Bitzlato Faces Legal Hurdles: Bitcoin Withdrawals Suspended

Bitzlato suspends Bitcoin withdrawals amid legal challenges following its co-founder's guilty plea and asset seizures.

Kikyo

Kikyo

I have long wanted to talk to you about the topic of "decentralization". It is not a new word, and it even has a bit of a "cliché" flavor, but I always feel that it is the most misunderstood and underestimated word of this era.

Now, the opportunity has finally come.

In the past two weeks, the two giants of the Web2 world -

Amazon and , with a piece of optical fiber and a line of script, mercilessly rubbed the entire encryption industry to the ground. This is not a technical speech or a philosophical debate, but a naked reality.So, starting from this article, I will write a three-article series, the title is: "Decentralization Trilogy"

I will try to answer the following three questions:

How far are we from true "decentralization"? The article you are reading.

What is the underlying logic of "decentralization"? Focus on how protocol functionalization makes centralization invalid from a micro perspective.

What can "decentralization" bring? Focus on the prospect of decentralization's subversion of Web2 business logic.

Don’t talk about slogans, just tell the truth; don’t talk about ideas, talk about reality first.

Then let’s start with these two “reality crits”.

This is the first time in history that someone clearly saw that an invisible “fiber breakpoint” could cause 15% of the global crypto spot trading market to get stuck at the same time.

In the early morning of April 15, 2025, at 3:00 Tokyo time, AWS (Amazon Cloud Service) Tokyo region suddenly experienced a large-scale connection interruption. In the first 15 minutes, Binance's API response time soared 12 times, MEXC's user withdrawal requests queued for more than 180,000, and the failure rate of KuCoin and Gate.io's pending orders soared to 47.3%.

Not only were transactions delayed, but user logins also timed out on a large scale. Especially at the 42nd minute of the AWS failure, DeBank wallet data showed that:The active transaction volume of on-chain addresses in the Asia-Pacific region dropped by 58%.The assets are still on the chain, but want to move them? - Sorry, the off-chain account system has been down.

Binance's emergency announcement was written very restrained:

We are aware of an issue impacting some services on the #Binance platform due to a temporary network interruption in the AWS data center. Some orders are still successful, but some are failing. If users failed, they may keep retrying.

(Translation) Due to AWS network interruption, some orders failed. If you fail, please keep retrying.

MEXC directly issued an early warning:

Abnormal candlestick charts

Failed order cancellations

Delays in asset transfers for spot trading

In that hour, orders failed, orders were stuck, and assets were frozen. The on-chain vault was like being sealed by an electronic door lock,

and no one could open it. Even if everything is normal in the blockchain network, as long as these key business logics are still entrusted to the centralized server, you are equivalent to handing your life to "someone else's socket".8 days later, something even more lethal happened.

On April 23, 2025, Google officially implemented the new advertising policy under the Crypto Asset Market Regulation (MiCA) in the European Union:

All crypto projects must upload the license number issued by the local financial regulatory authority for advertising;

Accounts that have not passed verification will stop displaying within 72 hours.

This was not a removal or blocking, and there was not even a warning. The Google advertising team just quietly added a line of whitelist filtering logic in the background. There was no downtime, no network blockage, and users clicked on the ad links normally. It was just that these ads disappeared silently from the search results.

Within three days, advertising traffic in France, Germany, and Spain changed rapidly:

The amount of advertising related to keywords such as "buy bitcoin" and "crypto wallet" dropped by 67%;

The exposure of small and medium-sized projects such as Coinstore, Bitget, and BitMart in some markets evenevaporated by 84%.

At the same time, giants that have obtained compliance licenses such as Crypto.com, Revolut, and Bitpanda took advantage of the situation to harvest traffic. According to media statistics, in just one week, their number of new user registrations was more than 5 times higher than that of the banned projects.

Google did not unplug your network cable. It just gently pushed a button in the background to make you "online", but "no one can see you".

Different methods - one is a physical chain break, the other is a policy blockade; different manifestations - one is a technical downtime, the other is a traffic blockade; but the results are the same:

The assets are on the chain,People can't move it;

The protocol logic has not changed,The market can't see you;

Under the shell of "decentralization" of the system, all key capabilities are still parasitic on the centralized platform.

This is not "a certain company is unlucky". This is a common disease of the entire industry. It is a collective streaking, a fantasy bubble silently punctured by "reality".

It is these two real scenes that make us have to ask the question again:

What is true decentralization?

Why is decentralization not only a technical ideal, but also the minimum guarantee for business survival?

If we don’t decentralize, what will we do when the next disaster comes?

Let’s clarify this issue now.

The word "decentralization" sounds like some kind of technical slogan or idealistic slogan. In the impression of many people, it is "no company", "no boss", "many nodes", "no server"... But these expressions are just vague impressions, or even misunderstandings.

To understand “why decentralization is necessary”, we must first answer a question that seems simple but very few people can really explain clearly:

What is true “decentralization”?

Let's first look at three common pseudo-decentralizations:

Misunderstanding 1: Multi-cloud deployment ≠ decentralization

Moving the server from AWS to GCP and then preparing an Alibaba Cloud hot backup does not mean decentralization. This is just the redundant fault tolerance of centralized services, which is physical distribution, not permission distribution. Control is still concentrated in the hands of a single company, and can still be taken away by a "blocking" or "freezing" operation.

Misconception 2: DAO is a decentralized organization?

If the governance logic of a DAO is written in Discord and Google Forms instead of on-chain contracts, then this "DAO" does not even meet the threshold of "authority cannot be tampered with". Decentralization ≠ no leadership, but each layer of control can be replaced and verified.

Misconception 3: More nodes means decentralization?

If all nodes are operated by a foundation, but are distributed in different regions and IP addresses, then it is essentially a centralized cluster. This is called "false distribution, true center".

Decentralization is not "no center", but "everyone is the center". The real "decentralization" includes three dimensions: architecture layer, process layer, and governance layer, each of which is indispensable.

2.2.1 Architecture layer: distributed ledger

Public chains such as Ethereum and Bitcoin are representatives of distributed ledgers. Anyone can build a node and synchronize block data, and all nodes jointly maintain a globally consistent copy of the ledger. This means:

If any node hangs up, the network will still operate normally;

No one can "delete" or "rewrite" the ledger records;

The network status can be re-verified at any time.

This is the first line of defense against "physical chain breaks".

2.2.2 Process layer: permissionless execution

A truly decentralized system cannot require you to "register an account, submit information, and wait for approval" to participate. For example:

Anyone can call a smart contract;

Anyone can deploy their own contract or front-end;

All function calls are open and transparent and can be reviewed.

For example: Uniswap is a typical "permissionless protocol". Whether you are a Wall Street trader or a new user in Southeast Asia, as long as you can operate a wallet, you can directly call its contract to trade or provide liquidity without any review.

2.2.3 Governance layer: rules written into code

In the Web2 world, rules are set in the background and can be changed at will by the administrator. In the decentralized world of Web3, rules are written into smart contracts and made public on the chain, and any changes must be implemented through on-chain voting. This is the true meaning of "machines cannot lie."

Take MakerDAO (now renamed SKY) as an example, the collateral rate, interest rate, and supporting assets of its stablecoin USDS (formerly DAI) are all decided by MKR token voting. The voting records are written into the on-chain contract, and any changes are publicly traceable and cannot be revoked afterwards.

To sum up in one sentence: "Decentralization" does not mean having no control, but it means sowing control in every node like sowing seeds, and everyone can verify and replace it.

Then the question is, how do we judge whether a system is "qualified for decentralization"?

The following are the minimum standards generally recognized in the industry (you can use it as a checklist):

If not, no matter how decentralized the project is promoted, it is at most "centralized business running on the chain."

In the previous section, we explained what true decentralization is from the three dimensions of structure, process and governance.

But definition alone is not enough. Many people are not against decentralization, they just -

That is to say, we need to usereal-world casesto illustratein which key scenariosthe practical role of decentralization is reflected.

And this question has been answered once with reality by Amazon and Google.

Let’s review the AWS downtime incident (April 15, 2025):

Binance, MEXC, and KuCoin all had order exceptions and withdrawals failed;

DeBank front-end login failed, on-chain transfers were normal but the UI stopped responding;

Within one hour, the number of on-chain interactive addresses in the APAC region decreased by 58%.

The reason behind this is actually not complicated:

Although the assets are recorded on the blockchain, the transaction matching system, user account system, and risk control and audit system all run on centralized servers. Once the server goes down, the assets on the chain are like being locked in a vault in the basement - you know it's there, but you can't get it.

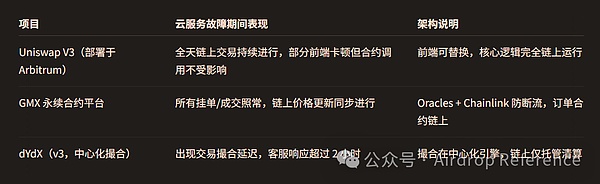

Then the question is: If it is a decentralized system, can it withstand this disaster?

Let's take a look at a set of data comparison:

The comparison shows that:

For protocols running on the core business logic chain, even if the front end is lost, it can still continue to be used normally through API calls and third-party front ends;

Projects that match off-chain and have centralized control can only "wait for the cloud to recover."

Summary in one sentence:

Decentralization does not guarantee that you will not have problems, but it guarantees that you "will not be completely paralyzed when problems occur."

Below, I will use an example to explain this issue.

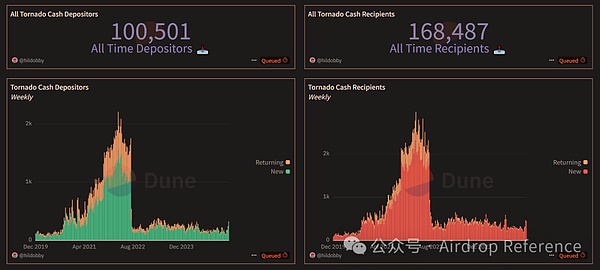

Back in August 2022, the Office of Foreign Assets Control (OFAC) under the U.S. Treasury Department officially announced sanctions on Tornado Cash on the grounds that it was "used as a money laundering tool by North Korean hacker groups."

The next 72 hours almost became a "targeted elimination" operation in the global cyberspace:

Tornado Cash's GitHub repository was removed;

The official front-end domain name tornado.cash was blocked by DNS;

Cloudflare withdrew TLS support and the front-end could not be accessed;

Core developer Roman Storm Arrested by the US government;

The USDC contract activated the blacklist mechanism and froze all on-chain addresses that interacted with Tornado Cash.

According to common sense, this protocol should be "dead".

But the result shocked everyone:

Not a single line of code in Tornado Cash's smart contract was closed or suspended.

Even if the front-end entrance disappears, the developer is thrown into jail, and the cloud service provider blocks support,the contract still runs as usual on the Ethereum blockchain. This is not based on people, but on code - the resilience and immutability of decentralized architecture.

3.2.1 Data Don’t Lie: The Protocol Is Still Alive, and Some People Are Using It

Public data from Dune Analytics (@hildobby) shows:

A total of 100,501 addresses have deposited assets into Tornado Cash;

168,487 addresseswithdrew assets from it;

at the peak in 2021–2022, more than 2,000 new usersparticipated in its use each week;

even after the sanctions and continuing to this day, hundreds of addressescontinue to actively use the protocol each week.

In other words:

Even if the "official" is eliminated,the "protocol" will still self-replicate, self-perpetuate, and self-execute in a decentralized manner.

The community quickly deployed more than 20 front-end images (such astornado.eth.limo), and users can also interact directly through CLI, RPC tools, ENS addresses, etc., completely bypassing the censorship blockade of centralized service providers.

3.2.2 The latest court ruling: Code is not an entity, and development is not a crime

More noteworthy is that at the end of 2024, this case ushered in a key legal turning point. In a landmark ruling, the U.S. federal court clearly ruled that:

OFAC has no right to include "open source smart contract code" itself in the sanctions list because it does not constitute an "identifiable controlled entity (Entity)".

This ruling conveys three judicial positions:

Smart contracts are not legal persons, companies or organizations, and cannot be sanctioned as "subjects";

Writing and publishing open source contract code is "freedom of speech" protected by the First Amendment;

Broadly blocking decentralized protocols is equivalent to reviewing the user's "tool choice" and violates constitutional principles.

On March 21, 2025, based on this ruling and policy review, the US Treasury officially removed sanctions on Tornado Cash.

This victory is equivalent to writing a "constitutional-level exemption reference" for global encryption developers and decentralized protocols.

From then on, the boundary between "writing code" and "conspiring" was officially drawn.

3.2.3 Decentralization, safeguarding the right to exist

Whether it is Tornado Cash that maintains the activity of the protocol under the pressure of censorship, or the US court's final denial of OFAC's overreaching behavior, it reveals a fact:

True anti-censorship does not rely on moral appeals, but on structural design;

True "freedom" is not in the homepage button, but in the contract where the code cannot be shut down and permissions cannot be blocked.

This is the practical value of decentralization in extreme scenarios - not sentiment, but the technical guarantee of the "right to exist" itself.

The essence of trust is not that you believe someone will not do evil, but that he can't do evil even if he wants to.

This is exactly the "trust lower limit" achieved by the decentralized system throughcode constraints + data disclosure.

For example:

When FTX collapsed in 2022, the records of user asset deposit and withdrawal operations were completely opaque;

Alameda Research was able to secretly embezzle user funds of up to 8 billion US dollars in the background, but users were completely unaware.

On Uniswap, every liquidity injection, every transaction, and every pool fee distribution can be queried in real time through the on-chain browser; in MakerDAO, any change in the stability fee will be written into the on-chain contract after a 48-hour time lock + referendum record.

Users do not need to believe that the development team is "good character",

As long as they can trust the code and verify the data, it is enough.

To sum up, decentralization is not more "idealistic" but more "realistic".

You don't need to "believe" in decentralization, you just need to feel its resilience and freedom when systemic risks break out. 4. Philosophical motivation for decentralization “You blockchain people just don’t want to be regulated.” — This is the first impression of many people in traditional industries on the crypto industry. But if we peel off the surface, we will find that the motivation for decentralization is not to evade regulation, but to respect power, defend freedom, and the ideal of co-governance.

The real source of decentralization is not Satoshi Nakamoto in 2009, but the foreshadowing was laid as early as the late 1980s.

Before the decentralized technology torrent swept the world, a black and white document born in 1988 had quietly written its prophecy.

This is "The Crypto Anarchist Manifesto" written by Timothy C. May, which is known as the spiritual starting point of the Cypherpunk movement.

A specter is haunting the modern world, the specter of crypto anarchy.

Translation: A specter, the specter of crypto anarchy, is haunting the modern world.

This is an imitation of the beginning of The Communist Manifesto. He is not advocating chaos, but a reminder:If technology is not allowed to serve freedom, it will eventually serve surveillance. The manifesto reads:

“Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner.”

“These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.”

Simply translated:

Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation.”

The cypherpunks represented by Timothy C. May are not idealists. They are a group of people who clearly know the boundaries, motivations and corruption speed of governments, enterprises and organizations. They know very well thatthe corruption of power is not "whether it will happen" but "when it will happen".

So the answer they gave is:

Don't rely on morality, but let technology itself achieve freedom.

In a centralized system, we are always required to "trust" the platform:

Trust it not to delete your account;

not to block your wallet;

not to record and sell your data.

But in a truly decentralized system, this kind of trust is unnecessary because:

you keep your private key yourself, not on the platform;

your assets exist on the chain and cannot be tampered with;

the transaction logic is executed by smart contracts, not by manual matching.

As the famous saying that is regarded as a golden rule in the encryption circle:

“Not your keys, not your coins.”

If you don’t have the private key, you don’t own the assets.

When you use a wallet like MetaMask for the first time, when you use a mnemonic phrase to control the overall situation for the first time without registering or logging in, when you find that you can change the front end, switch RPC, leave any platform at any time, but your assets and rights are still in your hands - you will truly realize:

"Freedom" is not a slogan, but a designed structural right.

Montesquieu, a French Enlightenment thinker, once said:

It is an eternal experience that all people with power are prone to abuse power.

To prevent the abuse of power, power must be constrained by power.

In modern society, laws, constitutions, and separation of powers are weapons against the abuse of power; in a decentralized system, "pledge mechanism + consensus algorithm + incentive model" is an algorithmic alternative to combat corruption.

Take Ethereum's PoS consensus mechanism as an example:

To become a validator, you need to pledge 32 ETH;

If you want to do evil (such as double signing, refusing transactions), you will be automatically

punished (Slash);

The penalty is automatically triggered by the consensus layer and is irrevocable and non-arbitrable.

This is like a "machine version of the separation of powers":

Incentives are legislation (public rules);

On-chain execution is administration (transaction verification);

Node verification is judicial (automatic ruling).

Without such a design, power will inevitably become corrupt after being concentrated.

For example, in 2017, some early DPoS public chains (such as EOS) had problems with super nodes colluding to "share profits" due to voting concentration and node alliances, and the verification process was completely black-box.

In a more decentralized system with transparent on-chain records, such malicious behavior will be immediately detected and handled by the community, on-chain analysis tools, and other nodes.

This is the "

programmed checks and balances" brought about by decentralization.We know from history thatthe greatest form of human organization is "cooperation". But cooperation is never simple. It requires consensus, trust, governance structure and incentive mechanism.

DAO (Decentralized Autonomous Organization) is the crypto world's answer to this proposition. A typical DAO:

There is no board of directors and no CEO;

Each token holder can vote to participate in decision-making;

The governance logic is written into the on-chain contract, and all operations are traceable, verifiable, and irrevocable.

Take MakerDAO as an example (now renamed SKY):

Its core asset is the decentralized stablecoin USDS (DAI is still retained);

Holders of the governance token MKR decide the interest rate (Stability Fee), collateral asset type, and risk parameters;

Decisions are made through on-chain Snapshot voting, and the results are written into the contract;

No one can unilaterally "raise interest rates" or "add junk collateral."

In 2024, SKY's DAO managed funds exceeding $6 billion. A "virtual organization" without an office or CEO manages more assets than most medium-sized commercial banks.

And this governance form of "using machine consensus instead of human credit" greatly reduces organizational friction and corruption space.

More importantly, it lowers the threshold for "participating in governance." Any ordinary person with a governance token can propose, vote, and influence policies. You are no longer a bystander, but a participant in the rules.

DAO is the "institutional design capability" expressed by technology. It tells us that human organizational models are not limited to companies, governments, and foundations, but can also be "code + community".

In the final analysis, the philosophical value of decentralization can be summarized in three words: “

We cannot prevent the existence of centralized systems, but we should ensure that wehave the option of “not relying on centralization”.

Because in many cases, this is not only a right, but also a dignity.

Here, we have completed a penetrating reality review.

From a fiber optic cable that caused the AWS outage in Tokyo to a line of script that was banned by Google in the EU, we can no longer naively believe that the so-called "decentralized industry" means that transactions on the chain run fast and nodes are widely distributed.

The fact is, no matter how much you use DEX, DAO, and DeFi, if:

matching runs on centralized servers,

login relies on the platform account system,

advertising relies on Web2 platform traffic,

decisions are made in Notion and Discord.

Then, you are still in acentralized closed system—it may be more fragile than you think.

Decentralization is not a belief label, but a survival issue.

It is not for showmanship, but for an additional escape route in the face of systemic risks.

It is not for anti-government, but for not giving all power to any one person, one button, or one background.

It is not just for geeks, but for everyone who wants to retain the right to choose freely and be responsible for their own assets. It is an underlying mechanism that deserves to be understood and embraced.

However, we must admit a less sexy fact:

Can the ideal of decentralization really be realized technically?

Can every service be "protocolized"? Can every layer of centralized infrastructure be replaced by functions? Can every business process be reconstructed on the chain? To ask more directly:

How do we go from “decentralization is impossible” to “decentralization is feasible”?

From philosophy and vision to engineering and products?

These questions are the core content to be answered in the next article.

Bitzlato suspends Bitcoin withdrawals amid legal challenges following its co-founder's guilty plea and asset seizures.

Kikyo

KikyoFiled in November 2019, the patent introduces a system that employs blockchain for effective road vehicle management.

Brian

BrianInvestors witness a shift as Bitcoin mining stocks, led by Marathon Digital and Riot Platforms, outperform Bitcoin's growth, marking gains over 800%. Amidst this surge, strategic moves and market predictions underscore the promising trajectory of crypto-related stocks amidst sector challenges.

Joy

JoyTelcoin overcomes a security challenge, reinforcing its commitment to user security and trust through transparency and enhanced measures.

Brian

BrianIndonesia launches CFX, a pioneering national crypto bourse, setting new standards for crypto regulation and oversight.

Alex

AlexBlast blockchain's $1.1 billion pre-launch deposits draw mixed reactions amidst controversy and high yield promises.

Kikyo

KikyoThe New York Times sues OpenAI and Microsoft over alleged copyright violations, highlighting a growing legal battle in AI and journalism.

Brian

BrianIndia's FIU demands compliance with AML laws from major crypto exchanges like Binance and Huobi, signaling tighter regulatory control.

Alex

AlexArgentina's new law aims to regulate undeclared cryptocurrencies, reflecting a shift in policy and embracing digital assets within its economic framework.

Kikyo

KikyoThe ruling permits Celsius to deviate from its previously approved bankruptcy plan, with the judge asserting that the restructuring does not harm creditors and customers.

Davin

Davin