How To Sell Products Online For Bitcoins

Selling products online for Bitcoin can be an exciting way to embrace the world of cryptocurrencies and tap into a global market.

Bitcoinworld

Bitcoinworld

Author: Marjan Alirezaie, William Hoffman, Paria Zabihi, Hossein Rahnama and Alex Pentland; Source: JRFM; Compiler: Liu Shiyu

In January 2024, JRFM published the article "Decentralized Data and Artificial Intelligence Orchestration for Transparent and Efficient Small and Medium-Sized Enterprises Trade Financing", which studied the role of artificial intelligence in the financing of small and medium-sized enterprises. Due to differences in data sources, conflicting contracts, residency requirements and the need for multiple artificial intelligence (AI) models in the trade finance supply chain, small and medium-sized enterprises (SMEs) are leveraging AI capabilities to improve business efficiency due to limited resources. and predictability are hampered. This paper introduces a decentralized AI orchestration framework that prioritizes transparency and explainability, providing valuable insights to funding providers such as banks, helping them overcome the challenges of assessing the financial creditworthiness of SMEs. By leveraging orchestration technologies involving symbolic reasoners, language models and data-driven forecasting tools, the framework enables capital providers to make more informed decisions on cash flow forecasting, financing rate optimization and ecosystem risk assessment, ultimately promoting better SMEs. Get better access to pre-shipment trade financing and enhance entire supply chain operations. The Institute of Financial Technology of Renmin University of China (WeChat ID: ruc_fintech) compiled the core part of the research.

Introduction

The lifeblood of the global economy—small and medium-sized enterprises Enterprises (SMEs) provide two-thirds of employment opportunities globally and contribute more than 50% of global GDP. Despite their importance, SMEs face significant challenges in accessing working capital to fund their operations. This limitation can severely impact their growth, expansion and competitiveness. SMEs in supply chains face an additional set of liquidity challenges due to difficulties in assessing their credit risk. Their often limited financial histories and lack of or immature business metrics make it difficult for financial services providers to assess their creditworthiness and offer appropriate trade finance terms. These factors may result in SMEs being chronically neglected in terms of trade finance, with approximately 50% of financing applications being rejected. SMEs often have to rely on post-shipment financing, which further leads to inefficiencies and delays in meeting their working capital needs.

This article builds on preliminary findings from a multi-year, federally funded government pilot project advancing the application of emerging artificial intelligence (AI) and data technologies— In particular, alternative data sources and collaborative AI models - to improve the effectiveness of SME trade credit risk assessment. The project focuses on innovatively using artificial intelligence (AI) to strengthen supply chain resilience. This article proposes an innovation framework that innovates in the following three dimensions:

- an AI-driven A suite of collaborative capabilities (including machine learning, machine reasoning and knowledge graphs) to improve the accuracy, reliability and compliance of AI use;

; - A decentralized, cross-industry network of datasets that are pre-approved, legally compliant, and designed to address a range of potential privacy and data risks;

- Provides a text-based natural language interface that relies on large language models (LLMs) as a means to extend decision support capabilities to frontline practitioners and relevant stakeholders.

These AI-based technological innovations collectively aim to solve the long-term liquidity challenges of SMEs to strengthen supply chain resilience. In addition to increasing working capital flows to SMEs (through improved access to pre-shipment trade finance), the paper provides insights into how to implement trustworthy AI governance principles and responsible public-private data collaboration to ensure that outcomes are commercially sustainable, inclusive and New insights you can trust.

As widely noted in the public-private data collaboration literature, enterprise data assets are widely undervalued for repurposing for the public good. This article provides a more comprehensive and applied understanding of how enterprise data assets and collaborative AI capabilities can be integrated and used responsibly and legally to enhance supply chain resilience and the economic growth of SME suppliers in global supply chains.

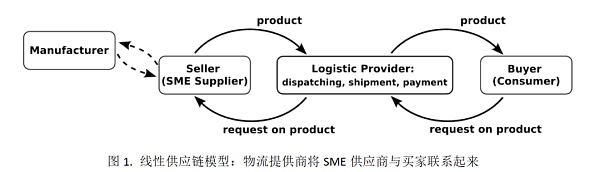

The traditional linear supply chain model is shown in Figure 1. It consists of buyers, small and medium enterprise (SME) suppliers and logistics providers. The process starts with the buyer expressing interest in the products or services offered by the SME seller. Logistics providers play a key role in delivering goods, managing logistics and facilitating communication between buyers and SME sellers. In this model, the goods purchased by the SME from the manufacturer provide the necessary funds to produce the goods needed to fulfill customer orders. This means that if the SME does not have sufficient working capital to deliver the items detailed in the invoice, they may not be able to supply the product, which could lead to supply chain disruption.

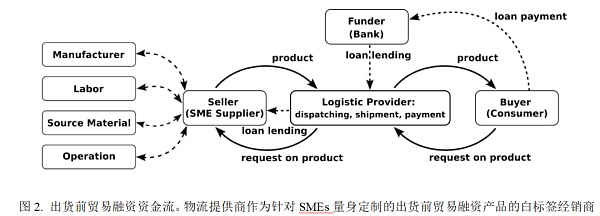

To address these challenges, the authors propose a non-linear trade finance model, as shown in Figure 2, in which logistics providers and capital providers jointly provide white labels to their SME suppliers with the logistics provider Dealer agreements for pre-shipment trade finance come to market. This model is designed to help SMEs overcome pre-shipment working capital challenges, strengthen relationships between SMEs and logistics providers, and create market expansion opportunities for financial service providers.

As shown in Figure 2, the proposed nonlinear trade finance model analyzes the existing relationships among SMEs, logistics providers and financial service providers within the supply chain. Relationships have had a significant impact. This model aims to solve SMEs’ pre-shipment working capital challenges, strengthen relationships between SMEs and logistics providers, and create market expansion opportunities for financial service providers. Logistics providers have become key players in facilitating the financial needs of SMEs by providing white label pre-shipment trade finance to SME suppliers. This not only strengthens the relationship between SMEs and logistics providers, but also creates a new dimension to their collaboration, as logistics providers play a role in providing financial support to SMEs. Additionally, the model creates market expansion opportunities for financial service providers, allowing them to offer uniquely customized solutions to address SME liquidity issues. This improved understanding of the credit profile of SMEs enables banks to provide loans at more attractive interest rates, ultimately lowering the cost of capital for these companies.

Before delving into the technical details of the proposed approach, the authors briefly review existing solutions and developments in the literature to solve similar problems.

Artificial Intelligence Powered Supply Chain Solutions: Materials and Methods

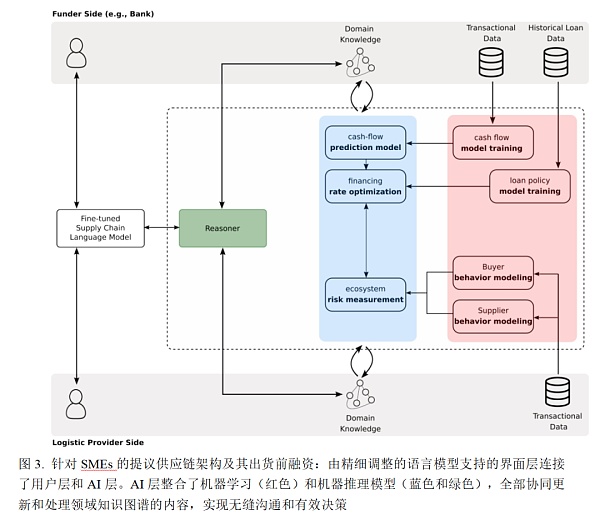

Figure 3 provides an overview of the proposed architecture for pre-shipment trade finance coordinators for small and medium-sized enterprises (SMEs). At the application layer, the architecture consists of two main parts: the interface layer (white part) and the AI layer (consisting of sub-layers shown in green, blue and red). Furthermore, the system involves various roles such as funding providers, buyers and SME suppliers, who all interact with the system. In this section, an in-depth explanation of the proposed collaborative AI model is provided, elucidating the materials and methods involved.

2.1 Data

The model’s architecture integrates transactions from different business areas such as logistics, banking and supply data. Data contributed by logistics providers includes shipment details, invoices, customer profiles and metadata that reflects financial behavior such as payment delays and transaction values. This mix of static (customer information, location) and dynamic (time-stamped invoicing solutions) data provides a comprehensive view of customer interactions. Financial institutions, such as banks, add depth with data such as transaction records, timestamps of deposits and withdrawals, loan history and compliance with bank policies.

It is worth mentioning that in order to implement the proposed model, the authors advocate the use of distributed and cross-domain data sources, providing access to data specifically designed to analyze and interpret specific Authorized access to a suite of collaborative AI algorithms for domain data. As shown, the API-based data transfer architecture enables the transfer of insights (via predefined queries) across institutions and boundaries, but the raw data does not move across institutions or geographic boundaries. This ensures a decentralized approach that eliminates the need to centralize all data and reduces data transfer instances, potentially alleviating security and privacy concerns. Section 4 will detail data decentralization, covering its distributed nature, improved security, scalability, and efficiency.

2.2 Method

As shown in Figure 3, the development The approach to collaborative AI solutions relies on a neurosymbolic approach (Hitzler et al., 2022), which consists of the fusion of data-driven machine learning techniques (represented by red layers) with knowledge-driven models (represented by blue and green layers) composition. Starting on the right closest to the raw data, the red layer contains ongoing learning processes that continuously receive data from various sources and update the model’s parameters to ensure its relevance and accuracy. In contrast, the blue layer selects the best performing model with the highest training accuracy to date and integrates it with additional domain knowledge from different parties, including funding providers, logistics providers, etc.

In the proposed neuro-symbolic architecture that fuses learning and reasoning models, the process starts with the learning phase where different AI models are trained to understand and interpret data. Once the model training is complete, the inference phase is applied. This inference stage is crucial as it verifies the plausibility and consistency of the generated and predicted responses. By combining these two aspects – learning from data and applying logical reasoning – the system ensures that responses are not only based on learned patterns but also follow a logical framework, leading to more accurate and reliable results.

The collaborative AI framework proposed in this article includes different types of AI models trained with diverse data sets. To reconcile the results and models trained on distributed data sources, the authors employ a knowledge graph populated with the outputs of these diverse models, making the entire process easy to reason about. This collaborative AI approach plays a key role in solving problems that require insights from a variety of data sources. By empowering business practitioners to reliably interact with data across industries, this article showcases an emerging framework currently undergoing pilot testing. These frameworks enhance the resilience and growth potential of small and medium-sized enterprises (SMEs) in the supply chain ecosystem. Additionally, they reveal innovative ways to provide added value to financial services providers. With AI, these providers can gain a deeper understanding of cash flow dynamics between different SMEs, logistics providers and ecosystem risks, ultimately enabling the market to deliver more efficient trade finance solutions.

In summary, this paper proposes a unique system that integrates a user-friendly interface layer using finely tuned large language models and a novel reference architecture , to meet the diverse needs of supply chain users and roles. The interface facilitates interaction with the AI layer by converting queries into formal scripts, which are then processed using a combination of machine learning techniques and knowledge-driven models. This innovative approach not only enhances data processing and model performance, but also builds on existing understanding of SME challenges. It differs from previous research focusing on financial innovation and supply chain finance (SCF) solutions, which often lack general applicability and require complex technological infrastructure. In contrast, our system enables business practitioners to use advanced computational models to address complex challenges and make informed decisions, thereby strengthening the resilience of global supply chains. Our model uniquely blends AI orchestration and data decentralization, emphasizing the synergy between AI and decentralized data. This not only improves the efficiency and financial access of SMEs, but also represents a new path for AI and technological innovation in trade finance, highlighting similarities and key differences with previous research in this area.

In order to verify the final response of the AI model, especially considering the diversity of data sets and different economic conditions, the authors emphasize the involvement of human experts in the verification process participate. This approach recognizes the importance of human judgment and expertise in assessing the accuracy and reliability of AI-generated responses. Therefore, the proposed system serves more as an assistant to these experts rather than as a substitute for human decision-making. AI models provide valuable insights and analysis, but the final decision-making power remains in the hands of human experts, who can interpret and place AI's findings in a broader and more nuanced way. This ensures balanced and effective use of AI in complex and changing environments.

In next steps, the authors aim to advance the presented model beyond its current demonstration-level implementation, which relies on artificially generated data. By leveraging real-world data in a real-time business environment, the goal is to validate the commercial, legal, operational and ethical aspects of the model, ensuring its practical viability and relevance.

The benefits of the proposed approach are manifold, as we discussed in the introduction section, they are as follows:

Access to working capital is critical to business growth and success, especially for multinational logistics companies. By granting funding providers access to their data, logistics providers not only increase their knowledge of the credit profile of the SMEs they work with, but also enable banks to provide tailored solutions to liquidity issues. The direct engagement approach ensures personalized and effective communication, providing logistics providers with the necessary support and financial solutions. By using advanced AI analytics to gain insights into invoices, payment terms, accounts receivable, accounts payable and other financial aspects, banks can better understand logistics providers’ operations, cash flows and business cycles. This improved understanding allows banks to offer loans at more attractive interest rates, thereby lowering the cost of capital for these companies.

Selling products online for Bitcoin can be an exciting way to embrace the world of cryptocurrencies and tap into a global market.

Bitcoinworld

Bitcoinworld Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive SuperWeb3 hosted an Online Demo Day on October 23, 2022 on ZOOM.

Others

Others Nulltx

NulltxGensokishi Online has announced the opening of its closed alpha. The project which incorporates the elements of NFT and GameFi ...

Bitcoinist

Bitcoinist