Author: ROUTE 2 FI; Compiler: Luccy, BlockBeats

Editor's note: On February 16, Ethena Labs, the developer of Ethereum-based stablecoin USDe, completed a US$14 million strategic round of financing at a valuation of US$300 million, jointly by Dragonfly, Brevan Howard Digital, and Maelstrom, the family office of BitMEX founder Arthur Hayes. Led the investment, with participation from PayPal Ventures, Franklin Templeton, Avon Ventures, Binance Labs, Deribit, Gemini and Kraken. It is reported that USDe is a stable currency based on Ethereum, guaranteed by derivatives, and its biggest label is "Delta Neutral". The so-called Delta, in finance, is an indicator used to measure the impact of changes in underlying asset prices on changes in investment portfolios. The value range is "-1 to 1". The definition of "Delta Neutral" is that if an investment portfolio is composed of related financial products and its value is not affected by small price changes in the underlying assets, such an investment portfolio is "Delta Neutral". Related reading: "Raising $14 million, is it possible for Ethena Labs to reshuffle the stablecoin market? ">To create USDe, Ethena allows users to use USD, ETH or liquid pledged tokens as collateral. Crypto researcher ROUTE 2 FI analyzes Ethena Labs’ synthetic dollar protocol, exploring how it works, its advantages, risks, and how it compares to other similar protocols. BlockBeats compiled the original text as follows:

There are two DeFi protocols that really excite me this year: EigenLayer and Ethena Labs.

I have introduced EigenLayer in detail, this time I want to take a look at Ethena Labs and their crazy 27% annualized return rate of return.

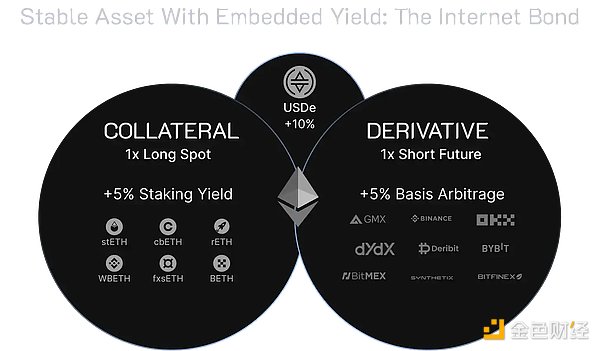

Ethena is a synthetic USD protocol built on Ethereum that aims to provide a crypto-native solution for currencies that do not rely on traditional banking system infrastructure and provide a globally accessible USD-denominated savings vehicle ——"Internet Bonds".

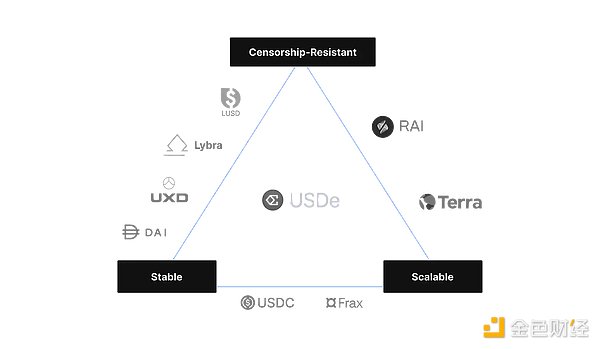

Ethena’s synthetic U.S. dollar USDe will provide the first censorship-resistant, scalable and stable crypto-native currency solution through delta hedging of staked Ethereum .

USDe will be transparently fully guaranteed on the chain and can be freely combined in DeFi.

USDe's peg stability is ensured through delta-hedging derivatives positions on the collateral held by the protocol, as well as minting and redemption arbitrage mechanisms. “Internet Bonds” will combine returns from staked Ethereum with financing and basis returns from perpetual and futures markets.

Ethena is built to solve the most important and obvious immediate needs in the cryptocurrency space. DeFi attempts to create a parallel financial system, however stablecoins are the most important financial instrument and are completely dependent on traditional banking infrastructure.

Why are stablecoins so important?

Stablecoins are the most important tools in cryptocurrencies.

In all major centralized and decentralized trading venues, whether it is spot or futures markets, the main trading pairs are denominated in stablecoins, with more than 90 % of order book transactions and over 70% of on-chain settlements are denominated in stablecoins.

Stablecoins have settled more than $12 trillion on the chain, constituting two of the top five assets in the field, accounting for more than 40% of DeFi Total Value Locked (TVL) and is by far the most widely used asset in decentralized currency markets.

Centralized stablecoins, such as USDC or USDT, provide stability and capital efficiency, but also introduce some problems:

· In regulated banks Bond pledges in accounts introduce custody risks that cannot be hedged and are susceptible to scrutiny.

· Critical reliance on existing banking infrastructure and country-specific evolving regulatory requirements.

· Users face a "risk-free return" situation because the issuer internalizes the benefits and transfers the risk of decoupling to the users.

Decentralized stablecoins have historically experienced a series of issues related to scalability, mechanism design, and lack of built-in benefits.

·"Hyper-collateralized stablecoins" have historically had problems scaling because their growth inevitably coincides with the growth in demand for on-chain leverage on Ethereum connected. Recently, some stablecoins have chosen to siphon off treasuries in order to improve scalability at the expense of censorship resistance.

·"Algorithmic stablecoins" face challenges in their mechanism design and are found to be inherently fragile and unstable. We believe these designs are not sustainably scalable.

· Previous "risk-free synthetic dollars" struggled to scale due to their critical reliance on decentralized trading venues that lacked sufficient liquidity.

Thus, USDe provides the following benefits:

· By leveraging derivatives, capital Scalability under utilization efficiency, which allows USDe to scale with capital utilization efficiency. Since the pledged ETH asset can be perfectly hedged by an equivalent short position, synthetic USD only requires a 1:1 “collateralization”.

· Stability is provided through hedging operations executed immediately upon issuance, which ensures USDe’s synthetic U.S. dollar value is supported in all market conditions.

· Transparent, 24 /7 Censorship-resistant in an auditable programmatic escrow account solution.

How does it work?

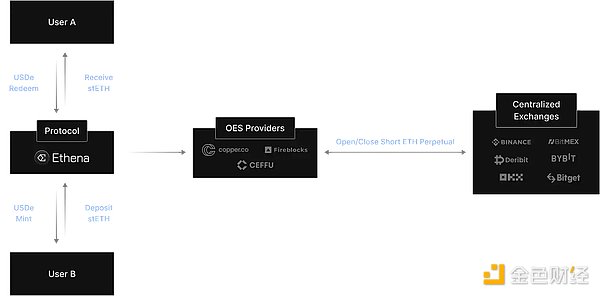

Users deposit approximately $100 in stETH and instantly receive approximately $100 in USDe, minus any costs of executing the hedge.

Ethena Labs opens a corresponding short-term perpetual position on a derivatives exchange for approximately the same USD value. The assets received are transferred to the OTC clearing service provider. Backing assets remain on-chain and on off-exchange servers to minimize counterparty risk.

Ethena Labs delegates, but never transfers, the backing assets to derivatives exchanges for pledging short-term perpetual hedging positions. Ethena Labs generates two sustainable revenue streams from deposited assets.

The income returned to qualified users comes from:

· Staking Ethereum to obtain consensus and executive level incentives (3,5% annualized return)

· Funding and basis spreads from hedging derivatives positions. (5-20% annualized rate of return)

The income from staking Ethereum is floating and denominated in ETH. Returns on funding and basis spreads can be floating or fixed. Funding and basis spreads have historically produced positive returns due to a mismatch between cryptocurrency leverage demand and supply, as well as the presence of positive baseline funding.

If the funding rate is deeply negative for a long time, so that the income from staking Ethereum cannot cover the cost of funding and basis spread, the Ethena Insurance Fund will bear the cost . Historical earnings can be viewed here.

Once users stake their USDe into sUSDe, they begin earning protocol yields automatically without any further action or cost. The amount of sUSDe a user receives depends on the amount of USDe deposited and the time of deposit. Ethena’s sUSDe uses a “token vault” mechanism, the same as Rocketpool’s rETH or Binance’s WBETH.

The protocol will not re-pledge, lend or otherwise utilize deposited USDe for any purpose. Since USDe’s support mechanism itself generates protocol yields, no such action is required. If the protocol suffers a loss due to funding or other reasons, Ethena's insurance fund will bear the cost rather than the staking contract.

· When a user mints USDe, Ethena Labs opens a short position on the exchange.

· Ethena Labs closes short positions on the exchange when users redeem USDe.

· Ethena Labs closes/opens positions on exchanges to realize unrealized P&L.

If the value of USDe in the external market is lower than the value provided by Ethena Labs, users can:

· Use USDC to buy 1 USDe at Curve for 0.95.

· Redeem 1 USDe from Ethena Labs at 1.00 to get ETH.

· Use the earned ETH to sell for USDC on Curve.

· Profit.

If the value of USDe in the external market is higher than the value provided by Ethena Labs, users can:

· Mint USDe using ETH from Ethena Labs.

· Sell USDe in exchange for USDC at > 1.00 in the Curve pool.

· Buy ETH with USDC on Curve.

· Profit.

What are the risks?

Funding cost risk

"Funding cost risk" involves the potential risk of continued negative interest rates. Ethena is able to earn income from funds, but may also be required to pay funds (equal to lower protocol income).

The Ethena Guarantee Fund exists and will step in when returns on combined LST assets (such as stETH) and funding rates for short-term indefinite positions become negative. This ensures that the collateral backing USDe is not affected. Ethena will not pass on any "negative yield" to users who stake their USDe into sUSDe.

Combining annualized stETH returns and funding rate values, only 10.8% of days have a total negative return. This is a positive comparison compared to the ~20.5% days that generate negative funding rates when stETH returns are not taken into account.

If you remember Anchor Protocol’s return reserve, the Ethena Guaranteed Fund will operate in a similar manner to support returns on “negative” days.

Liquidation risk

Ethena uses pledged Ethereum spot on short-term derivatives positions assets. Ethena uses staked Ethereum assets, such as Lido’s stETH, to stake short-term ETHUSD and ETHUSDT perpetual positions on CeFi exchanges. Therefore, the collateral asset used by Ethena is stETH, which is different from the underlying asset ETH of the derivative position.

The price difference between ETH and stETH must widen to 65%, which has never happened in history. The maximum value in history is 8% (in Shapella and the Luna decoupling in May 2022), then Ethena's positions will begin to be gradually liquidated and Ethena will suffer realized losses. USDe’s peg stability is automated through program-based delay-neutral hedging with the underlying staking assets. Refer to "Dust on Crust" by @CryptoHayes.

In order to mitigate the "liquidation risk" caused by the above risk scenarios:

· Ethena will Additional collateral is systematically delegated to improve the margin position of our hedging positions in case any risk scenarios arise.

· When any risk scenario occurs, Ethena is able to temporarily cycle delegated collateral between exchanges to provide support in specific situations.

· Ethena can be quickly deployed on exchanges to support hedging positions, leveraging our insurance fund.

· In the event of an extreme situation, such as a critical flaw in a staking Ethereum smart contract, Ethena will take immediate steps to mitigate the risk, with the sole motivation being to protect the staking The value of the product. This includes closing hedging derivatives positions to avoid liquidation risks coming into focus, as well as trading affected assets into other assets.

Custody risk

Because Ethena Labs relies on the solution of the "Off-Exchange Settlement" provider The protocol is used to store the assets supported by the protocol and is therefore dependent on its operational capabilities. Ethena’s capabilities include depositing and withdrawing assets on exchanges and conducting commissioned transactions. If any of these capabilities are unavailable or compromised, it will hinder the availability of transaction processes and the issuance and redemption functionality of USDe.

Exchange failure risk

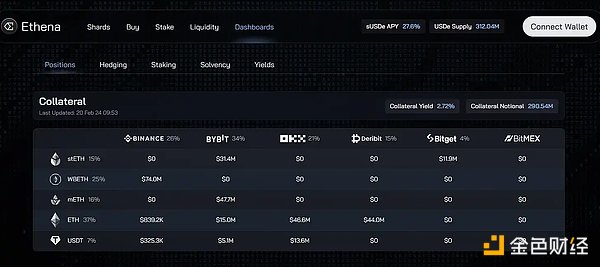

Ethena Labs uses derivatives positions to offset digital asset collateral risks of. These derivatives positions are traded on CeFi exchanges such as Binance, Bybit, Bitget, Deribit, and Okx. Therefore, if an exchange were to suddenly become unavailable, such as FTX, Ethena would need to deal with the consequences. This is the "exchange failure risk."

Collateral risk

In this case, "collateral risk" refers to The collateral asset of USDe (stETH) is different from the underlying asset of the perpetual futures position (ETH).

Currently, all protocols that rely on stETH (and any ETH LST) accept this liquidity risk profile. This means there may be delays in the amount of stETH that can be unstaking, or users may have to accept a slight discount if they need to trade immediately on external markets.

Approved users of Ethena can redeem USDe for stETH (or any ETH LST) on demand at any time, or request alternative assets, and take advantage of Ethena's multiple flows Sex pool to acquire assets.

Loss of confidence in the integrity of LST may be caused by the discovery of critical smart contract vulnerabilities in LST. In this case, users may try to unstake or exchange LST for alternative collateral as soon as possible. This could lead to long queues of exiting validators on protocols like Lido, as well as liquidity drying up on DeFi and CeFi exchanges.

Discussion

Okay, this is a fairly technical introduction. Now let's see why this product is interesting.

· 27.6% annual interest rate

· Earnings come from using LSD ETH as 1x Collateral for ETH short position

· LSD ETH income + short ETH financing rate = sUSDe income

">· Upcoming airdrop (called Ethena Shards), lasting 3 months or ending when USDe supply reaches 1 billion USD

· LPs provided + LP locked Tokens = 20x Shards per day

· Buy and hold USDe = 5x Shards per day

">· Staking and holding sUSDe = 1x Shards per day

· TVL is currently growing quite fast: reaching $300 million to date

< p style="text-align: left;">· All stable pool capacities are currently full (expect they will lift the limit, just my gut feeling)

· Smart contracts have lower risk, but higher centralization risk (funds are on centralized exchanges), and work best in bull markets (when people borrow with leverage) (don’t expect to raise money when everyone wants to short ETH) Interest rates are positive)

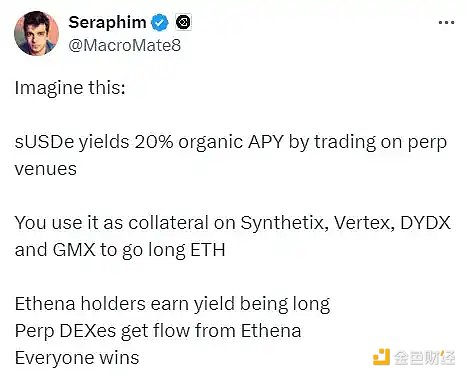

Looking further, you will soon be able to use your sUSDe in DeFi, see the following example from Seraphim, Head of Growth at Ethena Labs:

One thing that people have a hard time understanding is why we need financing rates.

The financing rate is established to ensure that the financing mechanism keeps the futures market price consistent with the index spot price: whenever there is excessive demand for long-term ETH, the perpetual price of ETH > ETH spot price, so CEX needs some way to reduce people's incentives to continue adding positions.

Therefore, the financing interest rate is a way to maintain a dynamic balance between the futures market price and the index spot price. Since the entire market is biased towards the bullish side, i.e. longs > shorts, if you go short ETH, you get the profits made by those who were long ETH, to offset the overwhelming demand that drives the ETH perpetual price closer to the ETH spot price.

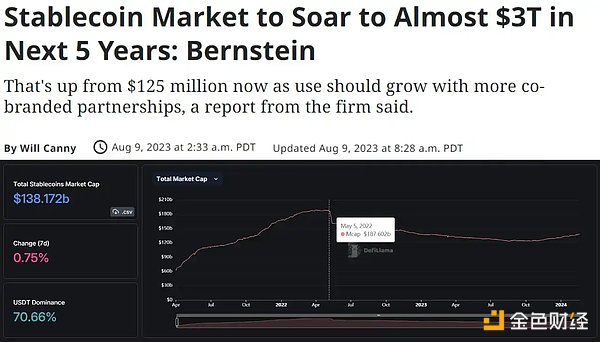

Global asset management company AllianceBernstein, which has $725 billion in assets under management, predicts that the market value of stablecoins will reach $3 trillion in 2028. If we look at the market today, the stablecoin market cap is currently $138 billion and peaked at $187 billion. This means potential growth of up to 2000%.

Additionally, Ethena has received $140 million in investment from top global investors, including @binance, @CryptoHayes, @Bybit_Official, @mirana, @lightspeedvp, @FTI_US, and more. Notably, angel investors include @dcfgod, @cobie and @blknoiz06.

Ethena has a really nice dashboard where you can monitor, at least giving some peace of mind in terms of risk.

Disadvantages of Ethena

Simply put, it is just a basis trade. When the yield inverts, you start losing money, and the larger the stablecoin, the more money you lose. People who are long ETH now pay people who are short ETH. This situation can last for a long time, especially in a bull market. But at some point, yields will invert and people will short ETH and profit from it. At this point Ethena suddenly has to bear the cost. They have their insurance fund to temporarily fix the problem. But as the yield on sUSDe decreases, I suspect people may be tempted to divest. That being said, this is not a fatal spiral. It's just that people may want to look for gains elsewhere.

Using stETH as collateral provides a margin of safety against negative interest rates. This means that Ethena only cares about those days when ETH financing is more negative than stETH returns. However, stETH liquidity is very important for pegging. USDe cannot scale to $100 billion without sufficient stETH liquidity.

Suppose the following happens:

· User redemption

· Insurance funds can be used for coverage. According to Ethena, USDe per $1 billion can survive almost any pessimistic funding rate forecast (Chaos Labs says $33 million per $1 billion is needed).

· The biggest risk for this project may not be explosive growth, but that more people will consider locking their funds in tokens with no returns, and Not choosing "trustworthy" alternatives (I'm just pointing out Lindy stablecoins like USDT or USDC, not saying these are better, but since they've been around for a while, most people trust them more).

· Counterparty risk from CEXs and smart contracts is probably one of the biggest issues. According to @tbr90, the long-term risk is a slow drain, as negative interest rates will eventually deplete the insurance fund and then force a slow unlock.

As Cobie points out, people can do this trade themselves.

For example, go short ETHUSDT and get funded every 8 hours, while going long stETH or mETH (for higher temporary gains). There is no 7-day staking queue and the risk is of your own choosing, although you will have to rebalance yourself.

Ethena founder @leptokurtic_ agreed, but noted: "Ethena Labs is not about saving you the hassle of executing cash transactions. Exciting What’s great is being able to tokenize this asset, make it extremely liquid through DeFi and CeFi, and then allow novel use cases to be built on top of that, combining different monetary LEGOs together.”

Anyway, I like this project. It brings some new and interesting content. I could see perpetual contract decentralized exchanges implementing their stablecoins and DeFi protocols looking to use them as currency LEGO, similar to what happened with EigenLayer and the recollateral narrative.

People may remember that I was a big fan of Anchor Protocol, and Ethena seems to be the healthier way of doing things. Personally, I feel that chasing 20% annual returns in a bull market is not much better than chasing bigger opportunities, so I may not use this protocol very often, but I will participate in airdrops.

Another thing I don't like is that it takes 7 days to redeem from staking and 21 days from LP. If it were possible to unstake immediately, I would consider it if I needed a break from the market, but 7 days is a long time to wait in the crypto space.

Having said that, they may implement sUSDe in several DeFi protocols so that you can earn from trading or mining etc. I will try to use these solutions more as they are implemented.

Overall, positive opinion of the product, even if this rant may seem a bit negative.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Beincrypto

Beincrypto Coindesk

Coindesk Coindesk

Coindesk Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist