The first month of 2024 has become history, and Solana has continued its high-spirited upward trend this month, arousing the speculation of many investors. The popularity of Solana naturally boosted the popularity of its on-chain projects, and even caused some farce.

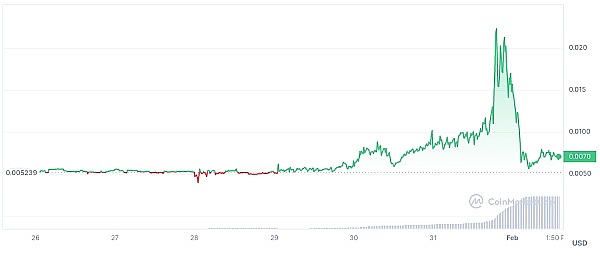

Just a few hours before Solana ecological transaction aggregator Jupiter launched the JUP airdrop on February 1, the JUP token of the same name on the Ethereum chain soared by more than 430%, and then in a few hours Then plummeted. This oolong incident will inevitably be regarded by investors as some kind of metaphor between SOL and ETH. From an objective perspective, if we analyze SOL's various data in depth, the recognition of this project may become higher and higher.

1. How long can SOL continue to rise after breaking through the key position of $100 and regaining lost ground?

From a price point of view, SOL once again broke through the key position of $100 on January 31, with an increase of 25% within 7 days. Some traders analyzed if SOL will rise in the future. If it can break through the resistance level of $104 on a daily basis, then it is more likely to break through the highest price in 2023 of $123.68. Traders are also optimistic that the $78 level is a resistance level for SOL and the possibility of a plunge in the asset does not exist. Of course, this is largely due to the help of meme coins such as Bonk and Dogwifhat. In addition, the $JUP mentioned above is listed on top CEXs such as Binance, Bybit, OKX, KuCoin and HTX, which also brings popularity to Solana.

At the same time, Bittensor (70%) and Helium (37%) on the Solana chain also achieved large increases, and are quite likely to be out of the independent market. meaning. It is important to note that Helium has its own blockchain with over one million hotspots before migrating to Solana in April 2023. To support growth and further expansion, Helium outsources tasks such as infrastructure support to Solana to save costs and achieve better scalability.

Looking at the recent macro background, after the adoption of the BTC spot ETF, all the bad news in the industry has been wiped out. Grayscale’s selling of GBTC has caused a smashing effect in the Bitcoin market. , the price fluctuated downwards, which also caused whale investors to turn their attention to Solana and its on-chain projects.

2. Various data continue to soar, will Solana win a good start in 2024?

The price increase is only an intuitive reflection of the project's fundamentals. If you comprehensively sort out Solana's recent data performance, you may find more.

1. SOL token trading volume continues to rise:

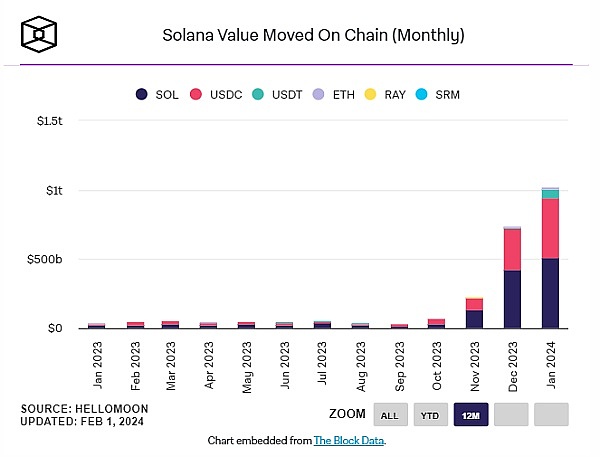

Data shows that as of 1 The transaction volume of SOL and SPL tokens on the Solana blockchain has soared to $951.9 billion on March 30, and the network’s economic throughput increased by 30% from $735.8 billion in December. Additionally, the growth in transaction activity on the Solana blockchain is significantly higher than in 2023 and much of 2022, compared with only about $40 billion in Solana network transaction volume in September 2023.

2. The number of new addresses on the chain has reached a new high:

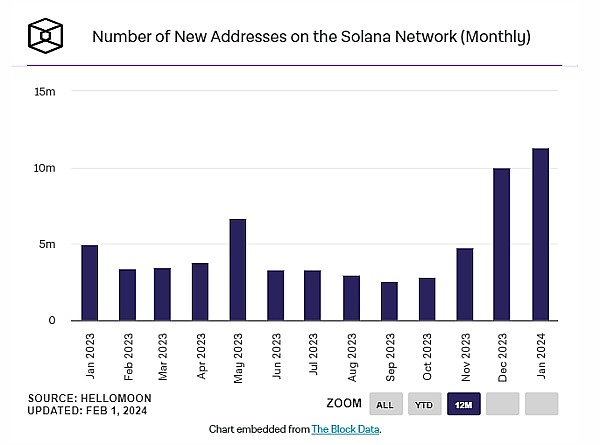

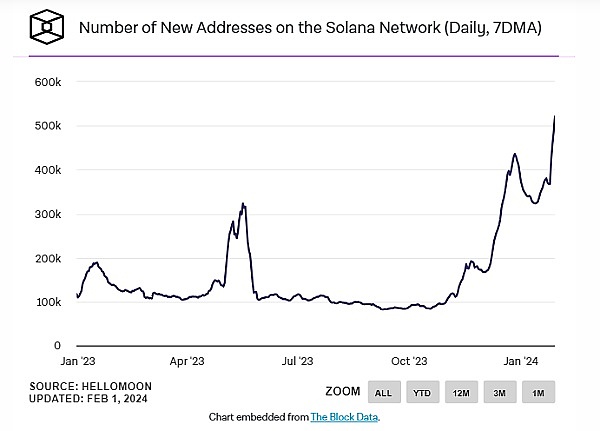

Data shows that the number of new addresses on the Solana network in January has exceeded It exceeded 10 million, setting a record high since May 2022, and is still increasing. The analysis pointed out that Solana’s increase in new addresses may have some moisture, because the popularity of WEN has had an impact on the increase in new addresses. It is currently airdropping to more than 1 million users, but as of the time of release, nearly half of the airdrops are still unclaimed.

3. The number of stablecoin transfers on the chain has increased sharply:

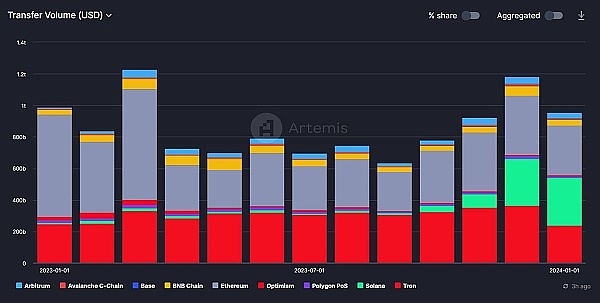

Artemis data shows that as of January 22, the amount of stablecoin transfers on the Solana chain was 303 billion U.S. dollars, which is already higher than the amount of stablecoin transfers on the chain in December 2023 (297 billion U.S. dollars), and an increase of 2520% compared to January 2023 (11.56 billion U.S. dollars). Solana’s on-chain stablecoin market share is currently close to 32%, a significant increase from its 1.2% share a year ago. Stablecoin activity on the Solana chain began to pick up in October last year and has grown steadily by 650% since then.

In addition, Solana Mobile's second-generation mobile phone reservations exceeded 40,000 units, and the DEX trading volume on the Solana chain was second only to ETH. Many other performances indicate that this once-famous but popular The project that almost died soon got a good start in 2024.

3. Communityization and high performance constitute the fundamental reason for Solana’s recovery, but the market outlook is still unpredictable

Compared with the recent booming scene, Solana's darkest moment since November 2022 is still fresh in the minds of the entire industry. At that time, after the FTX explosion, the price of SOL plummeted from $236 to $13 within a few weeks, triggering extreme panic among investors. With grief everywhere, Solana was in an extremely depressed state for more than a year. However, now whether there is someone behind Solana's return has become a hot topic among the public.

Solana's resurrection actually has two decisive factors: community and high performance.

In terms of community activity, Solana is the public chain with the strongest developer operation capabilities in the industry. Electric Capital reported that there were more than 19,000 developers in the blockchain ecosystem in October 2023, with developers on Solana accounting for approximately 15% of the entire ecosystem.

In terms of high performance, Solana provides developers with lower costs and faster transactions, and provides users with a better experience. As the suite of consumer starter tools grows around Solana, more and more developers will build on it. In addition, the high throughput and low transaction costs on Solana make it possible to create consumer-level applications, such as developers spending a few hundred dollars to send one million NFTs.

In addition, the recovery of the overall market in the second half of 2023 is also an important reason for Solana to get out of the decline. Of course, this cannot constitute a magic weapon for victory. As the United States is likely to start an interest rate cut cycle in 2024, it remains to be seen whether Solana can maintain its growth momentum in the new bull market, and may even target Ethereum, the leading public chain.

JinseFinance

JinseFinance

JinseFinance

JinseFinance CharlieXYZ

CharlieXYZ Bitcoinist

Bitcoinist Beincrypto

Beincrypto Bitcoinist

Bitcoinist Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph