I highly recommend Ray Dalio's "Changing World Order" model because it allows you to step back from the details and examine the broader picture. Rather than obsessing over the day-to-day drama of crypto Twitter, it's better to focus on long-term shifts. This is how we should view the crypto space. This isn't just about rapid narrative shifts; it's about the restructuring of the industry's entire order. The current crypto market is vastly different from what it was in 2017 or 2021. Here's the path of this order shift I've observed: 1. The Era of Big Rotation The launch of spot Bitcoin and Ethereum ETFs marks a major turning point. This month, the SEC approved universal listing standards for commodity ETPs. This means faster approvals and more assets can be listed. Grayscale has submitted its application under the new regulations. Bitcoin ETFs have set a record for the most successful issuance in history. Ethereum ETFs, despite a slow start, still hold billions of dollars in market capitalization despite a weak market. Buyers have shifted to pension funds, investment advisors, and banks. Crypto assets now fall into the same asset allocation category as gold or the Nasdaq index.

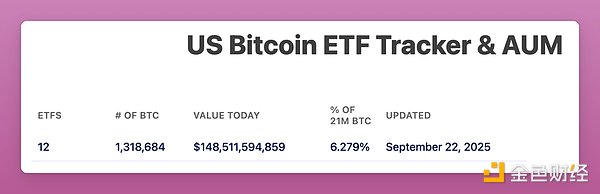

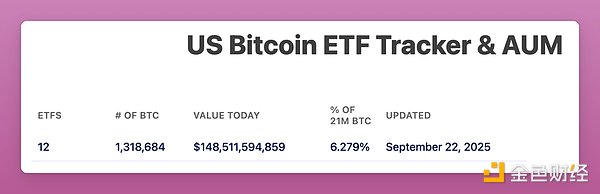

Bitcoin ETFs manage $150 billion, accounting for over 6% of the supply.

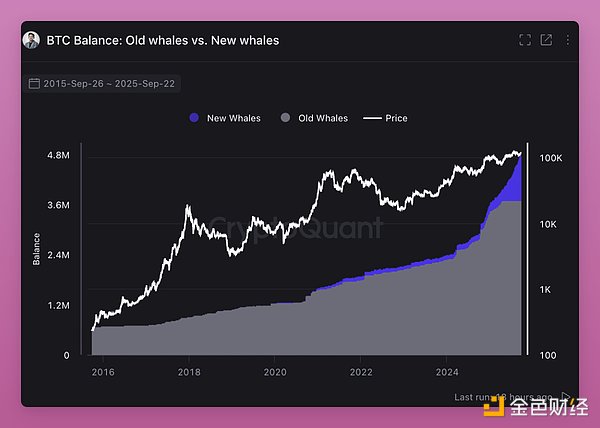

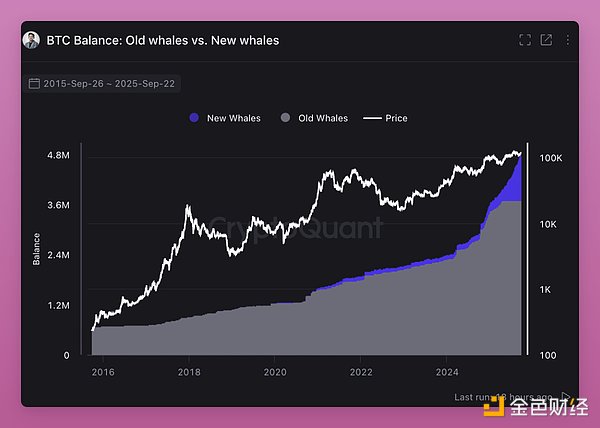

And Ethereum ETFs hold 5.59% of the total supply. All this took just over a year. ETFs have now become the primary buyers of Bitcoin and Ethereum. They are shifting ownership from retail investors to institutions. As you can see from my tweet below, whales are buying while retail investors are selling. More importantly, old whales are transferring their holdings to new whales.

Holdings are rotating. Four-year cycle believers are selling. They expected the same scenario to repeat itself, but a different scenario is unfolding. Retail traders who built positions at low levels are selling to ETFs and institutions. This shift resets the cost basis to a higher level. It also raises the bottom of future cycles because new holders won't sell at a profit. This is the great rotation in crypto. Crypto assets are moving from speculative retail investors to long-term investors. Universal listing standards unlock the next phase of this rotation. Similar regulations for equity-related products in 2019 tripled ETF issuance. This trend is poised to repeat itself in the crypto space. Numerous new ETFs, such as SOL, HYPE, XRP, and DOGE, are on the horizon, providing retail investors with the exit liquidity they need. However, the core question remains: Can institutional buying offset retail selling pressure? If the macro environment remains stable, I believe those who sold in anticipation of a four-year cycle will ultimately buy back in at higher prices. 2. The End of the Era of Universal Rally In the past, the crypto market rose and fell together. Bitcoin took the lead, followed closely by Ethereum, and the rest of the assets followed suit. The surge in small-cap cryptocurrencies stemmed from a downward shift in liquidity along the risk curve. This time, however, not all tokens rose simultaneously. Millions of tokens exist today. New tokens are listed daily on pump.fun, and "creators" are shifting their focus from older tokens to their own meme-based creations. Supply has exploded, while the total amount of retail investor attention remains constant. Because the cost of issuing new tokens is near zero, liquidity has been excessively diluted across a vast array of assets. Tokens with low circulating supply and high fully diluted valuations (FDV) were once all the rage and suitable for airdrops. Retail investors have learned their lesson. They demand tokens that create value or at least have a strong cultural connection (UNI's failure to rise despite strong trading volume is a testament to this). Ansem is right—we have reached peak pure speculation. The new paradigm is revenue-driven because it's sustainable. Applications that have product-market fit and can generate fees will rise, while others will not. Two points stand out in particular: the high fees users pay for speculation and the efficiency advantages of blockchain channels over traditional finance. The former is reaching its peak, while the latter still has room to grow. Murad adds a key point that Ansem fails to grasp: tokens that continue to surge often possess novelty, quirkiness, and a lack of awareness, and are driven by strong communities of belief. I'm someone who's drawn to new and trendy things (like my iPhone Air). Cultural identity can be the difference between survival and failure. A clear mission and vision (even if initially outlandish) can sustain a community until adoption snowballs. I'd put Pudgy Penguins, Punk NFTs, and meme coins in this category. But not all novelty succeeds. Runes, ERC404, and others have shown me how quickly their novelty wears off. Narratives can die before they even reach scale. I believe these perspectives together illustrate the new order: revenue capacity filters out inferior projects, while cultural power supports cognitive biases. Both are important, but in different ways. The biggest winners will be a small number of tokens that can integrate both. 3. The stablecoin order gives credibility to the crypto market. Initially, traders held USDT or USDC to purchase BTC and altcoins. New capital inflows were bullish because they converted into spot buy orders. At that time, 80% to 100% of stablecoin inflows were ultimately used to purchase crypto assets. This situation has changed. Stablecoins have expanded into lending, payments, yield management, treasury operations, and airdrop farming. Some funds never touch spot purchases of BTC or ETH. Yet, it still enhances systemic value—increasing transaction volumes on both L1 and L2 chains, strengthening DEX liquidity, increasing revenue for lending markets like Fluid and Aave, and deepening the expansion of the entire ecosystem's currency market. Payment-first L1 chains are a new trend. The Tempo chain, co-built by Stripe and Paradigm, is built for high-throughput stablecoin payments, equipped with an EVM toolchain and a native stablecoin AMM. Plasma, a Tether-backed L1 chain designed specifically for USDT and equipped with digital banking and credit card services for emerging markets, is pushing stablecoins into the real economy, beyond just transactional use cases. We're returning to the meta-narrative of "blockchain-based payments." The potential impacts are as follows (admittedly, these are still under observation): Tempo: Stripe's distribution network is massive. While it will boost crypto adoption, it may bypass spot demand for BTC or ETH. Tempo could repeat PayPal's mistakes—massive traffic but insufficient value creation for chains like Ethereum. The key question is whether Tempo will issue a token (I believe it will) and how much fee revenue will flow back into the crypto ecosystem. Plasma: Tether already dominates the issuance market. Through its trinity model of chain + issuer + application, Plasma could relegate emerging market payments to a closed ecosystem. This is comparable to the battle between Apple's closed ecosystem and the open internet model championed by Ethereum and Solana. This has triggered a battle with Solana, Tron, and EVM L2 for the default USDT chain. I believe Tron has the most to lose from this, while Ethereum wasn't originally focused on payments. However, protocols like Aave deployed on Plasma pose significant risks to ETH...

Base: The Base chain is the savior of Ethereum's Layer 2. Because Coinbase and Base drive the payments and USDC yield ecosystem through the Base app, they will continue to provide transaction fees to Ethereum and DeFi protocols. While the ecosystem remains fragmented, competition is fierce, which leads to a wider distribution of liquidity.

Regulation is aligning with this trend. The GENIUS Act is pushing countries to join the global stablecoin race.

The US Commodity Futures Trading Commission (CFTC) has just approved stablecoins as tokenized collateral for derivatives. This, in addition to payment demand, is compounded by non-spot demand in the capital market. Overall, stablecoins and emerging stablecoin-specific L1 chains are lending credibility to the crypto sector. Former casinos have assumed geopolitical significance. Speculation remains the primary demand, but stablecoins are clearly the second-largest application scenario in crypto. The winners will be the public chains and applications that can capture stablecoin flows and convert them into sticky users and cash flow. The biggest unknown is: Will new L1s like Tempo and Plasma become leaders in locking in ecosystem value, or will Ethereum, Solana, L2, and Tron be able to fight back?

The next major trading opportunity will emerge with the launch of the Plasma mainnet on September 25th.

4. Digital Asset Treasury: New Leverage and IPO Channels for Non-ETF Tokens

The digital asset treasury truly amazed me.

With every bull market cycle, we discover new ways to leverage tokens. This can drive price increases far beyond spot purchasing power, but the deleveraging process is always brutal. When FTX collapsed, the forced sell-off of CeFi leverage crushed the market.

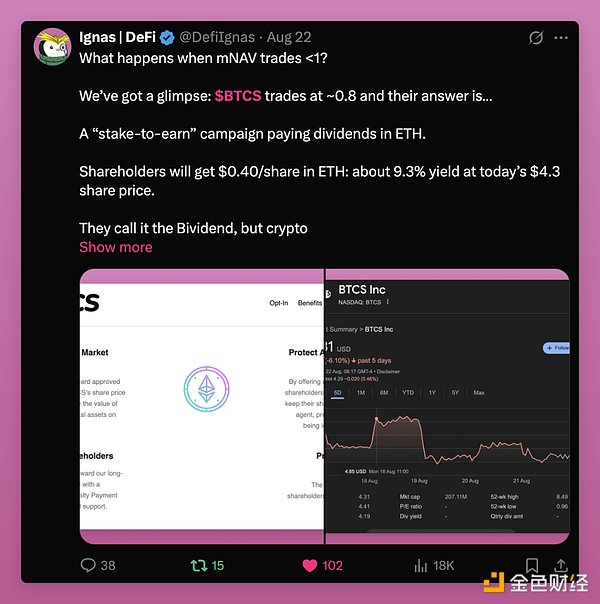

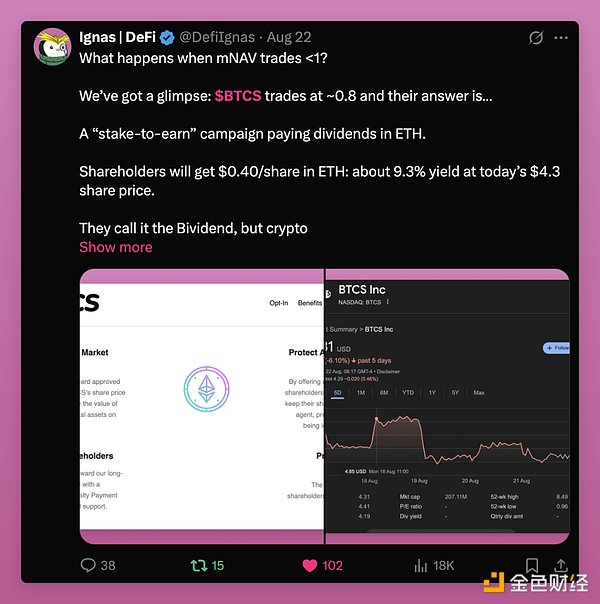

The leverage risk in this cycle may come from DATs. If they issue shares at a premium, raise debt, and concentrate their investment in tokens, this can amplify upward momentum. However, the same structure can exacerbate selling pressure when market sentiment reverses. Forced redemptions or the drying up of share buybacks could trigger significant selling pressure. Therefore, while DATs broaden access and attract institutional capital, they also add a new layer of systemic risk. We've already seen this happen when mNAV is greater than 1: in short, they distribute ETH to shareholders who are likely to sell. Yet, despite the "airdrop," BTCS still trades at 0.74x mNAV. This isn't a good situation.

On the other hand, DAT is a new bridge between the token economy and the equity market. As Ethena founder G said: "My concern is that crypto-native capital is no longer able to push altcoins above their previous cycle highs. If we look at the peak total nominal market capitalization of altcoins in Q4 2021 and Q4 2024, both reached approximately $1.2 trillion. Adjusted for inflation, the cyclical peaks are almost identical. Perhaps this is the upper limit of global retail capital's valuation of 99% of empty projects?" This is precisely the crucial background logic behind DAT. Retail capital may have peaked, but tokens with real businesses, revenue, and users can leverage the much larger equity market. Compared to the global stock market, the entire altcoin market is only a fraction of the size. DAT opens a channel for new capital inflows. Furthermore, since few altcoins possess the expertise required to launch a DAT, the successful ones will once again shift market attention from the millions of tokens available to a handful of Schelling point assets. Another point—that NAV premium arbitrage isn't significant...is actually a bullish signal. With the exception of Saylor (whose capital structure allows for leverage), most DATs are unable to maintain a sustained premium to NAV. The true value lies not in the premium game but in access. Even maintaining 1:1 NAV parity with steady capital inflows is far better than having no access at all. ENA and even SOL's DAT projects have been criticized for being used as "vehicles" for VC token cashing out. ENA is particularly vulnerable due to its massive VC holdings. However, precisely because of the capital mismatch problem, where private equity fund size far exceeds the demand for liquid secondary markets, exiting through DATs is beneficial—VCs can deploy the returned funds into other crypto assets. The key point is that VCs have suffered heavy losses in this cycle due to their inability to exit their investments. If they can cash out and gain new liquidity, they can ultimately fund new crypto innovation and drive industry development. Overall, DATs are a positive for the crypto space, especially for tokens that don't qualify for ETFs. They enable projects with real users and revenue, such as Aave, Fluid, and Hype, to shift risk exposure to the equity market. While many DATs will fail and cause market spillover effects, they also provide an IPO-style channel for ICOs. 5. The RWA revolution means we can build our financial lives on-chain. The total market size of on-chain RWAs has just exceeded $30 billion, a monthly increase of nearly 9%. The chart shows a unilateral upward trend. Government bonds, credit, commodities, and private equity are being tokenized. The escape velocity curve is rapidly rising. RWAs are bringing the world economy onto the blockchain. Several major changes include:

Previously, you had to convert crypto assets into fiat to purchase stocks or bonds. Now, you can stay on-chain, hold BTC or stablecoins, switch to government bonds or equities at any time, and maintain self-custody.

This allows DeFi to break free from the "circular Ponzi scheme" that has been the growth engine of most protocols. It also creates new revenue streams for DeFi and L1/L2 infrastructure.

The core change comes from the collateral paradigm.

Aave Horizon allows you to deposit tokenized assets like the S&P 500 index and borrow against them. However, the total locked-in value of $114 million is still relatively low, indicating that it is still early days for RWAs. (Note: Centrifuge is working to bring official SPX500 index RWAs on-chain. If successful, CFG may perform well—I have already established a position.) Traditional finance makes such operations nearly impossible for retail investors. RWAs ultimately make DeFi a true capital market. They set benchmark interest rates through government bonds and credit, expanding global access—anyone can hold U.S. debt without needing a U.S. bank (a trend that is becoming a focal point of global competition). BlackRock launched BUIDL, and Franklin launched BENJI. These aren't fringe projects; they serve as bridges for trillions of dollars to flow into crypto. Overall, RWAs are the most important structural revolution currently underway. They connect DeFi to the real economy and build the infrastructure for a fully on-chain world. 6. Four-Year Cycle The biggest question for crypto natives is: Has the four-year cycle broken down? Some investors around me have already started selling, anticipating a repeat of history. But I firmly believe that as the crypto order restructures, the four-year cycle will continue. This time is different. I'm betting on this with my own holdings because: ETFs have made BTC and ETH viable assets for institutional investors. Stablecoins have evolved into geopolitical tools, penetrating payments and capital markets. DATs open up equity funding channels for tokens that aren't eligible for ETFs, while also helping VCs exit and fund new projects. RWAs bring the world economy onto the blockchain and establish a benchmark interest rate for DeFi. This is no longer the casino of 2017, nor the frenzy of 2021. This is a new era of structural change and adoption—crypto and traditional finance are merging, but the driving force remains culture, speculation, and belief. The next round of winners won't come from a general rally. Most tokens may still experience a repeat of their four-year cycle of crashes. You need to be selective. The true winners will be those projects that can adapt to macro and institutional changes while maintaining cultural relevance for retail investors.

This is the new order.

Alex

Alex