Author: NingNing

Although the native token has not yet been TGE, Scroll has lost its reputation in the airdrop farmer community due to the two incidents of "electronic beggars" in the early stage and the recent "open airdrop". For any L2 project, the relationship with the airdrop farmer is relatively complicated. They have both collusion, such as cooperating to brush data to meet the requirements of VC and CEX, cooperating to open up and establish early block space needs, and building LP initial liquidity, and there is also a stage of mutual harm. For example, during the airdrop, the project needs to trade off between the team, VC, CEX and airdrop farmer in order to maximize the benefits of the project, and the airdrop farmer is often the victim.

This is mainly because the L2 War has actually ended. OP general Rollup leading projects such as Arbitrum, Base, and Optimism have fully utilized their first-mover advantage and operational capabilities to divide up the incremental market share of Ethereum's parallel expansion.

ZK general Rollup, which has always been promoted as "technically better", is no longer able to build an application ecosystem with large-scale real active users in the face of the remaining scarce ecological resources.

The typical life cycle of a ZK general Rollup project is as follows: L2 token airdrop expected airdrop → Farmer entry → Generate beautiful L1<>L2 block space Gas price difference income → Unlimited PUA activities expand Gas price difference income → Cancun upgrade DA fee drops by 2 orders of magnitude, Gas price difference income drops sharply → The lying earning mode ends, and TGE airdrops have to be airdropped → Farmers dump tokens, withdraw DEX LP, withdraw TVL and leave the market, L2 on-chain ecological data collapses → L2 projects enter the stage of living by selling coins.

ZkSync is like this, Taiko is like this, and Scroll is also like this.

But Scroll, which regards "Ethereum orthodoxy" and "good personal relationship with V God" as the basis of its survival, may not care about the "noise" from the market and the emotional feedback from the airdrop Farmer community at all. They still do their own thing.

Then let’s try to maintain a rational and peaceful state of mind and observe how Scroll does things through the dynamics on the chain.

1. According to the L2 milestones recorded on the L2beat website, in order to maintain the operation of PUA economics and squeeze as much gas fees as possible from airdrop farmers, the Scroll team, which has always boasted of its Ethereum equivalence, will delay the deployment of the Cancun upgrade on its L2 to April 29. Other mainstream L2s such as Arbitrum, Zksync, Starknet, OPtimism, etc. were deployed within two days after the Cancun upgrade.

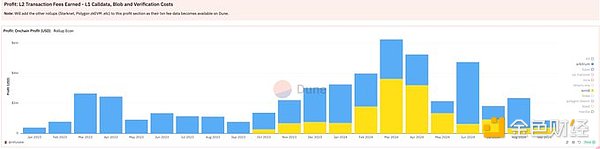

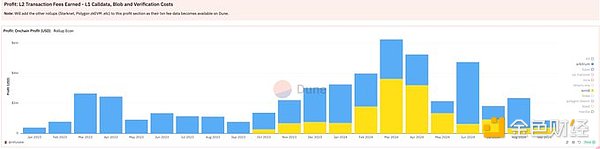

As shown in the figure, in March and April of this year, Scroll's on-chain profit easily surpassed Arbitrum. Revenue in March was $3.63 million and in April it was $3.21 million.

2. Unlike other L2 TVL structures that are mainly ETH, WETH, WBTC, and stablecoins, Scroll's current $1.26B TVL is mainly Restaking assets. Among them, Stone has 306 million US dollars, solvBTC has 129 million US dollars, weETH has 117 million US dollars, pufETH has 122 million US dollars, and rsETH has 74 million US dollars.

Faced with fierce external competition, Scroll has a serious lack of real active users in its ecosystem (the recent average daily Tx is only between 200,000 and 400,000), so it has to use its BD capabilities to cooperate with the LRT project party and use the mechanism of stacking points to attract Restaking assets to increase TVL.

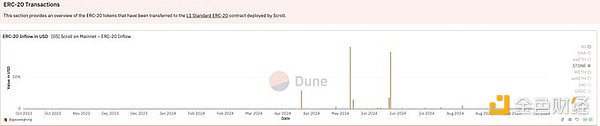

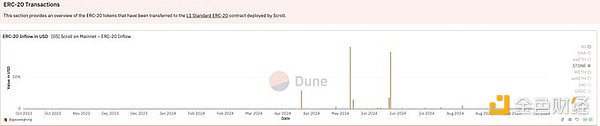

As shown in the figure, the inflow of Stone, the largest component of Scroll TVL, is very discrete, indicating that it is related to specific events or activities rather than normal user behavior.

It is worth noting that compared with bare assets such as ETH, WETH, WBTC, and stablecoins, Restaking assets are much worse in terms of liquidity, security, and value derivation capabilities. In a sense, they are "dead assets" and play a more prominent role in supporting TVL.

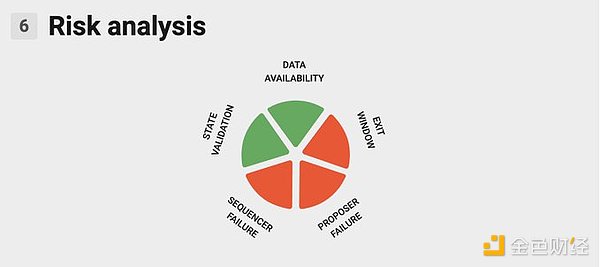

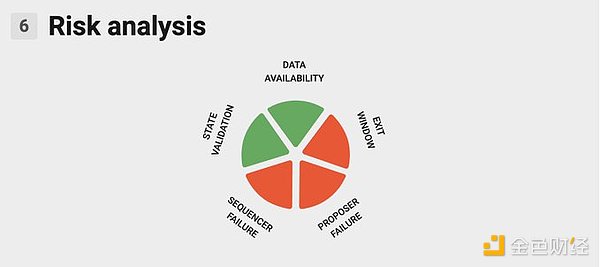

3. Scroll is technically proud of the security of ZK Rollup and the complete equivalence of ZKEVM. However, the Scroll mainnet is still in Stage 0, and the refusal to upgrade the exit window mechanism, escape hatch mechanism and Rollup crash recovery mechanism have not yet been deployed.

Since the token has not yet TGE, Scroll has not yet built a DAO governance mechanism, and the contract upgrade authority is currently controlled by a set of centralized multi-signature addresses. It is expected that after the token TGE, it will be handed over to the newly established ecological DAO organization.

The good thing is that Scroll's ZK Proof validity proof system has been deployed on the mainnet. This enhances the system security of Scroll Rollup, but it also makes Scroll pay high Proof verification costs, of which the highest verification fee paid to L1 (Ethereum mainnet) in March was as high as 2.43 million US dollars.

To this end, Scroll carried out the Curie upgrade in July, which successfully reduced the Proof verification cost by significantly compressing the state data. At the same time, Scroll is also actively exploring the ZK coprocessor network to further reduce the generation and verification costs of ZKP.

To sum up, Scroll's poor operating status can be described in two words: "born at the wrong time" and "the harder you work, the more unfortunate you are." Although the Scroll team struggled to survive in the harsh market environment of the post-Zksync airdrop era by delaying the deployment of the Cancun upgrade and using the strategy of stacking Lego points to siphon Restaking assets, and finally met Binance's listing standards, delivering a result to VC and the community, it is truly commendable from the perspective of the primary market.

But from the perspective of the secondary market, Scroll, which has neither a real ecosystem nor a new narrative, has turned from a magic scroll into disposable toilet paper at the moment of TGE.

That's all.

Weatherly

Weatherly