Cryptocurrency is issued and traded based on distributed ledger technology, with characteristics such as decentralization, globalization, anonymity, and irrevocable transactions. In recent years, it has become an important means for some countries to circumvent financial sanctions, and also provides a new analytical perspective for the development of crypto assets in various countries.

The Russian-Ukrainian conflict that broke out in 2022 and the subsequent US and European sanctions have promoted the transformation of Russia's cryptocurrency policy from "strict supervision to financial transactions, and then to the legalization of cross-border payments and mining", driving Russia's cryptocurrency transactions to resume rapid growth. At present, Russia's cryptocurrency holding rate is 6.06%, which is lower than the global overall level (6.9%), and there is still a large market development space in the future.

However, the speed of development of the Russian cryptocurrency market in the future, and whether it can help Russia break through the sanctions imposed by the United States and Europe, will directly depend on the influence of the following three factors: whether Russia's regulatory policies can be further relaxed, whether the sanctions imposed by the United States and Europe can be effectively extended to the field of cryptocurrency, and whether Russia can effectively prevent the outflow of domestic capital through crypto transactions. In the big picture, it also depends on whether the United States can lead the development of the global stablecoin and cryptocurrency markets, and how stablecoin and cryptocurrency transactions can implement anti-money laundering and anti-terrorist financing supervision.

Article source: Shen Jianguang, Zhu Taihui, Russian cryptocurrency policy evolution and development prospects, International Finance, 2025, No. 3.

Introduction

Cryptocurrency is issued and traded based on distributed ledger technology. It has the characteristics of decentralization, globalization, anonymity, and irrevocable transactions. In recent years, it has become an important means for some countries to circumvent US and European financial sanctions. Since Trump re-elected as US President, the United States and Russia have frequently interacted and bilateral relations have improved, but the US and European sanctions on Russia have not been reduced. In February 2025, the European Council approved the 16th round of sanctions against Russia. Trump decided to extend a series of sanctions against Russia for one year. In early April, bipartisan senators in the US Congress jointly proposed a draft sanctions against Russia, planning to impose a 500% "secondary tariff" on countries that purchase Russian energy.

Among them, the United States and Europe have further increased sanctions against Russian cryptocurrency services. The 16th round of EU sanctions included cryptocurrency exchanges as sanctions targets for the first time, covering cryptocurrency exchanges; in March 2025, the U.S. Department of Justice, together with law enforcement agencies in Germany, Finland and other countries, seized the website domain of the Russian cryptocurrency exchange Garantex and froze its assets. In contrast, the Russian Ministry of Finance and the Central Bank have recently begun to discuss the policy of using cryptocurrency for transaction payments in Russia on the basis of allowing the use of cryptocurrency for cross-border trade payments.

These changes have attracted widespread attention from policy authorities and cryptocurrency markets in various countries. How will the development of Russia's cryptocurrency market evolve? Will cryptocurrency become an effective means to circumvent financial sanctions? To answer this question well, it is necessary to comprehensively analyze the evolution of Russia's cryptocurrency policy in recent years, the supporting role of cryptocurrency transactions in cross-border trade, and what factors will affect the development of its cryptocurrency market. I. Before the Russia-Ukraine conflict: Cryptocurrency was recognized as a financial asset and strictly regulated

(I) Before the Russia-Ukraine conflict, regulatory policies only recognized the property attributes of cryptocurrenciesBefore 2017, cryptocurrencies were strictly regulated. At first, the Central Bank of Russia was very cautious about cryptocurrencies (virtual currencies), believing that cryptocurrencies had large price fluctuations and high financial risks, and was worried that they would be used for illegal activities such as money laundering and terrorist financing. In May 2017, the Central Bank of Russia stated to the public: "Since virtual currencies have been released in the market and because they have no gold reserves and their quantity is not controlled, virtual currencies should be more strictly regulated."In 2018, the Ministry of Finance and the Central Bank had differences in policy direction. The Russian Ministry of Finance led the formulation of the first draft of the "Digital Financial Assets Law", which aims to clarify the regulatory requirements for digital assets (cryptocurrencies) and initial coin offerings (ICOs), and standardize the behaviors and obligations in the creation, issuance, storage and circulation of digital financial assets. However, the policy orientation of the Central Bank of Russia is inconsistent with that of the Ministry of Finance. The Ministry of Finance advocates a looser regulation of cryptocurrencies, while the Central Bank tends to strictly control and even prohibit the issuance and trading of cryptocurrencies. In 2020, the property attributes of digital assets began to be recognized. In July 2020, Russia passed the "On Digital Financial Assets, Digital Currency and Amendments to Certain Legislative Acts of the Russian Federation" (i.e., the "Digital Financial Assets Law", which came into effect in January 2021), which explicitly recognized digital financial assets as property and legalized cryptocurrency transactions in Russia. Despite this, the Central Bank of Russia is not positive about digital asset transactions. In December 2021, the Central Bank of Russia clearly stated in its report that mutual funds are prohibited from investing in cryptocurrencies, warned of the risks associated with cryptocurrencies, and even proposed a comprehensive ban on cryptocurrency mining and trading. (II) The "Digital Financial Assets Law" sets investment and trading rules for cryptocurrencies

First, it clarifies the characteristic attributes of digital financial assets. The bill clearly states that cryptocurrencies (digital financial assets) are digital rights issued, recorded and circulated based on distributed ledger technology, including monetary claims, rights to issued securities, rights to non-public joint-stock companies, and rights to request the transfer of issued securities. At the same time, the bill allows digital financial assets to be used as investment tools, and the 2024 amendment to the bill further allows cryptocurrencies to be used as a means of exchange for the transfer of goods, engineering, services, information and knowledge achievements, etc., but it is prohibited to use them as a means of payment for goods and services or other means of repayment. Second, the issuance rules of encrypted assets are clarified. In terms of licenses, the issuer must be a Russian legal entity and must submit an application to and obtain approval from the Central Bank of Russia. At the same time, the transaction subject must comply with the regulatory provisions of the federal law on "securities market" and "organized transactions". In terms of information disclosure, the issuer must publish a white paper detailing the technical architecture, purpose, total issuance, potential risks, etc. of the tokens, and make public quotations. In terms of the use of smart contracts, it is allowed to use smart contracts to complete the issuance and distribution of digital financial assets, but the content of the smart contracts must comply with legal provisions. Third, the trading rules of cryptocurrencies are clarified. The bill requires that digital financial assets cannot be used as payment tools to prevent them from impacting the ruble and legal currency system; digital financial asset sales transactions must be conducted through digital financial asset exchange operators to ensure the transparency and security of transactions; cryptocurrency exchanges and wallet service providers need to be registered with the Central Bank of Russia, etc., or they can be credit institutions; some high-risk digital financial assets are limited to qualified investors with expertise and experience. In addition, unapproved cross-border digital asset transactions will be restricted to prevent capital outflows and money laundering. Fourth, clarify the regulatory agency for digital financial assets. According to the bill, the Central Bank of Russia, as the main industry regulator, is responsible for supervising the issuance of cryptocurrencies (digital financial assets) in Russia, as well as the registration and access management of cryptocurrency exchange operators, etc. (III) The Central Bank of Russia prohibits the circulation of cryptocurrencies in domestic payments

In January 2022, the Central Bank of Russia issued a consultation document "Cryptocurrency: Trends, Risks and Regulation", which believes that cryptocurrencies have four major risks: cryptocurrency prices are highly volatile, and transactions involve a large number of fraudulent activities; encryption is like dollarization, which affects monetary policy sovereignty; the development of cryptocurrencies will lead to financial disintermediation, thereby affecting the ability of the financial system to serve the real economy; cryptocurrencies are widely used in illegal activities, posing a challenge to the anti-money laundering and anti-terrorist financing system (Bank of Russia, 2022). In response, the Central Bank of Russia proposed a "three prohibitions" proposal: prohibiting Russian legal persons and residents from using cryptocurrencies as a means of payment for goods and services; prohibiting the issuance and circulation of cryptocurrencies in the Russian Federation; prohibiting financial institutions from investing in cryptocurrencies and related financial instruments, and using Russian financial intermediaries and Russian financial infrastructure for cryptocurrency transactions. This shows that although the Digital Financial Assets Law allows cryptocurrencies to be used as financial instruments and traded and circulated through cryptocurrency exchanges and wallet service providers (including credit institutions) registered in Russia (i.e., acting as a means of storing value), they cannot be used for domestic commodity and service payments (i.e., they cannot serve as a means of payment), and at this time, the Russian Central Bank will also strictly supervise in the process of regulatory practice (such as not authorizing credit institutions to carry out cryptocurrency services, not allowing cryptocurrency mining and issuance, etc.). II. After the Russian-Ukrainian conflict: In order to get rid of European and American sanctions, support the use of cryptocurrencies for cross-border payments

(I) US and European sanctions promote the shift of Russian cryptocurrency policyAfter the outbreak of the Russian-Ukrainian conflict, the United States and Europe froze the Russian Central Bank's foreign exchange reserves of about US$300 billion, excluded Russia from the global interbank payment system SWIFT, and gradually extended sanctions to key industries such as energy, finance and defense, greatly limiting the ability of Russian companies, individuals and banks to enter the international capital market. Influenced by this, under the promotion of Russian President Putin, the attitudes of the Russian Central Bank, the Ministry of Finance and other departments have been unified, and the cryptocurrency regulatory policy has accelerated after 2022. Russia's cryptocurrency policy began to shift in 2022. In February 2022, Russia revised the "On Digital Currency (Cryptocurrency)" Act, proposing to determine qualified investors through examinations. Qualified investors can purchase up to $7,000 of cryptocurrency each year, while unqualified investors are limited to $600. At the same time, digital currency (cryptocurrency) operating platforms are required to meet certain capital requirements, such as exchanges retaining at least 30 million rubles of capital, and digital trading platforms or auction platforms retaining at least 100 million rubles of capital. In 2024, Russia allowed cryptocurrencies to be used for cross-border payments. After entering 2024, with the increase in secondary sanctions from the United States and Europe, the payment of Russian imported goods has become more difficult. The problem of delayed payment has caused Russia's import growth rate to continue to decline since the second half of 2023, especially in the first and second quarters of 2024. To this end, Russia has actively promoted the formulation of relevant policies and bills around the international promotion of the digital ruble (CBDC), the legalization of mining, the compliance supervision of exchanges, and the application of blockchain technology. In July 2024, the Russian State Duma officially passed the "Cross-border Payments of Digital Currency (Cryptocurrency) Bill" and the "Crypto Mining Legalization Bill". After the use of cryptocurrencies in cross-border trade payments in Russia is legalized in September 2024, Russian companies can more conveniently use Bitcoin and other digital currencies for cross-border payments (usually using Bitcoin, Ethereum and stablecoins for direct settlement, or converting other countries' currencies into Russian rubles through cryptocurrencies and stablecoins). It is expected that the cryptocurrency inflows into Russia from July 2024 to June 2025 will be higher than the $182.44 billion received in the first 12 months. Correspondingly, Russia's import scale will resume positive growth from the third quarter of 2024 (see Figure 1). Figure 1: Changes in the scale and growth rate of Russia's commodity trade imports(II) Allowing cryptocurrencies to be used for cross-border payments under an experimental frameworkRussia allows the use of cryptocurrencies for cross-border payments. The core content of the "Cross-border Payment of Digital Currency Act" is to allow the use of digital currency (cryptocurrency) for cross-border settlement and foreign exchange transactions within the framework of the experimental legal system. It will take effect from September 2024 and mainly includes three aspects: using digital currency for foreign trade settlement, using digital currency for foreign exchange transactions, and creating a digital currency trading platform based on the "National Payment System". Affected by policy adjustments, the scale of cryptocurrency transactions in Russia has increased. According to Chainalysis data, in 2024, jurisdictions and entities sanctioned by the United States, Europe and other countries received $15.8 billion in cryptocurrencies, accounting for about 39% of all illegal crypto transactions, mainly from Russia. However, the scope of use of cryptocurrencies is more cautious. This "Cross-border Payment of Digital Currency Act" still prohibits the use of digital currency (cryptocurrency) for payment of goods and services in Russia, which is more stringent than the restrictions on the use of cryptocurrencies in Hong Kong, China, Japan and other countries. In 2022, Hong Kong, China amended the "Anti-Money Laundering and Terrorist Financing Ordinance" to clarify that cryptocurrencies/virtual assets can be used as a publicly accepted medium of exchange for the purpose of payment for goods or services, repayment of debts, investment, and provision of rights. In June 2022, Japan's newly revised "Fund Settlement Law" clearly stated that cryptocurrencies can be "used to unspecified persons when purchasing, renting items or receiving services." At the same time, stablecoins are prohibited from being used for domestic payments. In order to prevent and respond to the financial risk shocks brought by private stablecoins, the risk of ruble substitution, and the risk of illegal transactions, Russia also requires that stablecoins cannot be used for domestic payments. In July 2024, the Central Bank of Russia issued an analytical report "Stablecoins: Experience in Use and Supervision", which clearly stated: "Whether considering individual supervision or general supervision, it must be taken into account that stablecoins do not have the characteristics of national currency as a universal means of payment. Therefore, it is unacceptable to use stablecoins as a means of payment between Russian residents. In Russia, the only means of payment is the national currency-the Russian ruble" (Bank of Russia, 2024). (III) Legalization of cryptocurrency mining activities in RussiaThe Russian "Crypto Mining Legalization Act" will be implemented from November 2024, formally incorporating cryptocurrency mining activities in Russia into the legal framework and operating in compliance with government supervision. The key points are: legal persons and individual businesses registered with the Russian Ministry of Digital Development can legally carry out digital currency mining (including participating in mining pools), while unregistered entities can only operate within energy consumption limits; but cryptocurrency mining activities are prohibited in certain areas of Russia (mainly areas with power shortages). In February 2025, the Russian Ministry of Energy proposed that it plans to establish a comprehensive cryptocurrency mining equipment registration system, requiring all miners to use registered hardware, so as to more effectively monitor domestic mining activities and the development of various regions. In the same month, the Russian State Council Energy Committee announced that it plans to build a dedicated power station for cryptocurrency mining activities, which will not be connected to the public power grid to solve the "out of control" state of mining electricity in some parts of Russia. (IV) Actively promote the development of domestic cryptocurrency exchangesStarting from August 2024, the Russian government actively promoted the establishment of two major cryptocurrency exchanges in Moscow and St. Petersburg to promote the application of cryptocurrency in international trade. This move also provides a feasible cross-border payment solution under the background of European and American sanctions, provides a reliable trading platform for Russia's international trading partners, provides more flexible and diversified payment options for Russia's foreign trade enterprises, and helps Russian enterprises and individuals continue to conduct trade activities with the international market.There is a view that another purpose of Russia's launch of two cryptocurrency exchanges is to promote the use of BRICS stablecoins (a stablecoin pegged to the RMB or the currencies of BRICS countries) in cross-border payments, thereby reducing transaction costs and dependence on the US dollar, and strengthening economic ties between the "BRICS countries" (Ai Ying, 2024). However, this view lacks policy support from China. China currently believes that cryptocurrency (virtual currency) does not have the same legal status as legal currency, virtual currency-related business activities are illegal financial activities, and overseas virtual currency exchanges providing services to domestic residents through the Internet are also illegal financial activities. 3. Future Outlook: Policies drive rapid development, but there are still three major uncertainties

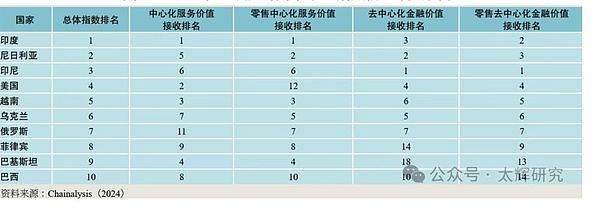

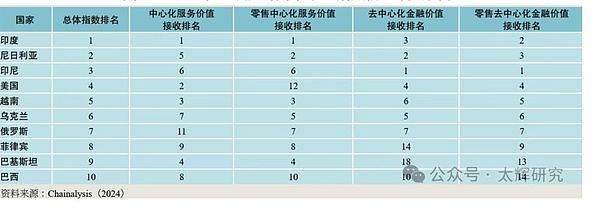

Policy changes have led to the resumption of growth in Russian cryptocurrency transactions. After 2022, Russia gradually clarified the scale of cryptocurrency purchased and held by investors and supported the use of cryptocurrency for cross-border trade settlement, and Russia's cryptocurrency transactions resumed rapid growth. According to Chainalysis statistics, from July 2023 to June 2024, the inflow of cryptocurrency into Russia reached US$182.44 billion, an increase of more than US$20 billion; Russia's ranking in the Global Cryptocurrency Adoption Index rose to 7th place, up 6 places from 2023 (see Figure 2). Figure 2: Top 10 Countries in the Global Cryptocurrency Adoption Index in 2024

Russia's cryptocurrency market still has a lot of room for development. According to Triple A (2024), as of 2023, Russia's cryptocurrency holders will be 8.75 million, and the penetration rate (the proportion of holders to the total population) will be 6.06%, which is lower than the global cryptocurrency penetration rate of 6.9%. The global cryptocurrency market is currently developing rapidly. In 2024, the number of global cryptocurrency holders increased by 34%, and the market value of cryptocurrency increased to 3.27 trillion US dollars, an increase of nearly 100%. At the same time, before the Russian-Ukrainian conflict, Russia was already an active region for cryptocurrency transactions, and was the world's second largest cryptocurrency mining country, second only to the United States. These factors indicate that there is still a lot of room for development in the Russian cryptocurrency market in the future. However, in the next few years, the specific development speed of the Russian cryptocurrency market will also depend on the impact of the following three uncertain factors:The first uncertainty factor: Can the policy differences between the Russian Ministry of Finance and the Central Bank be resolved?

Cryptocurrency is currently accelerating its integration with the traditional financial system, especially the rapid expansion of the application of stablecoins in cross-border payments (see "Ten Years of Stablecoin Development: Trends, Applications and Prospects" for details). At present, the Russian Ministry of Finance advocates the standardized use of cryptocurrencies for payment and settlement in Russia, but the Russian Central Bank is worried that cryptocurrencies will impact the dominant position of the ruble in Russia. It is unwilling to open up the application of cryptocurrencies in domestic payments in Russia, and opposes the use of stablecoins such as USDT and USDC as a means of payment in Russia. This is also a common problem that many major countries' monetary authorities are concerned about cryptocurrencies. However, in the case of Russia's simultaneous promotion of central bank digital currency (digital ruble), it is still uncertain whether it will be allowed to issue ruble stablecoins for payment and settlement in Russia in the future. On March 5, 2025, the Russian Ministry of Finance disclosed that the Russian Ministry of Finance and the Central Bank discussed launching cryptocurrency transactions in Russia within the experimental legal framework. Transaction participants will belong to the category of "super qualified" investors, and the identification standards are still being formulated. Although this policy is still in the discussion stage between the Ministry of Finance, the Central Bank and market participants, with the continuous expansion of US and European sanctions, the possibility of the Russian Ministry of Finance and the Central Bank reaching a consensus on the use of cryptocurrency transactions in the country has increased. The second uncertainty factor: whether the US and European sanctions on cryptocurrency trading service agencies are effective

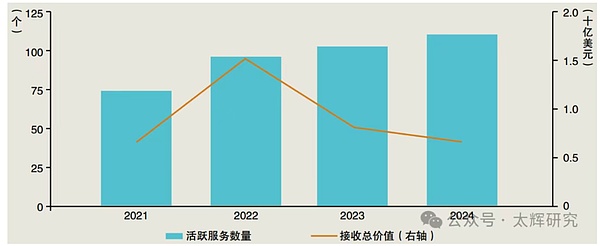

After the outbreak of the Russian-Ukrainian conflict, the United States, the European Union, the United Kingdom, Japan, South Korea and other countries also restricted and prohibited the provision of cryptocurrency trading services to Russian citizens and Russian IPs. Major global cryptocurrency exchanges such as Binance, FTX, and Coinbase blocked Russian trading accounts and addresses in accordance with US and European sanctions. In September 2023, Binance sold all its Russian business to the exchange CommEX. Recently, the United States and Europe have also increased their direct sanctions on Russian cryptocurrency transactions. In February 2025, the EU Council approved the 16th round of sanctions against Russia, which included cryptocurrency exchanges in the sanctions targets for the first time, and explicitly required sanctions against Garantex, a cryptocurrency exchange serving Russia. In March, the U.S. Department of Justice, together with law enforcement agencies in Germany, Finland and other countries, seized Garantex's website domain name and froze its assets in the name of money laundering. Affected by this, stablecoin issuer Tether froze about $28 million of USDT funds of the exchange, and some other cryptocurrency exchanges also announced their withdrawal from the Russian market. However, after being seized, Garantex is also seeking solutions to circumvent sanctions, and recently transferred its liquidity and customer deposits to Grinex, a newly established trading platform in Russia. The main impact of U.S. and European sanctions is on exchanges that have implemented customer identity verification procedures (KYC) for users, while the number of exchanges without KYC is increasing, which has weakened the impact of U.S. and European sanctions to a certain extent (see Figure 3). However, while exchanges without KYC help Russia circumvent U.S. and European cryptocurrency trading sanctions, they will also promote money laundering and illegal crypto trading activities. In addition, in addition to setting up cryptocurrency exchanges in Moscow and St. Petersburg, Russia is also supporting the development of related cryptocurrency exchanges. For example, Bitbanker, a cryptocurrency trading platform currently established in Russia, has set up offices in Russia, the United Arab Emirates, Kyrgyzstan and Armenia, providing cryptocurrency purchase, exchange, storage, investment and payment services for enterprises and individuals. Figure 3: Number of Russian-language exchanges without KYC and the scale of funds acceptedSource: Chainalysis (2025). The third uncertainty factor: Can we prevent capital outflows through cryptocurrency transactions?

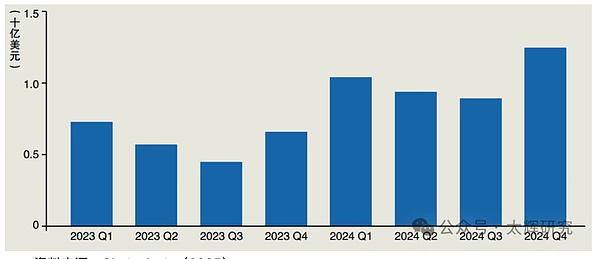

The openness and global nature of cryptocurrency transactions will help Russia ease the financial sanctions imposed by the United States and Europe, but at the same time, Russia also needs to guard against illegal financial activities and domestic capital outflows. Judging from Iran's experience in recent years, cryptocurrency has provided a new payment channel for cross-border trade, but geopolitical instability and the sharp depreciation and frequent fluctuations of Iran's national currency, the rial (IRR), have led to a high incidence of capital outflows from Iran. In 2024, Iran's capital outflows increased to US$4.18 billion, a year-on-year increase of about 70%. For this reason, in December 2024, Iran suspended withdrawal services for Iranian cryptocurrency exchanges (see Figure 4). Figure 4: Changes in the scale of capital outflow from Iran from 2023 to 2024Source: Chainalysis (2025). From the perspective of supervision and practice, Russia may take two approaches to prevent capital outflow through cryptocurrency transactions. On the one hand, in terms of supervision, we should strictly implement the license supervision of cryptocurrency transactions and the "travel rule" proposed by the Global Financial Action Task Force (FATF), and technically prevent money laundering risks and capital outflow risks; on the other hand, we should actively promote the stable development of the domestic economy and the stability of the value of the national currency, and fundamentally weaken the basis for capital outflow. Fourth, Conclusion and Enlightenment

The decentralization, globalization, anonymity, and irrevocable transaction characteristics of cryptocurrency have become an important means for some countries to circumvent US and European financial sanctions in recent years, and also provide a new analytical perspective for the development of crypto assets in various countries. The outbreak of the Russian-Ukrainian conflict in 2022 and the subsequent increase in US and European sanctions have promoted the transformation of Russia's cryptocurrency policy from "strict supervision to financial transactions, and then to the legalization of cross-border payments and mining." This policy shift has promoted Russia's cryptocurrency transactions to resume rapid growth, and its ranking in the 2024 global "Cryptocurrency Adoption Index" has also risen to 7th place, and has become an important tool to ease US and European financial sanctions. The current cryptocurrency holding rate in Russia is 6.06%, which is lower than the global average (6.9%). There is still a lot of room for market development in the future. However, the development speed of the Russian cryptocurrency market and whether it can help Russia break through the sanctions imposed by the United States and Europe will depend on the combined influence of three factors: whether Russia's regulatory policies can be further relaxed, whether the sanctions imposed by the United States and Europe can be effectively extended to cryptocurrency transactions, and whether Russia can effectively prevent the outflow of domestic capital through cryptocurrency transactions. At present, the development of these three factors is still in the early stages, and the subsequent evolution of the situation needs to be continuously observed. At present, major countries in the world are actively formulating regulatory laws and regulations to regulate the innovative development of cryptocurrencies, aiming to promote the benefits of cryptocurrencies and avoid harm and improve the quality and efficiency of financial services. The development of cryptocurrencies is ushering in a more certain policy environment. Following the European Union, the United Arab Emirates, Singapore, Russia, Hong Kong, China and other countries and regions, Trump shifted the main line of the US cryptocurrency policy to "supporting innovative development" after taking office. While accelerating the formulation of stablecoins and cryptocurrency regulations, he actively established a "strategic bitcoin reserve and digital asset reserve" (see "The shift and impact of US cryptocurrency regulatory policies" for details). As the country with the largest crypto market in the world, the US policy adjustment has produced a great driving effect. Since 2025, the UK, Australia, South Korea, Japan, India, Turkey, Argentina, Panama, Cayman Islands and other countries have announced legislation/legislation plans for cryptocurrency regulation. Stablecoins and cryptocurrencies are decentralized and have natural global attributes. Under the general trend that major countries around the world have recognized the legitimacy of cryptocurrencies through regulatory legislation and promoted the compliance development of cryptocurrencies, whether Russia and other countries can use cryptocurrencies to circumvent US and European financial sanctions and alleviate the influence of US financial power, in addition to the influence of the above three factors, it also depends on two important factors: one is whether the United States will dominate the development of the global stablecoin and cryptocurrency market (see "Zhu Taihui | The essence and impact of the US "Strategic Bitcoin Reserve"), and the other is how the anti-money laundering and anti-terrorist financing supervision of stablecoin and cryptocurrency transactions will be implemented (see "Research on the framework, theory and trend of global stablecoin supervision"). Under this situation, my country not only needs to pay attention to the model and effect of Russia's use of cryptocurrencies to circumvent US and European financial sanctions, but more importantly, the development trend of global stablecoins and cryptocurrencies, and the impact of regulatory policies of major countries on the global monetary system and financial landscape. Next, it is recommended that my country's policy makers closely track and grasp the progress and results of Russia's use of cryptocurrencies to circumvent financial sanctions, the development and changes of the global cryptocurrency market, and the policy evolution of cryptocurrency regulation in various countries. While comprehensively analyzing the potential risks and challenges of stablecoins and cryptocurrencies, we should deeply evaluate the synergistic effects of RMB stablecoins, digital RMB, and digital currency bridges on promoting the RMB internationalization strategy, and timely adjust my country's stablecoin and cryptocurrency management policies.  Clement

Clement

Clement

Clement Catherine

Catherine Hui Xin

Hui Xin Kikyo

Kikyo Joy

Joy Davin

Davin Joy

Joy Catherine

Catherine Hui Xin

Hui Xin Hui Xin

Hui Xin