Author: Biraajmaan Tamuly, CoinTelegraph; Compiler: Deng Tong, Golden Finance

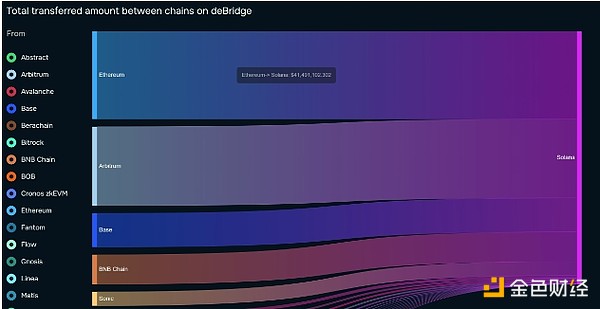

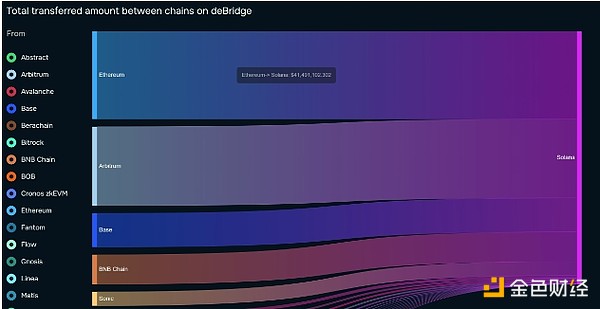

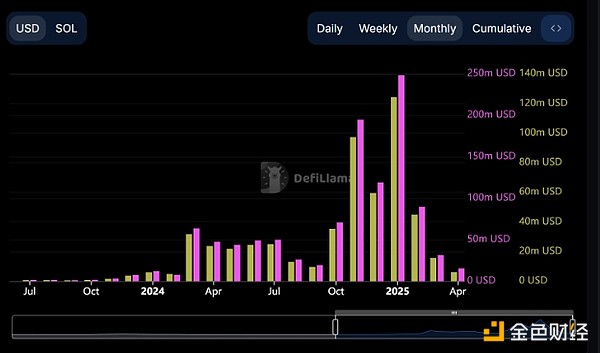

In the past 30 days, cryptocurrency market participants have bridged more than $120 million in liquidity from other blockchains to Solana, indicating renewed confidence in the network. According to Debridge data, traders transferred the highest amount from Ethereum at $41.5 million, followed by $37.3 million from Arbitrum.

At the same time, users on Base, BNB Chain and Sonic transferred $16 million, $14 million and $6.6 million, respectively.

Total amount transferred from other chains to Solana. Source: debridge

Solana’s liquidity return stands in stark contrast to the challenges the network has faced recently. After Argentine President Javier Milei was involved in the LIBRA meme coin scandal, Solana welcomed $485 million from investors who had moved funds to other blockchains such as Ethereum and BNB Chain.

The current influx of liquidity into Solana coincides with another double-digit rise in Meme coin prices, with POPCAT, FARTCOIN, BONK, and WIF up 79%, 51%, 25%, and 21% respectively in the past seven days.

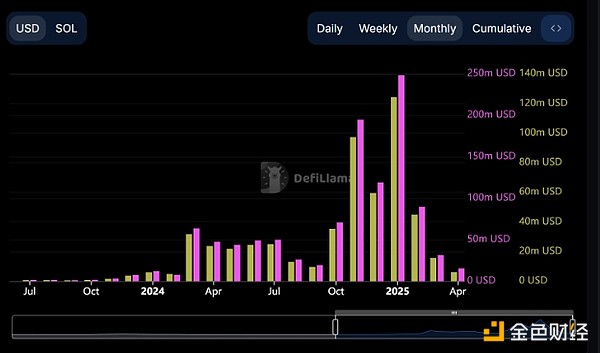

However, further analysis shows that total fees incurred in March were just under $46 million. In comparison, Solana's fees peaked at $400 million in January 2025. Currently, total fees incurred in April are around $22 million.

Total fees and revenue generated by Solana. Source: DefiLlama

Solana price faces a difficult uptrend ahead

From a technical perspective, Solana remains in a bearish trend on the 1-day chart. SOL must break out of the bullish structure and close above $147 to achieve a bullish trend shift.

Solana 1-day chart. Source: Cointelegraph/TradingView

Solana remains below $140, with the 50-day exponential moving average (blue line) acting as a stiff resistance. A close above the 50-day moving average would increase the likelihood of a trend reversal, but SOL price has stalled at current levels.

On the lower timeframe (LTF) charts, Solana is seeing a bearish divergence between its price and the relative strength index (RSI) indicator. Historically, bearish divergences have signaled a correction for Solana in 2025. Since January, SOL has experienced four bearish divergences, each following a price decline.

Solana 4-hour chart. Source: Cointelegraph/TradingView

The previous and current bearish divergences are very similar. Both divergences occurred after the price temporarily broke above the 50-day and 100-day moving averages (blue and green lines) on the 4-hour chart, ultimately leading to a drop in price.

Thus, Solana could follow a similar path in the coming days. The 1-day demand area is an immediate area of interest for a bounce between $115 and $108.

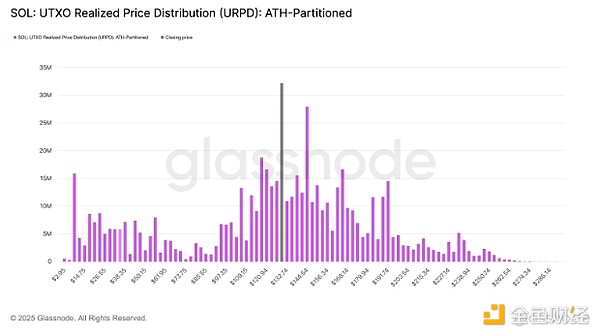

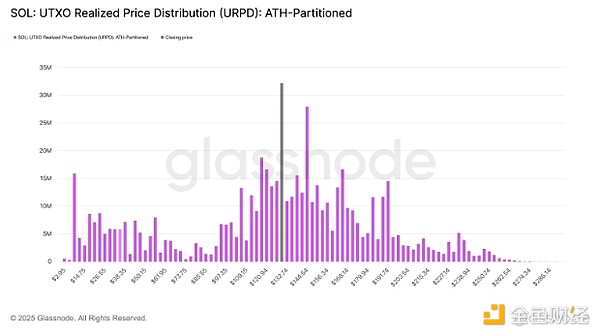

Meanwhile, Glassnode reported a significant shift in Solana’s realized price distribution in a recent X post, with over 32 million SOL purchased at $130 in the past few days. This represents 5% of the total supply, meaning that $130 could act as a strong support level going forward. The analysis added: “Below $129, we expect 18 million $SOL (3%) to be located at $117.99; above $129, 27 million $SOL (4.76%) will be located at $144.54. In the short term, $144 may act as resistance, $117 may serve as the lower limit of the price range, and $129 will become a key pivot area.”

Solana UTXO realized prices. Source: Glassnode

Davin

Davin