Who is Satoshi Nakamoto? We are all Satoshi Nakamoto

Satoshi Nakamoto is not the authority of Bitcoin, but "us" who run the Bitcoin nodes and "us" who use Bitcoin are responsible for Bitcoin.

JinseFinance

JinseFinance

Author: Lostin Source: Helius Translation: Shan Ouba, Golden Finance

Abstract

The Solana network consists of 4,514 nodes, including 1,414 validators and 3,100 RPC nodes (685th Epoch). No single validator controls more than 3.2% of the total stake.

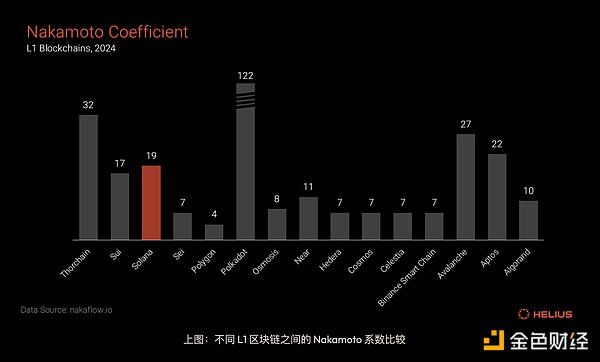

Nakamoto Coefficient (NC) represents the minimum number of independent entities that can cause network activity failure (inability to generate new blocks) in the event of malicious collusion. Solana’s Nakamoto coefficient is often considered to be 19, but the actual number may be lower because a single entity can anonymously run multiple validators without permission.

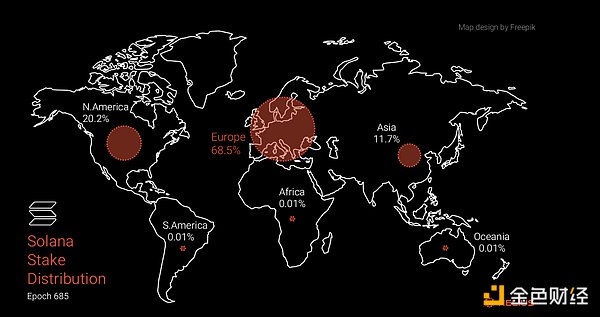

Solana’s validators are distributed in 37 countries. The region with the largest number of validators is the United States, with a total of 508 validators. Four regions have a stake share of more than 10%: the United States has 18.3%, the Netherlands and the United Kingdom both have 13.7%, and Germany has 13.2%.

68% of the stake is delegated to validators in Europe, and 20% to validators in North America. 50.5% of the stake is distributed among validators in the European Union (excluding Norway, Ukraine, and the United Kingdom).

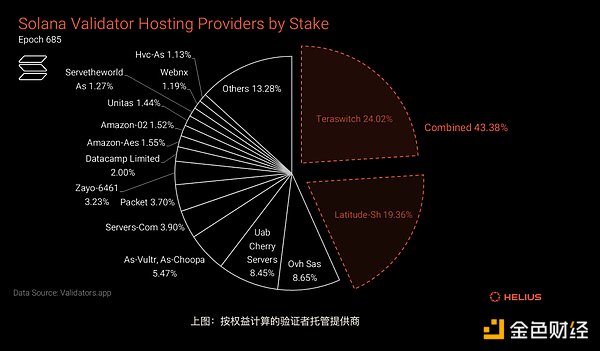

Validators are distributed across 135 different hosting providers. The top two providers are Teraswitch (a private US company, hosting 24% of the stake) and Latitude.sh (formerly Maxihost, a Brazilian provider of low-cost bare metal servers, hosting 19% of the stake).

Clients and Development

• Agave Client: 357 contributors to the codebase.

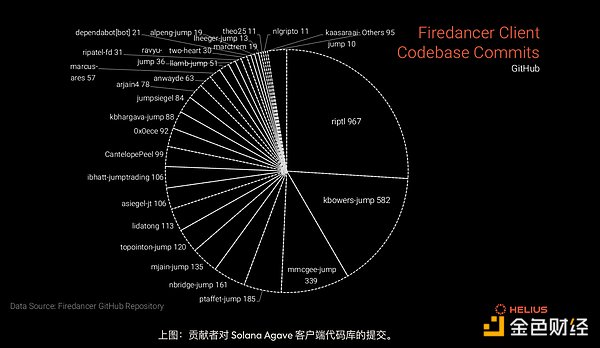

• Firedancer Client: Developed by a small team led by Scientific Director Kevin Bowers, currently with 57 contributors.

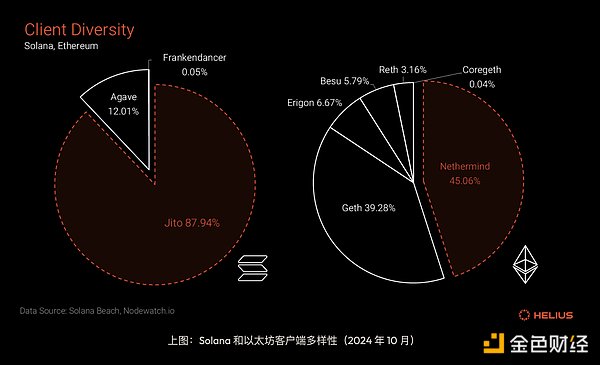

• Jito Client: A fork of the Agave client that adds off-chain block space auction functionality, currently accounting for 88% of the network stake. However, this share is expected to change significantly over the next 12 months as the Firedancer client is gradually introduced and integrated. Solana and Ethereum are the only Layer 1 blockchains that currently offer multiple client implementations.

Major changes to Solana's core components are subject to a formal public proposal process (Solana Improvement and Development, SIMD). Major protocol adjustments involving changes to economic parameters require a governance vote. To date, three governance votes have been held.

Solana Foundation

Founded in June 2019, the Solana Foundation is a non-profit organization registered in Switzerland dedicated to supporting the development of the Solana ecosystem. The Foundation consists of 60-65 full-time employees who manage grant programs, staking projects, and development tools.

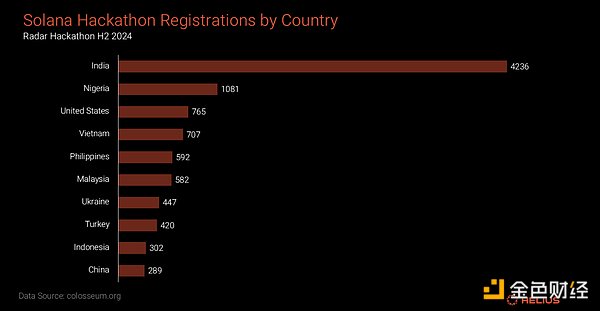

In addition, Solana's developer community has significant geographical diversity. In the most recent biannual hackathon “Radar”, 13,672 participants from 156 countries signed up, with the main participants coming from India, Nigeria, the United States, and Vietnam. The SuperTeam (the network connecting Solana creators, developers, and operators) now has 1,300 members in 16 countries.

What is decentralization?

Decentralization can be summarized as the absence of a single point of failure in a system. This multi-dimensional concept covers token distribution, the influence of key figures, permissionless network participation, development control, and software/hardware diversity. There is no unified method for measuring the level of decentralization of a blockchain, and many indicators are flawed, except for Balaji's Nakamoto coefficient. In addition, discussions around blockchain decentralization are often politically philosophical, often sparking ideological and even religious debates.

Solana has long been criticized and misunderstood by some in the blockchain community for its lack of decentralization and censorship resistance. A recent example is the concerns expressed by former US intelligence contractor and whistleblower Edward Snowden in his keynote at the Token2049 conference:

"Looking back at the Bitcoin whitepaper, I think you'll see a kind of adversarial systems thinking, and that's what we need to think about. A lot of people - I don't want to name names, but like Solana - they take a good idea and say, 'What if we centralize everything? It'll be faster, more efficient, cheaper...' You have to think about it in terms of adversarial, not in terms of convenient, easy inception."

Like many of Solana's critics, Snowden did not provide data to support his arguments, despite being openly invited to provide evidence. The following analysis will examine the level of decentralization of the Solana network based on data, highlighting its relative strength in decentralization while pointing out areas for further improvement.

Through this report, we will take a quantitative and multi-faceted approach to analyzing Solana’s decentralization, grounding our analysis in facts and publicly verifiable information.

We will evaluate the following areas:

Stake Distribution

Geographic Distribution of Nodes

Diversity of Hosting Providers

Client Software Diversity

Developer Diversity

Governance Processes and Entities

When appropriate, we will compare the Solana Network’s metrics to those of other industry peer-to-peer proof-of-stake L1 blockchains. Peer-to-peer networks serve only as a benchmark to provide broader context for Solana’s decentralization journey and highlight areas where it may be lagging or exceeding expectations.

These comparisons should not be misinterpreted as attempts to claim that one network is superior to another.

In many cases, Ethereum provides the most useful benchmark as it is widely considered the most decentralized Layer 1 Proof-of-Stake blockchain. Notably, Ethereum’s genesis block is more than twice as old as Solana’s, with its genesis block occurring in July 2015, while Solana’s genesis block occurred in March 2020. Decentralization is dynamic, and blockchains generally become more decentralized over time. Under similar conditions, it is reasonable to expect that older networks will achieve higher levels of decentralization.

Stake distribution in a blockchain network refers to how the network’s stake tokens are distributed among its validators. In a well-distributed system, no single validator or small group holds a disproportionately large amount of stake, reducing the risk that any one entity can gain undue influence or control over the network consensus. Balanced stake distribution ensures a diverse set of validators, which promotes decentralization and makes it more difficult for any malicious actor to undermine the integrity of the network. It also helps improve fault tolerance as the network becomes more resilient to single validator failures. "You need a very large validator set, and essentially the larger the validator set, the more secure the network is, but at an academic level, the larger the node set, the easier it is to guarantee that the honest nodes that are in the minority in that set always have a minimum spanning tree that can reach each other. And that doesn't even mean at the protocol level; it's literally people talking on the phone. People can actually go into Discord or IRC or call each other on their phones. That's how we solve partitions and figure out what the problem is. The more people we have, the easier it is for us to guarantee that partitions can't happen." - Anatoly Yakovenko, Breakpoint 2024 Running a node on the Solana network is completely permissionless, and the minimum mandatory stake required to run as a validator is very low (1 SOL). The network natively supports delegated proof-of-stake (dPoS) and consists of 4,514 nodes, including 1,414 validators and 3,100 RPC nodes.

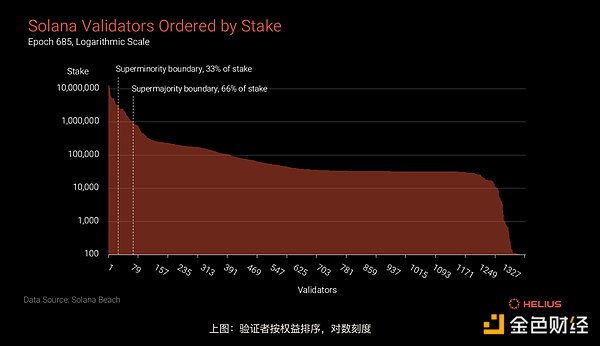

The two largest validators by stake are operated by Helius and Galaxy, each holding about 3.2% of the stake. The minimum delegated stake required to enter the top third super minority and top two thirds super majority is 4.4 million and 1.23 million SOL respectively.

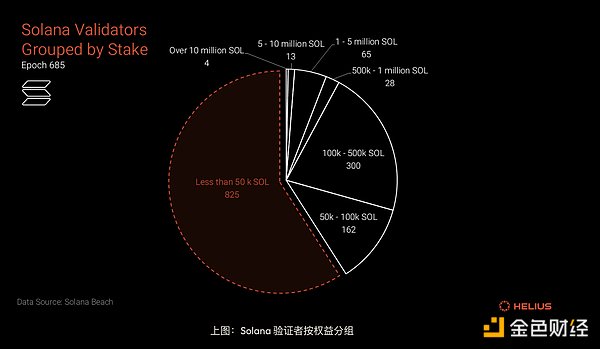

For greater clarity, the table below groups validators by delegated stake. At the upper limit, 82 validators (5.87% of the total) hold more than one million delegated SOL. Conversely, at the lower limit, 825 validators (59.1% of the total) have less than 50,000 delegated SOL, most of whom participate in the Solana Foundation Delegation Program (SFDP), which is designed to help small validators quickly become sustainable. About 72% of Solana validators benefit from SFDP support, and these validators collectively account for 19% of the total stake.

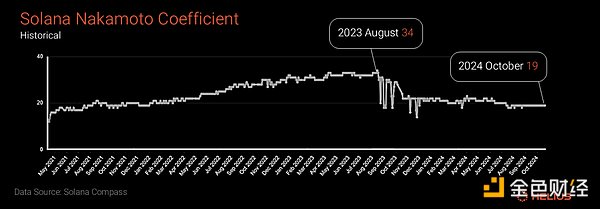

Just as blockchain addresses are not equivalent to users, the number of validators does not reflect the true number of different entities operating validators. Since larger entities may choose to spread their stake among multiple validators, the actual number will be lower. For example, Jito (1, 2), Coinbase (1, 2), and Mrgn (1, 2) operate multiple validators. There is nothing inherently wrong with a single entity operating multiple validators; in fact, if validators are distributed rather than co-located, this can strengthen the network by increasing geographic and hosting provider diversity. However, this can create risks if these validators are configured with non-standard setups or firewall rules. Additionally, having a single entity manage many validators on behalf of a large company or project as part of a “validator as a service” model can introduce further decentralization issues. Nakamoto Coefficient In a proof-of-stake network, the Nakamoto Coefficient represents the minimum number of nodes required to control at least one-third of the total stake (i.e., a super minority). The higher the Nakamoto Coefficient, the more widely distributed the stake is, and therefore the more decentralization is achieved. It can also be thought of as the minimum number of independent entities that can maliciously collude to cause a liveness failure, thereby denying the consensus required for new block generation. PoS-based and Byzantine Fault Tolerant blockchains require more than two-thirds of the stake to agree on the state of the network in order to continue processing transactions.

To determine the Nakamoto coefficient of the Solana network, we sort validators by their stake share from highest to lowest and calculate the number required to control one-third of the total stake. Solana's Nakamoto coefficient has historically ranged between a peak of 34 on August 13, 2023 and its current low of 19. The coefficient has been relatively stable over the past year.

Solana’s Historical Satoshi Coefficient

The Solana network’s Satoshi Coefficient is mid-range compared to industry peer networks. These numbers do not take into account that individual entities are free to operate multiple validators anonymously, so the true Satoshi Coefficient is likely lower.

Geographical diversity of network nodes is critical to reducing risk and increasing network anti-fragility. When too many validators are concentrated in one region, the resilience of the network becomes dependent on the regulatory frameworks of those specific jurisdictions.

Natural disasters such as earthquakes, floods, hurricanes, and tsunamis are another risk. Such events can put pressure on national power grids and can severely disrupt data center operations, causing sudden power outages. Man-made threats such as war, cyberattacks, and damage to critical internet infrastructure, including undersea cables, also pose further risks that could jeopardize the stability of the network.

The Solana data analyzed in this section was collected from validators.app for epoch 685. The original dataset is available here in spreadsheet format. These numbers reflect only staked validator nodes and do not include non-staked RPC nodes.

When grouped by continent, the data shows that 632 Solana validators (46%) are located in Europe and 550 (40%) are located in North America. In terms of stake distribution, 68% of the stake is delegated to validators in Europe and 20% to validators in North America. 50.5% of all stake is delegated to validators operating within the EU (i.e. European stake excluding Norway, Ukraine, and the UK).

Solana validators and stake distribution by continent

In comparison, Ethereum has a similar stake distribution, but with a higher North American weight of 34.4%.

Ethereum validators and stake distribution by continent

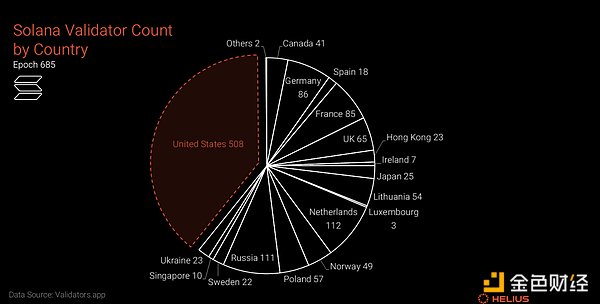

The Solana network’s validator set is spread across 37 different countries and regions. The largest concentration is in the United States, with 508 validators (37%) running in U.S. data centers, followed by 112 validators in the Netherlands (8%) and 111 validators in Russia (8%).

Solana Validators by Country

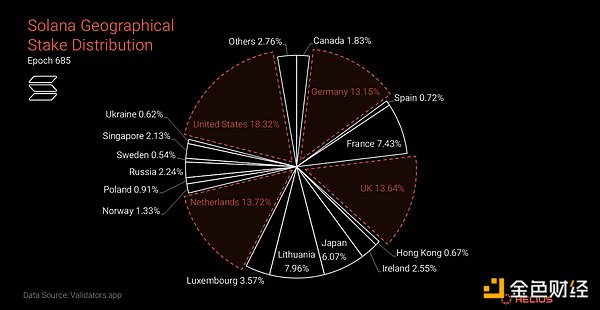

If validators are weighted by stake, the distribution is more balanced. Four major jurisdictions hold more than 10% of the stake each: the United States at 18.3%, followed by the Netherlands and the United Kingdom at 13.7% each, and Germany at 13.2%.

Geographical distribution of Solana staking

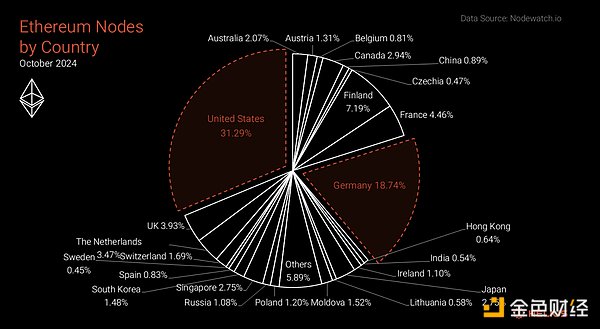

In contrast, Ethereum nodes are distributed in 83 different countries and regions, nearly half of which are located in the United States or Germany.

Ethereum nodes by country

A more detailed analysis of the distribution of validators and delegated stake by city shows that Solana validators are distributed in 121 cities around the world.

Specifically, for the United States, validators are scattered across all major regions, covering a total of 35 cities. The most popular are Chicago (124 validators, 2.3% stake), Los Angeles (57 validators, 2.3% stake), and New York (32 validators, 3.5% stake).

Earlier this year, Anza employee Rex St. John proposed strategies to improve the geographic diversity of Solana’s validators, specifically by expanding the presence of operators in the Global South.

Several key challenges were identified:

Higher latency: Nodes in remote areas have difficulty staying in sync with the network.

Bandwidth costs: Bandwidth costs are very high in some regions

Regulatory restrictions: Different jurisdictions have laws that restrict the feasibility of operating blockchain infrastructure

Undeveloped infrastructure: Inadequate network and data center infrastructure.

Unfavorable taxes and tariffs: High hardware equipment costs.

Talent Shortage: Solana lacks local expertise and has limited access to the funds needed for staking

Ideally, the validator set should be hosted by a wide range of independent providers, rather than relying heavily on a few centralized providers. This diversification is critical to reducing the risk of network outages or censorship by any single provider.

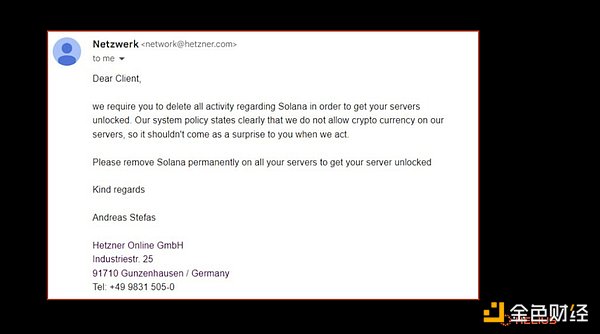

A major incident in 2022 involved German hosting provider Hetzner, which accidentally removed Solana validators from its service, causing more than 20% of active stake (about 1,000 validators) to go offline within a few hours. Despite this, Solana remained fully operational with no liveness issues. Most of the affected validators successfully migrated to new data centers within a few days, and almost all of the delinquent stake was back online within a few weeks.

Email notification sent to Hetzner customers instructing them to remove the Solana client software from their servers

The Solana validator set is scattered across 135 different hosting providers. The two leading providers are Teraswitch, a private US company that hosts 24% of validators, and Latitude.sh (formerly Maxihost), a low-cost bare metal server provider based in Brazil, which is used by 19% of validators. Together, these two providers account for 43.4% of the shares. Other popular hosts include French cloud computing company OVHcloud, which holds an 8.65% share, and Lithuania-based Cherry Servers, which holds 8.45% of validators.

Because Solana is a high-performance, high-throughput blockchain, its node requirements are more stringent than most of its industry peers. Hardware recommendations for Solana validators include the following key components:

CPU: 24 cores / 48 threads or more, 4.2GHz base clock speed or faster

Memory: 512 GB

Disk: PCIe Gen3 x4 NVME SSD, or higher, 2 TB or more total capacity. High TBW

No GPU required

In practice, Solana’s bandwidth requirements make home operations impractical, so validators primarily operate on bare metal servers in dedicated data centers.

Solana initially launched with a single validator client, developed by Solana Labs and written in Rust. While the Solana Labs client is no longer actively updated, a fork called Agave is currently in use. Complete reliance on a single client implementation is a significant vector for centralization, as it introduces a significant risk of software bugs that could cause liveness failures across the network.

Increasing client diversity has been a top priority for the Solana community, and with the launch of Firedancer, that goal has finally been achieved.

Currently, multiple Solana client implementations are either live or in development:

Agave: A fork of the original Solana Labs client, written in Rust and maintained by Anza, the Solana software development company.

Firedancer: A complete rewrite of the original client in the C programming language by Jump Crypto.

Frankendancer: A hybrid validator that combines the networking stack and block production components of Firedancer with the execution and consensus of Agave.

Jito: A fork of the Agave client built by Jito Labs that introduces an out-of-protocol blockspace auction to provide more economic incentives for validators through tipping.

Sig: A read-optimized Solana validator client written by Syndica using Zig.

In addition, Mithril is a client written in Golang developed by Overclock that can serve as a validating full node with lower hardware requirements.

Having multiple full-time core engineering teams reviewing each other's code bases can greatly increase the likelihood of finding bugs while promoting knowledge sharing and collaboration.

“We’ve learned a lot from the Firedancer client team; some of the solutions they came up with are really clever,” Anza engineer Joe Caulfield said in a recent interview.

Both Agave and Firedancer have significant bug bounty programs.

Solana and Ethereum are the only two layer 1 networks that offer multiple client implementations. Ethereum has at least five major software clients. The most widely adopted are Nethermind (written in C# with 45% usage) and Geth (written in Go with 39% usage).

On Solana, the Jito client currently owns 88% of the network. However, this landscape is expected to change dramatically over the next 12 months as new clients Frankendancer and Firedancer are gradually introduced and integrated into the ecosystem.

In Quantifying Decentralization, Balaji identified developer decentralization as a key factor in blockchain ecosystems, emphasizing the importance of minimizing reliance on individual contributors and reducing "key person risk."

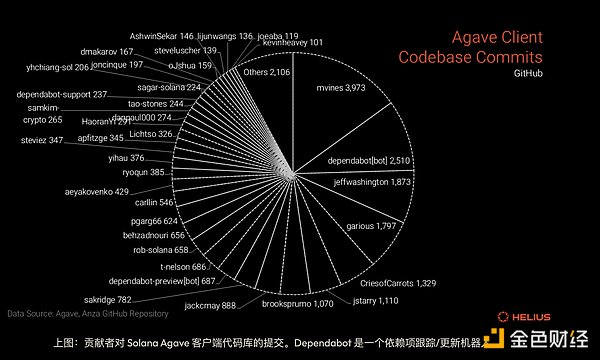

All core client software on Solana is publicly hosted on GitHub under an open source license, allowing open access and community contributions. The Agave validator, maintained by Anza, a software development company founded in early 2024, plays an important role in this space. Anza had about 45 employees when it was founded, about half of Solana Labs' previous workforce. In addition to managing Agave, the Anza team also contributes to the broader Solana ecosystem through initiatives such as developing token scaling, cross-border payment infrastructure, and Solana's permissioned environment. The Agave client code base has 357 contributors and 26,408 commits, but the raw commit count alone is not perfect and cannot fully reflect the depth of individual contributions. It is worth noting that a small group of developers (primarily Solana's senior engineers and co-founders) wrote the majority of commits, with a small group of smaller contributors.

In contrast, Ethereum’s popular Geth and Nethermind clients show similar patterns of contributor concentration in the larger community. Geth has 1,098 contributors, while Nethermind has 142. More than half of all Geth commits are attributed to three core contributors. Similarly, two developers account for more than 50% of all Nethermind commits.

The Firedancer client is developed by a small team led by Kevin Bowers of Jump, a well-known high-frequency trading company in the United States, and currently has 57 contributors and 3,722 commits. Given that Firedancer is a relatively new project (the first commit dates back to August 2022) and was only recently launched on the mainnet, the diversity of contributors is still limited.

The geographic diversity of the developer community is evident in the broader Solana ecosystem. Solana’s biennial online hackathon is one of the most well-attended hackathons in the world and has played an important role in fostering many of today’s most successful Solana protocol and application teams, including Tensor, Drift, Jito, and Kamino.

The recent Radar Hackathon attracted 13,672 participants from 156 countries, with India, Nigeria, the United States, and Vietnam particularly well represented.

Radar Hackathon Registrations by Country

Superteam, a network connecting Solana creatives, developers, and operators, has grown to 1,300 members in 16 countries. Its localized chapters foster collaboration through events and shared workspaces. Solana Allstars is an ambassador program run by Step Finance that has been a huge success in Nigeria, with over 120 well-attended meetups in many regions

Governance is an important vector of decentralization as it determines how decisions are made within the network. This affects everything from protocol upgrades to economic policy and community rules. Decentralized governance enhances transparency, fairness, and trust in the network.

Solana Improvement and Development (SIMD) Proposals are the formal documentation required for any significant changes to Solana’s core components. “Significant” changes are defined as those that generally alter the network’s protocol, transaction validity, or interoperability.

Non-substantial changes, such as small code refactorings or objective performance improvements, do not require proposals. Proposals should document the rationale for the feature as well as sufficient documentation to understand the implementation.

While SIMD submissions are permissionless and open to any developer or researcher, most SIMDs are submitted by developers on client teams working full-time on core protocol improvements.

There are two types of proposals:

Standards Proposals: impact Solana’s core functionality (e.g. consensus, networking, and API interfaces)

Meta Proposals: address processes or guidelines outside of the codebase

SIMDs typically go through stages of idea review, drafting, review, and acceptance. Formal review happens publicly on GitHub, and proposal authors are responsible for gathering feedback from relevant core contributors, who then decide whether to accept, modify, or withdraw the proposal.

Authors are under no obligation to implement their proposals, but are generally encouraged to do so as it is the best way to ensure successful completion.

If accepted, proposals will typically contain tracking issues related to feature implementation and may need to be activated through Solana’s feature gate mechanism. Feature gates are first activated at epoch boundaries on testnets, then on devnets, and finally on mainnet.

Discussions about improvements take place on the following venues:

SIMD (Solana Improvement Document) Github repository

sRFC (Solana Request for Comments) section of the Solana Official Forums

Solana Technical Discord

Decentralized social channels including X (formerly Twitter) and Telegram

Significant protocol changes to SIMD (especially those that affect economic parameters) require a governance vote. The Solana governance voting process is a relatively new initiative, led by long-time members of the validator community, focusing only on key issues to maintain engagement and avoid governance fatigue.

To date, three such votes have taken place:

Initial advisory vote in October 2023 (14.3% stake participation)

SIMD33 timely voting points in April 2024 (53% stake participation)

SIMD96 full priority fee to validators in May 2024 (51% stake participation)

Voting is conducted by depositing tokens into each validator’s identity account, and each account receives tokens proportional to its active stake in lamport.

To vote, validators need to transfer those tokens to one of several designated public keys corresponding to the available voting options, including the option to abstain. Once a vote is cast, it cannot be changed.

In this structure, SOL token holders participate only indirectly by delegating their staked SOL to vote for validators that align with their values or preferences.

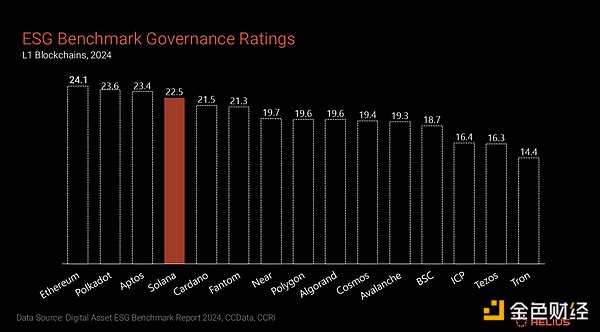

According to CCData’s benchmark report released earlier this year, Solana is one of only four AA-rated assets out of the top 40 digital assets assessed on environmental, social, and governance (ESG) criteria. The report’s governance rating evaluates factors such as stakeholder engagement, transparency, and decentralization, with Solana ranked fourth among L1 blockchains.

L1 Blockchain's Digital Asset ESG Benchmark Governance Rating

Founded in June 2019, the Solana Foundation (SF) is a Swiss-registered non-profit organization dedicated to the decentralization, adoption, and security of the Solana ecosystem. SF was initially funded with 167 million SOL tokens and is responsible for overseeing funding for grants, its delegation program, and developer tools. It controls the official brand assets, social media accounts, website, and trademarks.

The Foundation has a relatively lean team of 60-65 full-time employees, led by Executive Director Daniel Albert and President Lily Liu, and overseen by the Foundation’s Board of Directors.

SF’s mission is to foster a scalable and self-sustaining Solana network, with a focus on education, research, and ecosystem development initiatives. SF organizes large-scale Solana events, including Hacker Houses and the annual Breakpoint conference, to promote developer engagement and community building.

The SF Developer Relations team is responsible for maintaining official documentation, social channels, and developer education. In January 2024, SF will hand over management of the flagship hackathon to Colosseum, a new independent accelerator co-founded by former SF Head of Growth Matty Taylor.

“Our job is to solve our own problems. Find scalable ways to support the network and the ecosystem, and then let them go,” Dan Albert stated in a recent debate, indicating SF’s long-term goal of building a network that can sustain itself without oversight.

As outlined in this article, the Solana network’s decentralization matches or exceeds industry peers across a number of key metrics, including the Satoshi coefficient, geographic distribution of validators and stake, developer decentralization, and governance benchmarks. Client diversity remains a notable exception, which the new Firedancer client aims to address.

There are several opportunities to increase Solana’s decentralization:

Explore options for distributing SF responsibilities across multiple organizations

Increase transparency around Foundation spending and grant allocations

Develop initiatives such as “Solana Nations” to increase geographic diversity

Reduce voting costs, which is the largest expense for validator operators

Explore strategies to reduce validator data outflow requirements; these costs are particularly high for operators outside the EU and US

Encourage more people to actively participate in governance voting

Expand Solana ’s core contributors and research community to strengthen the network’s development

The validator set remains somewhat concentrated in the US and EU and relies on a limited number of hosting providers. While this challenge is not unique to Solana, it highlights Solana’s potential for improvement as one of the less centralized blockchains at the validator level.

Satoshi Nakamoto is not the authority of Bitcoin, but "us" who run the Bitcoin nodes and "us" who use Bitcoin are responsible for Bitcoin.

JinseFinance

JinseFinanceBTC continued to stay at 63k over the weekend. Ahead, as far as the eye can see, is the surging resistance zone. To pass or not, that is the question.

JinseFinance

JinseFinanceThe Bitcoin halving is done, and the Runes are released. What’s next? The Stacks Nakamoto upgrade.

JinseFinance

JinseFinanceWright’s lawyers countered that the Cryptocurrency Open Patent Alliance could not provide direct evidence that Wright was not Satoshi Nakamoto.

JinseFinance

JinseFinance JinseFinance

JinseFinanceDr. Craig Steven Wright, who asserts to be the Bitcoin inventor Satoshi Nakamoto, will present his case in a UK court.

Beincrypto

BeincryptoIt has emerged that Satoshi Nakamoto might have had a different idea regarding assigning the name to the flagship cryptocurrency.

Finbold

Finbold Cointelegraph

CointelegraphThe real identity of Satoshi Nakamoto remains a mystery but their brainchild, Bitcoin, has gone on to achieve wonderful things ...

Bitcoinist

BitcoinistAndrás Győrfi said: "No matter who he or she is, Bitcoin creates value, and especially the technology behind Bitcoin-blockchain creates value."

Cointelegraph

Cointelegraph