Author: Shi Hailong, Vice President of the Peony Card Center, Industrial and Commercial Bank of China. With the development of blockchain technology, the cryptocurrency market is diversifying. Stablecoins, a specialized cryptocurrency, achieve value stability by being pegged to fiat currencies or other assets, effectively addressing the challenge of cryptoasset price volatility. With the rapid evolution of the internet paradigm from Web 2.0 to Web 3.0, stablecoins, in addition to blockchain applications, integrate smart contracts, oracle systems, and other technologies, creating a new digital asset and payment settlement system that has a profound impact on the reshaping of the global financial system. This article systematically explains the evolutionary mechanisms and implementation paths of stablecoins from a technical perspective. The Evolution of Internet Paradigms and the Rise of Digital Currency The internet has undergone several paradigm shifts since its inception, from the early "read-only" Web 1.0 to the current "read-write" Web 2.0, and then to the rapidly evolving "read-write-own" Web 3.0. Each transformation has profoundly reshaped the way information flows, user interaction, and value is created. The emergence and development of stablecoins are key products of the transition from Web 2.0 to Web 3.0. 1. Web 1.0: The Internet's Information Portal Era (Read-Only Web). Web 1.0 (from the mid-1990s to the early 2000s) was characterized by read-only nature. The internet primarily served as an information publishing platform, with website content hosted and managed by centralized servers. Content updates were infrequent, resulting in a relatively simple user experience. User participation was also relatively limited, with users primarily serving as content consumers, lacking opportunities for interaction and contribution. Web 1.0 laid the foundation for internet adoption, but its one-way information transmission model limited user engagement and the internet's potential. 2. Web 2.0: The Rise of Social Interaction and the Platform Economy (Read-WriteWeb). Web 2.0 (mid-2000s to present) is the internet as we know it today. Its core concepts are "user-generated content" and "social interaction." With the widespread adoption of broadband internet and the rise of mobile devices, platforms such as social media, blogs, and Wikipedia have rapidly emerged, attracting large numbers of users by offering free services. Users can freely create, share, and interact on these platforms, becoming not just consumers of content but also producers and disseminators. By offering free services, large technology companies have accumulated vast amounts of user data and network effects, forming powerful platform monopolies and absolute control over user data and content. Web 2.0 has driven the prosperity and globalization of the internet, but it has also exposed deeper problems such as excessive centralized power and a lack of user data ownership, laying the groundwork for the rise of Web 3.0. 3. Web 3.0: The Decentralized + User-Powered Era (Read-Write-Owned Web). Currently still relatively unknown, Web 3.0 is the next-generation internet built on blockchain, decentralized networks, and cryptography. Its key features are decentralization, user ownership, and a value-based internet. This shifts control and value from centralized platforms to users, creating a more open, fair, and transparent digital world. Web 3.0's core technologies include blockchain (such as Ethereum), smart contracts, decentralized storage (such as IPFS), and zero-knowledge proofs. Based on the Web 3.0 platform, innovative applications such as DeFi (decentralized finance), NFTs (non-fungible tokens), GameFi (blockchain gaming), DAOs (decentralized autonomous organizations), and the metaverse have rapidly emerged, providing a platform for the rapid development of the digital economy. 4. The transition from Web 2.0 to Web 3.0 has created a strong demand for digital currency. In the traditional Web 2.0 system, financial trust is established through institutions: banks secure funds, clearing houses match and reconcile accounts, and payment platforms maintain transaction links. Users entrust their assets to institutions for management. However, the Web 3.0 world shifts from "institutional-mediated trust" to "protocol-neutral trust." Users no longer entrust their assets to intermediaries for safekeeping, but instead use wallets to independently control their private keys. On-chain assets are transparent and visible, and contracts and algorithms replace the roles of clearinghouses, payment intermediaries, and matchmakers in traditional finance. This fundamentally reshapes the underlying trust and system architecture. In the Web 3.0 era, digital currencies, especially stablecoins, serve as the carriers of value in a decentralized world, providing a stable value foundation for the digital economy. Furthermore, as on-chain assets, they are fully integrated into the logic of smart contracts, becoming an indispensable medium for contract operation. It can be said that without digital currency, Web 3.0 will not be able to achieve true trustless collaboration and autonomous value circulation, and the entire ecosystem will find it difficult to break away from the traditional financial system and move towards decentralization.

Technical Integration for the Evolution of Digital Currency to Stablecoin

As Web 3.0 progresses from concept to application, digital currency has also gradually evolved from the initial use of native digital currencies to stablecoins anchored to real-world value. Its technologies can be primarily summarized as an integrated financial engineering effort combining blockchain technology, smart contracts, and oracle systems.

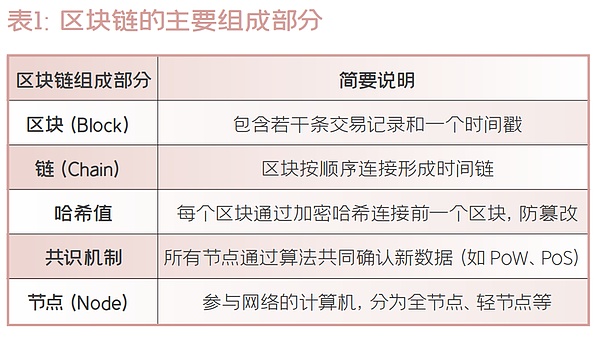

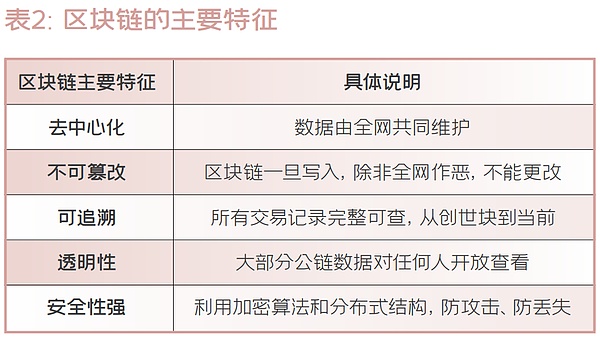

1. Blockchain technology. Blockchain is a distributed database technology that connects data blocks in chronological order through a chain structure to form an unalterable "chain". Each block contains a certain transaction record and the digital fingerprint of the block (hash function). Computers that help update, manage and verify blockchain information are called "nodes". When someone initiates a blockchain transaction, it is broadcast to the entire blockchain network, and each node verifies the transaction. Once verified, the transaction is added and submitted to the ledger, forming a chronological record of transactions. It is essentially a "data ledger". Each node keeps a complete copy, records all data changes, and once written, it cannot be changed.

Since 2008, blockchain has developed into an innovative technology with broad application prospects. It has achieved the immutability and traceability of data, provided a new trust-building mechanism for the digital economy era, made complex decentralized financial applications possible, and laid the foundation for digital currency and stablecoins. Blockchain technology builds a decentralized, immutable, and highly verifiable distributed ledger system. Through consensus mechanisms such as proof-of-work and proof-of-stake, data consistency can be achieved in a trustless environment without the need for traditional financial intermediaries, enabling secure currency issuance, transaction confirmation, and asset ownership verification. Furthermore, cryptographic algorithms further guarantee the authenticity of transaction data and the anonymity of user identities, making blockchain not only the "ledger" for the issuance and circulation of cryptocurrencies but also their "trust infrastructure." For this reason, blockchain is widely regarded as the technical prerequisite and institutional foundation for the independent operation of digital currencies outside the traditional financial system, and the fundamental technical foundation for the emergence and development of stablecoins. 2. Smart Contracts. If blockchain is the foundation of cryptocurrencies, especially stablecoins, then smart contracts are the core tools and automation engines of stablecoins. Popularized by Ethereum, they are the most critical technology for implementing the complex mechanisms of stablecoins. Its primary technical feature is programmability. Smart contracts are program codes deployed on the blockchain that automatically execute when preset conditions are met. They elevate currency from a simple "digital record" to a "programmable asset." All core logic for stablecoin issuance (minting), destruction, collateralization, and liquidation is defined and executed through smart contract code. Second, they offer automation and trustlessness. Once deployed, smart contracts run automatically and precisely without any human intervention. This makes it possible to build automated currency protocols that don't rely on human trust. For example, in the DAI system, the calculation of collateralization ratios and the triggering of liquidation procedures are completely automated by smart contracts, eliminating the risks and biases of human intervention. Third, they offer composability. On smart contract platforms like Ethereum, different smart contracts can be called upon and integrated with each other like Lego blocks. Stablecoins can be seamlessly integrated into various DeFi protocols, becoming the underlying assets for applications such as lending, trading, and derivatives, greatly enriching their application scenarios. The widespread adoption and application of smart contracts is inseparable from the promotion of standardization. The Ethereum platform's ERC-20 standard is currently the most widely used smart contract interface standard. It defines basic functions such as token transfers and balance inquiries, enabling seamless interoperability between tokens from different projects. However, the ERC-20 standard also has limitations, such as a lack of protection against incorrect transfers. Consequently, the Ethereum community continues to propose new contract standards, such as ERC-3643 for compliant tokens and ERC-4626, specifically designed for yield-based tokens. Smart contract execution typically proceeds through three stages: code development, contract deployment, and contract execution. Developers write contract code using Solidity or other blockchain programming languages, deploy it to the network through blockchain nodes, and users or other contracts trigger execution through transactions. The powerful advantages of smart contracts, such as automatic execution, efficiency, and decentralization, provide transparent, fair, and automated execution support and guarantees for the decentralized trading of stablecoins. 3. Oracle system. Oracles serve as a bridge between blockchains and external, real-world data. Blockchains are closed systems, unable to directly access real-time data from outside the blockchain (such as weather, stock prices, and sports results). Oracles, on the other hand, "feed" external information to smart contracts on the blockchain, enabling them to execute their logic based on real-world data. The core function of an oracle is to ensure data reliability and security, preventing smart contract execution anomalies caused by data errors or tampering. The specific working principle is as follows: first, request triggering. When a smart contract on the blockchain requires external data, it issues a data request. Second, data acquisition. After receiving the request, the oracle collects relevant data from various external sources, including APIs (such as financial market data and weather data), sensors (physical data such as temperature and location), and human input. Third, data processing. To ensure data accuracy and reliability, oracles process data through methods such as data aggregation (for example, taking a weighted average of ETH/USD prices from multiple exchanges), signature verification (data is signed by oracle nodes), and decentralized node consensus (data is jointly verified by multiple oracle nodes). Fourth, on-chain transmission. Processed data is written to the blockchain through transactions, becoming on-chain data and available for smart contracts to access, ensuring that the data is verified and recognized by other nodes in the blockchain network. Fifth, contract execution. After receiving external data on the chain, the smart contract executes corresponding operations according to pre-set logic. For example, a DeFi lending contract uses received price data to determine whether liquidation conditions have been met, and if so, automatically triggers the liquidation process. Oracles can be categorized as input or output based on the direction of data flow. Input oracles bring off-chain data into the blockchain; output oracles transmit on-chain information or event results to off-chain systems, triggering external operations or interactions. With the continuous advancement of oracle technology, its application in stablecoins will become more widespread and accurate, further promoting the adoption and innovation of decentralized finance (DeFi). Furthermore, with the introduction of new technologies such as multi-party protocols and zero-knowledge proofs, oracles will become more secure, fast, and transparent. Blockchain applications such as stablecoins will operate within more intelligent and automated systems, forging closer connections with the real world. The value anchoring ability of stablecoins stems from the deep integration of their technical architecture and economic model. Currently, mainstream practices present three distinct technical approaches, each of which addresses the impossible triangle of "currency stability, decentralization, and capital efficiency" through a unique combination of technologies. 1. Fiat-collateralized. Mainstream stablecoins represent a blockchain-based counterpart to traditional credit. Fiat-pegged stablecoins, such as USDT and USDC, utilize a two-tiered technical architecture: off-chain reserves + smart contracts. Their core mechanism relies on 1:1 asset backing through a third-party custodian. This means the issuer must maintain an equivalent amount of fiat assets in a regulated bank account. Once a user transfers $1 to the custodial account, the smart contract automatically mints one stablecoin. Upon redemption, the fiat is returned via token destruction. Furthermore, to address concerns about over-issuance, fiat-custodial projects have implemented monthly audits, disclosing the real-time matching of reserve assets with circulating tokens through third-party accounting firms. Furthermore, a "freeze/unfreeze" permission module has been embedded at the technical level. When there is a judicial order or compliance requirement, a smart contract can be used to urgently suspend token operations on a specific address. 2. Crypto-asset collateralization. This decentralized experiment in algorithmic autonomy, exemplified by the Dai issued by MakerDAO, has pioneered the "overcollateralization + oracle liquidation" technical paradigm. Its core approach is to replace the credit of centralized institutions with code logic. Users are required to collateralize on-chain assets such as ETH and WBTC at an overcollateralization ratio of 150%-200%. When the collateral price drops, causing the collateralization ratio to approach the liquidation threshold (e.g., 130%), the oracle synchronizes real-time off-chain price data, triggering a smart contract that automatically auctions the collateral and destroys the Dai, creating a closed-loop risk management system. To improve capital efficiency, MakerDAO has recently introduced a complex technical module, incorporating staked ETH certificates (stETH) and short-term Treasury bond tokens (such as USDT-B) into the collateral pool. It also developed the "Protocol Stability Module (PSM)." When the DAI price deviates from $1, the PSM is directly exchanged for USDC to implement price correction. The technical advantage of this design lies in the full on-chain transparency of the entire process, with collateral positions, liquidation progress, and auction records all publicly available. However, the issue of capital occupation caused by over-collateralization remains to be resolved. According to DeFiLlama data, the average collateralization ratio of DAI remained above 145% in 2024, significantly higher than that of fiat-collateralized stablecoins. 3. Algorithmically Regulated. Algorithmic stablecoins attempt to achieve value stability through pure code logic. Their technological evolution has evolved from a single mechanism to a complex system. Taking the early Ampleforth (AMPL) as an example, it employed a "rebase mechanism" to automatically adjust the total supply of tokens to maintain a price peg to a target price. When the price exceeded $1, additional tokens were automatically issued and distributed to holders; when it fell below $1, the supply was reduced and deducted. While this supply adjustment was technically feasible, the dynamic fluctuations in account balances conflicted with user trading habits. TerraUST, launched by Terra Blockchain, pioneered a dual-token arbitrage mechanism. When the UST price exceeded $1, users could burn LUNA to exchange for more UST. This arbitrage activity drove supply growth and suppressed prices. Conversely, when the price fell, UST was burned to buy back LUNA. However, the UST crash in 2022 revealed a fatal flaw in this model. When market confidence collapsed, the algorithm was unable to counteract systemic selling, ultimately triggering a "death spiral." Newer algorithmic stablecoins, such as Frax, incorporate hybrid reserve technology, with some positions anchored to stable assets like USDC and some relying on algorithmic regulation, attempting to strike a balance between capital efficiency and security. Today, the technological evolution of stablecoins has transcended the confines of a single currency. Supported by a multi-faceted blockchain ecosystem comprised of "smart contract development platforms (such as Ethereum and Solana) providing the underlying deployment environment, oracle networks (such as Chainlink) ensuring off-chain data reliability, cross-chain protocols (such as Polkadot) enabling multi-chain liquidity interoperability, and KYC/AML modules (such as Elliptic) ensuring regulatory compliance," they are evolving from "blockchain applications" to "digital financial infrastructure." By the end of June 2025, the global stablecoin market capitalization had exceeded $250 billion, with a total trading volume of $4.6 trillion. Their average daily trading volume accounted for 42% of the total cryptocurrency trading volume, making them a critical link between traditional finance and Web 3.0. Simultaneously, stablecoin technology is progressing towards real-world asset (RWA) mapping. According to McKinsey's forecast, by 2030, RWA-based stablecoins are expected to account for over 60% of the global stablecoin market, becoming a "value converter" connecting traditional finance and Web 3.0, and driving the full digitalization of the "asset on-chain - intelligent settlement" process in scenarios such as cross-border payments and supply chain finance. When real assets are digitally mapped through blockchain, stablecoins will not only become the financial infrastructure of Web 3.0, but will also redefine the rules of value circulation in the digital age.

Alex

Alex

Alex

Alex Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Davin

Davin Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian