Author: Danny @IOSG

Summary

SIMD 0228 proposal, an important decision that has recently touched the hearts of all Solana ecosystem participants, was ultimately not passed. The vote participation rate hit a record high for Solana (close to 50% of the total token supply), but the final support vote ratio was not enough to reach the supermajority threshold required for passage (66.67%).

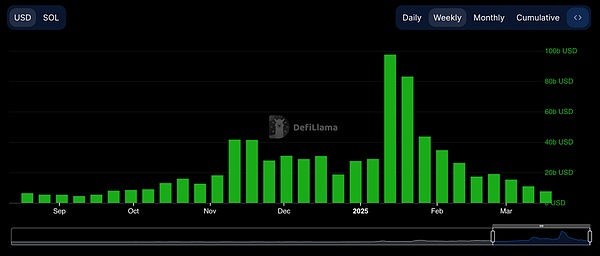

The background of such a proposal is that Solana has gradually calmed down from the on-chain frenzy brought by Memecoin after Trump’s coin issuance. Weekly trading volume has retreated from nearly $100b at the beginning of the year to no more than $10b, a 90% drop, which is lower than the trading volume in the early days of Memecoin's rise.

Along with Memecoin, Solana has become the most successful public chain in this cycle. As the Memecoin cycle gradually fades, Solana is also facing a stage of transformation and re-positioning. It was at this time that Solana's largest capital supporter, Multicoin, proposed the 0228 proposal. As soon as the proposal came out, it attracted fierce debate in the community. Twitter became the main battlefield, and different stakeholders argued for their reasons and voted until the last moment of the voting.

During the debate on the proposal, we can see many shadows of the previous promotion of changes in the Ethereum community. The proposal itself has a short window, and it proposes many long-term considerations and short-term solutions. Of course, there are also many interests that are not easy to express directly. But its transparency allows us to see the current attitudes and strategies of many Solana leaders.

Although the proposal was rejected this time, the proposer, Tushar from Multicoin, still called it "a victory" because of the high participation rate in the vote and extensive community discussion, which demonstrated Solana's decentralized governance capabilities.

Who is behind the Solana proposal governance this time, what does it mean, why did it not pass, and is the procedure fair and successful? Let's take a look at them one by one.

SIMD 0228 —— A hasty proposal

What is Proposal 228?

228 aims to maintain a 50% staking rate and reduce the issuance rate of SOL in the long term by dynamically adjusting the inflation rate based on the staking rate.

Solana's current inflation model is a curve that gradually decreases over time. At the launch of the mainnet (March 2019), an inflation rate of 8% was set and has decreased over time. The current inflation rate is about 4.8%, and the long-term target inflation rate is 1.5%-2%.

If this proposal is passed, short-term staking income will be reduced (according to the staking rate between 1% - 4.5%), and the long-term inflation rate will approach 1.5%.

The current staking rate is 70%, so if 228 is passed, the staking SOL income will be reduced in the short term, the issuance will be reduced in the long term, and the staking yield will be adjusted in real time according to the staking rate.

Unlike SIMD 0123, where validators can choose whether to opt in, 0228 is mandatory, which means that once it is launched, it will affect the interests of all stakers.

Voices of support

Voices of opposition

This proposal was put forward by Tushar and Vishal of Multicoin Capital and supported by Max, a researcher from Anza and former Consensys. The reasons include:

#

Reduce unnecessary token issuance and reduce inflation costs

Solana's current fixed inflation model is a "dumb emissions" because it does not take into account the actual economic activity or security needs of the network. Based on an inflation rate of 4.8% at the beginning of 2025, the annual issuance value will be approximately US$3.82 billion (based on a market value of US$80 billion). This high inflation is essentially a dilution of SOL holders, especially when the current staking rate is as high as 65.7% - the network security is already fully guaranteed.

The adoption of this proposal means that the concept of staking has shifted from "overpaying to ensure security" to "finding the minimum necessary payment".

Interestingly, this is exactly the argument that some KOLs in Solana have previously used to attack the economic security of Ethereum, that is, too many assets are supporting an economic security that is regarded as a "meme".

#

Release capital and promote the development of the DeFi ecosystem

The current high staking rate (65.7%) has caused a large amount of SOL to be locked, inhibiting the flow of capital in the DeFi ecosystem. Marius, founder of Kamino, pointed out that "staking encourages hoarding but reduces financial activity." This is similar to the reason why high interest rates in traditional finance inhibit investment.

It is worth noting that the main supporters of the Defi protocol on Solana are also the VCs who proposed the proposal, so releasing liquidity into Defi is also a motivation that cannot be ignored.

#

Reduce the "leaky bucket effect" and enhance the autonomy of the ecosystem

The leaky bucket effect refers to the value within the ecosystem, which produces great wear and tear and leakage during economic activities. Since the newly issued SOL is regarded as ordinary income and is subject to tax in the United States, the amount of additional issuance generated by inflation will be proportional to the value extracted from the entire ecosystem. For Solana, about $650 million in taxes and about $305 million in exchange commissions have flowed out of the ecosystem.

From the first principles, Solana has essentially entered a stable stage, and the inflation model set up in the early stage has become unreasonable. The development of the chain is based on improving economic activities, and the inflation plan should also be improved accordingly.

Placeholder partner Chris concluded that the real benefits should come from the spillover of the demand side to the supply side, and the fixed inflation setting that is conducive to cold start should not be used. In the long run, the arguments of the supporters do make sense. When a public chain ecosystem passes the cold start stage, it naturally needs a more ideal economic system to promote economic development.

Voice of support

Voice of opposition

The faction headed by Lily, chairman of the Solana Foundation, opposed the adoption of this proposal. The main point of dispute is whether to implement this proposal in such a short time, rather than a longer time. The proposal with great changes in asset attributes will affect participants in different links (engineers at the network layer, developers at the product layer, and institutions at the economic layer). At present, most of the discussions are among the core network layer personnel and product layer personnel, and the product layer and the economic layer groups dominated by institutions, which are farther away from the information channel, have fewer voices. Therefore, it should not be rushed to pass before the argument is not perfect.

Many opponents have raised concerns about the loss of small validators. Small nodes are inferior to large nodes in terms of scale effect and bargaining power, so the reduction in inflation will first eliminate these small nodes, which will hurt Solana's decentralization. However, after talking with some Solana nodes, the author found that most nodes still support passing. The reason is that Solana has a large amount of subsidies and everyone believes more in the value of SOL itself after continuous improvement. I can feel the centripetal force of the Solana community, which is a digression.

It is obvious that both parties are dissatisfied with the current inflation model and believe that it needs to be improved. The point of contention is whether to rush to implement it within two weeks.

In addition, there may be some factors of interest. The simplest one is that a large number of SOL holders, especially those who can obtain higher returns from the non-staking ecosystem (Defi), naturally do not want inflation to continue to remain at such a high level. The standard portrait here is the VC behind Solana and the projects it supports.

An important adoption of Solana at present is the institutional direction, including ETFs and more traditional institutional use cases. Then the parties involved in promoting institutional adoption will definitely oppose it. For institutional adoption, whether the passage of SIMD is a positive is controversial. Supporters believe that traditional institutions are more averse to high-inflation assets, while opponents believe that traditional assets have greater uncertainty concerns about assets with dynamically changing inflation rates.

Here, the author would think that the uncertainty of the mechanism may hinder the adoption of institutions. Institutions can evaluate the asset attributes under the mechanism, but if the mechanism keeps changing, it will hinder the evaluation of institutions. Therefore, for institutions, they should either pass it quickly or negotiate together after the initial adoption is completed. At this time, there are more conflicts of interest, which may make it more difficult to pass.

Why now?

Here, the question is, why is it so hasty to introduce and promote such a proposal?

Perhaps Solana still has a large amount of trading volume in the residual heat of the meme, resulting in the current node fees and MEV income remaining high, so the adjustment of the pledge mechanism will not usher in too much controversy. In 2024, Solana's MEV revenue totaled $675 million, and there is a clear upward trend. The MEV revenue of the nodes in Q4 even exceeded the inflation reward. For this reason, the nodes are currently relatively less sensitive to inflation income in the short term. If the Solana chain is completely cooled down, the income caused by this proposal will be worse, which will inevitably cause opposition from the staking community.

Solana's Restaking is about to kick off, and Renzo, Jito, etc. have already begun to show signs. Looking at the history of Ethereum, the emergence of liquidity staking and Restaking will bring great subsidized income to staking and validators, and also reduce the concerns of nodes about inflation rewards.

The Ethereum Foundation also proposed a proposal to improve the inflation curve in the middle of last year, similarly anchoring the staking rate to a fixed ratio to reduce excessive staking. The argument put forward at that time was that under the premise that economic security was far from sufficient, it was hoped that more liquidity would be released while reducing the role of LST such as Lido ETH as a substitute for ETH.

After this proposal was put forward, it also triggered a brief discussion. That was when the OGs re-examined the economic-related mechanisms of Ethereum's POW after the POS transformation. The proposal itself and the discussion process both put forward a lot of calculation and deduction support, but in the end, the proposal was not promoted without clarifying the theoretical basis. Ethereum's economic argument may provide some reference for 228, but the opposition it received also reflects the difficulty of passing such a proposal to "cut" interests.

The final result is also reasonable. Perhaps under the auspices of the foundation, the validators formed a view of the bearish proposal and worried about institutional adoption. Or perhaps this decision was indeed too hasty, resulting in no consensus among the validators and a split in the vote. Or perhaps the small validators formed a consensus on short-term income pressure and collectively chose to oppose it. Broad discussion does not necessarily mean deep discussion. If the discussion is not deep, there will be disagreements. The hastily promoted proposal also reflects the current consensus pain of Solana parties on the unclear positioning of the chain itself, the unclear stages, and the consensus pain of where to go next after the memecoin supercyle.

The governance process is a victory

Although this proposal was hasty, a very transparent and open discussion broke out in just a few weeks. Both parties spoke frankly on Twitter, without a middle ground, and directly gave their approval or disapproval and gave their arguments. This discussion mode allows everyone to understand the considerations of both parties. At the most intense moment, even a Space was directly pulled, and the relevant parties expressed their opinions in the Space.

Another highlight is the acceptance of the community's voice. A large number of Solana project owners/builders’ pertinent suggestions on Twitter have been responded to and included in the discussion on Space. The proposal is no longer an obscure formula, but has become the voice of each community and has been proposed for discussion. One of the criticisms of voting is that stakers cannot directly participate in the opinion voting, which also brings about the self-contradiction of many large nodes - how to coordinate the opinions of all stakers and make the final decision. This is a problem that all public chains need to solve, and Solana has lit up this problem for the first time.

The proposal attracted 74% of the staked supply to participate, still showing a high degree of community participation. SIMD's clear voting mechanism and passing threshold make the decision-making process clearer and more predictable. In contrast, Ethereum's proposal decision-making process is relatively vague, relying mainly on discussions and consensus among core developers, and lacks a formal voting mechanism.

Finally, the efficiency of the proposal. Although we always criticize it for being too hasty, the proposal took no more than two months from proposal to voting to completion of voting, which makes people have to sigh at the efficiency of the idea of this ecosystem from top to bottom. This is probably why Tushar thinks this is a victory.

Conclusion

Overall, the SIMD228 proposal reflects that Solana has entered the stage of institutional adoption and continued construction of on-chain consumer applications after the prosperous period of innovating asset issuance models. The contradiction in the distribution of interests is the opportunity for the whole event.

Supporters also need to take advantage of this prosperous stage of on-chain activities to quickly promote reforms with little friction, but it seems too hasty, resulting in intense but insufficient discussions, insufficient support and education for small validators, and insufficient consensus among validators. The life cycle of the proposal is very short, and this process also reflects the execution and openness of the Solana ecosystem. It is an excellent governance case worthy of learning for all ecosystems.

Anais

Anais

Anais

Anais Weatherly

Weatherly Catherine

Catherine Kikyo

Kikyo Joy

Joy Catherine

Catherine Weatherly

Weatherly Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine