Source: Liu Jiaolian

Although the long and short sides of BTC (Bitcoin) are still tug-of-war at the 70,000 dollar level, it seems that the shorts' attempt to take advantage of the high inflation in the United States and the postponement of the Fed's interest rate cut expectations to hit the longs seems to have failed. The bulls have destroyed the wedge trend on the market and torn a gap at the tail.

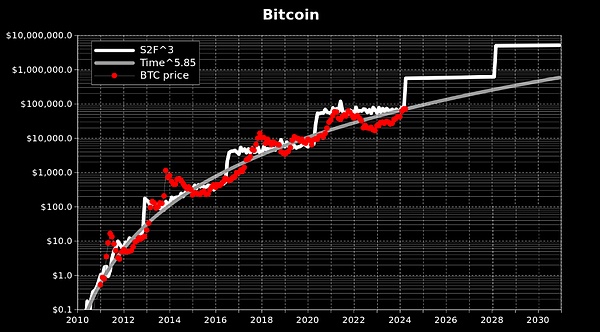

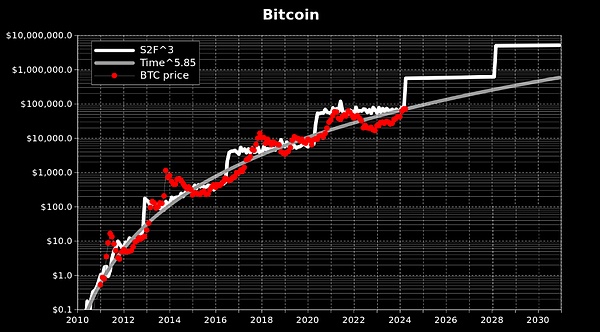

Looking from a long-term perspective, BTC has now gone through three halving cycles and four bull market cycles, and is currently at an extremely special historical crossroads. The past is gone, but there are two routes to contend for in the future: will it continue to grow exponentially and advance at a high speed, or will it grow according to the power law and the increase will subside?

Will the quantitative change lead to qualitative change by reducing production again and again? Can the second growth cycle be opened? Will the assumption that the US dollar has been stable and controllable growth (the premise of the power law) be broken?

Stepping out one level, looking at the world, the global political and economic landscape is facing "a major change not seen in a century". Two masters are competing in internal strength at the Huashan Sword Contest. On the border where the two sides are connected, the sound of ping-pong comes and goes. The wind blows the red flag, and the sand and rocks fly and the trees sway.

Continue to zoom out and extend the vision. Since the entire human race evolved from apes to humans millions of years ago, it has experienced two major macro civilization stages: the silicon-based civilization era (millions of years ago to 3000-5000 years ago, with silicon atom compounds - stones - as the main productivity tools), and the iron-based civilization era (3000 years ago to the present, with iron atoms - steel - as the main productivity tools). Now, humans are standing at the starting point of the third macro civilization stage - the new silicon-based civilization era (with separated pure silicon atoms - semiconductors - as new quality productivity tools).

The essence of life is to use carbon atoms as the center, combine with other atoms, and use energy input from stars to achieve atomic self-organization. After carbon atoms have arranged and combined themselves, they begin to arrange and combine silicon atoms or iron atoms (and their compounds or analogues) as their own tools and external aids. Carbon is the body and silicon iron is the function. This is the whole story of how humans and the universe eulogize civilization.

The tools that are sprouting today, built on the new silicon base, and unprecedented and unheard of since the birth of mankind millions of years ago, are likely to be the protagonists of the next macro civilization era. For example, Bitcoin.

If one day in the future, BTC can completely strip away the value storage function of houses, one of the largest value-added commodities in human society, and force it to return to its residential attributes, that is, its use value, then it must be a great thing that benefits the country and the people, and is beneficial to social progress and development, so that everyone can live in cheap houses, and no longer let high housing prices kidnap the national economy and suppress population fertility. This is the greatest kindness of BTC. Jiaolian once wrote: "The fact that Bitcoin has no use value is the greatest good of Bitcoin. No matter how high the price of Bitcoin is, it will not cause any pain to our lives. The opposite example is a house." If a value-storage asset has both use value and a use value with rigid demand, it will cause pain to society. If the value-storage asset is also what Buffett calls a productive asset, then it will naturally lead to mergers. The increasing mergers of the foundation of people's livelihood are the inherent driving force of the dynasty cycle law. BTC is naturally incapable of generating interest and is not a productive asset, which is precisely the embodiment of its non-exploitative nature. Most people do not care about the macro cycle on a millennium scale, but such people are often attracted by asset price fluctuations in the short economic cycle. I remember that since 2020, friends have asked from time to time whether to sell houses and hoard cakes. Cake, that is, big cake, is the nickname of BTC. Usually, the more BTC rises, the more people have such thoughts and questions.

Although hoarding cakes is obviously much better than hoarding houses, especially in the context of vigorous deleveraging in the real estate market in recent years, assets are shrinking, and perhaps for quite a long time, we will face the dilemma of "this year is the best year in the next few years", but for those who ask such questions, it may not be suitable to do it.

To put it more extreme, asking the question itself is already an answer - but it is a negative answer. Why?

You ask such a question, which clearly shows that you lack the belief in your heart to support action, or lack the motivation to overcome all difficulties and resolutely execute. You have only a superficial understanding, you are not confident enough, you have no courage, you are blocked everywhere, and you subconsciously do not want to take all the responsibility for failure alone, including regret and guilt. In this case, the answer is not important. Because whether it is yes or no, you can't take action. And if you can take action just by asking others for affirmation, such action will also be an absolute disaster.

Therefore, there is only one answer to this question, a negative answer. Except for yourself, everyone else should give resistance. Only in this way can you really know whether you have the courage and ability to overcome resistance and move forward firmly. If you give up, it is your own choice. If you overcome resistance and do it resolutely, there are two consequences: if you succeed, it is your own victory and the glory you deserve; if you fail, it is also your own responsibility and the destiny you deserve.

Learning to be completely and thoroughly responsible for the fate you choose is the first step towards success.

Perhaps 99% of investors have become old leeks from new leeks, but they have never really learned to be responsible for themselves from beginning to end. That is why BTC is placed in centralized exchanges for a long time and the control of assets is handed over to others. That is why you speculate on contracts and give heads to market makers who accurately blow up positions and harvest customer losses. That is why you participate in pyramid schemes and pin your hopes on the online and leaders to make you rich. That is why you blindly follow the big Vs and KOLs who shout orders and lead orders, and you will buy whatever dog coins they recommend. That is why you participate in the copycat projects controlled by strong dealers, thinking that you can eat meat by following the big brother. That’s why they didn’t keep their private keys properly. As a result, they lost their private keys and their coins were permanently locked, or their private keys were stolen and became a feast for hackers…

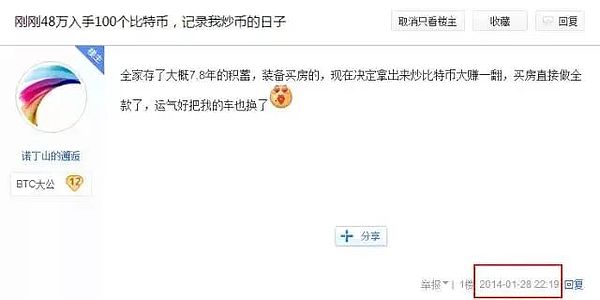

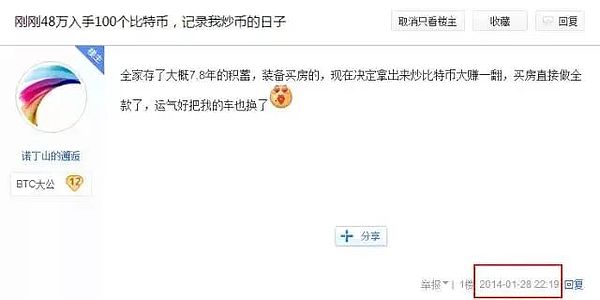

I remember that in 2014, there was a famous “480,000 Brother” on Baidu Tieba, who used all the 480,000 RMB he was going to use to buy a house and get married to buy 100 BTC. He posted a post on Tieba to make this public on January 28, 2014 (BTC was about $800).

On January 14, 2015, BTC fell below $200. The value of 480,000 Brother’s 100 BTC shrank from $80,000 to less than $20,000, and only a few hundred thousand RMB of 480,000 remained.

He withstood the darkest moment, but sold out before dawn in 2016. On June 14, 2016, he appeared again on Tieba and posted that he had sold it at a loss of 180,000 yuan. It can be inferred that BTC had doubled from the bottom in 2015 to around 3,000 RMB.

Take over at high prices, cut at low prices, and recover and stop profit - "The Three Treasures of Leek" are true to me.

The legend of Brother 480,000 came to an end.

The 100 BTC he bought at the beginning, if you get 70,000 dollars today, is 7 million US dollars, about 50 million RMB.

However, it is not easy for him to hoard it until today. For example, the btcchina he used was closed during the "94" period in 2017. There was also the BCH hard fork at the end of 2017. The death valley of the bear market at the end of 2018. The "312" in 2020. The "519" in 2021. The CEX clearance at the end of 2021. The FTX crash at the end of 2022. And so on. Of course, there are even more terrifying things, that is, the big surge in 2017, the small spring in the middle of 2019, the big surge in early 2021, the second spring at the end of 2021, and the big surge at the end of 2023. Every rise is an extreme temptation to sell. As the article "If you own 5,000 bitcoins in 2010" on the teaching chain on March 24 ended: "The bull market is the culprit for the reduction in the amount of coins. Be wary of the bull market."

The story of Brother 480,000 can serve as a mirror for those who question selling houses to hoard bitcoins.

Those who dare to think but not to act will never succeed. Many people who dare to think and act will end up losing more than they gain, and end up in failure. Those who dare to think, act and succeed will fall into the path dependence of the mysterious self-confidence of successful people. They will continue to fight in a game ten times bigger next time, and then fail once and ruin all the money they earned from the previous nine consecutive successes, and even owe a lot of debt (because the more courageous they are, the higher the leverage).

When you have more money behind you, you forget to withdraw your hands, and when you have no way ahead, you want to turn back.

People's fate in the business of speculation has probably been determined by probability theory.

Miyuki

Miyuki