Author: Arain, ChainCatcher

In the past few cycles, whenever Ethereum got into a "performance" dilemma, there were always "Ethereum killers" emerging. "Ethereum killers" refer to Layer 1 blockchains, and the Layer 2 solution proposed by Ethereum is the antithesis.

But since Ethereum completed the Cancun upgrade this year, the narrative volume of Ethereum Layer 2 has been higher than that of Layer 1, and even replaced Layer 1 as the mainstream narrative. On the one hand, the competitive landscape of Layer 1 has not changed. From the perspective of market value, (except BTC) ETH, BNB and Solana form a three-legged situation, with ETH being the only one in the lead; on the other hand, there is a question, that is, in this cycle, why are there almost no new Ethereum killers emerging?

Interestingly, Ethereum also seems to be in the dilemma of Layer2. Token Terminal data shows that ETH Layer1 revenue has fallen sharply, down 99% since March 2024. At the same time, in August this year, Multicoin Capital blasted Ethereum Layer 2 on the Bankless show, and then Ethereum Foundation researchers said in an AMA that Ethereum was still exploring Layer 1, rather than relying entirely on Layer 2.

The problems obscured by the prosperity of Layer 2 have therefore begun to surface.

Public chain war: the past of a hundred schools of thought

Layer 1 and Layer 2 are blockchain networks at different levels, of which Layer 1 is the main chain and autonomous chain, on which transactions are directly executed and confirmed, and provides the necessary infrastructure for the blockchain network, which can directly interact with users. The famous public chains Bitcoin and Ethereum are at this layer.

Layer 2 is an off-chain vertical expansion solution that runs on top of Layer 1 blockchains such as Ethereum to improve scalability. Popular projects on this layer include Arbitrum and Optimism.

It can be said that Layer 1 comes before Layer 2. With the development of technology and the update of market awareness, in addition to these two layers of networks, the blockchain ecosystem has also extended Layer 0 and Layer 3. Layer 0 refers to the underlying infrastructure on which multiple Layer 1 blockchains can be built, and Layer 3 refers to the blockchain-based application layer, including games, wallets, and other DApps.

The war of public chains originated from Layer 1. It can be said that in order to break the limitations of Bitcoin, a number of public chains began to flourish. Bitcoin was originally designed as a trustless peer-to-peer electronic cash system, and it is also a Layer 1. Security and decentralization are its biggest advantages. In order to maintain the advantages of these two characteristics, Bitcoin is not suitable for carrying too many applications and developments, so its scalability is poor.

Security, decentralization and scalability are important parts of the "blockchain impossible triangle" theory, which was proposed by Ethereum founder Vitalik Buterin and refers to the fact that blockchain networks cannot achieve security, decentralization and scalability at the same time.

In 2015, Ethereum was officially launched. Since then, almost at the same time, other public blockchains have emerged one after another, such as Cardano and Polkadot. Among them, Ethereum became the first widely recognized public chain with a Turing-complete programming language, filling the scalability defect of Bitcoin.

But from a historical perspective, this expansion is limited. Whenever the adoption rate of Ethereum rises, the network becomes congested, and in order to avoid the risk of "centralized spread" in the protocol, Ethereum developers are reluctant to increase the throughput limit. Therefore, in this case, Ethereum is also caught in the "impossible triangle" problem. The most intuitive feeling is that whenever this moment comes, the use of Ethereum becomes very expensive or the speed becomes slower. This is a disaster for application creators and users, but it gives competitors a chance to survive.

According to incomplete statistics, in 2018, the number of new public chains in the world exceeded 100, ushering in an era of "10,000 chains launched simultaneously". Among them, blockchains such as EOS, TRON, Tezos, and Cardano have completed fundraising activities of over US$400 million, US$200 million, US$227 million, and US$117 million, respectively, becoming eye-catching projects in the market.

These public chains were once more or less dubbed "Ethereum killers" by the market, but now some have new categories, some are classified as Layer0, and some are classified as Layer2.

From 2020 to 2021, the competition among public chains has become increasingly fierce, because not only the number continues to grow, but the public chains that have been launched have fought to seize market share, which can be seen from the data performance of developer activities:

Solana's developer activity increased by 223% in 2021. With its proprietary consensus mechanism, it has become a prominent non-EVM blockchain, emphasizing the ultimate cost-effectiveness, which has enabled the rapid development of applications on it. To this day, this Layer1 blockchain is still quite competitive in the market.

NEAR's developer activity increased by 100% during the same period, and its technology Nightshade aims to achieve faster transaction speeds, lower costs, and higher transaction volumes. Aurora can be compatible with EVM, which can be understood as developers can easily transplant their smart contracts from Ethereum to the new chain.

Avalanche saw a 46% increase in developer activity during the same period. This Layer 1 blockchain consists of three parallel public chains, with the C chain responsible for smart contract development, deployment, and interaction, and is compatible with EVM. The project's validators protect the network through a proof-of-stake consensus protocol, enabling fast and low-cost transaction processing. Note that this public chain is currently classified as a Layer 0 project.

Polygon (MATIC) saw a 350% increase in developer activity during the same period. Polygon is technically a sidechain, and was initially classified as Layer 1 because its experience was close to Layer 1. Because Polygon has a Layer 1 experience and extreme cost-effectiveness, a large number of developers have flocked to Polygon for construction. The current network layer classification of this public chain has also changed, and it is now classified as Layer 2.

At the end of 2021, as the market entered a period of drastic fluctuations and leveraged funds were cleared, some public chains gradually fell behind, forming the current situation.

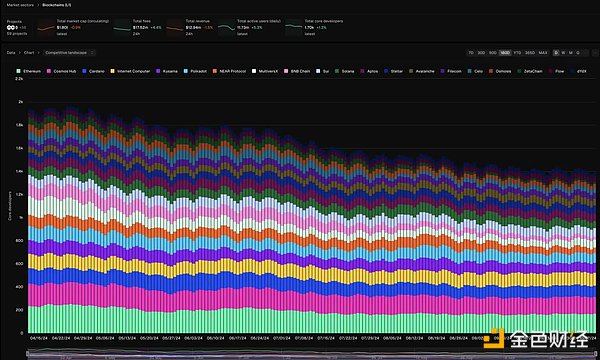

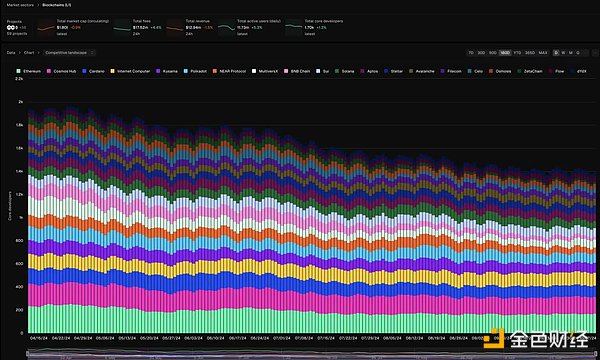

According to Tokenterminal data, from the perspective of market value, there are only four public chains with a weight of more than 1%, namely BTC, ETH, BNB and Solana, which account for approximately 70.23%, 16.92%, 4.84% and 3.84% of the weight respectively.

From the number of core developers, there are currently more than 100 people in Ethereum, Cosmos, internet computer and OP Mainnet, followed by Cardano, Kusama and Polkadot, with nearly 100 core developers. More developers often represent the potential of a project, because from a business perspective, public chains will compete for developer resources through incentive mechanisms and visions, and more developers will have more products and users.

From the above data, we can see that the top two market share almost monopolize the public chain market share, but the above market value ranking does not match the ranking of the number of developers, which shows that there are a number of undervalued public chains in the market.

Public chains sitting on the bench: the embarrassment of Cosmos

Before discussing these neglected public chains, it is better to summarize the development model and competition pattern of several mainstream public chains. Taking star projects as an example, the mainstream public chains currently recognized by the developer community and the investment market are mainly of the following types and developments: 1. Multi-chain architecture: Ethereum (ETH): As the originator of the smart contract platform, Ethereum ranks first in security, innovation and number of users, but its scalability, fees and old architecture are its shortcomings. The latest classification is Layer1+Layer2. Polkadot (DOT): It has an advanced architecture and the support of Gavin Wood, but the fee model puts a lot of pressure on developers, and the ecosystem is still in its infancy. The latest classification is Layer0. Cosmos: It provides more advanced architecture and freedom, but its organizational structure is loose, the development threshold is high, and the ecosystem is also in its infancy. The latest classification is Layer0.

Avalanche (AVAX): Adequate funding, integrated architecture, and comprehensive ecology, but lack of interactivity between subnets, and lack of consensus on new features in a bear market. Latest classification as Layer 0.

Polygon: Adequate funding, extensive layout, and advanced concepts, but the overall network concept is unknown, and lack of consensus on new features in a bear market. Latest classification as Layer2.

2. Single-chain architecture:

Solana: Parallel execution and minimization of network communication consumption are innovative points, but there are problems with decentralization and node performance squeeze. Layer1 network.

Aptos: Adopts optimistic execution, which is developer-friendly, but if all transactions are linked, the efficiency improvement is limited. Layer1 network.

Sui: Similar to Aptos, but requires transactions to declare relevance in advance. Layer1 network.

Fuel: Focuses on modularization, only does the execution layer, abandons the consensus and DA layers, but is currently in the early stages. Layer2 network.

3. Special architecture:

Near: Sharding is the highlight, but the ecological development is slow and the system complexity increases. Layer1 network.

Ar: A new paradigm public chain built on storage, but security, decentralization and market acceptance are questionable. Layer0 network.

BSC: Large traffic, sufficient funds, prosperous ecology, but weak technological innovation. Layer1 network.

In the view of some public chain practitioners, fierce competition may cause many projects to adopt conservative strategies in the long-term development due to resource loss, narrative or hot spot changes, and some even abandon past construction achievements. Due to failure to cater to the market, it ultimately leads to the waste of continuous investment and construction of public chains. Cosmos's current embarrassing situation can be said to be a microcosm of the public chain group that is gradually marginalized in the competition.

As a pioneer in the development of cryptocurrency and blockchain, Cosmos has built a concept similar to "super city clusters", pioneered the concept of "application chain", and through the "Inter-Blockchain Communication (IBC) protocol, which allows different blockchains to exchange information and value securely and efficiently, it has a profound impact on modular blockchain theory and the concept of blockchain sovereignty.

During Ethereum congestion and fee surges in 2017, Cosmos was seen as a scalability solution and attracted a lot of attention. And during the cryptocurrency bull run from 2017 to 2018, the market value of Cosmos's token ATOM was in the top 20 of the cryptocurrency market value.

The number of Cosmos Zones is an important indicator of the construction of the Cosmos ecosystem. Zones can be understood as application chains, which are independent blockchains built on the Cosmos SDK. These Zones can communicate with each other through IBC so that Zones and Hub (the central node of the Cosmos ecosystem) can interact securely and facilitate cross-chain asset transfers. According to the Cosmos Explorer, there are currently 91 zones, of which 84 are active, which shows the success of Cosmos in ecological construction.

Today, Cosmos' market value has slipped out of the Top50, and with the evolution of the times, its unique technical solutions can be replaced to a certain extent - the Rollup solutions on Ethereum and Celestia provide developers with customization options similar to the Cosmos application chain, and have a more mature community and liquidity pool.

The Cosmos ecosystem has come to a crossroads.

Complementary advantages "Public chain Lego" activates unpopular star public chains

The blockchain ecological network layer can be changed. Now Cosmos has been realized that it is a Layer0 blockchain, so Cosmos cannot be measured by Layer1 standards.

Layer0 aims to solve problems such as scalability and interoperability more effectively by creating a more flexible infrastructure and allowing developers to launch dedicated blockchains on their own.

The core components of Cosmos include Cosmos SDK, IBC protocol and Tendermint consensus engine:

Cosmos SDK, a set of open source frameworks and public chain construction toolkits and template libraries, greatly reduces the difficulty for developers to develop blockchains and related applications;

The IBC protocol allows information exchange and interoperability between different blockchains, so that the various blockchains in the Cosmos ecosystem can form a joint network. In addition, blockchains built using Cosmos SDK can

The Tendermint consensus engine provides an efficient and reliable consensus mechanism, allowing nodes in the blockchain network to reach consensus quickly and fairly; ·

Among them, Cosmos SDK plays the role of helping developers quickly build blockchains from scratch. It should be noted that Cosmos provides developers with consensus mechanisms and application development tools (SDK) instead of traditional execution engines (EVM virtual machines) in order to provide developers with a higher degree of freedom, allowing them to customize the operating environment and transaction types of the application chain according to their own specifications, or even a completely independent blockchain. This means that even if it is not a Cosmos ecological project, you can use this SDK, and the projects built using this SDK can exchange tokens and values with other chains in Cosmos through the IBC protocol, thereby "linking" with the Cosmos ecosystem.

This is like a "traffic entrance". But now, this "entrance" has a little problem. In fact, the Cosmos SDK relies on the CometBFT consensus algorithm, which was not originally designed for high-performance public chains, but more focused on fault tolerance. This consensus algorithm is based on the Practical Byzantine Fault Tolerance (pBFT) consensus algorithm from the 1990s, which seems a bit "outdated" in today's public chain competition environment. According to industry insiders, many high-performance public chains initially considered using Cosmos SDK to build, but found that SDK could not meet the needs during the actual operation, and finally had to turn to it.

These requirements that Cosmos SDK cannot meet are as follows:

1. Limited scalability and performance. As the number of validators increases, CometBFT performs poorly in terms of high transaction throughput;

2. Inefficient P2P network design. This will cause block proposal voting communications to slow down significantly in large networks with fewer validators;

3. Transaction ordering and status are tightly coupled within the consensus engine, which in fact limits performance and flexibility;

4. EVM compatibility issues. The lack of seamless compatibility with EVM actually excludes developers who want to use Ethereum tools or connect to the Ethereum community;

5. Validator scalability limitations. Communication and signature aggregation issues prevent the Cosmos blockchain from efficiently scaling beyond 150 active validators, limiting decentralization and network security;

6. Database performance bottlenecks, especially high-performance applications, affect transaction processing speed.

Continued use of CometBFT will limit scalability, performance, and integration diversity, and then create business obstacles for many blockchain teams built on Cosmos, which may eventually affect the long-term development of the Cosmos ecosystem. In order to break through the limitations, Cosmos is seeking solutions. In the recently released SDK v2, Cosmos announced support for the new consensus engine Supernova Core.

Supernova Core is a consensus framework compatible with Cosmos SDK, designed to directly replace CometBFT. It has effectively and specifically solved the current problems of Cosmos SDK:

1. The use of Boneh–Lynn–Shacham (BLS) signature aggregation allows the network to maintain high performance with more than 150 validators;

2. The layered network architecture design replaces the P2P network design, reducing latency and ensuring efficient communication, thereby improving overall performance;

3. Based on HotStuff consensus. Compared with traditional pBFT implementations, the network can achieve up to 3 times the throughput while improving fault tolerance;

4. Fully compatible with EVM, developers can enjoy a seamless deployment experience, and developers in the Cosmos ecosystem can use Ethereum tools and ecosystem;

5. Allowing transaction sorting and state processing to be separated, this architecture allows EVM execution to be independent of consensus and independent expansion, thereby optimizing performance, which may provide better flexibility in the future, and the decentralized Layer2 based on this will have better performance and higher security.

Meter creates a public chain Lego model house

Supernova Core is a solution proposed by Layer 1 blockchain Meter for the problems faced by Cosmos SDK. Founded in 2018, Meter is a decentralized Ethereum network expansion solution that integrates the advantages of PoW and PoS. It processes transactions based on the proof of stake of the HotStuff consensus, while resisting MEV and transaction front-running, aiming to become a decentralized and highly performant Ethereum sidechain.

Meter founder Zhu Xiaohan said that since 2021, the Meter team has been exploring cross-chain bridges and creating many projects to make efforts in the future evolution and performance improvement of "public chain Lego". It is understood that the core code of the consensus engine Supernova Core supported by Cosmos has been implemented on the Meter mainnet and has been running uninterrupted for four years, with a peak daily transaction volume of 8 million. During the peak load of the network, because many community verification nodes used AWS resource-constrained virtual machines, AWS once randomly shut down about 20% of the verification nodes. In this case, Supernova Core can still ensure the integrity and performance of the network, showing its robustness, security and efficiency.

In the future, Supernova Core will support parallel EVM execution and optimize database I/O as improvement goals to further improve throughput, efficiency and performance, thereby enhancing user experience.

As representatives of Layer 0 and Layer 1 projects respectively, the cooperation between Cosmos and Meter has undoubtedly created an excellent cooperation model for "public chain Lego". In this cooperation case, we can see that there is still a vibrant Layer0 ecosystem behind Cosmos, and the integration of Cosmos SDK and Meter's Supernova Core is expected to add more convenience to Cosmos ecosystem members, which will help more new developers come to the Cosmos ecosystem.

For Meter, the demonstration effect of the cooperation case will help the market see more of Meter's proven technical capabilities, and is expected to promote Supernova Core to become the preferred solution for building scalable, efficient and high-performance blockchains, thereby promoting wider adoption and collaboration in the blockchain community and making high-performance blockchain development easier.

Whether it is a new Layer1 or an enhanced Layer2 solution, Meter encourages industry participants to use Supernova Core.

It is worth mentioning that in the enhanced Layer2 solution, Supernova Core can solve the current Layer2 centralization problem. In addition to hotly discussing the Layer1 and Layer2 routes, the current Ethereum community is also worried about the lack of centralization of the existing Layer2 - the centralization of the sorter will bring risks of possible behaviors such as malicious, transaction insertion, MEV, etc., and the severity is that its existence has a greater potential black forest than Ethereum. The existing Layer2 has no intention to decentralize at all due to the considerable income brought by the sorter. Supernova Core can provide a framework for decentralized Layer2 without impacting Layer2 income to ensure the long-term development of Layer2 in the future.

The Supernova Core test network will be launched at the end of this year, so you can wait and see. Make high-performance Layer1 and decentralized Layer2 development no longer daunting - this will not be just a slogan.

Although today's market hotspots focus more on Layer2, it cannot be ignored that Layer 2 projects are more about playing games to attract liquidity and lack new value creation. The future trend will still call for several powerful Layer1s to lead the market, and Layer0, as the starter of Layer1, will provide this breeding ground.

As long-term participants in the market, we still need to focus on the bottom layer, the underlying technology - Layer1, and even Layere0. There is the future.

Brian

Brian