Article author:Prathik Desai Article compilation: Block unicorn

In 2020, Strategy (then known as MicroStrategy) began swapping debt and equity for Bitcoin. purchasesBTC, becoming the largest publicly traded Bitcoin holder.

Five years later, the company is still selling software, but the gross profit from operations continues to decline in the company's overall contribution. In 2024, operating gross profit fell to approximately 15% from 2023. In the first quarter of 2025, the figure fell 10% compared to the same period of the previous year. As of 2025, Strategy's strategy has been imitated, improved, and simplified, paving the way for more than a hundred publicly traded entities to hold Bitcoin.

The strategy is simple:Fund the business with low-cost debt, buy Bitcoin, wait for it to appreciate, then issue more debt to buy more Bitcoin—a self-reinforcing cycle that turns corporate coffers into leveraged crypto funds. Debt that matures is settled by issuing new shares, which dilutes existing shareholders. But the premium in the stock price due to the rise in the value of the company's Bitcoin holdings offsets this dilution.

Most of the companies following the Strategy's footsteps have existing businesses that hope to increase the return on their balance sheets by using Bitcoin as an appreciating asset.

Strategy used to be completelyappreciation potential, but they don't want to bear the burden of building a physical business. They have no customers, no profit model, and no operational roadmap. They just need a balance sheet full of Bitcoin and a quick access to the public market through financial shortcuts. Thus, the special purpose acquisition company (SPAC) came into being.

These BitcoinsTransaction. They can pre-negotiate valuations and wrap them in an SEC-compliant shell while avoiding being labeled an investment fund.

The PAC route makes it easier for companies to sell their strategies to stakeholders and investors,because there is nothing else to sell except Bitcoin.

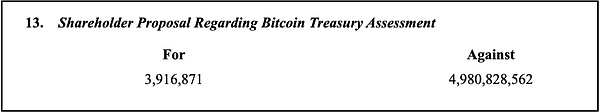

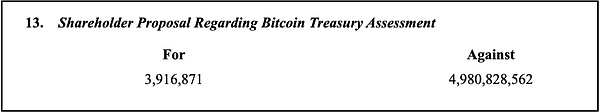

Remember what happened when Meta and Microsoft considered adding Bitcoin to their treasury? It was overwhelmingly rejected.

For public market investors, SPACs are seen as a vehicle to provide pure Bitcoin exposure without having to touch the cryptocurrency directly. Just like buying a gold ETF.

SPACs do face challenges with adoption by retail investors, who prefer to gain Bitcoin exposure through more popular routes, such as exchange-traded funds (ETFs). The 2025 Institutional Investor Digital Asset Survey showed that 60% of investors prefer to gain cryptocurrency exposure through registered vehicles, such as ETFs.

Nevertheless, demand remains. Because this model fully exploits the potential of leverage.

When Strategy bought Bitcoin, it didn't stop at one purchase. It continued to issue more convertible bonds, which were likely to be redeemed by issuing new shares. This approach turned a former business intelligence platform into an accelerator for Bitcoin. In the process of rising stock prices, its performance even exceeded that of Bitcoin itself. This blueprint left a deep impression on investors. Bitcoin companies based on SPACs can also provide the same acceleration effect: buy Bitcoin, and then issue more shares or debt to buy more Bitcoin. Repeatedly, forming a closed loop.

When a new Bitcoin company announces a $1 billion PIPE (private equity investment) backed by institutions,it’s a demonstration to the market that real money is watching. For example, Twenty One Capital has tremendous market credibility with the backing of heavyweights like Cantor Fitzgerald, Tether, and Softbank.

SPACs allow founders to achieve this goal early in the company’s lifecycle without having to build a revenue-generating product first. Early institutional backing helps attract attention, capital, and momentum, and SPACs have fewer hurdles than the investor resistance that an already public company might face.

For many founders, the SPAC route offers flexibility. Unlike an IPO, which has a strict disclosure timeline and pricing, a SPAC offers more control over narrative, forecasts, and valuation negotiations. Founders can tell a forward-looking story, develop a capital plan, and retain equity, while avoiding the cumbersome process of the traditional VC-to-IPO financing model.

The SPAC packaging itself is part of the appeal. Public offerings are a well-known language. Stock tickers can be traded by hedge funds, added to retail platforms, and what you actually buy and how much is very important.

Catherine

Catherine