This article is based on the speech given by Cobo Lily Z. King on June 10, 2025 at the RWA event of Junhe Law Firm in Hong Kong, entitled "Real World Asset Practice in an Uncertain World".

"Every asset - every stock, bond, and fund - can be tokenized, which will bring about an investment revolution." This is a sentence from Larry Fink, Chairman and CEO of BlackRock. Larry Fink's vision that everything can be tokenized not only depicts a technical possibility, but also foreshadows a profound change in the financial field. The time, place and occasion when Larry Fink said this is more important than the sentence itself. This sentence appeared in BlackRock's annual letter to all investors on March 31 this year. However, in BlackRock's annual letter last year, stablecoins, RWA, tokenization, digital assets, these most popular words in the market this year, were not mentioned at all. The only thing related to digital assets was BTC's ETF. This year's annual letter from BlackRock is shouting for the democratization of finance brought by tokenization.

Why do so many bigwigs, including Larry Fink, choose to discuss real-world assets (RWA) at this moment? Some people say that it is because the income on the DeFi chain is not good, so everyone looks for income from the real world. Some people say that because RWA is the only hot spot now, whoever touches it will rise, whether it is currency or stock. Others say that there was also a RWA craze in 2017-2018. At that time, it was called ICO, which was a trend. Some people also say, why analyze so much, if you don’t do RWA, you will almost be out of work!

We may still need to understand the ins and outs of this RWA trend so that we can make the right choice in the next 6-12 months, so that RWA can really take off in Asia and occupy a place in the subsequent global competition.

Today, the world is undergoing a huge change in the macro landscape. For the first time in decades, we are in a world full of geopolitical uncertainty, trade wars and capital controls, and the fragmentation and even weaponization of the global financial system. Although the US dollar is still strong-but countries are seeking to hedge risks, and cross-border capital flows are being more strictly controlled.

Under such circumstances, global capital will naturally look for faster, cheaper, and more open channels for flow. At the same time, digital asset-related policies are also catching up. Both parties in the United States are promoting stablecoins and tokenization policy frameworks, and tokenization in Asia is no longer a niche experiment - digital assets have risen to a national strategy. Finally, the technical support level is also gradually maturing. In the past 12 to 18 months, we have seen tremendous progress: transaction fees on Tron, Solana, Base, and various Layer 2 chains are almost zero, the final confirmation time of stablecoin chain transactions has reached sub-seconds, and the user experience of digital wallets is rapidly improving - such as abstracting gas fees, one-click approval, and institutional-level banking experience custody services.

So, why is Larry Fink mentioning RWA now? Not because the hype cycle has arrived, but because the world needs it more than ever before - a way and vision to efficiently, compliantly, and globally connect traditional finance to future finance.

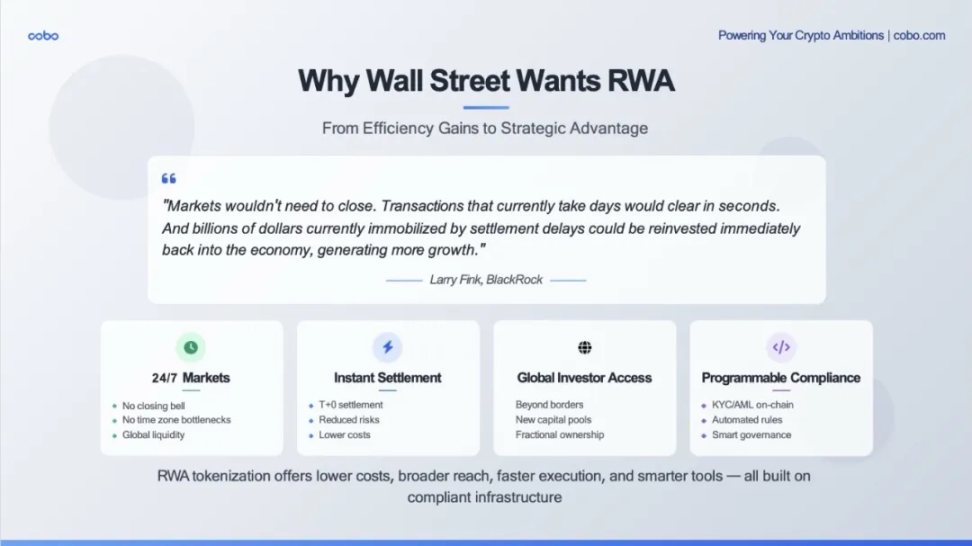

In Larry Fink's view, Wall Street needs to reduce costs and increase efficiency. Simply put, real world assets (RWA) can make the market faster, more streamlined, and more global-and it does not touch the existing rules. Wall Street is not encrypted for encryption, but to improve the infrastructure of the existing capital market.

First is the issue of efficiency. The settlement cycle of traditional finance such as bonds and private credit is slow and expensive, and the operation process is cumbersome. In contrast, RWA has achieved the following after being put on the chain:

Instant settlement-T+0, instead of T+2 or even longer.

24/7 liquidity - no closing time, no time zone restrictions.

Built-in auditability - the ledger is real-time and transparent.

Large institutions have seen the potential for cost reduction and efficiency improvement and acted quickly. Large institutions including BlackRock and Franklin Templeton have launched large-scale tokenized treasury bonds on the blockchain, which can be settled on the chain and pay out returns daily through smart contracts. These are no longer experiments - they are new financial infrastructures that are in operation.

The second is the issue of reach. Tokenized assets can reach investors that traditional channels cannot reach - especially emerging markets or non-traditional investor groups. For example:

Tokenized treasuries launched by Ondo, Matrixdock, and Plume are being purchased by DAOs, cryptocurrency vaults, and stablecoin holders in Asia, Latin America, and Africa—groups whose KYC is a strong credit asset with stable returns that traditional brokers may never be able to touch.

Some real estate tokenization projects in the UAE and the United States have achieved fragmented ownership and global distribution subject to compliance thresholds, which was simply not feasible before tokenization.

RWA not only reduces friction, but also expands the market.

Finally, programmability. This is where tokenized assets are fundamentally more powerful, with the ability to embed business logic into the asset itself:

compliant transfer rules

embedded yield payments

automatic rebalancing

even embedded governance

Cantor Fitzgerald (whose CEO is the current US Secretary of Commerce and who has a deep relationship with Tether) recently partnered with Maple Finance to launch a $2 billion Bitcoin-collateralized credit facility - using smart contracts to automate parts of the loan structure and risk monitoring. This heralds the beginning of a larger change: financial products that are not just digital, but smart - they can be traded globally, have compliance built into their design, and can be instantly integrated into any digital portfolio.

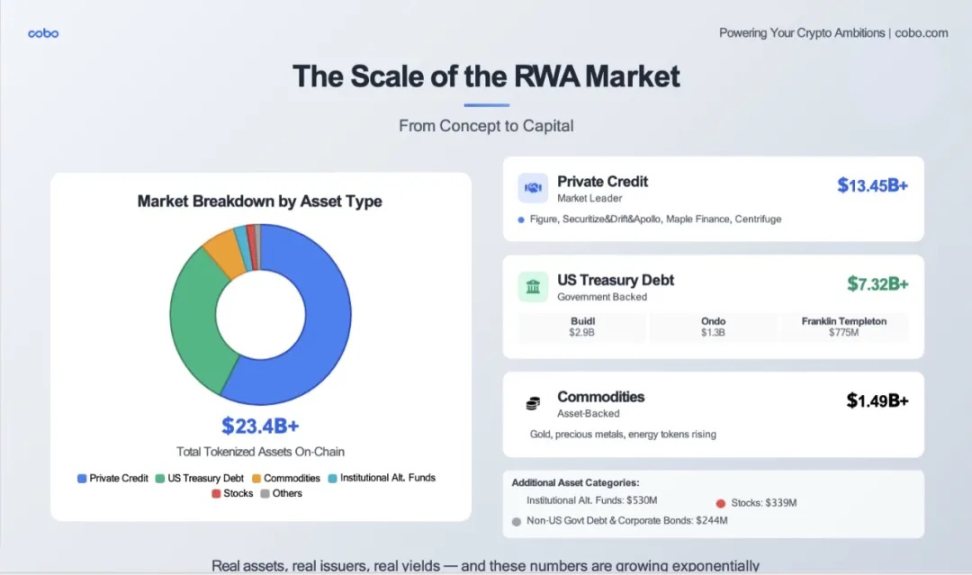

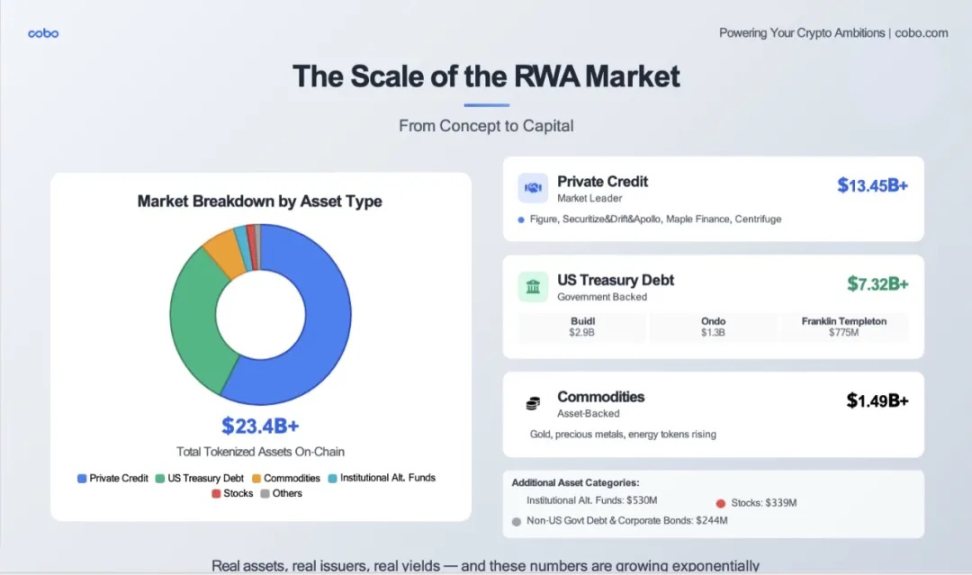

RWA is in full swing, and the specific numbers in the market can tell us whether RWA is still a marginal experiment or has already gone mainstream.

As of June 9, the total value of tokenized real-world assets (RWA) on public blockchains has reached nearly $23.4 billion. This is only the part that can be tracked. The on-chain asset products include U.S. Treasuries, corporate credit, real estate, various funds, and even commodities. $23.4 billion accounts for about 10% of the size of stablecoins, 0.7% of the entire Crypto market, and the market value ranks 10th or 11th among all tokens.

Further analysis of the data leads to several observations:

? Private credit scale exceeds national debt scale

The largest scale of Figure's core products is $12 billion (home equity revolving credit, investor mortgages, cash-out refi). From the birth of the loan to the transfer between institutions, the Provenance blockchain (Cosmos) "moves" institutional-level home loans to the chain, and completes the transfer and settlement of ownership/income rights on the chain. Each loan will be minted into a digital eNote and registered in the Digital Asset Registration System to replace MERS registration and manual custody verification, obtain an on-chain identity, and can be sold, pledged or securitized immediately. 90-95% of Figure's existing loans already exist in the form of on-chain eNotes. This process eliminates paper bills, MERS registration fees, and manual custody verification, reducing friction costs by more than 100 basis points per loan and shortening the time it takes to get funds to your account from weeks to days.

Securitize works with Drift Protocol to bring Apollo's $1 billion diversified credit fund to the chain.

To date, Maple Finance has issued more than $2.5 billion in tokenized loans.

Centrifuge is supporting real-world credit pools for DeFi protocols such as Aave and Maker.

? Tokenized government bonds have become a trend

BlackRock's BUIDL fund: with a total management scale of US$2.9 billion, it is currently leading the way.

Ondo has a scale of US$1.3 billion, and Franklin Templeton's BENJI fund has a tokenized scale of approximately US$775 million.

Matrixdock and Superstate have pushed the scale of this category to more than US$7 billion.

These are not crypto-native experiments, but mainstream financial institutions using blockchain as infrastructure to settle and distribute government bonds.

? Commodity futures tokens are an earlier attempt than treasury bonds, and have a certain first-mover advantage.

?Fund-based RWAs, including real estate funds, are catching up strongly.

In the UAE, MAG Group (one of Dubai's largest developers), MultiBank (the largest financial derivatives trader) and Mavryk (a blockchain technology company) announced a $3 billion partnership to put luxury properties on the chain.

Platforms such as RealT and Parcl in the United States are allowing retail investors to buy fragmented shares of income-generating properties - the income is distributed directly to wallets.

These asset tokens are income-generating, tradable, and legally enforceable assets, which are particularly attractive in today's market environment - they generate income, have low volatility, and are now within the reach of stablecoin holders, DAOs, and financial executives of fintech companies.

Based on the above analysis, we believe that tokenized RWA is no longer just a concept - it is already a market: real assets, real issuers, real returns, and these numbers are compounding.

Let's take a look at some specific and real RWA project cases, especially the RWA practices in Hong Kong and Asia: Five representative RWA projects, covering different stages and models from traditional banks to technology companies, from gold to new energy, and from pilot to formal operation.

1. HSBC Gold Token

This is a typical case of traditional banks entering the RWA field

Key insights: HSBC chose a private chain, focused on retail customers, and avoided the complex secondary market

Strategic significance: Banks are more concerned about compliance and risk control rather than maximizing liquidity

Illustration of the problem: Traditional financial institutions may first choose a closed ecosystem when testing the waters

2. Longxin Group × Ant Digital (new energy charging piles)

This represents China’s RWA exploration in the field of “new infrastructure”

The financing scale of RMB 100 million proves the recognition of institutions for the tokenization of physical assets

Key points: It is still in the sandbox stage, indicating that supervision is proceeding cautiously

Investor composition: Domestic and foreign institutions + family offices, showing the interest of cross-border capital

3. GCL Energy Photovoltaic Power Station RWA

Larger scale: more than RMB 200 million, showing the attractiveness of green energy assets

ESG concept: Green power assets are in line with the global ESG investment trend

Circulation design: It is still in the design stage, indicating that the tokenization of complex assets requires more technical and legal innovations

4. UBS × OSL tokenized warrants

Pilot of international banks: The participation of UBS as a Swiss banking giant is of great significance

B2B model: Directed issuance to OSL, focusing on process verification rather than scale

Technical verification: The focus is on proving the technical feasibility of tokenized warrants

5. China Asset Management Hong Kong Digital Currency Fund

The most transparent case: On the Ethereum public chain, the data is fully traceable

Retail orientation: 800 address holders, truly for ordinary investors

Compliance balance: KYC Balance between requirements and on-chain transparency

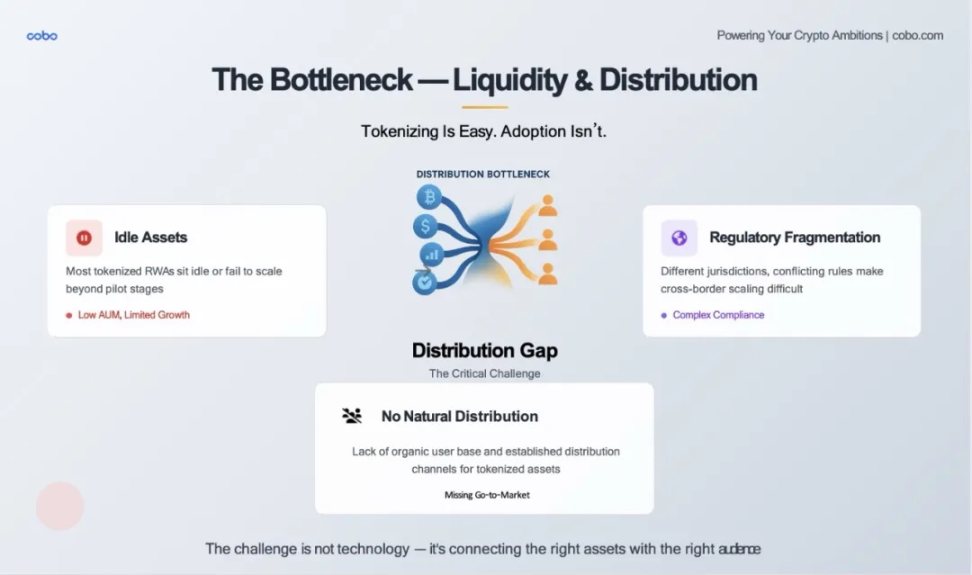

From the above five projects, we can simply extract a few keywords: private chain, institutional and targeted retail, pilot non-scale. These projects cover different backgrounds in Hong Kong, the mainland and the world, showing a flourishing attitude. Specifically, Hong Kong is relatively open and supports innovation; mainland projects are cautiously promoted and sandbox pilots are carried out; internationally: major banks are actively testing the waters. The real challenge for the current projects is liquidity challenges: most projects face insufficient liquidity in the secondary market, which is also the current "bottleneck" of RWA.

Compared to Hong Kong's projects, some of which are still in the experimental stage, we look at the five head RWA projects that are currently operating on a large scale in the global market. They represent the best practices of the current market.

1. BUIDL - BlackRock's flagship product

Leading in scale: $2.9 billion, leading all tokenized treasury products

Institutional orientation: There are only 75 holding addresses, but the monthly trading volume is as high as $620 million

Key insights: The average holding of each address is nearly $40 million, proving the huge demand from institutional investors

Strategic significance: BlackRock has chosen the route of quality rather than quantity, focusing on serving large institutions

2. BENJI - Franklin Templeton's retail experiment

The most interesting data: 577 addresses hold it, but the 30-day trading volume is only $20

Retail orientation: This is a product truly for ordinary investors

Liquidity challenges: There is almost no secondary trading, which means that the holders are more of a "buy and hold" type. It is also possible that the holders are not unfamiliar ordinary people, but may be the most familiar ordinary people.

Market Insight: Retail investors may care more about returns than liquidity

3. OUSG - Ondo Finance's institutional products

Balanced strategy: $690 million in scale, 70 addresses, $14 million in trading volume

Institutional efficiency: Although not as large as BUIDL, the trading activity is relatively high

Clear positioning: Focus on US qualified investors and avoid retail regulatory complexity

4. USTB - Compliance-driven products

Moderate scale: $640 million, $67 addresses

High trading activity: $63 million in 30-day trading volume shows good liquidity

Dual compliance: for US accredited & qualified investors, with the strictest compliance requirements

5. USDY - A breakthrough in globalization

The biggest discovery: 15,487 addresses! This is a truly "popular" product

Global strategy: Specialized in serving non-US investors, avoiding the complexity of US regulation

Popular investment: On average, each address only holds about $40,000, truly realizing inclusive finance

Through the analysis of international projects, we can draw several core insights and trends: Investor type determines product design. Institutional products are generally held by only a few large investors, with high unit prices and low frequency of transactions; retail products are mostly held by retail investors, with small unit prices and mainly held; and global products focus on avoiding regulatory complexity through regional differentiation.

Combining the current RWA projects in Hong Kong and the international market, we can draw several observations:

No one model is suitable for all markets: Institutional and retail markets require completely different product designs;

Regulation is the biggest watershed: Product performance between US and non-US investors varies greatly, and US professional investors have a clear advantage in liquidity;

Liquidity remains a challenge: Even for the most successful products, the secondary market is not very active;

The key to scale: either go deep (institutional large amounts) or go wide (retail popularization).

The above data and analysis reveal an important reality to us: successful RWA products need to find their own liquidity and unique product-market fit.

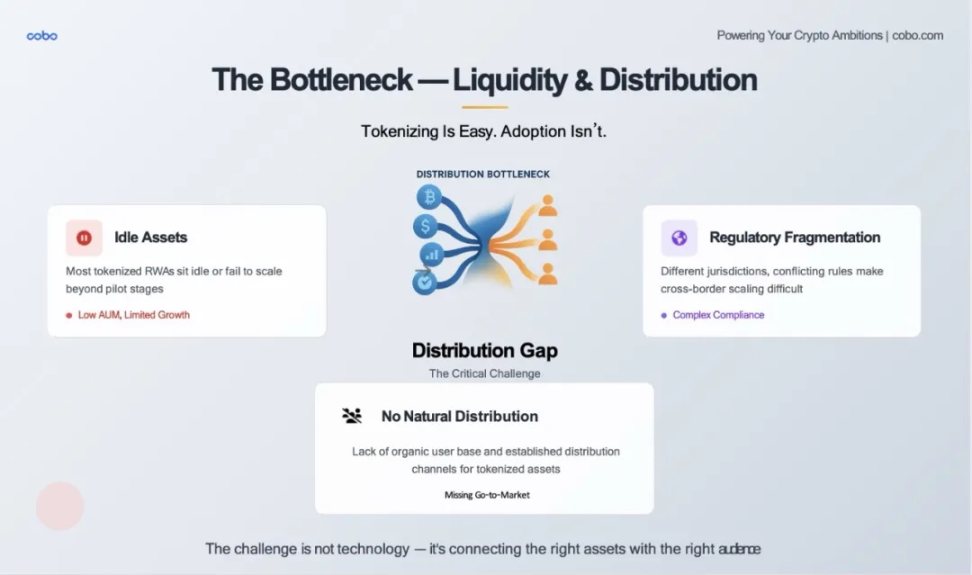

RWA tokenization is easy, but distribution is hard. Anyone can mint a token that represents a piece of real estate or a U.S. Treasury bond. How to get these tokens to the right buyers at scale, compliantly, and continuously - this is the real challenge.

In addition to the top RWA projects we have seen before, there are actually dozens of tokenized Treasury products on the chain, many of which offer considerable returns, but most of them have less than a few million dollars in assets under management (AUM). Why? Because they are not integrated into DeFi protocols, are not listed on regulated exchanges, and institutional buyers cannot easily obtain them without a customized docking process.

The value of a tokenized asset depends directly on how easy it is to exit. Currently, with the exception of a few pools such as Maple or Centrifuge, RWA secondary market liquidity is very weak. One reason is that RWA does not yet have a bond market like Nasdaq, or even a decent one. This also leads to opaque pricing, which limits institutional participation.

Finally, fragmented regulation of RWAs remains a major obstacle. Each jurisdiction has different views on whether tokens are securities, how they are custodied, and who can hold them. This is slowing down the cross-border scale of RWAs, especially in Asia.

Therefore, we see that the quality of RWA assets is improving and the infrastructure is becoming increasingly powerful, but the "last mile" has not yet been opened: how to match tokenized assets with the right funds, build liquidity, and make RWAs truly useful.

This is the challenge facing the RAW industry today, and it is also the biggest opportunity.

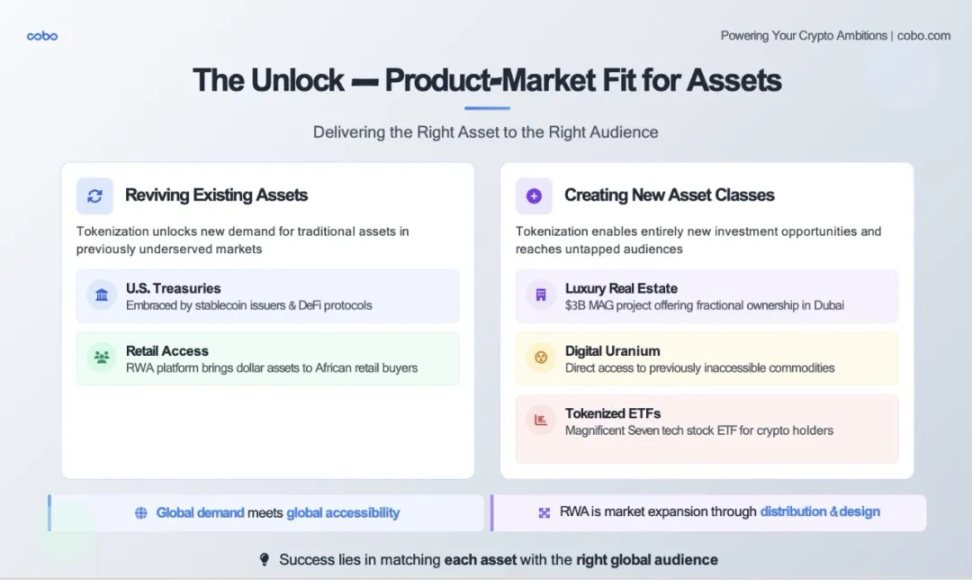

To solve this liquidity problem, the real breakthrough is not just better infrastructure, but the fit between product and market. This is not as simple as putting old traditional assets on the new blockchain track. The core question is actually: Who really needs this asset? If this asset becomes more accessible, what new markets can it serve? If US stocks are traded 24X7, if more and more brokers can buy and sell digital assets, will there still be demand for tokenized ETFs and US stock trading?

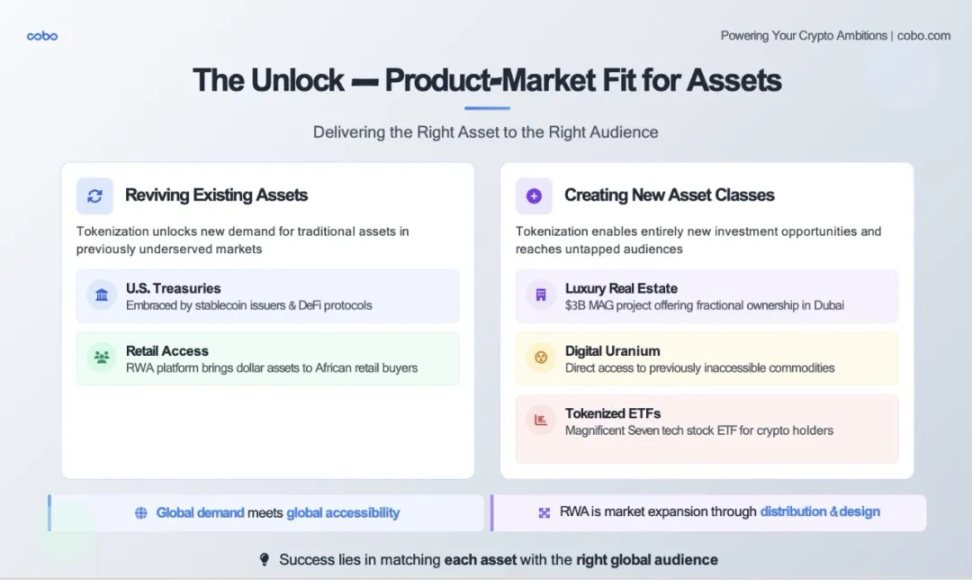

Tokenization can do two very powerful things: one is to find new demand for existing assets that are stagnant in traditional markets, and the other is to create new investable assets and deliver them to investors who have never been able to participate before in new ways.

Re-energizing demand: The hottest asset in RWA right now, U.S. Treasuries, is actually such an example. In traditional financial markets, the U.S. Treasury market is becoming crowded and less attractive. However, in the crypto world and emerging markets, they have gained new opportunities: on-chain stablecoin issuers are using tokenized treasuries to obtain on-chain returns. Blockchain platforms designed specifically for RWA have sold U.S. Treasuries directly to retail investors in Africa, allowing these retail investors to access dollar-denominated, income-carrying assets that local banks have never provided. In this case, tokenization is not just about digitizing assets - it also matches assets to a global, underserved audience that craves security and returns.

Innovating new investable assets: When tokenization creates new assets, this is an even more exciting opportunity.

Case 1: Take Dubai's luxury real estate as an example. The growth of Dubai's real estate in the past few years has impressed many overseas investors. But how many investors can really enter this market? First, do investors have to fly to Dubai? Second, you need a reliable real estate agent. But sorry, they don't show up during the day. Traditionally, this market has been closed - opaque, high barriers, and difficult for foreigners to enter. Now, through tokenization, projects like the $3 billion MAG are opening up fragmented ownership of high-end properties to global buyers - and equipped with compliance, income and liquidity paths. Under this model, is it possible for Shanghai people to repeat the grand scene of buying houses in Japan after the epidemic in Dubai? Here we see that the tokenization of new assets is not just financial inclusion - it is market expansion.

Case 2: Commodities such as uranium. Most retail investors have never touched uranium - it is too complex, too restrictive, and too niche. However, through the new tokenization tool "Digital Uranium", investors can now directly invest in this key resource that powers the global nuclear energy transition. A brand new asset - delivered to a brand new audience - becomes investable through tokenization.

Case 3: Stocks are also being reorganized. When the crypto market is down, tokenized NASDAQ Magnificent Seven ETFs — bring it to traders seeking real-world returns without having to exit cryptocurrencies. In other words, tokenization allows assets to follow the money, not the other way around.

Case 4: Private Credit. Tightening spreads in traditional financial markets have kept lenders on the sidelines. Platforms like Maple and Goldfinch are using tokenization to fund small and medium-sized enterprise (SME) loans in underbanked areas, while allowing global DeFi users to earn returns from real-world cash flows.

So, the bigger picture of RWA should be this: tokenization is not just about packaging old financial instruments, it’s about redefining what can be an asset — and putting it in the hands of those who value it most. This is what “product-market fit” looks like in the on-chain era: global demand meets global accessibility, new assets meet new liquidity, and matching them well to find product-market fit.

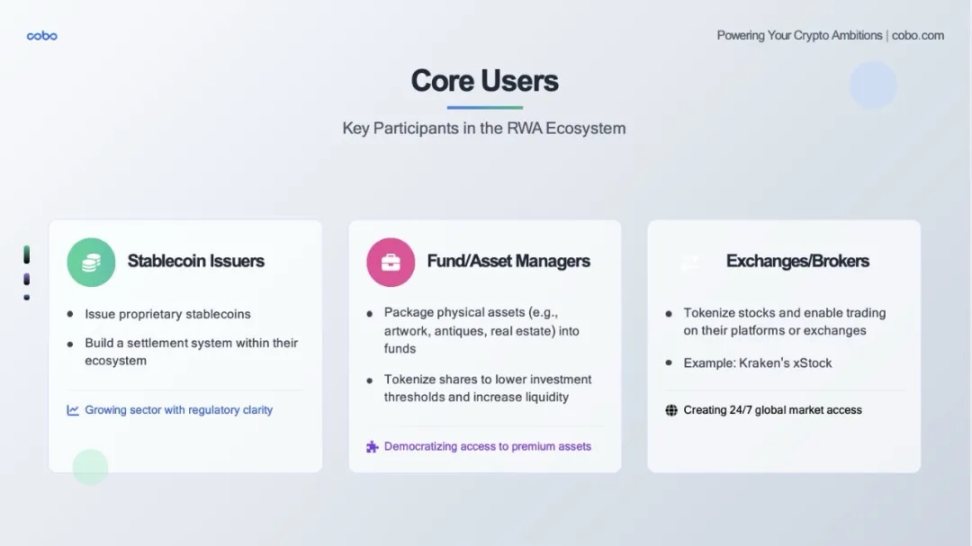

These new audiences - including institutional investors, financial departments of fintech companies, and crypto-native investors - actually straddle two fields. Some are in traditional finance, while others are native to DeFi. The only way for RWA to truly achieve large-scale development is to build a bridge between the two. It can be understood this way: traditional finance (TradFi) brings assets - including credibility, compliance, and scale; decentralized finance (DeFi) brings distribution - 24/7 access, smart contract automation, and global liquidity. The opportunity lies in how to connect the two securely, compliantly, and programmably.

This is not just talk, but is happening: Ondo Finance brings BlackRock's tokenized treasury bonds to the chain and connects them to the DeFi treasury; Centrifuge converts off-chain credit into on-chain assets for use by protocols such as MakerDAO and Aave; Maple and Goldfinch enable institutional lenders to access global yield-seeking funds through DeFi channels. These examples all show what kind of sparks can be produced when traditional financial assets meet DeFi liquidity.

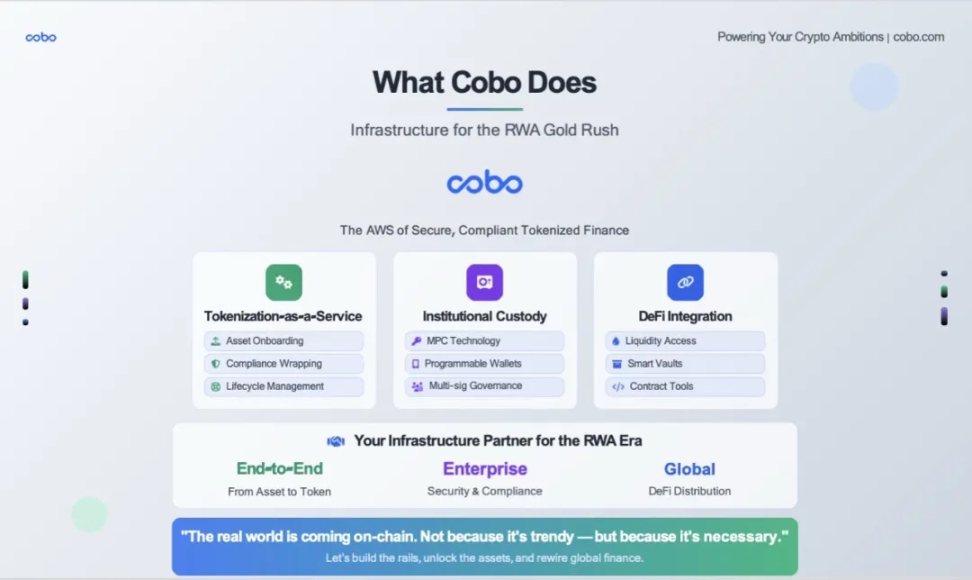

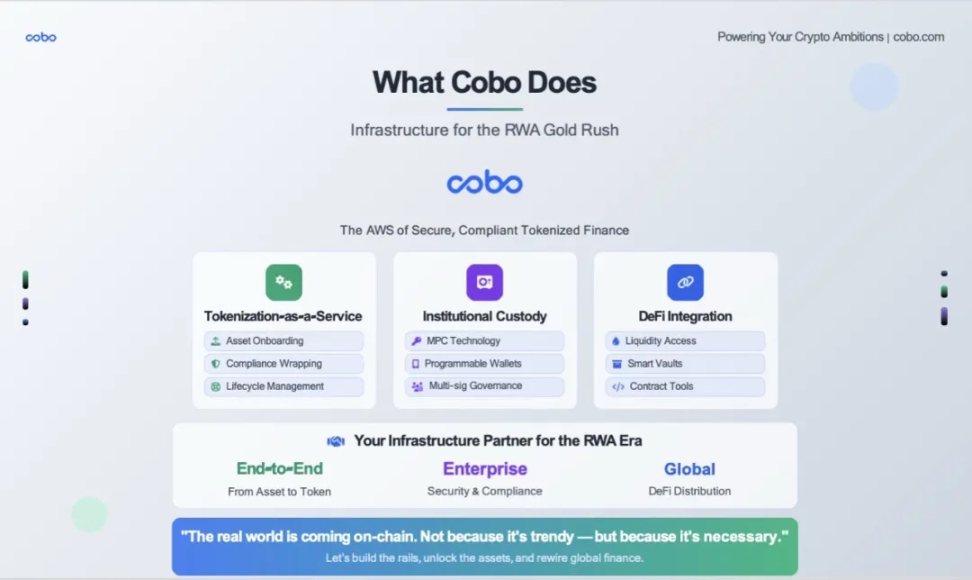

After understanding the trend opportunities and confirming the direction, what we need is to get the right tools to participate in this RWA boom. This is where Cobo comes in: Cobo provides end-to-end infrastructure for tokenized assets. Whether it is an asset issuer, fund or securities company, Cobo can help you bring real-world assets to the chain safely and compliantly.

Specifically, we do this:

?️ Tokenization as a Service

We help you connect various assets such as treasury bonds, credit, real estate, etc. to the platform and encapsulate them through smart contracts.

You can choose the chain, compliance framework and access rights.

We are responsible for technology, legal structure and full life cycle management.

? Institutional-Grade Custody

Cobo is a qualified custodian for regulated institutions.

Our MPC (Multi-Party Computation) wallet technology stack gives you security, automation, and full control - no mnemonics and no single point of failure.

We support whitelisted transfers, time-locked vaults, multi-signature governance - all the security features you need to ensure that your tokenized assets are foolproof.

? DeFi Integration

We don’t just wrap your assets, we give you the tools to distribute and interact with them.

Whether you want to access Aave, provide staking services, or build a liquidity pool - we can distribute and interact with the infrastructure needed by institutional wallets such as Web3 wallets and MPC wallets that can interact directly with the blockchain.

Think of Cobo as a middleware layer between traditional assets and on-chain liquidity. From asset access to custody, from compliance management to role-based authorization to interaction with the blockchain in a risk-controlled environment, Cobo is your infrastructure partner to help you build and expand your business in this new market.

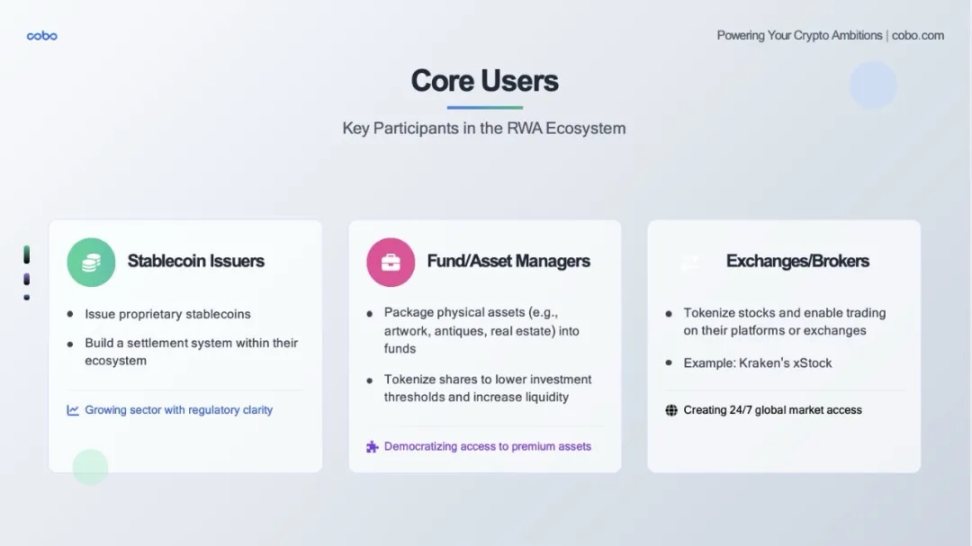

Our RWA Engine can serve all stablecoin issuers, asset managers, exchanges and quasi-exchange institutions.

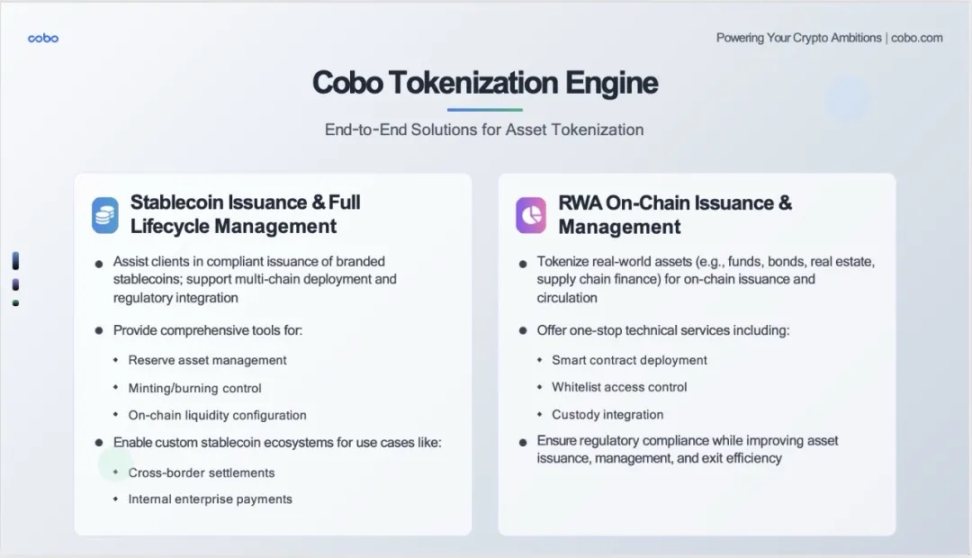

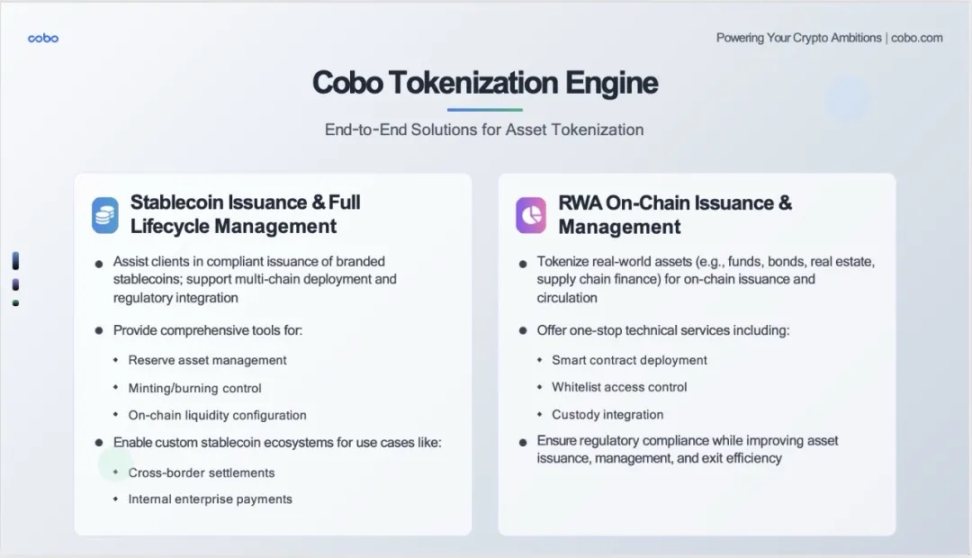

Cobo Tokenization Engine is our core technology engine built for the RWA era. Instead of simply providing a single tool, we have built two complete end-to-end solutions covering the two most important tracks in the tokenization field.

Left: Stablecoin issuance and full life cycle management

In our contact with customers, we found that many institutions want to issue their own branded stablecoins, but face three major challenges:

High technical barriers: smart contract development, multi-chain deployment

Complex compliance: regulatory requirements in different jurisdictions

Operational difficulties: reserve management, liquidity allocation

Cobo's solution

We provide not only technical tools, but also a complete ecosystem:

1. Compliance issuance: Help customers issue branded stablecoins in compliance with local regulatory requirements

Right: RWA on-chain issuance and management

The data we just saw - BUIDL's $29 billion, China Asset Management's $120 million - all prove the huge potential of the RWA market. However, to truly scale up, industrial-grade infrastructure is needed. What we provide to RWA issuers is a truly “ready-to-move-in” solution:

Smart contract deployment: audited, modular contract templates

Whitelist access control: precise permission management to meet different regulatory requirements

Custody integration: seamless integration with our custodian, MPC wallet and Hong Kong Trust Company

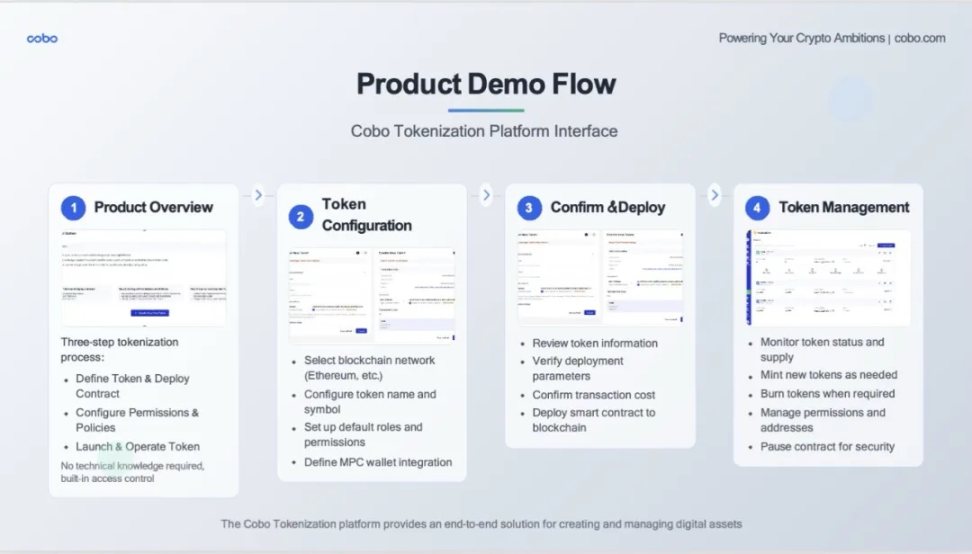

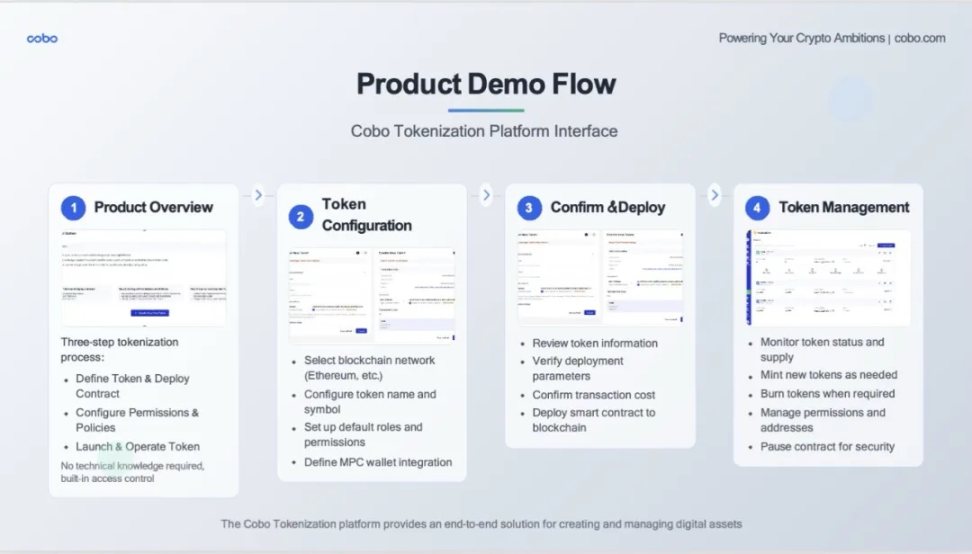

Here is the real user interface and operation process of our tokenization platform.

Step 1: Product Review (Product Overview)

This is the first interface the user sees.

•Three-step process clearly displayed: define tokens & deploy contracts, configure permissions & policies, launch & operate tokens

•No technical threshold commitment: the interface clearly states "no technical knowledge required"

•One-click start: lower the user's usage threshold

Step 2: Token Configuration

The actual configuration interface is shown here:

•Blockchain selection: users can choose different blockchains such as the Ethereum mainnet

•Basic token information: name, symbol and other necessary information

•Security settings: MPC wallet integration to ensure asset security

•Custom settings: meet the personalized needs of different customers

Step 3: Confirm & Deploy

This is the key confirmation link:

• Information verification: All parameters are clear at a glance

• Cost transparency: Clearly display the deployment fee ($0.99)

• MPC wallet display: Demonstrates our core security technology

• Final confirmation: Give users a final chance to check

Step 4: Token Management

This is the management interface after deployment:

• Multi-token management: Supports simultaneous management of multiple token projects

•Status monitoring: Success, Processing, Failed and other different states are clearly displayed

•Rich functions: complete functions such as minting, destruction, permission management, contract suspension, etc.

•Detailed data: total supply, personal holdings, contract address and other key information

Today we discussed a lot of content together - from market trends to technical architecture, from specific cases to product demonstrations. But I would like to summarize today's core ideas in one sentence:

The first sentence: The inevitability of reality - the irreversibility of tokenization;

The second sentence: The nature of motivation - RWA is not because blockchain is cool and tokenization is fashionable. It is because of the limitations of the traditional financial system - geographical boundaries, time constraints, high costs, complex processes - these problems must be solved;

The third sentence: A call to action. The asset side needs to bring high-quality real-world assets; the technology side needs to provide reliable infrastructure (this is our role); the investor side: provide liquidity and trust; the regulator side: provide a compliant framework.

This window will not be open forever. Early participants will gain the greatest benefits - not only economic benefits, but also the opportunity to shape the future financial system.

Anais

Anais