how many MGPs will be destroyed and converted into IDO quotas?

According to the number of 378.57m, if all are destroyed, these destroyed quantities correspond to an EGP quota valued at 20m US dollars, so the EGP value corresponding to each MGP is $0.052. It is obviously unrealistic to destroy all. So how many Magpies should be destroyed?

I personally think it is about 25%, mainly due to the dynamic balance between price and demand and the liquidity demand of MGP, which means that the EGP value corresponding to a single MGP is about $0.2.

Now the price of MGP is only $0.07, and the expected profit margin can reach 185%.

These calculations are actually based on some assumptions. I have summarized a formula, and you can calculate the arbitrage space according to your own judgment:

Profit rate = EGP value corresponding to MGP / MGP current price

EGP value corresponding to MGP = MGP's expected FDV * 40% * IDO quota ratio occupied by token destruction / expected MGP destruction quantity.

Risks

Of course, this solution also has risks:

1. Magpie will not place MGP destruction quota in IDO (key factor)

2. The proportion of MGP destruction in IDO is extremely low (personal calculation is that if it is not less than 3%, there will be no loss)

3. Magpie's FDV is extremely low. Since the LRT track opportunity is to list coins at the same time within a period of time, the FDV is expected to be much lower when the market liquidity is insufficient.

4. The unlocking period of EGP will be similar to Penpie/Cakepie, etc., which will bring liquidity risks and unpredictable price risks. (Several other SubDAOs unlock 30%)

5. Smart contract issues, team issues and other systemic risks.

Conclusion

I personally appreciate the execution of the Magpie team. A team that can persist in the bear market and innovate in the bull market deserves praise, but it has not been listed on the exchange, and the low attention makes me have some concerns about its operational capabilities. But in general, I think the potential rate of return of this strategy is relatively high. Even if it is not destroyed in the later stage, holding ParentDAO Token for staking or waiting for secondary opportunities is cost-effective.

As for whether Magpie decides to issue quotas by destroying MGP, I personally think that if the team wants Parent DAO to have greater popularity and community support, it should give MGP holders certain rights and interests. Even if it is not destroyed, it will be distributed to vlMGP holders. The author asked the administrator in the community, but has not received a clear answer yet. Interested friends can follow my Twitter or subscribe to this column. I will update if there is new news.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Catherine

Catherine Beincrypto

Beincrypto Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Nulltx

Nulltx