Author: Prathik Desai Source: thetokendispatch Translation: Shan Ouba, Golden Finance

At least for those who have been deeply involved in the crypto world for a long time, similar stories always start the same way: a new network emerges, claiming to finally liberate Bitcoin from its passive asset status and give it real utility; it promises to integrate Bitcoin into financial infrastructure, improve liquidity, increase returns, and lay a solid foundation for the future of finance.

Then the hype fades, cross-chain bridge vulnerabilities emerge, and Bitcoin is ultimately back to square one.

Now, we are at a similar point again—yet another project claims to achieve this goal. As with previous attempts, this one does offer some differences, but can it truly succeed?

In today's in-depth analysis, I will break down the key elements behind the latest wave of attempts to bring Bitcoin liquidity to DeFi. When Starknet, an Ethereum Layer 2 (L2) zero-knowledge proof (ZK) solution, announced at the end of September that users could stake Bitcoin directly on its Rollup network and earn STRK rewards, a sense of déjà vu struck. But this time, there was a twist: this crypto project, claiming to "activate Bitcoin's utility," was actually built on Ethereum's Layer 2 network. Starknet named its Bitcoin-related initiative BTC-Fi Season, focusing on trustless returns and claiming it to be "the first fully trustless Bitcoin staking solution on a Layer 2 network." According to its website, the initiative aims to support the development of ecosystem protocols, help decentralized exchanges (DEXs) and money markets create highly liquid Bitcoin pools, and enable stablecoin lending using Bitcoin as collateral. Initial data appears impressive. According to DeFiLlama data, as of October 9, 2025, Starknet's total locked value (TVL) soared to US$222 million, a 65% increase from US$135 million two weeks ago; on October 6, the platform's daily application fees reached US$63,594, a record high in a year and a half; and after deducting the costs paid to liquidity providers, the protocol's retained revenue on that day also reached US$39,962. As Wrapped Bitcoin liquidity began to flow into the staking pool, platform usage and fee revenue soared. Even Starknet's native token, STRK, saw its value rise accordingly—from less than $0.13 on September 30th to $0.1968 on October 6th, an increase of over 50%. These data seem to indicate that Starknet's strategy of "generating yield by bringing Bitcoin into DeFi" is showing initial success. But remember, the early data from every previous Bitcoin cross-chain project has shown similar booms. II. The Past of Bitcoin DeFi As early as October 2018, Wrapped Bitcoin first made the dream of "integrating Bitcoin into DeFi" a reality. By issuing an ERC-20 token pegged 1:1 to real Bitcoin, WBTC provides a path for traders to introduce Bitcoin into the Ethereum DeFi ecosystem. However, it still relies on trust—the custodian BitGo holds the private keys. It wasn't until the advent of the "Summer of DeFi" in 2020 that WBTC truly exploded in popularity. To most Bitcoin holders, it was little more than a "gifted IOU." In fact, attempts to build cross-chain bridges for Bitcoin preceded WBTC: Nearly a decade ago, the smart contract platform Rootstock (RSK) invited Bitcoin miners to merge-mine its smart contract sidechain; later, the Liquid Network built a notary public alliance system to enable faster transaction settlement. Both projects promised to improve speed and scalability without sacrificing security, but ultimately came to nothing. Without clear application scenarios, what could users do with their cross-chain Bitcoin? Early decentralized cross-chain solutions (such as renBTC and tBTC V1) seemed ingenious in design, but they collapsed due to inherent flaws. It wasn't until tBTC underwent a complete restructuring and launched V2 that the project finally came to fruition. After the release of the latest version, it finally achieved stable operation.

In addition, projects such as Badger and Thorchain have also tried to introduce Bitcoin liquidity into DeFi. Each project attracted a certain amount of funds within one or two quarters, but ultimately failed to achieve large-scale popularization.

This deadlock continued until the launch of Babylon in 2024. Years of attempts have led the industry to a clear conclusion: you cannot force Bitcoin holders to leave the Bitcoin native chain. Babylon learned this lesson and chose to "keep Bitcoin where it is" - it does not require users to encapsulate or transfer Bitcoin across chains, but allows Bitcoin holders to stake native BTC to provide security for other Proof of Stake (PoS) networks, and earn income without leaving the Bitcoin network.

In return, users who stake Bitcoin can receive BABY, OSMO, SUI This model was a huge success, proving in just a few months that there is a strong market demand for Bitcoin interest as long as the private keys remain in the hands of Bitcoin holders.

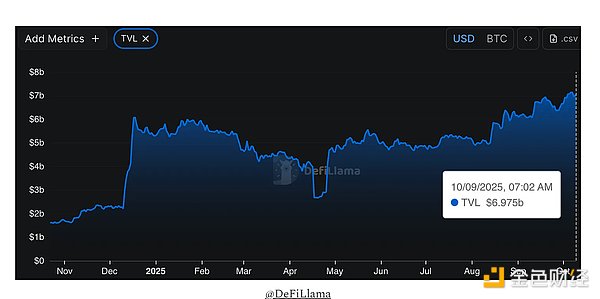

In the year since its launch, Babylon's TVL has grown from $1.6 billion to approximately $7 billion, an increase of more than 3 times.

At the same time, other Bitcoin DeFi paths are gradually taking shape:

Threshold's tBTC launched a "trust-minimized" Cross-chain bridges allow Bitcoin to circulate in DeFi (now including Starknet) without requiring a central custodian. Mezo takes a different approach—allowing users to hold native Bitcoin while unlocking fixed-rate loans and a Bitcoin-based stable balance (MUSD). Garden Finance focuses on "intent-based rapid cross-chain swaps," supporting asset swaps between Bitcoin and EVM chains and the Solana ecosystem. Together, these projects demonstrate a genuine market demand for Bitcoin yield and liquidity solutions that respect self-custody. Starknet, by contrast, has chosen a different path. Similar to previous attempts, it plans to bring Bitcoin off-chain, but claims to leverage sophisticated cryptography and a robust economic model to ensure the project's sustainability after the initial incentives expire. The Starknet process is as follows: Users first wrap Bitcoin into tokens such as WBTC, LBTC, and tBTC, then cross-chain these wrapped tokens to Starknet. Rollup network, and finally delegate it to the validator. Starknet allocates 25% of the total staking weight to Bitcoin, and the remaining 75% is controlled by STRK holders to ensure that governance rights remain in the native Starknet ecosystem.

In return for staking, Bitcoin holders can receive STRK token rewards - the Starknet Foundation has also set up a special incentive pool of 100 million STRK to further enhance the attractiveness of returns. The annualized return on basic staking can reach 4%, and if a "liquidity pool strategy" is adopted, the return can be even higher. In addition, since the staked Bitcoin corresponds to a "circulating token certificate", users can use it for lending or trading while earning income.

Starknet's goal is to build a "self-circulating ecosystem": the more Bitcoins staked, the more stable the system and the more active the ecological activities. With the help of zero-knowledge technologies such as Circle-STARKs, Starknet's Rollup The network can verify Bitcoin-related data in milliseconds, without relying on oracles or multi-signature cross-chain bridges. Its economic model is similar to Ethereum's early staking phase—building trust and momentum through token rewards until the network's usage reaches sufficient levels to sustain the ecosystem.

Fourth: The Shadow of the Old Model

However, Starknet's solution still suffers from the shadow of the old model:

First, custody risk hasn't disappeared; it's simply shifted from "centralized" to "decentralized." Instead of BitGo dominating, there are multiple wrapped token issuers, each with its own trust mechanisms—the risk remains, just in a different form.

Second, liquidity remains an issue. If the early high returns fade before DeFi demand truly matures, liquidity could erode again.

Finally, the "human factor" This remains a key obstacle. Bitcoin holders' instinct to store their assets securely and minimize volatility remains a major challenge for Starknet in attracting Bitcoin inflows and its use in DeFi.

Starknet's bet is that higher returns and a simpler user experience can change the inherent behavior of Bitcoin holders.

This model stands in stark contrast to Babylon: Starknet requires holders to cross-chain/encapsulate some of their Bitcoin to a second-layer network for DeFi use and earn rewards denominated in STRK; while Babylon allows holders to self-custody their native Bitcoin within the Bitcoin network, simply "entrusting" its economic security to other consumer chains, earning token rewards from those chains without transferring assets.

Babylon's $7 billion in staked Bitcoin is sufficient to demonstrate the appeal of "self-custody" to Bitcoin holders. However, Starknet currently has only $4.7 million in Bitcoin staked, making it difficult to judge its prospects. Both paths may be plausible: one targets "patient capital," the other more opportunistic.

V. Odds of Success

Starknet's true advantage may lie in "timing."

In 2025, DeFi will no longer be a "niche playground," but will have grown into a massive, mature industry—with a current TVL of $170 billion. Audit firms, insurance services, Re7 Capital, and other institutional funds are investing in "Bitcoin-denominated yield vaults." Zero-knowledge Rollups have also emerged from their testing phase and are maturing. The tools required for liquid staking and cross-chain accounting are now well-developed—key elements previously lacked by Bitcoin cross-chain projects.

Ironically, Starknet and Babylon's paths may ultimately reinforce each other: If Babylon... Proving that Bitcoin staking can be self-custodied and economically viable would vindicate the concept of Bitcoin productivity; if Starknet can ensure the security and liquidity of wrapped Bitcoin, it would demonstrate that DeFi can increase Bitcoin's utility without triggering a crisis. The success of both would reinforce the idea that Bitcoin can provide security and liquidity to networks beyond its own. A year from now, we'll either write the epitaph for yet another Bitcoin DeFi project or witness a success story comparable to Babylon. History has shown that even more remote opportunities have arisen before.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Catherine

Catherine JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Jasper

Jasper dailyhodl

dailyhodl cryptopotato

cryptopotato