Author: Techub Hot News

Written by: Glendon, Techub News

Despite the continued decline in the crypto market and the pervasive sense of panic, the development of the altcoin ETF market has not stalled.

Yesterday, the 21Shares Solana ETF (ticker symbol TSOL) officially listed on the Chicago Board Options Exchange (CBOE) after receiving approval from the U.S. SEC. The fund supports cash or physical redemption, has a management fee of 0.21%, and allows Solana to generate additional returns through staking. Its initial assets under management were $100 million, with a first-day trading volume of $400,000, and its net asset value has now climbed to $104 million.

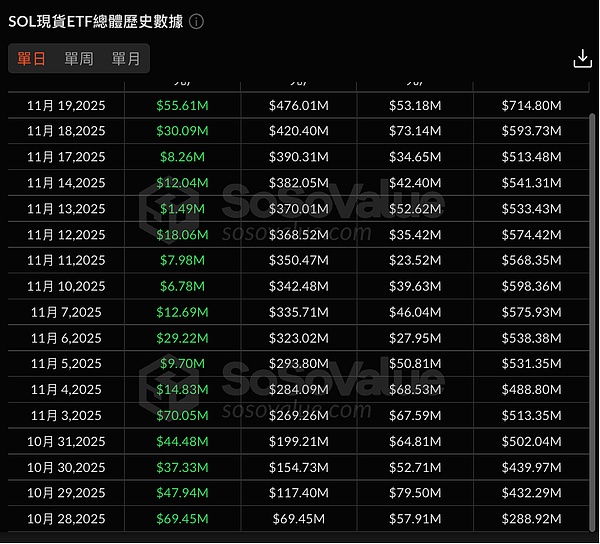

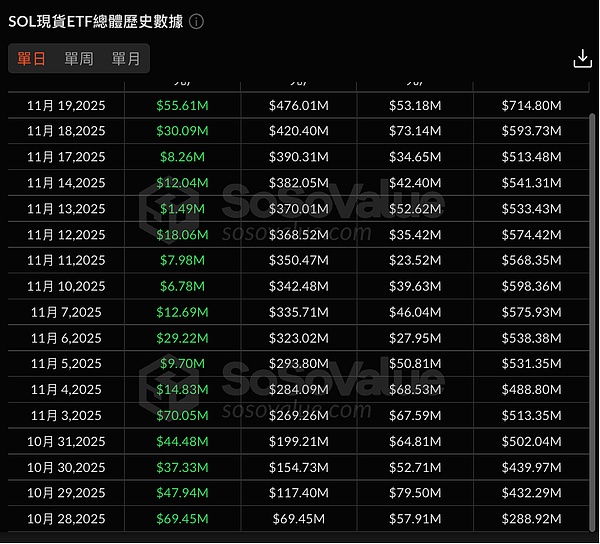

Following the listing of TSOL, the total number of US Solana spot ETFs has increased to six, far surpassing other altcoin ETFs in terms of quantity. It's worth noting that while US Bitcoin and Ethereum spot ETFs have seen continuous outflows for several days, the Solana spot ETF experienced a net inflow of $55.61 million yesterday, marking the third-highest net inflow in its history, second only to $70.05 million on November 3rd and $69.45 million on October 28th. Considering the current sluggish state of the crypto market, the Solana spot ETF's performance is quite remarkable. Besides Solana, the first XRP, HBAR, and LTC spot ETFs were also listed around the same time, officially opening the door to altcoin ETF listings. So, how are the currently listed altcoin ETFs performing? Is a wave of altcoin ETFs about to arrive? Solana: The "Leader" of Altcoin ETFs Currently, there are 6 US-listed Solana spot ETFs: Bitwise Solana Staking ETF (BSOL), Grayscale Solana Trust (GSOL), Fidelity Solana Fund ETF (FSOL), VanEck Solana ETF (VSOL), Canary Marinade Solana ETF (SOLC), and 21Shares Solana ETF (TSOL). According to SoSoValue data, as of today, the total net inflow into US Solana spot ETFs is approximately $476 million, with total net assets reaching approximately $715 million, representing about 0.97% of the SOL market capitalization. The Bitwise BSOL ETF, listed on the NYSE on October 28th, is the first US Solana spot ETF. With a management fee of 0.99% and an initial investment of $220 million, it is a "collateralized" ETF, not only allowing investors to hold SOL but also generating returns for them through staking, thus increasing asset value. On its first day of trading, BSOL saw a turnover of $56 million, setting a new record for the highest trading volume among nearly 850 newly listed ETFs this year, with a net inflow of $69.45 million. Its performance on the second trading day was even stronger, with trading volume climbing to $72.4 million. This impressive figure is undoubtedly a good start for the Solana spot ETF. To date, BSOL has taken a dominant position, with cumulative net inflows reaching $424 million, accounting for 89% of the total net inflows. The Grayscale GSOL ETF followed closely behind. On October 29th, this ETF successfully completed its transformation from a trust product to an ETP and was listed on the NYSE Arca. GSOL has a management fee of 1.5% and supports SOL staking. The fund's trading volume on its first day of listing was approximately $4 million, far less than BSOL, but still considered moderate. Currently, GSOL has accumulated a net inflow of approximately $41.05 million. In November, the Solana spot ETF market saw the listing of four more ETFs. On November 17th, the VanEck VSOL ETF listed on Nasdaq with a management fee of 0.3%. On its first day of trading, the fund saw no net inflows. This fund also supports offering investors returns through staking Solana assets and adopted an aggressive fee strategy: waiving its 0.3% management fee until February 17th or until the fund's assets reached $1 billion, attempting to attract investors with low fees. However, as of today, VSOL's net asset value is only $10.26 million, still far from its target asset size. The Fidelity FSOL ETF listed on the NYSE on November 18th with a management fee of 0.25%. This ETF tracks the Fidelity Solana Reference Index (FIDSOLP) and includes SOL staking rewards. Its initial seed funding was 23,400 SOL tokens, valued at approximately $3.3 million at the time. Net inflows in the first two days were $7.49 million, and the current net asset value of FSOL is approximately $10.46 million. The Canary SOLC ETF, a spot ETF launched by Canary Capital in partnership with Marinade Finance, listed on Nasdaq on the same day as FSOL. This ETF has a management fee of 0.5% and supports on-chain staking, allowing investors to stake a portion of their SOL holdings to earn network rewards, which are then distributed to investors. However, in the two days since its listing, the ETF has seen zero net inflows and its net asset value is only $763,800, indicating poor market performance.

Based on the above data, it's clear that although the overall crypto market is weak, the Solana spot ETF has seen nearly $500 million in net inflows in just half a month, demonstrating the potential of the SOL ETF market. It's worth noting that since the first Solana ETF was listed on October 28th, the SOL spot ETF has seen net inflows every trading day, achieving net inflows for 17 consecutive days.

Besides Solana, three other altcoin spot ETFs have been officially launched in the US market: XRP, HBAR, and LTC.

So, how have these altcoin ETFs performed compared to SOL? XRP, HBAR, and LTC Spot ETFs Unlike the dismal performance of the Canary Marinade Solana ETF (SOLC), the XRP ETF (ticker symbol XRPC), also issued by Canary Capital, presents a different picture. The Canary XRP ETF officially listed on Nasdaq on November 13th, becoming the first and currently only spot ETF for the single XRP token in the United States. It supports both cash and physical redemption, with a management fee of 0.50%. The ETF saw a trading volume of $58 million on its first day of trading, setting a new record for the highest first-day trading volume among nearly 900 newly listed ETFs this year, even surpassing the previously highly anticipated Bitwise BSOL ETF. While XRPC saw no net inflows on its first day, it experienced a net inflow of $243 million through cash or in-kind subscriptions on its second day, far exceeding BSOL's previous record for single-day net inflows (approximately $69.45 million). As of this writing, XRPC has only been listed for five trading days, with a cumulative net inflow of $293 million and total net assets of approximately $269 million. Although there is currently only one XRP ETF, in the altcoin ETF sector, XRPC's performance is, like BSOL's, truly exceptional. Currently, asset management companies such as Bitwise, 21Shares, and Grayscale have all submitted applications for XRP spot ETFs, and the relevant products are in the preparation stage. For example, Bitwise announced details of its XRP ETF today. This ETF will be listed on the New York Stock Exchange (ticker symbol XRP), with a management fee of 0.34%, and will be waived until its assets under management reach $500 million. This shows that Ripple's potential is no less than Solana's. Compared to these two leading cryptocurrencies, the asset size and prospects of the other two altcoins appear much bleaker. The Canary HBAR ETF (HBR) and the Canary Litecoin ETF (LTCC), also issued by Canary Capital, are the first US spot ETFs for their respective cryptocurrencies and were officially listed on Nasdaq on October 28th. On its first day of trading, HBR and LTCC recorded trading volumes of $8 million and $1 million, respectively. HBR has a management fee of 0.95%, and since its listing, it has seen a cumulative net inflow of approximately $75.29 million, with total net assets of approximately $58.1 million. As Eric Balchunas, senior ETF analyst at Bloomberg, pointed out, most ETFs tend to see a decline in trading volume after the initial hype, and HBR's performance perfectly aligns with this pattern. Specifically, HBR achieved a total net inflow of $69.93 million in its first seven trading days, demonstrating strong momentum. However, several consecutive days saw zero inflows of funds, and even net outflows. These changes indicate that the altcoin ETF market is showing signs of fatigue and lack of momentum. Compared to HBAR, LTC, as a "veteran" token, is in an even more dire situation with its first US spot ETF, "LTCC." This ETF also has a 0.95% management fee and introduces a staking mechanism, allowing investors to stake their LTC holdings to generate on-chain returns. Unfortunately, this ETF is clearly not very attractive to investors. As of today, LTCC's total net inflow is only $7.26 million, and its total net assets are only $7.74 million. Furthermore, data from SoSoValue shows that LTCC's daily net inflows are mostly only a few hundred thousand dollars, with more than half of the days seeing zero inflows.

It is evident that although several altcoin ETFs have successfully launched on the market, the existing data is insufficient to strongly support the view that an altcoin ETF wave is about to sweep across the market. The situation of altcoins themselves, as well as the overall operating trend of the crypto market, will have a profound impact on the development direction of this specific market. So, how will the altcoin ETF market develop?

Short-term pressure, long-term potential for explosive growth

Objectively speaking, the crypto market has already entered a "short-term bear market" phase, but the performance of SOL and XRP ETFs is still commendable.

For example, yesterday the US Solana spot ETF saw a net inflow of $55.61 million, and the US XRP spot ETF also saw a net inflow of $15.82 million. However, the relatively optimistic data from ETFs failed to significantly boost cryptocurrency prices. Taking SOL and XRP as examples, as of the time of writing, market data shows that since October 28th, SOL and XRP have fallen by more than 30% and 20%, respectively. In the current market environment, investors have a strong risk aversion towards altcoins, and the inflows into ETFs are more driven by long-term allocation needs than short-term speculative activities, leading to more cautious capital flows. From a negative perspective, the development trend of the Bitcoin investment product market is not optimistic. A recent report from research firm K33 points out that the Bitcoin derivatives market is exhibiting a "dangerous" pattern. This is because traders are continuously increasing aggressive leverage during the ongoing Bitcoin price correction. Data shows that open interest in perpetual futures surged by over 36,000 bitcoins last week, marking the largest weekly increase since April 2023, while funding rates continued to climb, indicating that traders are using high leverage to "buy the dip." Vetle Lunde, Head of Research at K33, stated that these leveraged long positions have become a potential source of selling pressure in the market, significantly increasing the risk of increased market volatility due to forced liquidations. Furthermore, Bitcoin is facing pressure from continued outflows of funds from ETFs, a pressure that will be transmitted to the entire crypto market. Under this trend, reduced market liquidity naturally affects altcoins such as SOL and XRP, preventing their prices from receiving effective support and further curbing the expansion of funds in the ETF market. However, this market is not without positive signs. Yesterday, Bitcoin spot ETFs saw a net inflow of $75.4696 million, ending five consecutive trading days of net outflows. This undoubtedly sends a positive signal to the market, indicating that institutional investors have not completely lost confidence in the ETF market. Overall, the limited development of the altcoin ETF market is mainly attributed to the severe downward trend in the crypto market. Therefore, in the short term, this sector will continue to bear the pressure from the overall decline in the crypto market, but a longer-term perspective may lead to a turnaround. 21Shares analyst Maximiliaan Michielsen believes that the current decline in the crypto market is merely a short-term adjustment, not the beginning of a deep or long-term bear market. Although volatility and consolidation may continue until the end of the year, the fundamental factors driving this cycle remain solid, supporting its long-term positive outlook. Historically, pullbacks of this magnitude typically end within 1 to 3 months and often foreshadow a consolidation phase before the next upward move. Furthermore, while altcoins inherently suffer from high volatility and insufficient liquidity, their performance relative to Bitcoin has been relatively resilient during the recent market downturn. Glassnode points out that altcoins tend to stabilize relative profits during deep market sell-offs. Although this is uncommon, it occurs after a prolonged period of poor altcoin performance. In fact, most altcoins have recently outperformed Bitcoin. Based on the current situation, the altcoin ETF market faces several constraints in the short term, including a downward trend, spreading panic, and liquidity pressures, but its long-term development also presents many positive factors. On the one hand, the increasing clarity of US regulatory policies has accelerated the development of ETFs. Currently, the US SEC has approved a common listing standard for crypto ETFs and issued relevant guidance, simplifying the approval process. This move has attracted more institutions to participate in the ETF market, accelerating the approval or listing process for dozens of cryptocurrency ETFs. According to incomplete statistics, more than 130 ETP products have applied for listing, such as Grayscale's expected launch of the first Dogecoin ETF on November 24. Furthermore, the US cryptocurrency market structure bill has also made progress. US Senate Banking Committee Chairman Tim Scott recently revealed that the bill is expected to complete review and voting by both committees by the end of the year and be submitted to the full Senate for review early next year for President Trump's signature. A clear regulatory framework helps reduce market uncertainty and encourages funds to shift from high-risk derivatives to compliant spot products. On the other hand, the collateralization function of ETFs may stimulate demand from institutional investors. As can be seen from the ETF products mentioned earlier, almost all of them have introduced staking functionality to attract investors. Staking provides investors with an additional source of returns, increasing product appeal and thus helping to attract more capital inflows. Will Peck, Head of Digital Assets at WisdomTree, predicts that ETFs holding diversified cryptocurrency portfolios will fill a significant gap in the market in the coming years and are poised to become one of the next investment waves. Peck explains that while many new investors now understand the concept of Bitcoin, they often struggle to assess the value of the "next 20 assets." A diversified cryptocurrency portfolio allows them to access the space while reducing the "specific risks" of investing in a single token. From a long-term perspective, accelerated regulatory policy implementation and a slowdown or reversal of the market downturn will provide growth momentum for the ETF market. If market sentiment recovers and investor confidence rebounds, funds will be more willing to flow into the altcoin ETF market. It is expected that early next year, driven by both favorable policies and improved market sentiment, altcoin ETFs will likely experience a significant surge.

Weatherly

Weatherly