Source: StableLab

Key findings

Ajna’s lending pool shows moderately concentrated activity. Of the 313 available lending pools, 90% of transactions are concentrated in 39 of them, indicating the diversity of the Ajna ecosystem and also reflecting user preferences for certain pools.

After the release of Ajna V2 in early 2024, user participation has increased significantly, but the retention of V1 users is still a problem, with only about 9 users active at the same time There are two versions: V1 and V2.

Ajna users have diverse participation patterns in the DeFi space, with many users interacting with major protocols such as Frax, Lido, Safe, Maker and Curve, indicating the existence of strategic integration opportunities .

Transaction volume analysis shows that there was an obvious activity window period before the release of Ajna V2, and the activity increased significantly after the release, which shows that the protocol improvements have an impact on user activities. Significant impact, but then activity quickly declines again.

These findings provide guidance for Ajna's strategic development, focusing on user engagement, cross-protocol integration and continuous innovation to sustain ecosystem growth.

Introduction

This report provides an in-depth analysis of the Ajna lending pool Dynamics of user interactions, using on-chain data to conduct a comprehensive analysis of user engagement, transaction patterns, and ecosystem health. Our goal is to provide valuable findings that help enhance and enhance the strategic development of Ajna Protocol.

User interaction analysis

Each pool Transaction Distribution

Our analysis of the Ajna protocol on the Ethereum chain reveals key insights into user participation in its lending pool. A total of 148 unique addresses were identified, with a total of 1,302 transactions taking place on the platform. Notably, most activity is concentrated in a handful of lending pools:

90% of transactions occur in 39 of the 313 available lending pools.

The number of transactions in the top 5 pools accounts for 38% of the total number of transactions (i.e. 499 transactions out of 1302 transactions).

The top two lending pools by number of transactions are now deprecated or empty.

This distribution shows that although users prefer a few specific pools, there is still widespread interaction in about 10% of lending pools. This finding highlights the balance between user preferences for specific pools and the diverse interactions within the Ajna ecosystem.

Ordered by transaction volume, the top 2 lending pools are now deprecated or empty, while the 4th and 5th lending pools are An ETH pool mainly used for leveraged staking rewards. A total of 499 transactions occurred in these five lending pools, accounting for 38% of the total number of transactions analyzed (1302 transactions).

Figure 1. All Ajna lending pools, sorted by decreasing number of transactions

< img src="https://img.jinse.cn/7259640_image3.png">

Figure 2. Ajna user life cycle

User lifespan and retention

< p style="text-align: left;">We analyzed the lifetime of all users who interacted with the Ajna lending pool, revealing interesting patterns in user engagement over time:

An increase in user activity density was observed in the second half of 2023 and early 2024.

After the release of the Ajna V2 pool in early 2024, interest increased significantly.

The transition from Ajna V1 to V2 has been limited, with only about nine users participating in both versions.

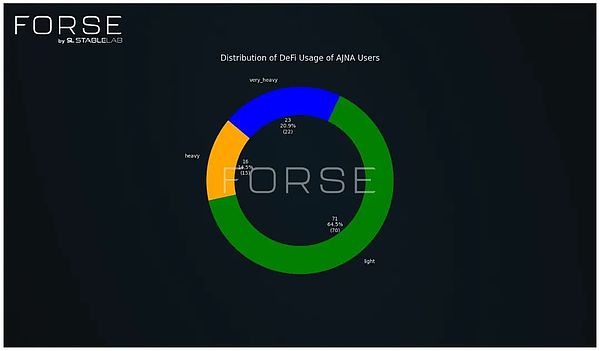

Figure 3. Ajna users, classified by DeFi activity level

DeFi Interaction Patterns

To better understand Ajna users’ participation in broader DeFi, we based our analysis on their interactions with other DeFi applications ( dApp) interactions categorize them:

Light users: <5 dApp interactions

Heavy users: 5-10 dApp interactions

Very heavy users: 15+ dApp interactions

This categorization shows that while the majority of Ajna users interact with a limited number of protocols, nearly a third of users show significant engagement on multiple dApps. It is worth noting that the light user category may include bot accounts created for a specific purpose, such as accounts that have only made two Ajna trades. Therefore, the number of users they represent may be less than the number of addresses.

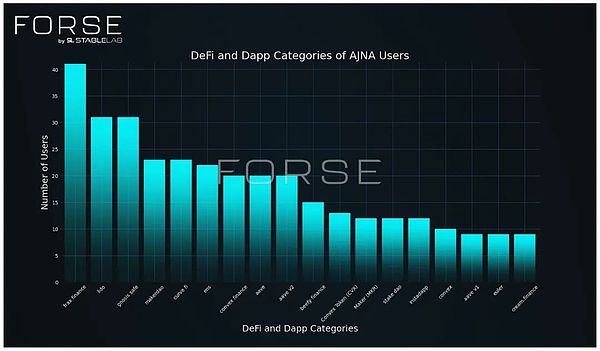

Figure 4. DeFi protocol of Ajna user interaction, sorted in descending order by the number of interacting Ajna users

Protocol Overlap

Our analysis reveals significant overlap between Ajna users and other major DeFi protocols:

42 of the 148 Ajna users have participated in the Frax protocol.

Other major protocols include Lido, Safe, Maker, and Curve.

By integrating with these leading protocols, Ajna has the potential to increase protocol adoption, enhance composability, and provide a seamless experience for intensive users of these protocols.

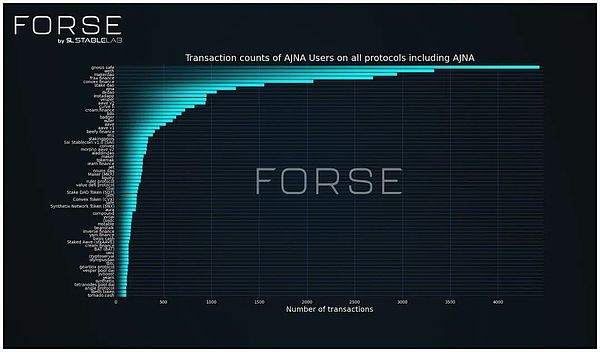

Figure 5. DeFi protocol of Ajna user interaction, sorted in descending order by the total number of Ajna user interactions

Transaction volume analysis

Although Frax is the most commonly used protocol by Ajna users, the actual transaction volume shows a different Situation:

Safe has the highest trading volume, followed by Maker DAO.

Frax, Convex and Stake DAO also have significant trading volumes.

These conditions highlight the importance of integrating with high-engagement protocols to leverage existing user behavior and transaction volume.

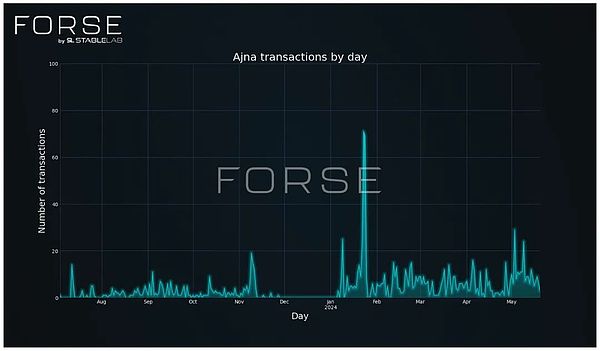

Figure 6. Total daily transactions of Ajna lending pool

Daily transaction trends

Analysis of daily transaction counts across all Ajna pools reveals significant activity patterns:

A clear window of trading activity was observed between December 2023 and January 2024.

Transaction volume increased sharply after the release of Ajna V2.

The overall activity level has improved compared to earlier versions.

The surge in daily transaction volume highlights the renewed user attention and engagement following improvements in the Ajna V2 version.

Conclusion and final thoughts

Ajna Lending Pool Chain The above analysis shows a comprehensive view of user behavior and user engagement within the protocol. 1,302 transactions occurred among 148 users. This data shows that transaction activity is concentrated in a few specific lending pools, but also reveals a wide range of participation within the entire ecosystem. It is worth noting that the vast majority of interactions are limited to 39 lending pools, and the number of transactions in the top 5 pools accounts for 38% of the total number of transactions, highlighting user preferences and strategic utilization of lending pools.

User longevity analysis shows increased user interest following the release of Ajna V2 in early 2024, despite a large number of V1 users not transitioning to V2. This demonstrates the need for improved user retention as the protocol evolves. Additionally, user engagement patterns show diverse interactions with DeFi applications ranging from light to very heavy usage, with possible signs of bot activity among light users.

Our findings of protocol overlap indicate that Ajna users frequently interact with other major DeFi platforms such as Frax, Lido, Safe, Maker, and Curve. Cumulative interaction data shows that Ajna users interact with the Safe and Maker DAOs with the highest transaction volume, highlighting the opportunity for deep integration with these protocols to promote greater adoption and composability.

Finally, analysis of daily transaction numbers reveals a window of activity before the release of V2, followed by a significant increase, reflecting protocol improvements and renewed user interest. ignite. Together, these insights provide a roadmap for Ajna's strategic development, focusing on user engagement, cross-protocol integration and continuous innovation to sustain growth and user satisfaction within the Ajna ecosystem.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Beincrypto

Beincrypto TheBlock

TheBlock Coindesk

Coindesk Nulltx

Nulltx Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist