Author: Wall Street News

Powell ignites the best "Federal Reserve Decision Day".

On Wednesday local time, after the Federal Reserve lowered its economic forecast for this year and raised its inflation forecast, Powell expressed "indifference" to economic risks at the subsequent press conference, and once again put forward the "temporary inflation theory", revealing a "firm" position to maintain the status quo.

Analysts believe that his "careless" attitude towards the risks of the US economy has had a significant impact on market sentiment, and he seems to be "deliberately appeasing the financial market".

Driven by Powell's subtle gesture, stocks and bonds in the US market rose together overnight, a rare phenomenon.

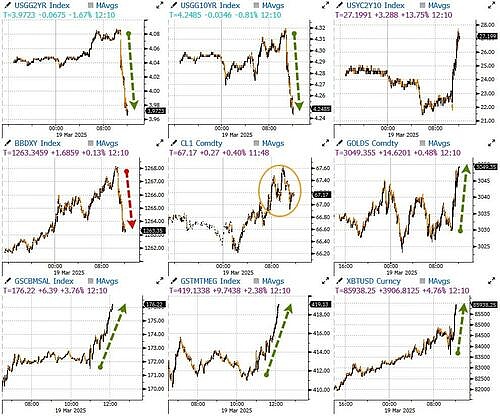

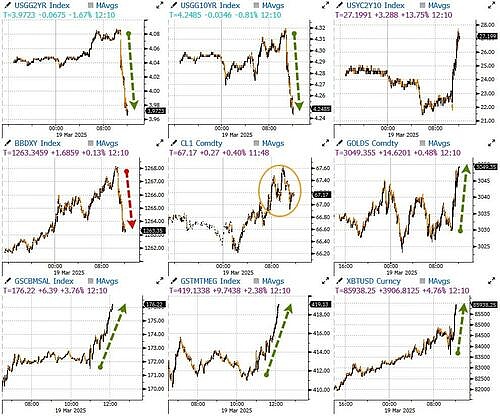

The S&P 500 and Nasdaq rose by more than 1%, and the S&P achieved its best performance on the "Federal Reserve Decision Day" since July last year. The 2-year Treasury yield once plunged by more than 10 basis points, and the 10-year Treasury yield fell by more than 4 basis points, setting a new daily low.

The spot gold price hit a record high during the two consecutive days, approaching $3,052 during Powell's press conference.

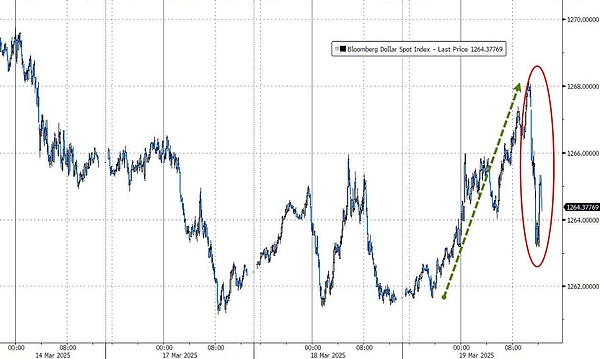

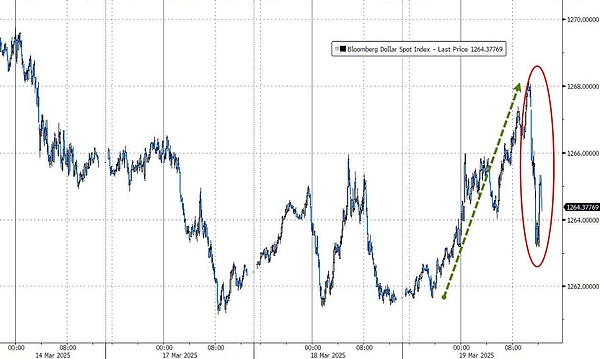

In a word, except for the US dollar, almost all asset classes recorded increases.

It is worth noting that Powell's "temporary inflation theory" reminds people of the memory of the Fed's slow response to the surge in inflation driven by the epidemic. Whether this strategy can work is undoubtedly the focus of the current market.

Powell insisted in 2021 that inflation was only "temporary", which turned out to be a costly misjudgment. At that time, inflation not only did not subside temporarily, but soared to the highest level in 40 years, forcing the Fed to raise interest rates sharply in the later period to control prices.

The difference is that this time Powell emphasized uncertainty more, and the word he emphasized most at this meeting was "uncertainty". When Fed officials begin to emphasize "uncertainty", it usually means that they are leaving room for policy shifts.

The Fed is on hold and will slow down its balance sheet reduction from April

On Wednesday, March 20, Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range of the federal funds rate will remain unchanged at 4.25% to 4.5%.

This is the second consecutive monetary policy meeting of the Federal Reserve to decide to suspend interest rate cuts. The Federal Reserve has raised interest rates by 525 basis points from March 2022 to July last year, and has cut interest rates for three consecutive meetings since September last year, with a total reduction of 100 basis points.

At the same time, the Federal Reserve announced that it will slow down the pace of reducing its balance sheet (balance sheet reduction) from April.This is the first time the Federal Reserve has adjusted its balance sheet reduction since June last year. From June 2022 to the end of last year, the Fed has reduced its balance sheet by nearly $2 trillion.

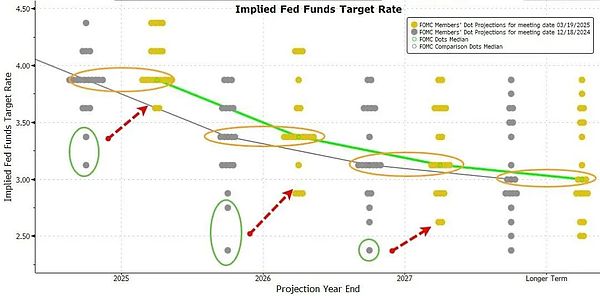

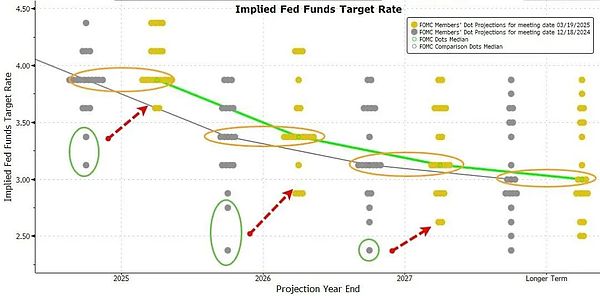

The interest rate forecast dot plot released by the Fed after this meeting shows that Fed officials, like at the end of last year, still expect two interest rate cuts this year.

Concerns about stagflation and tariff policies remain

In terms of economic and inflation prospects, the Fed simultaneously lowered its economic growth forecast and raised its inflation forecast, which once again raised concerns about stagflation.

The Fed expects inflation to rise from the current 2.5% to 2.7% by the end of the year, still far above the Fed's 2% target; it lowered its GDP growth forecast for this year from 2.1% to 1.7%, a significant slowdown from the level of nearly 3% in 2022 and 2023.

After the Fed's decision was announced, Nick Timiraos, a senior Fed reporter known as the "New Fed News Agency," commented that the Fed has extended the suspension of interest rate cuts this time, and the economic outlook is bleaker than before. Fed officials expect higher inflation and unemployment rates this year than before, reflecting the possible impact of tariffs.

He pointed out that almost all Fed officials expect downside risks to economic growth and believe that there are upside risks to unemployment and inflation expectations.

The FOMC's swing between stickier inflation and slower growth is likely due to uncertainty about future tariff policy, especially the reciprocal tariffs that the Trump administration plans to discuss on April 2, Sam Stovall, chief investment strategist at CFRA, said in a report.

"Stocks and bonds did not initially react to the news as the market realized that the mutually "contradictory" economic forecasts were likely the Fed's hint that it needed more clarity before adjusting monetary policy."

Powell puts out fire on economic anxiety and reassures investors

Powell reassured investors at a press conference, suggesting that the Fed did not see the need to take drastic action on tariffs and their impact on inflation.

He said, "We are indeed seeing pretty solid (economic) hard data at the moment," with job growth "at a healthy level" and the unemployment rate "very close to its natural level," which shows that the U.S. economy is "healthy."

Powell acknowledged that the risk of a recession may have increased in recent months, but he tried to reassure the outside world that the probability of an imminent recession remains low.

When asked how much of the Fed's upward revision of inflation expectations was caused by tariffs, Powell replied that it was difficult to analyze to what extent inflation was driven by tariffs, and the "baseline" forecast was still that tariffs had a "temporary" impact on inflation. "As I mentioned, sometimes it's appropriate to ignore inflation if it's transitory if we don't take action. That may be the case with the tariff inflation. I think it depends on whether we can get through the tariff inflation quickly." He noted that if long-term inflation expectations are well controlled, the Fed can ignore the one-time shock of policies such as tariffs. Long-term inflation expectations have been stable, allowing the Fed to ignore it. He said that during Trump's first presidency, "the last time there were tariffs," the impact on inflation was transitory. During Powell's press conference, the U.S. stock market rebounded, with the three major U.S. stock indexes hitting new highs for the day, U.S. Treasury prices jumped, and the two-year U.S. Treasury bond yield plunged and fell below 4.0%. Gold hit a new high, cryptocurrencies rebounded, and the dollar narrowed its intraday gains.

Kathleen Brooks, research director at London-based XTB, commented that Powell's controversial re-use of the word "temporary" to describe expectations of tariff-induced inflation showed that he "seemed to go out of his way to appease financial markets":

"This is not Powell's 'at all costs' moment, but his indifference to the risks of the US economy has had a significant impact on market sentiment."

UBS analysts said that Powell's performance gave them a glimpse of a "Powell put option", and his policy stance was more dovish than the market expected.

In UBS's view, the Federal Reserve is more concerned about economic growth than inflation risks, and believes that excessive focus on inflation caused by tariffs may have unnecessary negative impacts on economic growth.

Brian

Brian