Author: Steven Ehrlich Source: unchainedcrypto Translation: Shan Ouba, Golden Finance

$PUMP's initial coin offering (ICO) is seen as one of the most anticipated events in the crypto market in recent years. This has also attracted traders from all walks of life who want to take advantage of this wave of heat, volatility and extremely successful sales to profit.

So far, most trading activity has occurred in the perpetual contract market, but now options contracts are also becoming active, which can bring considerable returns if they eventually "reach the price".

PUMP traders are betting heavily that the token will far exceed the ICO price

Crypto prime broker FalconX said that customers are using options contracts to make large-scale bets, expecting that the token price will continue to rise.

Before last Saturday's landmark ICO, Pump.fun's unlisted PUMP token had already sparked rapid speculation in the market, with $500 million of tokens sold in just 12 minutes.

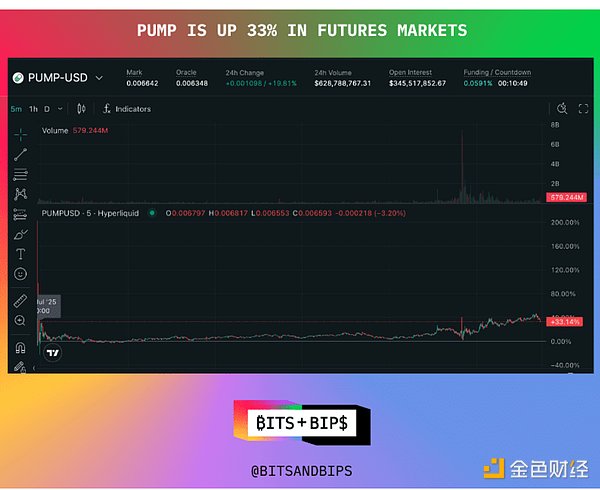

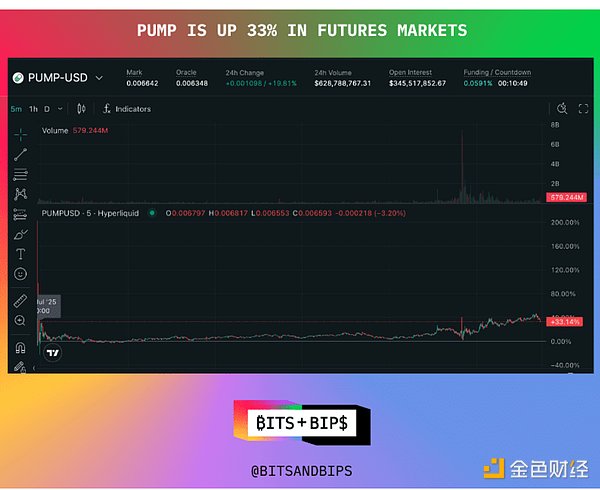

But almost all of the early hype was concentrated in the perpetual contract (perps) market. This is a cash-settled product offered on platforms such as Hyperliquid and Binance for obtaining spot-like price exposure with leverage. Since July 10, the PUMP perpetual contract on Hyperliquid has risen 33%, with a total contract volume of $628 million during the same period.

Now things are changing.

FalconX exclusively told Unchained that the company is matching customized options trades for clients through its OTC (over-the-counter) desk, with a notional size of hundreds of millions of dollars.

Unlike futures contracts, which require settlement at maturity (cash or physical delivery), options contracts give buyers and sellers the "right" rather than the "obligation" to exercise the contract. This means that traders can design trading strategies with potentially extremely high returns, as long as the final price trend is in line with expectations.

FalconX's head of derivatives, Griffin Sears, said that the company's clients are using these options to bet heavily on the upside of PUMP, reflecting the industry's optimism about this major ICO that has been rare in many years. He said: "We see strong interest in traders for call options that are significantly out of the money, indicating that they expect prices to far exceed the ICO price."

Options vs. Perpetual Contracts: Comparison of the Two Tools

Due to the hot subscription of this ICO, many traders were forced to turn to the derivatives market for exposure.

Perpetual contracts offer traders linear price exposure—in simple terms, betting on prices going up or down. Gains (or losses) can be magnified with leverage, but such contracts are limited to certain complex trading strategies.

By contrast, options are more attractive to traders during volatile times. First, the risk is limited to the initial principal invested, and a larger notional position can be established through leverage, without the risk of forced liquidation. The worst outcome is that the contract expires "out of the money" and the trader loses only the initial investment.

In FalconX's case, trading demand has been concentrated in call options, which are considered bullish bets because they give buyers the right to buy an asset at a specific price. According to FalconX, the strike price range for short-term call options is approximately 25% to more than 150% of the ICO price. However, the company did not disclose leverage ratios or specific expiration dates. But traders are using these options to build strategies with "asymmetric" upside risk.

Will the next few days be busy?

At least until the PUMP token is officially circulated after a 48-72 hour lock-up period, trading activity around the token is expected to remain very active. Although PUMP's recent revenue data has declined, it is still seen as a high-beta bet on SOL.

"Demand for PUMP far exceeds the allocation that customers can get," said Sears. "For some institutions, derivatives are almost the only way for them to get full exposure before the token is officially distributed."

Joy

Joy