Holdings: 1,713,899 ETH, based on $4,561.53, with a total market value of approximately US$7.82 billion, accounting for 1.43% of the total Ethereum supply. Interpretation: BMNR has a huge holding volume, almost equivalent to a mini version of ETH ETF, and its price trend is highly bound to ETH. 3.2 SBET — A Copycat ETH Mirror Holding: 800,000 ETH, valued at $4,561.53, with a total market capitalization of approximately $3.65 billion, representing 0.67% of the total ETH supply. Interpretation: While ETH holdings are small, the asset structure is simpler. 3.3 DYNX — New Narrative + ETH Positions: 345,362 ETH, with a market capitalization of approximately $1.623 billion, representing 0.28% of the total ETH supply. Interpretation: DYNX's logic is "new narrative + ETH holdings." Although much smaller than BMNR/SBET, DYNX's leverage is higher when compared to its ETH holdings based on its circulating market capitalization. 3.4 UPXI — An Indirect Investment in the Solana Ecosystem Holdings: 2,000,000 SOL, with a market capitalization of approximately $400 million. Interpretation: Unlike the previous three companies, UPXI holds SOL rather than ETH. It is an indirect investment in the Solana ecosystem. Appendix: Comparison of Four US Treasury Stocks Overall, the logic behind these stocks is similar to that of ETFs: driven by token holdings and a combination of risk premiums. Once the ETH and altcoin season begins in Q4, they will become another battleground for capital.

Conclusion and Outlook

From the macro perspective to the blockchain, and then to the US stock and blockchain stocks, the signals are gradually converging in one direction:

1. Macro Level:

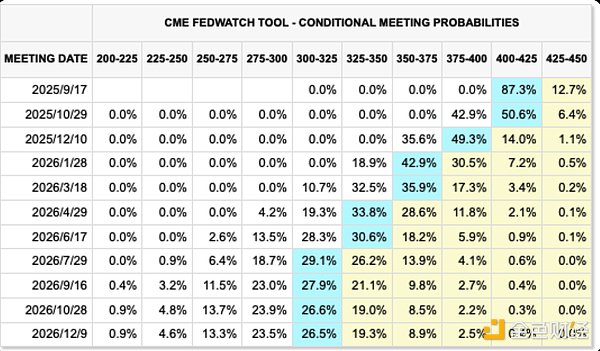

The Federal Reserve's first interest rate cut in September is almost certain. Whether there will be consecutive rate cuts in Q4 will determine the pace of liquidity release.

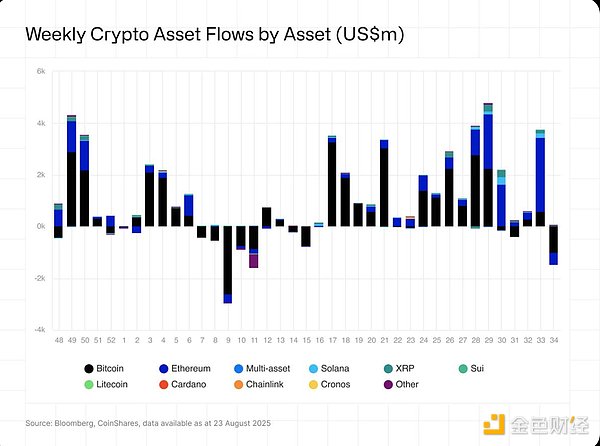

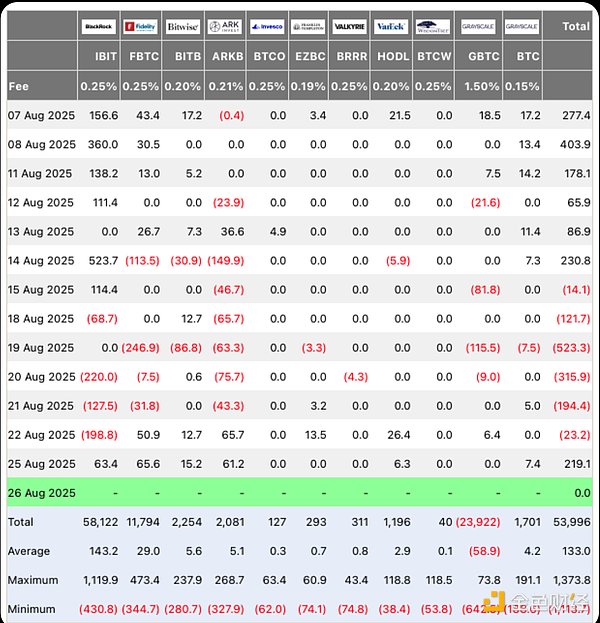

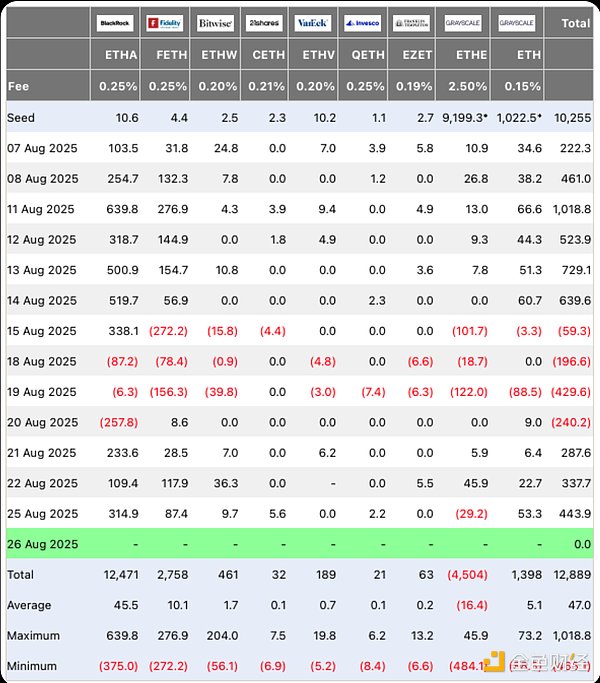

The bond market and the US dollar have already reflected the expectation of capital inflows. 2. Capital Flows: BTC ETFs experienced continued net outflows (-$1 billion), indicating the market is avoiding short-term pressure on Bitcoin. ETH ETFs led the way (+$2.5 billion), with funds clearly shifting toward ETH, demonstrating both compelling narrative and liquidity. 3. Market Pricing: BTC maintained its market anchor, but lacked incremental buying. ETH has taken the lead in strengthening, becoming the primary focus of capital allocation. Early signs of altcoin season have emerged, and Q4 is expected to see a larger-scale rotation. 4. US Stock-Chain Stock Mapping: BMNR: High financial leverage amplifies risk and returns. SBET: A mid-sized, more stable ETH proxy. DYNX: Small-cap with a high position, a potential "monster stock." UPXI: The Solana ecosystem narrative. Their volatility has amplified market expectations for mainstream assets like ETH and SOL. Looking Ahead to Q4: Optimistic Scenario: The Federal Reserve enters a period of continuous rate cuts → Rapid liquidity release → ETH continues to attract capital, and altcoins and treasury stocks rally in unison. Neutral Scenario: The rate cut path is delayed → BTC remains volatile → ETH is relatively strong, but the altcoin rally is delayed until the end of the year or Q1 2026. Risk Scenario: If inflation rebounds or employment data exceeds expectations, the Federal Reserve is forced to slow rate cuts → Short-term funds flow back into the US dollar and bond markets → Cryptocurrencies and blockchain stocks come under renewed pressure.

Summarize in one sentence:

The core logic of Q4's market is that ETH leads → altcoins take over → treasury stocks resonate. "Paper tiger"-like pullbacks are just noise on the road to a bull market.

Catherine

Catherine