Deng Tong, Golden Finance

On September 5, 2025, Hyperliquid announced the launch of its USDH stablecoin. After the network upgrade, validators will use a transparent on-chain voting mechanism to select the team best suited to build and mint the native Hyperliquid stablecoin. Interested teams can submit proposals on the forum.

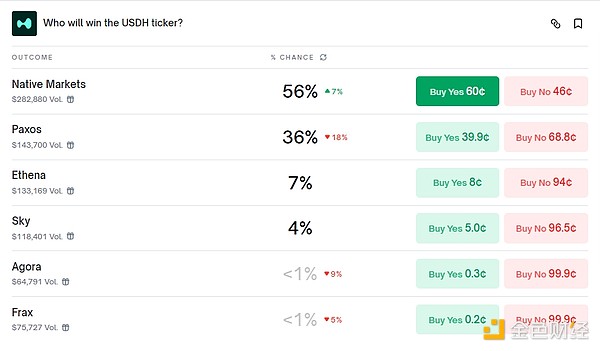

Following the announcement, numerous crypto companies in the industry submitted proposals to support HyperLiquid's USDH stablecoin, intensifying competition for the right to issue the USDH stablecoin. Polymarket even launched a related betting platform.

This article sorts out which companies are participating in the competition for USDH issuance rights, and explores why USDH is so popular and whether it will have an impact on USDC.

I. The Six Major Companies’ Battle for USDH Issuance Rights

On September 5, 2025, just over an hour after Hyperliquid’s announcement, Native Markets, founded by Hyperliquid advocate Max Fiege, submitted a proposal, initiating the battle for USDH stablecoin issuance. The plan, to issue USDH through Stripe’s stablecoin payment processor, Bridge, met with strong community opposition. On September 7, 2025, stablecoin issuer Paxos announced on the X platform that it has submitted a proposal to support HyperLiquid's stablecoin, USDH. If approved, USDH issued by Paxos will comply with the GENIUS Act standards. Furthermore, revenue sharing will drive protocol and validator development, while clear regulation and global scale will support HyperLiquid's growth. Paxos will allocate 95% of the interest from its USDH-backed reserves to repurchase HYPE and redistribute it to ecosystem initiatives, partners, and users. On September 8, 2025, Frax submitted its proposal. Frax launched its frxUSD stablecoin earlier this year, proposing a 1:1 backing for USDH, with frxUSD itself backed by BlackRock's yield-generating BUIDL on-chain treasury fund. The Frax core team wrote that under the Frax proposal, "100% of the underlying treasury bond yields would be programmatically forwarded on-chain to Hyperliquid users, with zero Frax fees." Frax characterized the proposal as a "community priority" aimed at "facilitating seamless minting/redemption between frxUSD, USDC, USDT, and fiat" and compliant with the GENIUS standard. Frax stated that, given the treasury bond's 4% annual interest rate, Hyperliquid's current stablecoin deposits generate $220 million in annual yield. "We have no intention of manipulating USDH; we simply want to provide the underlying stablecoin infrastructure. All of our infrastructure is built around frxUSD, which makes it easier to support. USDH will inherit all of these features, including multi-chain support, minting/redemption capabilities, regulatory compliance, and future features such as bank card spending." On September 8, 2025, stablecoin startup Agora proposed to work with infrastructure providers such as Rain and LayerZero to jointly provide USDH stablecoin support for Hyperliquid. Agora pledged to use all net USDH revenue for HYPE repurchases and fund support, and to provide at least $10 million in initial liquidity. USDH will adopt a compliant structure, be eligible for issuance in multiple locations, and prioritize serving the Hyperliquid ecosystem to avoid lock-in or diversion from external platforms.

On September 9, 2025, Sky (formerly MakerDAO) joined the competition for the issuance rights of Hyperliquid's USDH stablecoin. Sky co-founder Rune wrote on the X platform: "Sky's main advantages in providing USDH to Hyperliquid are: USDH will have access to $2.2 billion in instant USDC liquidity for off-chain redemptions; Sky can deploy its balance sheet of over $8 billion to Hyperliquiquid; all USDH on Hyperliquiquid can earn a 4.85% yield, higher than the yield on government bonds, and all 4.85% of the USDH generated will be used for the HYPE repurchase fund; Sky can provide $25 million in funds to create an independent Hyperliquid Star project and independently develop Hyperliquid DeFi; Sky can transfer its repurchase system to Hyperliquid and use its annual profits of over $250 million to build USDH liquidity."

On September 8, 2025, Ethena, the issuer of the third-largest US dollar stablecoin USDe, Ethena Labs hinted at joining the competition for issuing rights to Hyperliquid's USDH stablecoin. Ethena Labs posted, "Dear Jeff (Hyperliquid co-founder), I wrote to you, but you still haven't called back. I sent two USDH proposals last fall, and you definitely didn't receive them. Maybe there was a problem with Discord or something else, or I'm just a little sloppy when writing deployment addresses." The next day, Ethena Labs officially released a proposal, requesting the community and validators to consider the USDH token identity. It proposed launching a stablecoin centered on the Hyperliquid platform. This stablecoin would integrate the expertise and resources accumulated by Ethena and its partners in the field, with an emphasis on security, community collaboration, and compliance. Ethena pledged to invest significant financial and human resources to establish USDH as a benchmark, leading stablecoin for Hyperliquid users and developers. The core terms of the proposal include that USDH will initially be 100% backed by USDtb; Ethena commits to donating at least 95% of net revenue generated from its USDH reserves to the Hyperliquid community; if the Hyperliquid community wishes to rebase trading pairs currently denominated in USDC on core exchanges to USDH, Ethena will cover all USDC-to-USDH transaction costs; and the Ethena Labs research team will submit a proposal to the Ethena Risk Committee to request that USDH be listed as a compliant backing asset for USDe. Ethena showcased its collaboration with Anchorage Digital, a federally chartered digital asset bank, and Securitize, a real-world asset tokenization company backed by BlackRock. Anchorage is responsible for issuing Ethena's USDtb stablecoin, which is backed by BlackRock's tokenization fund, BUIDL. Robert Mitchnick, Head of Digital Assets at BlackRock, stated in the proposal, "We are excited to integrate Ethena's USDtb with Hyperliquid. USDtb is 100% backed by BUIDL, providing Hyperliquid users with institutional-grade cash management and on-chain liquidity." According to Ethena's proposal, USDH will initially be backed by USDtb, indirectly gaining support from BlackRock's BUIDL Fund, a $14 trillion asset management giant. At least 95% of the income generated by the USDH reserve will be allocated to Hyperliquid's "rescue fund" and used to repurchase HYPE tokens and distribute them to validators.

Second, Why is USDH so popular?

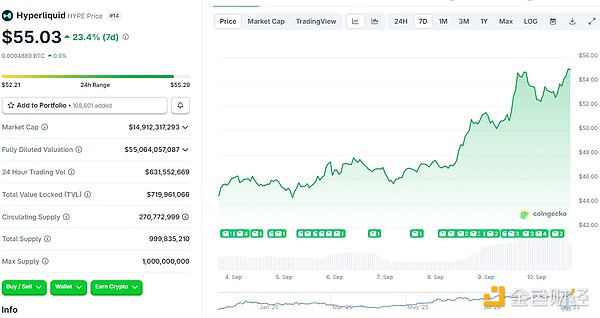

Paxos noted: The greatest opportunity in the Hyperliquid ecosystem lies in ensuring that the revenue generated from stablecoin balances and transaction fees flows back to the ecosystem's builders and users. USDH solves this problem with its issuance scale and incentive mechanism. According to a Hyperliquid post on X, Hyperliquid's buyback program has already absorbed over 30 million HYPE tokens. This move tightens supply, increases token value, and demonstrates Hyperliquid's commitment to returning revenue to its ecosystem rather than external shareholders. Hyperliquid has strengthened the incentive loop surrounding USDH, making the USDH stablecoin more attractive to traders seeking yield and governance risk. Influenced by the USDH stablecoin news, the market has once again generally favored the Hyperliquid ecosystem and HYPE's market performance. Recently, whales and institutions have flocked to HYPE. On September 8th alone, for example, the whale "qianbaidu.eth" deposited 2.05 million USDC to purchase HYPE; qianbaidu.eth purchased $12 million worth of HYPE; a smart money fund deposited 4.01 million USDC into Hyperliquid, of which 2.996 million were used to purchase 63,197 HYPE tokens; Mike Dudas, co-founder of TheBlock and founder of 6MV, posted on X that 6MV had increased its holdings in HYPE. This weekend's events clearly demonstrate that the Hyperliquiquit ecosystem is ready for takeoff; and Nasdaq-listed Lion Group Holding Ltd. announced plans to convert all of its SOL and SUI assets into HYPE.

HYPE's strong performance reflects confidence in the investment market. Over the past seven days, HYPE has been primarily upward, especially since September 8th. With competition for HYPE issuance rights intensifying among multiple companies, HYPE's gains have been encouraging. As of press time, it was trading at $55.03, a 23.4% increase over the past seven days.

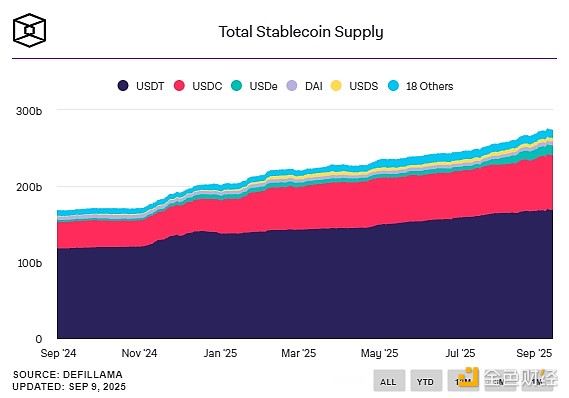

3. Will USDH impact USDC?

Under the US GENIUS Act, stablecoin issuers are prohibited from paying interest directly to holders. This fundamentally distinguishes USDH from Circle's USDC. This legal barrier means that even if US Treasury yields shrink in a low-interest environment, Circle cannot compete on yields. If USDH succeeds, while interest won't be paid directly to holders, it could return revenue to the ecosystem through other means. For example, Paxos has proposed allocating 95% of the interest from the reserves backing USDH to repurchase HYPE and redistribute it to ecosystem initiatives, partners, and users. Frax has also proposed programmatically forwarding 100% of the underlying treasury bond yields on-chain to Hyperliquid users. This indirect revenue distribution method allows USDH to provide users with certain economic incentives while maintaining compliance, which is a clear difference from USDC. This could potentially drain significant liquidity from USDC, particularly in the yield-oriented DeFi market, which could weaken Circle's position. Under the MiCA Act, MiCA effectively bans yield-generating stablecoins by requiring a 1:1 reserve ratio, and algorithmic stablecoins are also prohibited due to a lack of reserves. While MiCA doesn't directly use the word "ban" to refer to yield-generating stablecoins, the regulation is designed to protect banking functions and prevent them from being too similar to banking products, making the issuance of yield-generating stablecoins incompatible with the framework. Amid industry debate about whether USDH will challenge USDC, Circle has joined Hyperliquid in defending its position. Circle co-founder and CEO Jeremy Allaire posted on X, urging people not to be fooled by the hype. Circle will be a major participant and contributor in the Hyperliquid ecosystem. While it's exciting to see others acquire the code for new USD stablecoins and compete, USDC, with its deep liquidity and near-instant cross-chain interoperability, is sure to be warmly welcomed by the market. Circle is preparing to launch its native USDC within the HYPE ecosystem, aiming to maintain its position in a space dominated by USDH.

This has turned the competition between the two major stablecoin systems into a head-on confrontation within the same platform:

USDH is attractive due to its advantages such as yield, user incentives and new governance.

USDC has the advantages of scale, liquidity, regulatory trust and interoperability.

IV. Views of industry insiders

Bernstein analysts believe that the launch of USDH and other stablecoins should create a more competitive environment, but the impact on Circle will not be immediately apparent. "Injecting liquidity into new stablecoins is not an easy task, especially for crypto capital market products such as futures, where position size and execution efficiency are critical. Hyperliquid may choose to work with more stablecoin partners (including Paxos) to enhance the resilience of its platform, but building liquidity on its futures products is a gradual process."

"With the start of the interest rate cut cycle, we expect the digital asset cycle to shift to a risk-driven one, further driving demand for USDC (and demand for USDC on-chain returns). In addition, as Circle continues to expand its USDC financial ecosystem, the demand for stablecoins in payment and financial services integration is still in its early stages."

Bitget Wallet Chief Marketing Officer Jamie Elkaleh said in a report: "By anchoring its native stablecoin, Hyperliquid reduces its dependence on external assets such as USDC or USDT, while strengthening the integration between trading, settlement and liquidity within its derivatives platform. In many ways, USDH is not so much a direct competitor to Tether, USDT or USDC as it is a redefinition of how stablecoins are aligned with the core economic mechanisms of each protocol." Bitget Chief Analyst Ryan Lee pointed out: "This stablecoin has been positioned as a major competitor to USDC, and its issuance will help concentrate liquidity, further pushing up the price of HYPE. Ultimately, the entire industry is optimistic about HYPE. 's growth potential, and confidence in its long-term position among the top five cryptocurrencies."

Conclusion

The competition for the right to issue the USDH stablecoin may have a profound impact on the current stablecoin landscape. USDH's revenue mechanism may provide important insights into how stablecoins can strike a balance between compliance and profitability.

With the dust settled on the battle for USDH's stablecoin issuance rights, whether HYPE can join the ranks of mainstream currencies, whether USDH can compete with USDC, and whether USDC can maintain its market share will all be key points to watch.

ZeZheng

ZeZheng

ZeZheng

ZeZheng Alex

Alex Xu Lin

Xu Lin JinseFinance

JinseFinance Joy

Joy JinseFinance

JinseFinance Davin

Davin decrypt

decrypt Others

Others Cointelegraph

Cointelegraph