We are entering the era of tokenization of the market. Slowly but surely, all assets will move to the chain, challenging the status quo of global capital markets for 30 years. This is especially true given that the RWA meta is at the intersection of two trends that are shaping the world today: everything will be financialized and digitized. Financialization:In today's world, finance is borderless, and the economy is becoming increasingly borderless, with individuals being able to transfer asset ownership around the world. Everything has a market, everything has a price, and everything becomes tradable. Therefore, it becomes increasingly meaningful to establish a more efficient, transparent, fair, and open market mechanism.

Digitalization:Our world is increasingly becoming digital. We have connected phones, watches, and soon, connected brains. In this sense, it seems that the next logical step is to migrate proof of asset ownership to the blockchain network.

In this sense, RWA is well positioned to seize the opportunities brought by these two trends.

(3)Main Challenges

There is no doubt that real-world assets on-chain have very interesting properties, but they also bring many challenges. These challenges mainly revolve around:

Regulation:Currently, there is no clear answer as to where to establish a tokenized asset market in the absence of complex regulation. However, as the world's view on crypto continues to evolve over the years, this may change.

Liquidity:Providing the right market structure for liquidity and market making for real-world assets can be challenging, especially for highly illiquid markets that trade around the clock.

Education: It takes a long time for everyone to understand the true value proposition of bringing real-world assets to the chain, because it may be difficult to understand and master blockchain technology and its pros and cons at the beginning.

2. The evolution of RWA

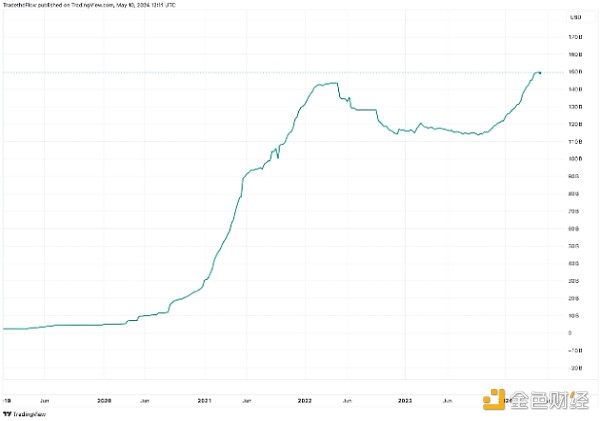

(1) USD-pegged stablecoins

Fiat-backed stablecoins are the first killer use case for the tokenization of real-world assets, and this market has grown significantly in recent years. Today, the two largest fiat-backed stablecoins are Circle's USDC and Tether's USDT, with a total market value of more than $130 billion. At the beginning of 2020, their total market value was around $5 billion.

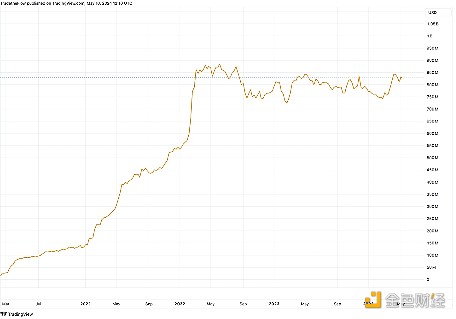

(2) Commodity-backed tokens

The tokenization of precious metals has also become another popular application of RWA. For example, Tether Gold (XAUT) or PAX Gold (PAXG), which are tokens backed by physical gold. Although this is a relatively new market, it is developing rapidly, and the market capitalization of XAUT and PAXG is about US$840 million in total.

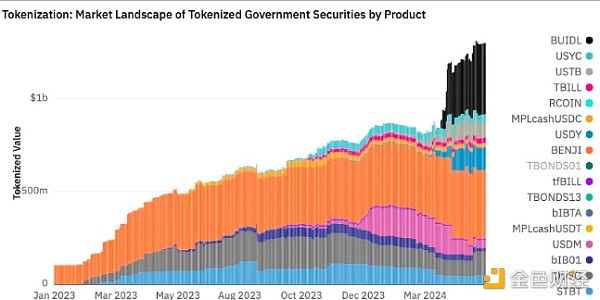

(3)Tokenized Treasury Bonds Are Growing Rapidly

The last big trend in RWA is the tokenization of U.S. Treasury bonds. According to 21co data, we noticed that the market value of this field has grown very fast, reaching more than $1.3 billion. But what is more noteworthy is that large TradFi institutions are entering this market. For example, Franklin Templeton’s BENJI token has accumulated approximately $370 million in deposits, while BlackRock’s BUIDL token has received more than $380 million in deposits.

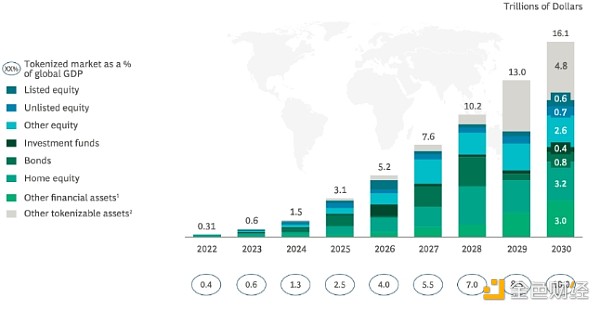

(4) The beginning of the next chapter

This tokenization trend has just begun and is expected to continue to grow rapidly. According to the Boston Consulting Group, the global market size of tokenized financial assets will reach 16 trillion US dollars by 2030, which may eventually become the long-awaited bridge between TradFi and DeFi, creating the next generation of markets.

We can imagine a future where not only purely financial assets, but almost all assets that are easy to tokenize - from luxury watches to art to real estate - will be tokenized on the blockchain. This is the financial world of the future.

3. Seize the opportunity

Seeing this, I am sure you are now asking yourself: "Okay, I get it, but how can my portfolio take advantage of this new trend?" Don't worry, I have prepared a list of RWAs for you that should help you.

But I will remind you that at present, the crypto world is highly speculative and must be tread carefully. So, as always, what follows is not a prediction, just my thoughts. As data becomes more accessible and noise is isolated over time, ideas can change a lot.

Note that this is not an exhaustive list, just a few projects I think are worth watching. There are many more of these projects, and I obviously left many out.

Ready? Now let’s look at a few projects you might want to add to your watchlist:

(1) Chainlink (LINK)

Chainlink recently updated their description of the network to call it “a universal platform for the future of global on-chain markets”. As a bridge between real-world data and blockchain, Chainlink is key to enabling the tokenization of real-world assets.

I wrote the following tweet a while ago, but today it rings truer than ever. Currently, Chainlink is actively working with Swift, The DTCC, and some of the world’s largest banks, and these are not hype partnerships. Very real pilots and case studies prove that the technology is already being implemented, and it’s only a matter of time before you see full-scale on-chain RWAs.

In the long term, I remain very bullish on Chainlink.

(2) Ondo Finance (ONDO)

Ondo is building the next generation of financial infrastructure to improve market efficiency, transparency, and accessibility. It allows retail and accredited investors on the chain to enter the bond market through products such as USDY (a tokenized note backed by U.S. Treasuries) and OUSG (short-term U.S. Treasuries).

ONDO is the best performing emerging token in 2024. I think this project is very interesting and has had strong momentum recently. But it may be a little too hyped and overvalued right now. Nonetheless, it is definitely worth adding to your RWA watchlist.

(3)Pendle Finance(PENDLE)

Pendle is a decentralized financial protocol that supports users to tokenize and sell future earnings. It is an innovative tokenization model solution that provides users with flexible and dynamic yield management options.

It is also a very good protocol for earning points.

(4)TrueFi(TRU)

TrueFi is a modular infrastructure for on-chain credit that connects lenders, borrowers, and portfolio managers through smart contracts governed by TRU.

(5)Mantra Network(OM)

Mantra is a security-first RWA L1 chain designed to comply with real-world regulatory requirements.

(6)Polymesh Network(POLYX)

Similar to Manta, Polymesh is an institutional-grade permissioned blockchain built specifically for regulated assets.

(7)Centrifuge(CFG)

Centrifuge provides infrastructure and ecosystem for tokenizing, managing and investing in a complete and diversified portfolio of real-world assets. The asset pool is fully secured, investors have legal recourse, and the protocol is asset class agnostic. The asset pool covers structured credit, real estate, US Treasuries, carbon credits, consumer finance, etc.

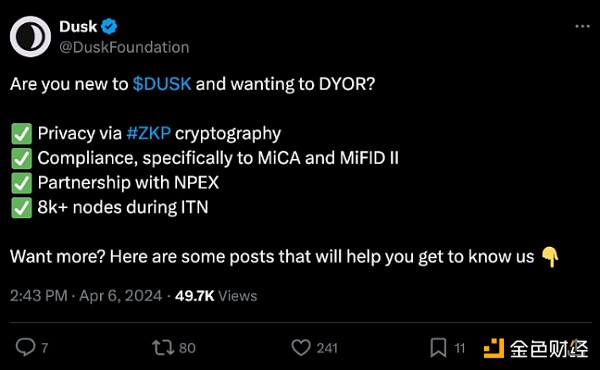

(8)Dusk Network(DUSK)

Dusk is a permissionless, ZK-friendly L1 blockchain protocol focused on the tokenization of real-world assets.

(9)Clearpool(CPOOL)

Clearpool is a decentralized financial ecosystem that aims to bring the first ever permissionless market for unsecured institutional liquidity.

(10)Polytrade(TRADE)

This is a real-world asset market. It brings together tokenized treasuries, credit, stocks, real estate, commodities, as well as collectibles, art, intellectual property, creator royalties, and luxury goods from all chains onto one platform.

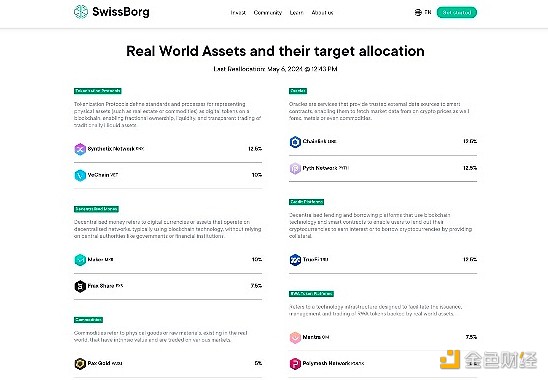

The easiest way to participate in this trend:

If you don’t want to spend too much time researching and monitoring different projects, you have another option: SwissBorg’s RWA Thematic.

You can think of it as a basket of RWA tokens, and the token selection and token allocation will automatically rebalance for you based on market conditions. It's like an ETF, but for the RWA universe.

This is a way to get exposure to the entire RWA universe, quickly and easily, with just one click.

These are your alpha opportunities.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance