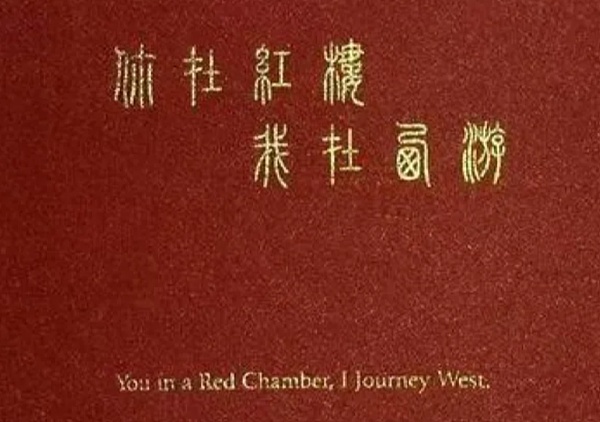

The year 2025 for stablecoins was both exciting and fragmented, from the US Genius Act's definition of compliant stablecoins to Hong Kong's Stablecoin Ordinance, which sparked heated discussions about offshore RMB stablecoins and the debate surrounding the digital RMB, culminating in the final chapter for stablecoins in mainland China in 2025. Who is in the Dream of the Red Chamber, and who is in Journey to the West? We probably all have the answer in our hearts. However, we need to look beyond the surface to the essence. We need to clarify the logic behind stablecoins in 2025 and understand future development trends. What has fundamentally changed for stablecoins that have attracted global attention in 2025, and what hasn't changed at all? At the 2025 Financial Street Forum Annual Meeting in October, Governor Pan Gongsheng of the People's Bank of China stated: "Since 2017, the People's Bank of China, together with relevant departments, has successively issued a number of policy documents to prevent and deal with the risks of domestic virtual currency trading and speculation. These policy documents remain valid. Going forward, the People's Bank of China will work with law enforcement agencies to continue to crack down on the operation and speculation of domestic virtual currencies, maintain economic and financial order, and closely monitor and dynamically assess the development of overseas stablecoins." We will focus on: "the policy documents remain valid" and "dynamically assess the development of overseas stablecoins." I. Mainland China's Regulatory Attitude Towards Virtual Currencies Remains Unchanged—Continued Crackdown 1.1 Mainland China's Regulatory Strategy: The Virtual Currency Nature of Stablecoins Recently, 13 ministries held a meeting to define the legal status of stablecoins under the mainland's regulatory system: http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/5916794/index.html On November 28, 2025, the People's Bank of China convened a meeting of the coordination mechanism for combating virtual currency trading and speculation. Officials from the Ministry of Public Security, the Cyberspace Administration of China, the Central Financial Stability and Development Office, the Supreme People's Court, the Supreme People's Procuratorate, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Justice, the People's Bank of China, the State Administration for Market Regulation, the State Financial Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange attended the meeting. The meeting pointed out that in recent years, all relevant departments have earnestly implemented the decisions and deployments of the CPC Central Committee and the State Council, and in accordance with the requirements of the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading and Speculation" jointly issued by the People's Bank of China and ten other departments in 2021, have resolutely cracked down on virtual currency trading and speculation, and rectified the chaos in the virtual currency market, achieving significant results. Recently, influenced by various factors, virtual currency speculation has resurfaced, and related illegal and criminal activities have occurred from time to time, posing new situations and challenges to risk prevention and control. The meeting emphasized: Virtual currencies do not have the same legal status as legal tender, do not have legal tender status, and should not and cannot be used as currency in the market. Virtual currency-related business activities are illegal financial activities. Stablecoins are a form of virtual currency, and currently cannot effectively meet the requirements for customer identification and anti-money laundering, posing a risk of being used for illegal activities such as money laundering, fundraising fraud, and illegal cross-border fund transfers. The meeting required all units to adhere to the guidance of Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, fully implement the spirit of the 20th National Congress of the Communist Party of China and its subsequent plenary sessions, regard risk prevention and control as the eternal theme of financial work, continue to uphold the prohibitive policy on virtual currencies, and continuously crack down on illegal financial activities related to virtual currencies. All units should deepen coordination and cooperation, improve regulatory policies and legal basis, focus on key links such as information flow and capital flow, strengthen information sharing, further enhance monitoring capabilities, severely crack down on illegal and criminal activities, protect the safety of people's property, and maintain the stability of economic and financial order. 1.2 Mainland regulators' attitude towards virtual currencies has not changed. Yesterday's meeting was a concrete implementation of the "Notice on Further Preventing and Handling Risks of Virtual Currency Trading and Speculation" (Yinfa [2021] No. 237) issued in 2021, reflecting that "the policy document remains valid." The link provided (https://www.gov.cn/zhengce/zhengceku/2021-10/08/content_5641404.htm) indicates that including stablecoins within the scope of virtual currencies means that stablecoin/virtual currency-related business activities constitute illegal financial activities. The statement, "We will continue to adhere to the prohibitive policy towards virtual currencies and continue to crack down on illegal financial activities related to virtual currencies," represents a stricter trend. Previously, the descriptions of illegal financial activities related to virtual currencies were illustrative; now, they are direct and general. Although virtual currencies are recognized as "virtual goods" in China (with their property attributes partially acknowledged in criminal and civil judicial practice), their place of existence as "financial assets" or "settlement instruments" has been completely eradicated in mainland China. 1.3 Industry Practitioners Remain Unchanged – Walking on Thin Ice Although stablecoins have been included in the scope of virtual currencies under mainland China's regulation, let's think back: what changes have these brought to industry practitioners? Actually, nothing. We are still going global, still on the path of compliance, obtaining licenses in the relevant jurisdictions, and meeting the regulatory requirements of various regions to conduct business in compliance with regulations. It's still like walking on thin ice.

(Briefly describe China's regulatory attitude towards virtual currencies)

II. The financial infrastructure based on blockchain has changed—dynamically assessing the development of overseas stablecoins

The US Genius Act gives a clear definition of stablecoins:

“Payment stablecoins” are digital currencies that rely on distributed ledgers, are pegged to national fiat currencies, and are used for payments and settlements.

Let's set aside for now the various forms of digital currency: stablecoins, deposit tokens, and CBDCs. What has changed? — The ledger upon which assets are based has changed, becoming more efficient, convenient, and global. This is what Europe and America are eagerly pursuing; it's what Blackrock's CEO stated: "asset tokenization" will lead the next financial revolution; it's the innovation the Federal Reserve embraced during its "historic" meeting; it's the direction of Nasdaq's transformation: tokenized trading, tokenized IPOs, and 24/7 trading. This is also a point that mainland regulators need to dynamically assess—the financial infrastructure based on blockchain, regardless of what kind of digital assets are running on it. 2.1 Starting from the Origin of Blockchain As Dr. Xiao said, we need to start from the origin of blockchain, from first principles, from the basics, to examine the currently hotly debated digital currencies/crypto assets, the crypto market, and the blockchain technology behind them. What is the essence of finance? It is the mismatch of value across time and space. This essence has remained unchanged for millennia. New finance based on blockchain can greatly improve the efficiency of finance: Across time. On the one hand, this is reflected in the time value of money; on the other hand, it is reflected in transactions and settlements. Across space. Globally, value allocation across spaces. Methods of value transfer. Just as the essential attributes (measure of value) and core functions (medium of exchange) of money remain unchanged, despite the evolution of monetary carriers or forms such as seashells, tokens, cash, deposits, electronic money, and stablecoins, the essence of finance remains the same. What needs to be considered is how to provide better financial services in a distributed, digitalized, and time-transcending scenario. 2.2 New Financial Infrastructure Compared to traditional finance, the biggest innovation of new finance is the change in accounting methods—the blockchain, a transparent global public ledger. Changes in human accounting methods have occurred only three times in thousands of years, each profoundly shaping economic forms and social structures, and each breakthrough reflecting the co-evolution of technology and civilization. Sumerian single-entry bookkeeping (around 3500 BC) enabled humanity to overcome the limitations of oral communication for the first time, promoting early trade and the formation of states, as it necessitated the recording of taxes and trade. Commercial dispute clauses appeared in the Babylonian Code of Hammurabi. Double-entry bookkeeping played a significant role in the commercial revolution of the Renaissance (14th-15th centuries). The flourishing trade of Mediterranean city-states, Genoese fleet investments, and the Medici family's transnational bank all required complex financial instruments, thus driving the emergence of banks and transnational corporations and the establishment of commercial credit. What followed was the familiar distributed ledger technology, driven by Bitcoin in 2009, which facilitated decentralized finance, changes in trust mechanisms, and the rise of digital currencies. This new financial system, based on the transformation of distributed ledger technology, is inevitably inseparable from blockchain, smart contracts, digital wallets, and programmable currencies. Blockchain, as the ledger settlement layer of financial infrastructure, was initially designed to solve the problem of eventual consistency in payment clearing. The combination of digital currencies built on distributed ledgers and smart contracts can bring unlimited possibilities to the new finance: near-instantaneous settlement, 24/7 availability, low transaction costs, and the programmability, interoperability, and composability with DeFi inherent in digital currency tokens themselves. Thus, the new finance mainly presents three major changes: First, the accounting method has changed from centralized double-entry bookkeeping to decentralized distributed ledgers; second, accounts have changed from bank accounts to digital wallets; and third, the unit of account has changed from fiat currency to digital currency. Most importantly, distributed ledgers arise from the trans-temporal, trans-spatial, and trans-organizational characteristics of digitalization. 2.3 The Tremendous Changes in Financial Infrastructure Therefore, regardless of the various forms of digital currencies—stablecoins, deposit tokens, CBDCs—the financial infrastructure based on blockchain has undergone a radical transformation. What seeds have been sown here? The uniqueness of digital currencies lies in their simultaneous location at the intersection of three massive markets: payments; lending; and capital markets. Not to mention the value channels of the future AI silicon-based civilization. Despite the anti-globalization wave caused by geopolitical factors, we will still be aligned by the unified ledger of blockchain. You will find that the world really is flat. Just like the book says: "We wanted transoceanic planes, but we invented Zoom instead." III. In Conclusion The key points, "the policy documents are still valid" and "dynamically assess the development of overseas stablecoins," still provide us with guidance. Although the reality of stablecoins in 2025 seems like a magical "you're in the Dream of the Red Chamber, I'm in Journey to the West" scenario. "I'm on a Journey to the West"—it's about leaving home, spiritual practice, the unwavering determination to overcome all eighty-one tribulations, and the ambition to explore the next generation of financial infrastructure. In 2008, Modern Sky released a music compilation titled "You're in the Dream of the Red Chamber, I'm on a Journey to the West," inspired by "Dream of the Red Chamber" and "Journey to the West," reinterpreting classic tracks to create a cultural dialogue between classical and modern, East and West, fantasy and reality. You go on your journey through the mortal world, I embark on my long and arduous journey. But ultimately, we may all arrive at the same destination, albeit by different paths.

YouQuan

YouQuan

YouQuan

YouQuan Hui Xin

Hui Xin Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan Brian

Brian YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin Joy

Joy