SOL's recent strength is driven by continued buying by multiple listed companies, with treasury reserves now reaching 17.112 million tokens, directly driving up prices!

Just as Bitcoin and Ethereum ETFs have reshaped the funding landscape, Solana is also experiencing its own "holding reshuffle."

We previously analyzed Ethereum's holdings structure. This is our second analysis of holdings of major cryptocurrencies.

Who are Ethereum's "financial backers," and do ordinary investors still have a chance?

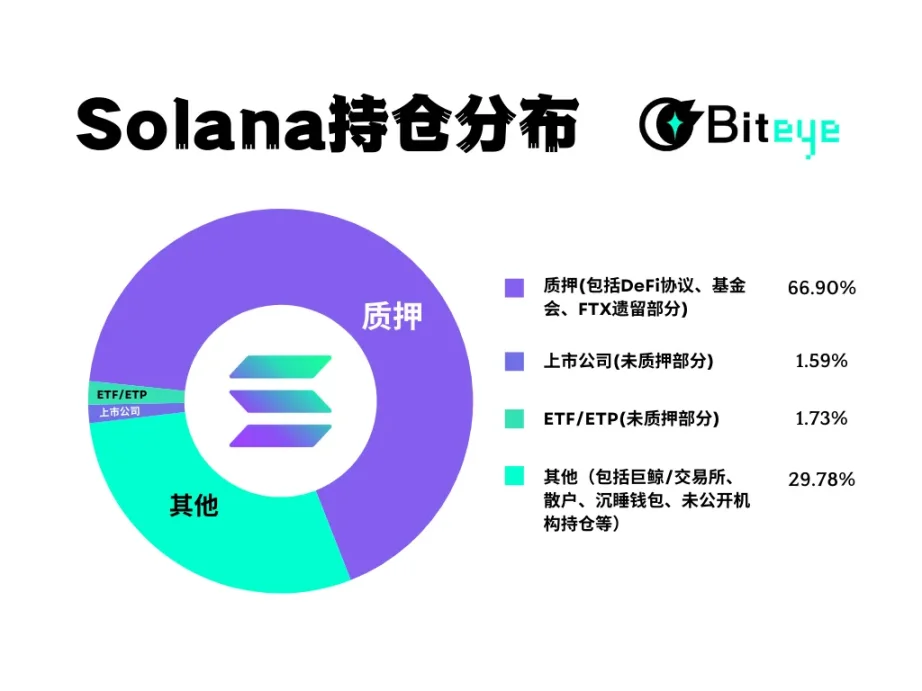

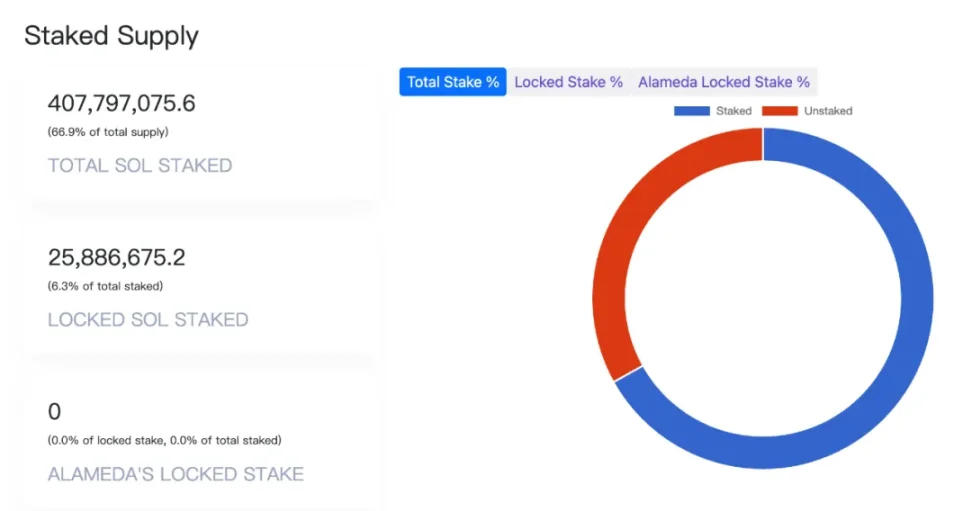

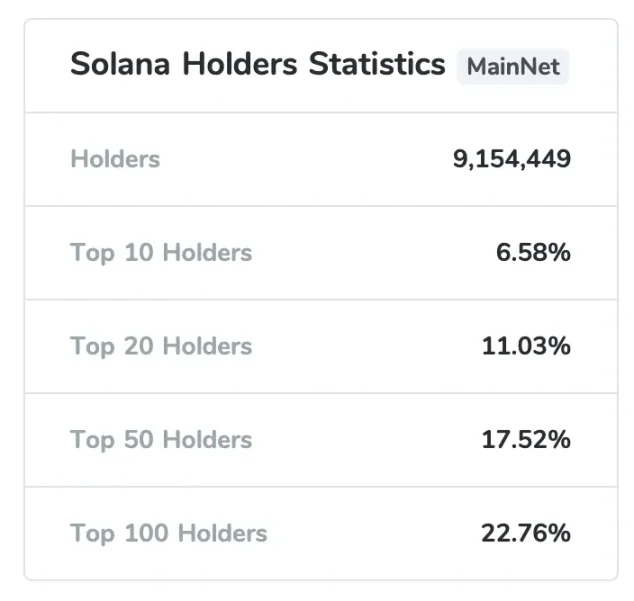

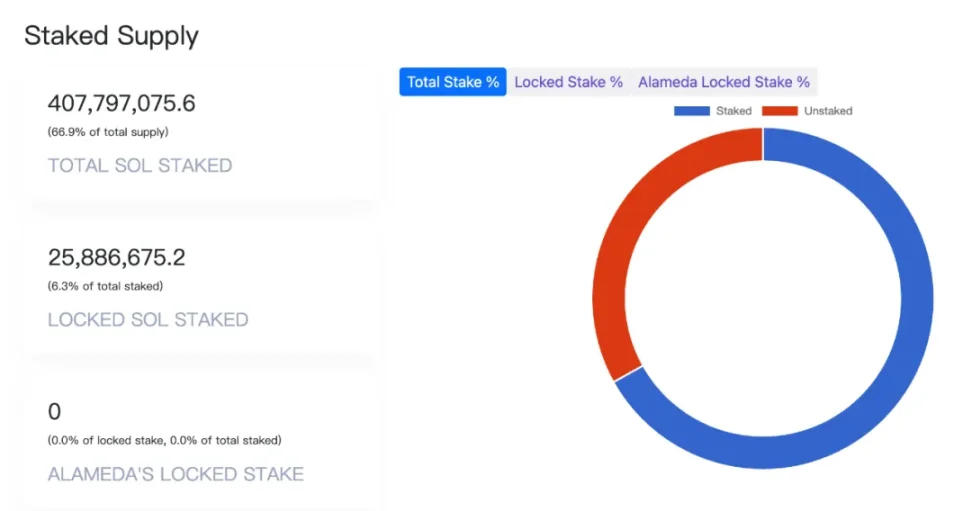

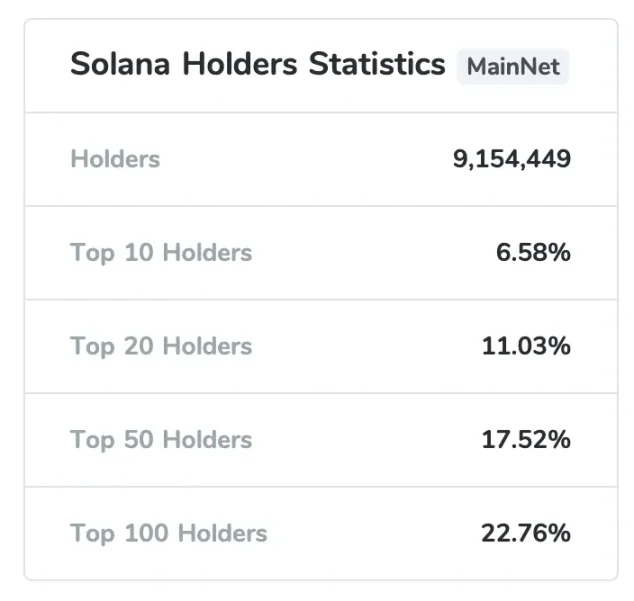

01 Why is it important to study institutional holdings? The crypto market moves at a fast pace. So who is buying? How much? Who is selling? Where is the selling pressure concentrated? Which funds are locked up for the long term, and which funds are subject to outflow at any time? These questions determine the token's price elasticity and the potential for price fluctuations in the next cycle. 02 staked, accounting for approximately 66.9% According to the Solana compass, the total supply of SOL is 610 million. As of September 16, approximately 408 million SOL has been staked across the Solana network, representing 66.9% of the total supply. Essentially, SOL is a massive platform comprised of retail staking, DeFi protocols, treasury stakes from listed companies, foundations, and institutional whales. By comparison, ETH's staking rate is only 40%. This makes SOL one of the mainstream public chains with the highest staking rates in the crypto market, indicating limited selling pressure and strong price support.

1. Analysis of the Concentration of Staking:

There are also some interesting points in the staking validator structure. According to everstake data:

The top three validators, Helius, Binance Staking, and Galaxy, control more than 26% of the total, of which Helius alone holds 13.22 million SOL (accounting for 9.76%)

Followed by Ledger by Figment, Kiln, Coinbase, and Everstake

This means that Solana's staking structure exhibits a "top concentration + long tail dispersion": large institutional nodes have significant influence, but overall it maintains a certain level of decentralization, avoiding complete dominance by a single force.

Note: The data in the pie chart below primarily shows the distribution of top validators and does not represent the total 408 million SOL staked on the entire network. 2. DeFi Protocols According to DeFiLlama data, Solana's total network TVL is approximately 52.89 million SOL. However, it's important to note that a significant portion of this TVL comes from LST derivatives (such as JitoSOL, mSOL, and bSOL), not just SOL. This data also overlaps with the 66.9% total staked on the entire network and represents an independent increase in locked-in tokens. 3. Foundation: The Solana Foundation and Solana Labs hold SOL primarily in staking accounts, which are included in the 408 million staked SOL. The exact percentage is unknown. 4. FTX and Alameda: SOL is unique in that it has a "legacy" holding: the stakes held by FTX and Alameda. During the early stages of Solana's ecosystem development from 2020 to 2022, FTX and Alameda were among the most important supporters, purchasing and holding large amounts of SOL. Following the FTX collapse in November 2022, these assets were placed in escrow and included in the liquidation process. Their future unlocking, auctions, and even over-the-counter trading will affect the supply and demand balance of SOL. Since November 2023, FTX and Alameda-related staking addresses have redeemed and transferred a total of 8.98 million SOL. Currently, approximately 4.18 million SOL (0.69%) remains staked on-chain, with installments set to unlock until 2028. This portion is viewed by the market as potential selling pressure, potentially driving price fluctuations. 03 listed companies, accounting for approximately 1.59% (unpledged portion) According to data from the Strategic SOL Reserve (as of September 16th), 17 entities have established SOL treasury reserves, totaling 17.112 million SOL, accounting for 2.8% of the current total supply. Of these holdings, the amount of SOL pledged is approximately 7.4 million SOL, accounting for approximately 1.2% of the total supply.

Companies with the largest holdings:

Forward Industries (FORD): 6.822 million SOL, approximately $1.63 billion

Sharps Technology (STSS): 2.14 million SOL, approximately $510 million

DeFi Development Corp (DFDV): 2.028 million SOL, approximately $480 million

Upexi (UPXI): 2 million SOL, approximately $470 million

Galaxy Digital: 1.35 million SOL, approximately $320 million

2. Retail Investors

Dispersed but large in number, they constitute the market's foundation

3. Undisclosed Institutions

Holds held by some funds or venture capital firms, but not included in the financial statements

06 Government Holdings

To date, no publicly disclosed government or sovereign wealth fund directly holds SOL.

07 Celebrity Announcements

Beyond the money, there's also narrative. Who's bullish on Solana? Bitwise's Chief Investment Officer, Matt Hougan, recently emphasized in an article that Solana is at a critical juncture of ETP approval and the rise of corporate Solana vaults, a combination that has historically driven significant price increases for Bitcoin and Ethereum. Former Goldman Sachs executive Raoul Pal @RaoulGMI called Solana's "long-term structure stupidly bullish," expressing a long-term bullish view on Solana. Renowned cryptocurrency trader Ansem @blknoiz06 recently expressed bullish sentiment, stating, "If Treasury funds exit Solana DeFi, it will be extremely bullish." Helius Labs CEO Mert Mumtaz is betting that Solana will rise 150% over the next five years, believing any short-term price movements are just noise. From its position structure to its narrative, Solana has entered a phase of "institutional buying driven by market bullish sentiment." Based on the Hyperliquid liquidation chart, the current price is $238: First target: $250-275 — the uppermost short position liquidation zone, a breakout could trigger a short-term acceleration. Second target: $275-315 — the area with the highest short position concentration, a breakout could usher in a more intense short squeeze. With the resurgence of ETFs/ETPs and treasury companies, market expectations for Solana will also be reshaped. If capital flows continue, a bull market scenario could see Solana reach the $300-$400 range.

Kikyo

Kikyo